Insurance Get A Quote

Insurance is a vital aspect of our lives, providing financial protection and peace of mind in uncertain times. Whether it's safeguarding your health, protecting your assets, or ensuring a secure future, insurance plays a crucial role in managing risks and uncertainties. In this comprehensive guide, we will delve into the world of insurance, exploring various types, understanding the importance of coverage, and providing expert insights to help you navigate the complex landscape of insurance quotes.

The Significance of Insurance: Protecting What Matters

Insurance serves as a financial safety net, offering protection against unforeseen events that can have a significant impact on our lives and livelihoods. From health emergencies to property damage, insurance policies provide a means to mitigate risks and minimize potential losses. Understanding the significance of insurance is the first step towards ensuring a secure and stable future.

Health Insurance: Prioritizing Well-Being

Health is undoubtedly one of the most valuable assets we possess. Health insurance plays a pivotal role in ensuring access to quality healthcare without the burden of exorbitant medical expenses. With rising healthcare costs, having comprehensive health coverage is essential to maintain physical and financial well-being.

Here’s a breakdown of the key benefits of health insurance:

- Comprehensive Coverage: Health insurance policies typically cover a wide range of medical services, including doctor visits, hospitalization, prescription medications, and preventive care.

- Financial Protection: By sharing the cost of healthcare expenses with the insurance provider, individuals can avoid significant out-of-pocket costs, ensuring they receive the necessary medical treatment without financial strain.

- Peace of Mind: Knowing that you have health insurance provides a sense of security, allowing individuals to focus on their well-being and recovery without worrying about the financial implications of medical treatment.

Property Insurance: Safeguarding Your Assets

Whether it’s your home, vehicle, or valuable possessions, property insurance is essential to protect your assets from unexpected damage or loss. From natural disasters to accidents, property insurance provides a financial safety net to help you rebuild and recover.

Key aspects of property insurance include:

- Coverage Options: Property insurance policies offer various coverage types, such as homeowners’ insurance, renters’ insurance, and auto insurance. Each policy is tailored to meet the specific needs of the insured, providing protection for their unique assets.

- Risk Mitigation: By assessing potential risks and vulnerabilities, insurance providers offer coverage options that address specific concerns. This proactive approach helps individuals minimize the impact of unforeseen events on their property and finances.

- Claims Process: In the event of a loss, property insurance policies outline a clear claims process, guiding policyholders through the steps to receive compensation for damages. This ensures a streamlined and efficient recovery process.

Understanding Insurance Quotes: Navigating the Process

Obtaining insurance quotes is a critical step in securing the right coverage for your needs. Insurance quotes provide an estimate of the cost of an insurance policy, allowing individuals to compare options and make informed decisions. Here’s a comprehensive guide to understanding and navigating the insurance quote process.

Factors Influencing Insurance Quotes

Insurance quotes are influenced by a multitude of factors, each playing a role in determining the cost and coverage of a policy. Understanding these factors is essential to make informed choices and obtain the best possible insurance coverage.

- Age and Gender: Age and gender are significant factors in insurance quotes, particularly for health and life insurance. Younger individuals generally receive lower premiums, while gender-specific health conditions may impact quotes for certain policies.

- Health Status: Pre-existing medical conditions and overall health play a crucial role in health insurance quotes. Insurance providers assess an individual’s health history to determine the risk associated with providing coverage, which directly impacts the premium.

- Location and Occupation: Your geographical location and occupation can affect insurance quotes, especially for property and liability insurance. High-risk areas or hazardous occupations may result in higher premiums due to increased likelihood of claims.

- Driving Record: For auto insurance, your driving record is a key factor. A clean driving record with no accidents or violations can lead to lower premiums, while a history of accidents or traffic violations may result in higher costs.

- Policy Coverage and Deductibles: The level of coverage and deductibles chosen also impact insurance quotes. Higher coverage limits and lower deductibles often result in higher premiums, as the insurance provider assumes more financial responsibility.

The Quote Process: Step by Step

Obtaining insurance quotes involves a systematic process that ensures a transparent and accurate assessment of your insurance needs. Here’s a step-by-step guide to navigating the quote process:

- Assess Your Needs: Begin by evaluating your specific insurance requirements. Consider the type of coverage you need (e.g., health, auto, homeowners’ insurance) and the level of protection desired. Understanding your needs is crucial for obtaining relevant quotes.

- Research Insurance Providers: Research reputable insurance providers in your area. Look for companies with a solid reputation, financial stability, and positive customer reviews. Compare multiple providers to ensure you have a range of options.

- Gather Information: Collect the necessary information required for insurance quotes. This may include personal details (age, gender, address), health records, driving history, and details about your property or assets. Having this information readily available speeds up the quote process.

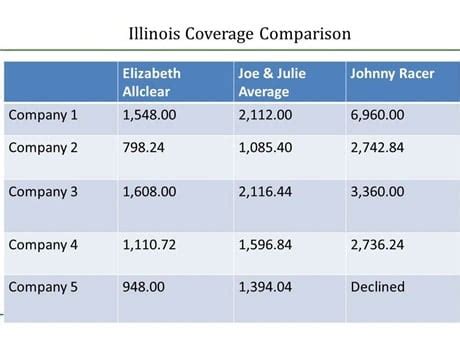

- Compare Quotes: Obtain quotes from multiple insurance providers. Compare the coverage, premiums, and any additional benefits or discounts offered. Look for policies that align with your needs and provide the best value for your money.

- Analyze Coverage and Costs: Carefully examine the coverage provided by each insurance quote. Ensure that the policy meets your specific needs and provides adequate protection. Compare the premiums and any potential discounts or incentives offered by the insurance providers.

- Seek Expert Advice: If you have questions or need clarification, consult with insurance professionals or brokers. They can provide valuable insights and guidance, helping you understand complex policies and make informed decisions.

- Choose the Right Policy: Based on your analysis and expert advice, select the insurance policy that best meets your needs and budget. Consider the long-term benefits and peace of mind provided by the chosen policy.

Maximizing Your Insurance Coverage: Expert Tips

Obtaining insurance quotes is just the beginning. To ensure you maximize your insurance coverage and receive the best value, consider these expert tips:

- Understand Policy Exclusions: Carefully review the policy exclusions to ensure you are aware of any limitations or conditions that may impact your coverage. Being aware of exclusions helps you make informed decisions and avoid surprises during claims.

- Bundle Your Policies: Many insurance providers offer discounts when you bundle multiple policies together. For instance, you can bundle your auto and homeowners’ insurance to save on premiums. This approach simplifies your insurance management and provides additional savings.

- Maintain a Clean Record: For auto and property insurance, maintaining a clean record can lead to significant savings. Avoid accidents, violations, and claims, as these can impact your premiums and future coverage options.

- Explore Discounts and Rewards: Insurance providers often offer discounts for various reasons, such as safe driving, good grades, or loyalty programs. Stay informed about available discounts and take advantage of them to reduce your insurance costs.

- Regularly Review and Update Your Coverage: Your insurance needs may change over time. Regularly review your policies to ensure they still meet your requirements. Update your coverage as necessary to reflect changes in your life, such as marriage, childbirth, or purchasing a new home.

Future Trends and Innovations in Insurance

The insurance industry is continuously evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of insurance and the innovations that are shaping the industry.

Digital Transformation

The digital age has brought about significant changes in the insurance industry. Digital platforms and mobile apps are transforming the way insurance is accessed and managed. Insurtech companies are leveraging technology to offer innovative solutions, such as instant policy issuance, real-time claims processing, and personalized coverage options.

Digital transformation in insurance brings numerous benefits, including:

- Convenience and Accessibility: Insurance services are now accessible anytime, anywhere, thanks to online platforms and mobile apps. Policyholders can manage their policies, submit claims, and receive assistance with just a few clicks.

- Data-Driven Insights: Digital platforms collect and analyze vast amounts of data, providing insurance providers with valuable insights. This data-driven approach allows for more accurate risk assessment and personalized coverage recommendations.

- Enhanced Customer Experience: Digital tools and automation streamline the insurance process, reducing administrative burdens and improving overall customer satisfaction. Policyholders can expect faster claim settlements and more efficient policy management.

Telematics and Usage-Based Insurance

Telematics is revolutionizing the auto insurance industry by using real-time data to assess driving behavior and calculate premiums. Usage-based insurance (UBI) policies leverage telematics devices to track driving habits, such as speed, acceleration, and mileage. This data is used to determine the risk associated with a driver, allowing for more accurate and personalized insurance rates.

The benefits of telematics and UBI include:

- Fairer Premiums: UBI policies reward safe drivers with lower premiums, as their driving behavior is directly reflected in their insurance rates. This encourages safer driving habits and promotes road safety.

- Data-Driven Insights: Telematics data provides insurance providers with valuable insights into driving behavior, allowing them to develop more accurate risk models and offer personalized coverage options.

- Incentives for Safe Driving: By offering lower premiums for safe driving, UBI policies incentivize drivers to adopt safer habits, reducing accidents and improving overall road safety.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming various aspects of the insurance industry, from risk assessment to claims processing. These technologies enable insurance providers to analyze vast amounts of data, identify patterns, and make more accurate predictions.

AI and ML applications in insurance include:

- Underwriting and Risk Assessment: AI algorithms can analyze historical data and identify patterns to assess risk more accurately. This allows insurance providers to offer personalized coverage options and more efficient underwriting processes.

- Claims Processing and Fraud Detection: AI-powered systems can analyze claims data, detect anomalies, and identify potential fraud. This streamlines the claims process, reduces costs, and ensures fair and efficient claim settlements.

- Customer Service and Personalization: AI-powered chatbots and virtual assistants are revolutionizing customer service in the insurance industry. These tools provide instant assistance, answer queries, and offer personalized recommendations, enhancing the overall customer experience.

Conclusion: Empowering Your Financial Security

Insurance is a powerful tool for managing risks and securing your financial future. By understanding the significance of insurance, navigating the quote process, and maximizing your coverage, you can take control of your financial well-being. Stay informed about the latest innovations and trends in the insurance industry to ensure you stay ahead of the curve and make the most of your insurance policies.

How often should I review my insurance policies?

+It is recommended to review your insurance policies annually or whenever significant life changes occur. This ensures your coverage remains up-to-date and aligned with your evolving needs.

Can I negotiate insurance premiums?

+Yes, you can negotiate insurance premiums, especially if you have a clean record or are bundling multiple policies. Contact your insurance provider to discuss potential discounts or explore alternative providers for better rates.

What is the role of an insurance broker?

+An insurance broker acts as an intermediary between you and multiple insurance providers. They can offer unbiased advice, help you compare policies, and negotiate better rates on your behalf. Working with a broker can simplify the insurance process and provide access to a wider range of options.