Insured By The Fdic

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government that provides deposit insurance to protect bank customers' funds in the event of a bank failure. With its establishment in 1933, during the Great Depression, the FDIC has played a crucial role in maintaining stability and confidence in the banking system. Today, it stands as a cornerstone of financial security, offering peace of mind to millions of Americans with insured deposits.

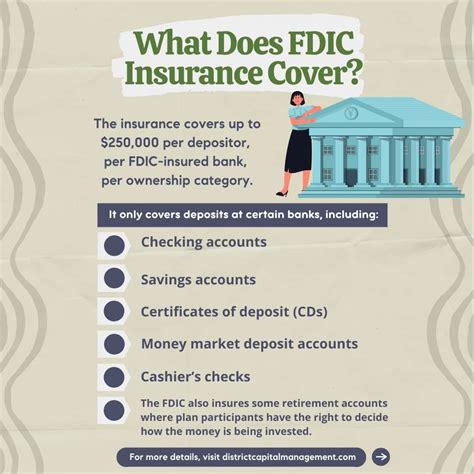

Understanding FDIC Insurance: A Financial Safety Net

FDIC insurance safeguards eligible deposit accounts up to a specific limit, currently set at $250,000 per depositor, per insured bank, per ownership category. This insurance covers various types of deposit accounts, including checking, savings, and certain certificate of deposit (CD) accounts. It is important to note that not all financial products are insured by the FDIC; investment products like stocks, bonds, and mutual funds are not covered.

The FDIC's insurance program is funded by premiums paid by member banks and operates as a pay-as-you-go system, meaning it does not rely on taxpayer funds. It is backed by the full faith and credit of the United States government, ensuring that insured deposits are secure even in the most challenging economic circumstances.

Eligibility and Coverage

To be insured by the FDIC, a bank must be a member of the FDIC and follow specific guidelines and regulations. Not all banks are FDIC members, and it is essential for consumers to verify the insurance status of their bank. The FDIC maintains a BankFind tool to help individuals check the insurance status of their financial institutions.

The FDIC insurance coverage limit applies to each depositor's funds at each insured bank. This means that if you have multiple accounts at the same bank, the total balance across those accounts is insured up to $250,000. Additionally, if you have accounts at different banks, each bank's accounts are insured separately, allowing you to maximize coverage.

| Ownership Category | Coverage Limit |

|---|---|

| Single Accounts | $250,000 |

| Joint Accounts | $250,000 per co-owner |

| Retirement Accounts (IRAs) | $250,000 |

| Trust Accounts | $250,000 per beneficiary |

FDIC Insurance: A Pillar of Financial Confidence

The FDIC’s deposit insurance program has been a cornerstone of financial stability for nearly a century. By offering insurance on deposits, the FDIC encourages Americans to keep their money in banks, promoting economic growth and development. This insurance also helps prevent bank runs and systemic financial crises, as depositors can rest assured that their funds are secure.

Benefits of FDIC Insurance

- Financial Security: FDIC insurance provides peace of mind, ensuring that even in the unlikely event of a bank failure, depositors’ funds are protected.

- Encourages Savings: With insured deposits, individuals are more inclined to save, knowing their funds are secure and accessible.

- Stability for Banks: FDIC insurance helps maintain the stability of the banking system by reducing the risk of bank runs and promoting confidence in the financial sector.

- Consumer Protection: The FDIC acts as a watchdog, ensuring that insured banks operate within ethical and legal boundaries, thereby protecting consumer interests.

Navigating FDIC Insurance Limits

While the FDIC insurance limit of $250,000 provides substantial coverage for most individuals and families, it is essential to understand how to maximize this protection, especially for those with significant savings or multiple accounts.

Strategies for Maximizing Coverage

- Single Accounts: If you have a single account, ensure the balance does not exceed the insurance limit. Regularly monitor your account to avoid any unexpected overages.

- Joint Accounts: Joint accounts are insured separately for each co-owner, so you can maximize coverage by opening joint accounts with different financial institutions.

- Multiple Ownership Categories: Take advantage of different ownership categories. For instance, you can have a single account, a joint account with your spouse, and a trust account for your children, all insured up to the limit.

- CDARS and ICS: Consider utilizing the Certificate of Deposit Account Registry Service (CDARS) or the Individual Retirement Custodian Service (ICS) to access FDIC insurance on large deposits without having to open multiple accounts.

FDIC’s Role in Financial Regulation

Beyond its insurance role, the FDIC plays a critical part in the financial regulatory landscape. It supervises and examines insured banks to ensure they comply with federal laws and regulations, focusing on areas like consumer protection, fair lending, and community reinvestment.

Supervision and Examination

The FDIC’s supervision and examination process is designed to identify and address potential risks early on. This involves regular on-site examinations to assess a bank’s financial condition, management practices, and compliance with regulations. By actively monitoring insured institutions, the FDIC aims to prevent financial crises and protect consumers.

The FDIC also works closely with other regulatory bodies, such as the Office of the Comptroller of the Currency (OCC) and the Federal Reserve, to ensure a coordinated approach to financial oversight. This collaboration helps maintain a stable and secure financial system.

How often does the FDIC update its insurance coverage limits?

+The FDIC revises its insurance coverage limits based on changes in the national average price of consumer goods. This ensures that the coverage limit keeps pace with inflation. As of 2023, the coverage limit stands at 250,000 per depositor, per insured bank, per ownership category.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any exceptions to FDIC insurance coverage?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, there are a few exceptions. FDIC insurance does not cover investment products like stocks, bonds, mutual funds, or life insurance policies. It also does not cover safe deposit box contents, nor does it protect against fraud or theft from your account.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Can I have multiple accounts at the same bank and still be fully insured by the FDIC?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, you can. The FDIC insurance limit of 250,000 applies to each depositor’s funds at each insured bank. So, if you have multiple accounts at the same bank, the total balance across those accounts is insured up to $250,000. To maximize coverage, consider opening accounts at different banks as well.