Good Health Insurance In Florida

When it comes to health insurance in Florida, finding a comprehensive and affordable plan can be a complex task. With a diverse range of options available, it's crucial to understand the market and make an informed decision that aligns with your healthcare needs and financial situation. In this article, we will delve into the world of health insurance in Florida, exploring the key factors to consider and providing valuable insights to help you secure the best coverage for your well-being.

Understanding the Florida Health Insurance Market

Florida boasts a dynamic healthcare landscape, offering a multitude of insurance providers and plans to cater to its diverse population. The state’s robust healthcare system, coupled with its favorable tax incentives and robust Medicaid program, makes it an attractive destination for insurers. However, with numerous options available, navigating the market can be daunting. Let’s unravel the intricacies of Florida’s health insurance scene and provide a comprehensive guide to assist you in making an educated choice.

Key Factors to Consider for Good Health Insurance in Florida

Selecting the right health insurance plan in Florida requires a thoughtful approach, taking into account various crucial aspects. Here are the key factors to ponder when evaluating your options:

Coverage and Benefits

One of the primary considerations is the scope of coverage provided by the insurance plan. Ensure that the plan encompasses the essential healthcare services you anticipate requiring, including primary care, specialist visits, prescription medications, and any specific treatments or procedures you may need. Additionally, scrutinize the plan’s benefits, such as preventive care coverage, maternity benefits, and mental health services, to ascertain that they align with your personal healthcare needs.

For instance, if you have a pre-existing condition, verify that the plan offers comprehensive coverage for it, including any necessary treatments and medications. Similarly, if you frequently visit specialists or require ongoing medical attention, choose a plan that provides generous coverage for these services to minimize out-of-pocket expenses.

Network of Healthcare Providers

The network of healthcare providers affiliated with an insurance plan plays a pivotal role in your healthcare experience. Opt for a plan that boasts a wide network of trusted and reputable healthcare professionals and facilities, ensuring you have convenient access to quality care. Verify that your preferred doctors, specialists, and hospitals are included in the plan’s network to avoid unexpected costs or inconveniences.

Furthermore, assess the plan's network for any restrictions or limitations. Some plans may require you to obtain prior authorization or meet specific criteria to access certain services or providers. Understanding these restrictions beforehand can help you make an informed decision and ensure a seamless healthcare journey.

Cost and Affordability

The cost of health insurance is a critical factor, as it directly impacts your financial well-being. When evaluating plans, consider not only the monthly premiums but also the overall out-of-pocket expenses, including deductibles, copayments, and coinsurance. Assess your healthcare needs and financial situation to determine the level of coverage and cost that aligns with your requirements.

For instance, if you anticipate minimal healthcare expenses, a plan with a higher deductible and lower monthly premiums may be more cost-effective. Conversely, if you anticipate frequent medical visits or require specialized treatments, opting for a plan with a lower deductible and higher monthly premiums may provide better value and financial protection.

Plan Type and Flexibility

Florida offers a variety of health insurance plan types, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) plans. Each plan type comes with its own set of advantages and restrictions, so it’s essential to understand their nuances.

HMOs, for example, typically offer lower premiums but may have more restrictions on provider choices and require referrals for specialist visits. PPOs, on the other hand, provide more flexibility in choosing healthcare providers and often cover out-of-network services at a higher cost. Consider your personal preferences and healthcare needs to determine the plan type that best suits your lifestyle.

Customer Service and Reputation

The quality of customer service provided by an insurance company can significantly impact your overall experience. Research the insurer’s reputation and customer satisfaction ratings to ensure they offer timely and responsive support when needed. Look for companies with a track record of prompt claim processing, easy-to-navigate websites, and helpful customer service representatives.

Additionally, assess the insurer's financial stability and longevity in the market. A financially stable company is more likely to provide reliable coverage and honor its commitments over the long term. Consider seeking recommendations from friends, family, or healthcare professionals who have had positive experiences with certain insurers.

Top Health Insurance Providers in Florida

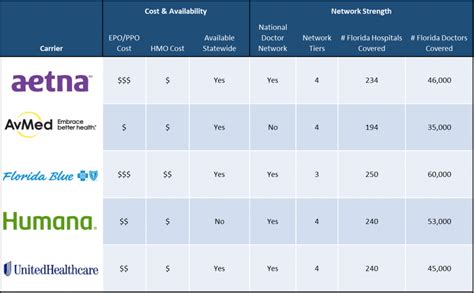

Florida’s health insurance market is served by a variety of reputable providers, each offering a unique range of plans and services. Here’s an overview of some of the top health insurance providers in the state:

| Provider | Plan Types | Notable Features |

|---|---|---|

| Blue Cross Blue Shield of Florida | HMO, PPO, EPO | Comprehensive coverage, wide network, flexible plan options |

| UnitedHealthcare | HMO, PPO, POS | National coverage, innovative technology, diverse plan options |

| Aetna | HMO, PPO, EPO | Focus on wellness and prevention, robust digital tools |

| Cigna | HMO, PPO, POS | Personalized care, global network, emphasis on behavioral health |

| Florida Blue (formerly Blue Cross and Blue Shield of Florida) | HMO, PPO, EPO | State-specific plans, community engagement, comprehensive coverage |

These providers offer a range of plan types and features to cater to different healthcare needs and preferences. It's essential to compare their offerings, including coverage, network, cost, and customer service, to find the best fit for your circumstances.

Florida’s Health Insurance Exchange: A Resource for Comparison

Florida’s Health Insurance Exchange, also known as the Health Insurance Marketplace, is a valuable resource for individuals and families seeking health insurance coverage. The exchange, created under the Affordable Care Act (ACA), provides a centralized platform for comparing and enrolling in health insurance plans. It offers a wide range of plans from various insurers, making it easier to find the right coverage at an affordable price.

The Health Insurance Marketplace in Florida allows individuals to browse and compare plans based on their specific needs and preferences. It provides detailed information on each plan's coverage, costs, and benefits, ensuring transparency and empowering consumers to make informed choices. The exchange also offers financial assistance in the form of subsidies and tax credits to eligible individuals, making quality health insurance more accessible.

Additionally, the Health Insurance Marketplace provides valuable resources and tools to assist individuals in understanding their healthcare options. It offers educational materials, calculators, and personalized assistance to guide consumers through the enrollment process and ensure they select the most suitable plan for their circumstances.

By utilizing the Health Insurance Marketplace, Floridians can explore a diverse range of insurance plans, compare features and costs side by side, and find the best coverage that meets their healthcare needs and budget. It serves as a one-stop shop for individuals and families seeking comprehensive and affordable health insurance.

Tips for Finding Good Health Insurance in Florida

Navigating the health insurance landscape in Florida can be challenging, but with the right approach, you can secure a plan that provides the coverage and benefits you need. Here are some valuable tips to guide you through the process:

- Define your healthcare needs: Assess your personal and family healthcare requirements, including any specific conditions or treatments you anticipate needing. This will help you identify the type of coverage and benefits that are most crucial for your well-being.

- Research and compare: Utilize online resources, insurance comparison websites, and the Health Insurance Marketplace to research and compare different plans. Evaluate factors such as coverage, network, cost, and customer satisfaction to find the best fit for your circumstances.

- Seek expert advice: Consult with healthcare professionals, financial advisors, or insurance brokers who can provide personalized guidance based on your unique situation. Their expertise can help you navigate the complex world of health insurance and make informed decisions.

- Consider your budget: Assess your financial capabilities and determine the level of coverage you can afford. While it's important to prioritize comprehensive coverage, finding a balance between cost and benefits is crucial to ensure sustainability.

- Understand plan exclusions and limitations: Carefully review the plan's exclusions and limitations to avoid unexpected surprises. Ensure that any essential treatments, medications, or services are covered, and clarify any restrictions or prior authorization requirements.

- Explore additional benefits: Look beyond basic coverage and explore plans that offer additional benefits such as wellness programs, disease management support, or telemedicine services. These extras can enhance your overall healthcare experience and provide added value.

- Stay informed and shop around: The health insurance market is dynamic, with plans and providers evolving regularly. Stay updated on industry trends and changes, and don't hesitate to shop around for better deals or improved coverage options.

FAQs about Health Insurance in Florida

What is the average cost of health insurance in Florida?

+The average cost of health insurance in Florida can vary based on factors such as age, location, and plan type. According to recent data, the average monthly premium for an individual plan in Florida is around 400, while family plans can range from 1,000 to $1,500 per month. It’s important to note that these averages may not reflect the actual cost of your specific plan, as premiums can vary significantly depending on your personal circumstances and the level of coverage you choose.

Are there any government-funded health insurance programs in Florida?

+Yes, Florida offers several government-funded health insurance programs to assist eligible individuals and families. The most notable program is Medicaid, which provides comprehensive healthcare coverage to low-income individuals and families. Additionally, the state also offers the Florida KidCare program, which provides affordable health insurance for children from low-income families.

Can I purchase health insurance outside of the open enrollment period in Florida?

+In Florida, you can purchase health insurance outside of the open enrollment period if you qualify for a special enrollment period. Special enrollment periods are typically granted due to life events such as losing other health coverage, getting married, having a baby, or moving to a new state. It’s important to note that outside of these special enrollment periods, you may face limitations or higher costs when purchasing health insurance.

How can I find the best health insurance plan for my family in Florida?

+Finding the best health insurance plan for your family in Florida requires careful consideration of your specific needs and preferences. Start by evaluating your family’s healthcare requirements, including any chronic conditions or specialized treatments. Research and compare plans based on coverage, network, cost, and customer satisfaction. Seek expert advice and utilize resources such as the Health Insurance Marketplace to make an informed decision. Remember to consider the overall value and flexibility of the plan to ensure it meets your family’s healthcare needs.

What are some common exclusions or limitations in health insurance plans in Florida?

+Health insurance plans in Florida, like in other states, may have certain exclusions or limitations. Common exclusions can include elective procedures, cosmetic surgeries, and certain alternative therapies. Additionally, plans may have limitations on the number of specialist visits, prescription refills, or hospital stays. It’s crucial to carefully review the plan’s summary of benefits and exclusions to understand any potential limitations and ensure that your essential healthcare needs are covered.