Cheap Insurance For Auto

In today's world, finding affordable and comprehensive insurance for your vehicle is a priority for many drivers. With rising costs and the need to protect one's assets, the search for cheap insurance for auto has become a common quest. This comprehensive guide will delve into the factors that influence insurance rates, provide tips to secure the best deals, and offer an in-depth analysis of the options available in the market.

Understanding Auto Insurance: A Comprehensive Overview

Auto insurance is a contract between an individual and an insurance provider, designed to protect against financial loss in the event of an accident or other vehicle-related incidents. It is a legal requirement in most countries and states, serving as a vital safety net for drivers and pedestrians alike. The cost of auto insurance can vary significantly, influenced by a multitude of factors that we will explore in detail.

Key Components of Auto Insurance

Auto insurance policies typically consist of several components, each offering different types of coverage. These include:

- Liability Coverage: This covers the costs associated with causing harm or property damage to others in an accident. It is often mandatory and includes both bodily injury and property damage liability.

- Collision Coverage: Collision coverage helps pay for repairs or replacements if your vehicle is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This provides protection for damages not caused by collisions, such as theft, vandalism, natural disasters, or damage caused by hitting an animal.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this covers medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance.

Factors Influencing Auto Insurance Rates

The cost of auto insurance is determined by a variety of factors, including:

- Driver’s Age and Gender: Young drivers and males often pay higher premiums due to their higher risk profiles.

- Driving History: A clean driving record with no accidents or traffic violations can lead to lower insurance rates.

- Vehicle Type and Usage: Sports cars and high-performance vehicles typically have higher insurance costs. Additionally, vehicles used for business or commercial purposes may have different rates.

- Location: Insurance rates can vary significantly based on your geographic location, with urban areas often having higher rates due to increased accident and theft risks.

- Credit History: In many states, insurance companies use credit-based insurance scores to help determine rates. A good credit history can lead to lower premiums.

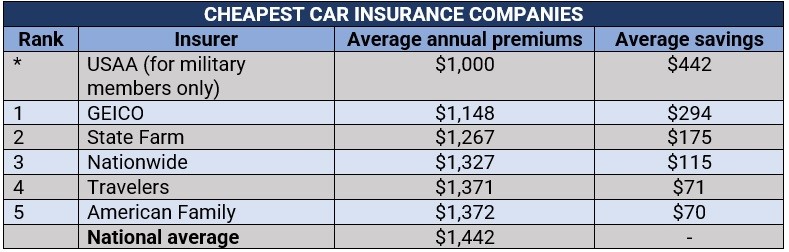

- Insurance Company and Policy Type: Different insurance providers offer various policy types and pricing structures. Shopping around and comparing quotes is essential to find the best deal.

Strategies to Find Cheap Auto Insurance

Securing cheap auto insurance requires a combination of understanding the market, negotiating skills, and a bit of creativity. Here are some effective strategies to help you find the best deals:

Shop Around and Compare Quotes

The insurance market is highly competitive, and prices can vary significantly between providers. Use online comparison tools or contact multiple insurance companies to get quotes. Compare not just the prices, but also the coverage offered and any additional perks or discounts.

Understand Your Coverage Needs

Not all drivers need the same level of coverage. Assess your specific needs based on your vehicle, driving habits, and financial situation. For instance, if you have an older vehicle, you may not need collision or comprehensive coverage, as the cost of repairs might exceed the vehicle’s value.

Bundle Policies for Discounts

Many insurance providers offer discounts when you bundle multiple policies with them. Consider combining your auto insurance with other types of insurance, such as homeowners or renters insurance, to save money.

Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep insurance costs low. Avoid accidents and traffic violations, as these can lead to increased premiums for several years.

Explore Discounts and Rewards

Insurance companies offer a variety of discounts, such as safe driver discounts, loyalty discounts, good student discounts, and discounts for completing defensive driving courses. Additionally, some providers offer usage-based insurance programs that reward safe driving habits with lower rates.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, uses data from a device installed in your vehicle to monitor your driving habits. It can be a great option for safe drivers, as it offers personalized rates based on actual driving behavior rather than generalized risk profiles.

Choose a Higher Deductible

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can significantly reduce your insurance premiums. However, ensure you can afford the higher deductible in the event of a claim.

Keep Your Credit Score Healthy

As mentioned earlier, your credit history can impact your insurance rates. Work on improving and maintaining a good credit score to potentially lower your insurance costs.

Ask About Loyalty and Other Discounts

Loyalty discounts are common in the insurance industry. If you’ve been with the same provider for several years, don’t hesitate to ask about potential discounts for your loyalty.

Top Tips for Managing Auto Insurance Costs

In addition to finding the right insurance policy, there are several ways to manage your auto insurance costs over time:

Review Your Policy Annually

Insurance rates and your personal circumstances can change over time. Review your policy annually to ensure you’re still getting the best deal and that your coverage meets your current needs.

Maintain a Good Relationship with Your Insurer

Building a positive relationship with your insurance provider can lead to better service and potential discounts. Keep your insurer informed of any changes to your vehicle, driving habits, or personal circumstances that might impact your coverage.

Consider Alternative Payment Methods

Some insurance companies offer discounts for certain payment methods, such as paying your premium in full annually rather than monthly. Explore these options to see if they can save you money.

Understand Claim Procedures

Knowing the claim process and your responsibilities can help you navigate any potential claims smoothly. It’s important to understand when and how to file a claim to avoid unnecessary increases in your insurance rates.

Stay Informed about Insurance Trends

The insurance industry is constantly evolving, with new products and services being introduced regularly. Stay informed about the latest trends and innovations to ensure you’re taking advantage of any advancements that could benefit you.

The Future of Auto Insurance: Trends and Innovations

The auto insurance industry is undergoing significant changes, driven by advancements in technology and shifting consumer needs. Here are some key trends and innovations to watch:

Telematics and Usage-Based Insurance

Usage-based insurance, powered by telematics, is gaining popularity. This technology allows insurers to offer personalized rates based on real-time driving data, providing a more accurate assessment of risk.

Artificial Intelligence and Machine Learning

AI and machine learning are being used to streamline insurance processes, from underwriting to claims handling. These technologies can analyze vast amounts of data to identify patterns and predict risks more accurately.

Digitalization and Paperless Processes

The move towards digital insurance is gaining momentum. Insurers are offering more online and mobile services, from quote generation to policy management, making the process more efficient and environmentally friendly.

Pay-Per-Mile Insurance

This innovative model charges drivers based on the number of miles driven, rather than a flat premium. It’s an attractive option for low-mileage drivers, offering significant savings.

Connected Car Technology

With the rise of connected car technology, insurers are exploring ways to use vehicle data to offer more personalized coverage. This includes real-time monitoring of driving behavior and vehicle diagnostics, leading to more accurate risk assessments.

Case Study: A Real-World Example of Finding Cheap Auto Insurance

To illustrate the process of finding cheap auto insurance, let’s consider the example of John, a 35-year-old driver living in a suburban area. John is looking to reduce his insurance costs without compromising on coverage.

John’s Strategy

John starts by shopping around and comparing quotes from multiple insurance providers. He uses online comparison tools and also contacts local insurance brokers to get personalized advice and quotes. He ensures he understands the coverage offered and any potential discounts.

John then reviews his current coverage needs. As a safe driver with a clean record, he decides to maintain liability coverage but removes collision and comprehensive coverage for his older vehicle, as the cost of repairs would likely exceed the vehicle's value.

He explores discounts, finding out that his current provider offers a loyalty discount for customers who have been with them for over 5 years. He also discovers that he's eligible for a safe driver discount and a discount for completing a defensive driving course.

Finally, John considers switching to a usage-based insurance policy, as he drives relatively few miles each year. He installs a telematics device in his vehicle and, after a month of monitoring, finds that his driving habits qualify him for a significant discount.

Results

By implementing these strategies, John is able to reduce his insurance premiums by 30%, saving a substantial amount each year. He maintains comprehensive coverage without compromising on his safety net, and he feels confident that he has made an informed decision based on his specific needs and circumstances.

| Strategy | Savings |

|---|---|

| Shopping Around and Comparing Quotes | $200 |

| Removing Collision and Comprehensive Coverage | $350 |

| Loyalty and Safe Driver Discounts | $150 |

| Usage-Based Insurance | $400 |

| Total Annual Savings | $1,100 |

Frequently Asked Questions

How can I lower my auto insurance premiums if I have a poor driving record?

+

Improving a poor driving record can be challenging, but it’s not impossible. Start by taking a defensive driving course, which can help you become a safer driver and may qualify you for an insurance discount. Additionally, maintain a clean driving record going forward to demonstrate your improved driving behavior. Finally, consider usage-based insurance, which evaluates your driving habits in real-time, potentially offering lower rates for safer driving.

Are there any downsides to usage-based insurance?

+

While usage-based insurance can offer significant savings for safe drivers, it’s important to consider potential privacy concerns. The telematics device installed in your vehicle collects data on your driving habits, which may be shared with your insurance provider. Additionally, if you’re a less-than-perfect driver, usage-based insurance could lead to higher premiums due to your real-time driving data.

What are some common mistakes people make when shopping for auto insurance?

+

One common mistake is assuming that all insurance providers offer the same coverage and pricing. It’s crucial to compare quotes from multiple insurers to ensure you’re getting the best deal. Additionally, not understanding your coverage needs and opting for a policy with too much or too little coverage can lead to financial strain in the event of a claim. Finally, neglecting to review your policy annually can result in missing out on potential savings or needed coverage updates.