Insurance Products

The world of insurance is vast and intricate, offering a range of products designed to provide financial protection and peace of mind to individuals, families, and businesses. In this comprehensive guide, we will delve into the diverse realm of insurance products, exploring their types, benefits, and the impact they have on our daily lives. From personal policies to complex commercial solutions, insurance plays a pivotal role in managing risks and securing our future.

Understanding Insurance Products

Insurance products are financial instruments that mitigate risks by transferring them to insurance companies. These companies, often referred to as insurers, underwrite policies and collect premiums to provide coverage for various contingencies. The principle behind insurance is to share risks among a large pool of policyholders, ensuring that in the event of a loss, the financial burden is distributed and manageable.

Insurance products are tailored to address a multitude of risks, from the unexpected to the foreseeable. They are categorized based on the type of coverage they offer, the risks they insure against, and the specific needs of the policyholder. Let's explore some of the key insurance products and their significance.

Life Insurance: A Legacy of Protection

Life insurance is perhaps one of the most fundamental and widely recognized insurance products. It provides financial security to individuals and their families in the event of the policyholder’s death. Life insurance policies can be designed to cover a range of needs, including income replacement, debt repayment, and funding for education or other significant expenses.

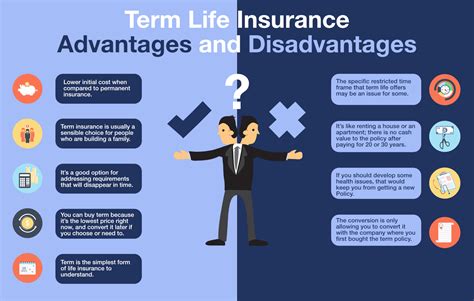

There are two primary types of life insurance: term life and permanent life insurance. Term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years. It is often more affordable and provides a straightforward solution for those seeking temporary coverage. On the other hand, permanent life insurance, such as whole life or universal life insurance, offers lifelong coverage and often includes a cash value component that can be utilized during the policyholder's lifetime.

The importance of life insurance extends beyond financial security. It can help ensure that loved ones are provided for, debts are settled, and future goals are achievable even in the absence of the primary income earner. Life insurance policies can also be structured to address specific needs, such as funding a child's education or providing a nest egg for retirement.

| Life Insurance Type | Description |

|---|---|

| Term Life | Coverage for a specified period, offering affordable protection. |

| Permanent Life | Lifelong coverage with potential cash value benefits. |

Health Insurance: Safeguarding Well-Being

Health insurance is an essential component of any comprehensive insurance portfolio. It provides coverage for medical expenses, ensuring that individuals and families have access to necessary healthcare services without incurring overwhelming financial burdens.

Health insurance plans can vary widely, offering different levels of coverage and benefits. Common types of health insurance include employer-sponsored plans, individual policies, and government-funded programs such as Medicare and Medicaid. These plans may cover a range of services, including doctor visits, hospital stays, prescription medications, and preventive care.

The importance of health insurance extends beyond personal health. It plays a crucial role in maintaining a healthy population and reducing the financial strain on individuals and healthcare systems. By sharing the costs of healthcare, health insurance enables timely access to medical treatment and promotes overall well-being.

| Health Insurance Type | Description |

|---|---|

| Employer-Sponsored | Health plans offered by employers, often with employer contributions. |

| Individual Policies | Personal health insurance plans purchased directly by individuals. |

| Government Programs | Publicly funded health insurance, such as Medicare and Medicaid. |

Property and Casualty Insurance: Protecting Assets

Property and casualty insurance, often referred to as P&C insurance, is a broad category that encompasses a range of policies designed to protect personal and business assets. This type of insurance provides coverage for damages or losses to property and liability risks.

Key types of property and casualty insurance include homeowners' insurance, renters' insurance, auto insurance, and commercial property insurance. Homeowners' insurance, for instance, covers the structure of a home and its contents against perils such as fire, theft, and natural disasters. Renters' insurance, on the other hand, provides coverage for personal belongings and liability protection for individuals living in rental properties.

Auto insurance is another crucial aspect of P&C insurance, offering protection for vehicles and their owners. It covers a range of risks, including collision, comprehensive coverage, and liability protection in the event of an accident. Commercial property insurance, tailored for businesses, provides coverage for commercial buildings, equipment, and liability risks associated with business operations.

| Property and Casualty Insurance Type | Description |

|---|---|

| Homeowners' Insurance | Covers home structures and contents against various perils. |

| Renters' Insurance | Protects personal belongings and provides liability coverage for renters. |

| Auto Insurance | Covers vehicles and their owners, including collision and liability protection. |

| Commercial Property Insurance | Provides coverage for commercial buildings and business operations. |

Specialty Insurance: Tailored Solutions

In addition to the core insurance products, there is a vast array of specialty insurance policies designed to address specific risks and needs. These policies are tailored to provide coverage for unique situations and industries.

Examples of specialty insurance include travel insurance, pet insurance, cyber insurance, and professional liability insurance. Travel insurance, for instance, provides coverage for trip cancellations, medical emergencies while traveling, and lost luggage. Pet insurance, on the other hand, covers veterinary costs and provides peace of mind for pet owners.

Cyber insurance has become increasingly important in the digital age, offering protection against cyberattacks, data breaches, and other online risks. Professional liability insurance, also known as errors and omissions (E&O) insurance, safeguards professionals such as lawyers, doctors, and consultants against claims of negligence or mistakes in their work.

| Specialty Insurance Type | Description |

|---|---|

| Travel Insurance | Covers travel-related risks, including cancellations and medical emergencies. |

| Pet Insurance | Provides coverage for veterinary costs and pet-related incidents. |

| Cyber Insurance | Protects against cyber risks, including data breaches and attacks. |

| Professional Liability Insurance | Covers claims of negligence or errors made by professionals in their work. |

The Impact of Insurance Products

Insurance products have a profound impact on individuals, communities, and the economy as a whole. By transferring risks and providing financial protection, insurance plays a vital role in shaping our daily lives and the overall stability of societies.

Financial Security and Peace of Mind

One of the primary benefits of insurance is the financial security and peace of mind it provides. Whether it’s protecting a family’s financial future with life insurance, ensuring access to healthcare with health insurance, or safeguarding assets with property and casualty insurance, insurance products offer a safety net against unforeseen events.

By mitigating financial risks, insurance allows individuals and businesses to focus on their goals, pursuits, and passions without constant worry about potential losses. It empowers people to take calculated risks, start businesses, and pursue dreams with the knowledge that they are protected.

Stability and Growth

Insurance products contribute to the stability and growth of economies. By spreading risks across a diverse pool of policyholders, insurance companies can effectively manage and mitigate potential losses. This stability allows insurers to invest in the economy, providing capital for businesses and stimulating economic growth.

Moreover, insurance plays a crucial role in facilitating trade and commerce. From marine insurance that protects cargo during transportation to liability insurance that safeguards businesses against lawsuits, insurance products enable a wide range of economic activities to thrive.

Community Resilience

Insurance also fosters community resilience by providing a safety net for individuals and families facing unforeseen circumstances. In the event of natural disasters, accidents, or health emergencies, insurance coverage can help communities recover and rebuild. It ensures that those affected have the financial means to address losses and move forward.

Additionally, insurance contributes to social welfare by providing access to healthcare and other essential services. Health insurance, for instance, ensures that individuals can receive necessary medical treatment without facing catastrophic financial burdens. This promotes overall well-being and reduces the strain on public health systems.

Conclusion

Insurance products are a cornerstone of modern society, offering a wide range of benefits and protections. From life insurance that secures the future of families to health insurance that ensures access to healthcare, and property and casualty insurance that safeguards assets, insurance plays a vital role in our lives.

As we navigate an increasingly complex and uncertain world, the importance of insurance cannot be overstated. It provides financial security, peace of mind, and the ability to thrive despite unforeseen challenges. By understanding the diverse range of insurance products and their impact, we can make informed decisions to protect ourselves, our loved ones, and our communities.

Whether it's securing our legacy with life insurance, safeguarding our health with comprehensive health plans, or protecting our assets with property and casualty insurance, insurance products empower us to live confidently and embrace the future with resilience.

How do I choose the right insurance products for my needs?

+Choosing the right insurance products involves assessing your unique needs and priorities. Consider factors such as your financial situation, family circumstances, and potential risks. Evaluate the coverage and benefits offered by different policies, and consult with insurance professionals to tailor a comprehensive insurance plan that aligns with your goals.

What are the key factors to consider when comparing insurance policies?

+When comparing insurance policies, pay attention to factors such as coverage limits, deductibles, premium costs, and exclusions. Assess the reputation and financial stability of the insurance company. Consider the level of customer service and claims handling processes. Additionally, evaluate the flexibility and customization options available to ensure the policy meets your specific needs.

How can I ensure I have adequate coverage for my home and belongings?

+To ensure adequate coverage for your home and belongings, review your insurance policy regularly and assess if your coverage limits are sufficient. Consider the replacement cost of your home and its contents, and adjust your coverage accordingly. Take inventory of your possessions and consult with an insurance professional to ensure you have the right level of protection.