What Is Gap Insurance For Cars

Gap insurance, an acronym for Guaranteed Asset Protection insurance, is a specialized type of coverage designed to safeguard car owners and leasers from financial loss in specific scenarios. It acts as a safety net, ensuring that you're not left with a significant debt burden in the event of a total loss or write-off of your vehicle. This form of insurance is particularly crucial for those who have taken out a loan or lease to finance their vehicle, as it bridges the gap between the actual cash value of the car and the amount owed on the loan or lease.

Understanding Gap Insurance

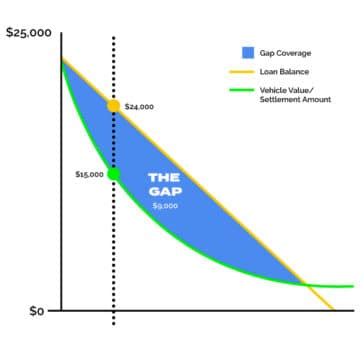

Imagine purchasing a brand-new car. Within a matter of months, its value can drop significantly, especially in the first year. This rapid depreciation can leave you in a situation where the outstanding loan amount is higher than the vehicle’s current market value. Gap insurance steps in to cover this difference, providing financial protection.

Gap insurance is an optional add-on to your standard car insurance policy. While it doesn't protect against physical damage to your vehicle, it ensures that you're not personally responsible for any financial shortfall should the worst happen. This is particularly important when considering the potential costs of an accident or theft, where the vehicle is rendered a total loss.

When is Gap Insurance Necessary?

Gap insurance is most beneficial in the following circumstances:

- Vehicle Loan or Lease: If you’ve financed your car through a loan or lease agreement, gap insurance can provide peace of mind, ensuring you’re not left with a large outstanding debt if the vehicle is written off.

- Rapid Depreciation: Cars, especially new models, depreciate quickly. Gap insurance covers this rapid loss of value, ensuring you’re not personally liable for the difference.

- Total Loss: In the event of a severe accident or theft where the vehicle is a total loss, gap insurance steps in to cover the difference between the insurance payout and the amount owed on the loan or lease.

How Gap Insurance Works

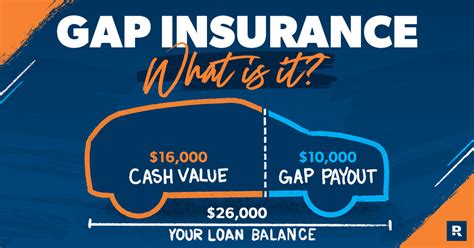

Gap insurance operates by providing an additional layer of coverage to your existing car insurance policy. It’s activated when your vehicle is declared a total loss, and the insurance company pays out the actual cash value (ACV) of the car at the time of the incident. If the ACV is less than the amount owed on your loan or lease, gap insurance steps in to cover the difference, ensuring you’re not left with a financial burden.

| Scenario | Outcome with Gap Insurance |

|---|---|

| Vehicle Total Loss | Gap insurance covers the difference between the ACV and the outstanding loan/lease amount, ensuring no personal financial loss. |

| Vehicle Depreciation | Gap insurance accounts for the rapid depreciation, providing coverage for the difference between the original purchase price and the current ACV. |

The Benefits of Gap Insurance

Gap insurance offers several key advantages to car owners and leasers:

- Financial Protection: The primary benefit of gap insurance is financial security. It ensures that you’re not personally liable for any outstanding debt if your vehicle is written off.

- Peace of Mind: With gap insurance, you can drive with confidence, knowing that you’re protected against potential financial losses due to vehicle depreciation or total loss.

- Affordability: Gap insurance is typically very affordable, especially when compared to the potential costs of a total loss without this coverage.

- Wide Availability: Gap insurance is offered by most major insurance companies, making it easily accessible for car owners and leasers.

Who Should Consider Gap Insurance

Gap insurance is particularly beneficial for the following groups:

- New Car Buyers: Those who have recently purchased a new car, as these vehicles depreciate the fastest.

- Leasers: Individuals who have leased a vehicle, as they are typically required to return the car at the end of the lease term, regardless of its financial value.

- Loan Borrowers: Car owners who have financed their vehicle through a loan, especially if the loan term is longer than the expected depreciation period of the car.

The Future of Gap Insurance

As the automotive industry evolves, gap insurance continues to play a crucial role in protecting car owners and leasers. With the rise of electric vehicles (EVs) and the potential for rapid technological advancements, the depreciation patterns of vehicles may change. Gap insurance will likely adapt to these changes, ensuring that car owners are protected against financial losses due to technological obsolescence or rapid depreciation.

Additionally, with the increasing popularity of subscription models and shared mobility services, gap insurance may need to evolve to cater to these new ownership and usage models. This could involve developing specific gap insurance products tailored to these unique scenarios.

Frequently Asked Questions

Is Gap Insurance Mandatory for All Car Owners?

+Gap insurance is typically not mandatory for all car owners. However, it is highly recommended, especially for those who have financed their vehicle or are leasing. It provides crucial financial protection in the event of a total loss.

How Much Does Gap Insurance Cost?

+The cost of gap insurance can vary based on several factors, including the value of your vehicle, the type of coverage, and the insurance provider. On average, gap insurance can range from 100 to 500 annually, making it an affordable option for the protection it provides.

Can Gap Insurance Be Purchased Separately from My Car Insurance Policy?

+Yes, gap insurance can often be purchased as a standalone policy from various providers, including car dealerships and insurance companies. However, it is typically more cost-effective to add gap insurance as an endorsement to your existing car insurance policy.