Insurance Mortgage Quote

Securing a mortgage is a significant financial step, and an essential part of the process is understanding your insurance options. The right insurance coverage can provide peace of mind and protect your investment, while a quote can give you a clear idea of the costs involved. In this comprehensive guide, we delve into the world of insurance mortgage quotes, exploring the key factors, benefits, and considerations to help you make informed decisions.

Unraveling the Insurance Mortgage Quote Process

When it comes to obtaining an insurance mortgage quote, there are several crucial aspects to consider. First and foremost, it’s essential to understand the type of insurance coverage you require. Mortgage protection insurance, for instance, safeguards your ability to repay the mortgage in case of unforeseen circumstances. On the other hand, home insurance protects the physical structure and your belongings against various risks.

The quote itself provides a detailed estimate of the insurance premium you'll need to pay. This premium is influenced by a range of factors, including the type of insurance, the value of your property, your personal circumstances, and the level of coverage you opt for. By obtaining multiple quotes, you can compare different insurance providers and find the most suitable and cost-effective option for your needs.

Key Factors Influencing Insurance Mortgage Quotes

Several critical factors come into play when determining your insurance mortgage quote. Let’s take a closer look at these factors and how they impact the overall cost of insurance:

- Property Value: The value of your property is a significant determinant. Higher-value properties often attract higher insurance premiums to adequately cover the risk.

- Location: The location of your property can also impact the quote. Areas with higher crime rates or natural disaster risks may result in increased insurance costs.

- Coverage Options: The type and extent of coverage you choose play a vital role. Comprehensive coverage, which includes various perils, will typically cost more than basic coverage.

- Deductibles: Opting for a higher deductible can lower your insurance premium. However, it's essential to consider your financial capacity to pay the deductible in case of a claim.

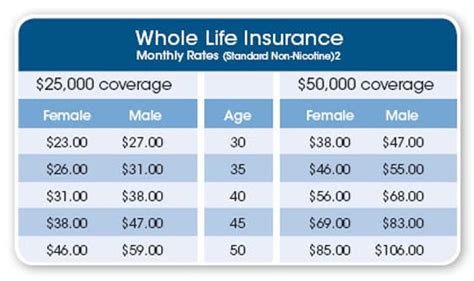

- Personal Circumstances: Your age, occupation, and health can influence the quote. Certain professions or health conditions may pose higher risks, leading to increased premiums.

It's worth noting that insurance providers often offer discounts and incentives to attract customers. These can include loyalty discounts, multiple policy discounts, or even discounts for specific professions or memberships. Understanding these factors and leveraging available discounts can help you secure a more affordable insurance mortgage quote.

The Benefits of Comprehensive Insurance Coverage

Comprehensive insurance coverage offers numerous advantages that go beyond simply protecting your mortgage investment. Here’s a closer look at the benefits it provides:

Financial Protection and Peace of Mind

One of the primary benefits of comprehensive insurance coverage is the financial protection it offers. In the event of a covered loss, such as a fire, flood, or burglary, your insurance policy will step in to cover the costs of repairs or replacements. This financial support ensures that you can maintain your standard of living and continue making mortgage payments without incurring additional debt.

Moreover, comprehensive insurance coverage provides peace of mind. Knowing that your home and its contents are protected against a wide range of risks allows you to focus on enjoying your home and planning for the future without the constant worry of potential financial setbacks.

Coverage for Specific Risks

Comprehensive insurance policies are designed to cover a broad spectrum of risks. This includes not only structural damage to your home but also damage to your personal belongings, liability coverage in case of accidents on your property, and even temporary living expenses if your home becomes uninhabitable due to a covered loss.

By opting for comprehensive coverage, you can customize your policy to include specific risks relevant to your situation. For example, if you live in an area prone to natural disasters like hurricanes or earthquakes, you can add additional coverage to protect against these specific perils. This tailored approach ensures that your insurance policy aligns with your unique needs and provides the necessary protection.

Flexibility and Customization

Comprehensive insurance coverage offers flexibility and customization options that allow you to tailor your policy to your specific circumstances. Insurance providers often provide a range of coverage levels and optional add-ons that you can choose from. This enables you to select the level of coverage that best suits your budget and the value of your assets.

Additionally, comprehensive insurance policies often come with additional benefits and services. These may include 24/7 emergency assistance, access to a network of preferred repair professionals, and even identity theft protection. By choosing comprehensive coverage, you gain access to these valuable services, enhancing your overall protection and peace of mind.

Comparative Analysis: Insurance Mortgage Quotes vs. Alternatives

When considering insurance for your mortgage, it’s essential to explore alternative options and conduct a thorough comparative analysis. While insurance mortgage quotes provide a comprehensive solution, there are other avenues to explore, each with its own advantages and considerations.

Self-Insuring: The Risks and Rewards

One alternative to traditional insurance is self-insuring, where you set aside funds to cover potential losses instead of paying insurance premiums. This approach can be appealing to those who prefer to have full control over their finances and avoid paying for coverage they may not utilize. However, it’s crucial to carefully assess the risks and rewards associated with self-insuring.

The primary advantage of self-insuring is the potential for cost savings. By not paying insurance premiums, you can allocate those funds towards other financial goals or investments. Additionally, self-insuring provides flexibility, as you can choose how and when to use your funds. However, it's important to recognize that self-insuring comes with significant risks.

One of the main risks of self-insuring is the potential for financial strain in the event of a major loss. If your home suffers extensive damage or you experience a total loss, the costs can be substantial. Without insurance coverage, you may be left with a significant financial burden that could impact your ability to make mortgage payments or even result in foreclosure.

Furthermore, self-insuring may not provide the same level of protection against liability claims. If someone is injured on your property or if you are found liable for damages, the financial consequences can be severe. Without insurance coverage, you may be personally responsible for covering these costs, which could lead to significant financial hardship.

Shared Equity Schemes: A Collaborative Approach

Shared equity schemes offer an alternative approach to traditional insurance and self-insuring. These schemes involve a collaborative arrangement between homeowners and a third party, often a housing association or a government agency. The third party provides a portion of the funding for the purchase of the property, typically in exchange for a share of the equity.

One of the key advantages of shared equity schemes is the reduced financial burden on homeowners. By sharing the equity with a third party, homeowners can often secure a mortgage with a smaller deposit and lower monthly payments. This can be particularly beneficial for first-time buyers or those with limited financial resources.

Additionally, shared equity schemes provide a level of financial security. The third party's investment in the property acts as a form of insurance, as they have a vested interest in the property's value and maintenance. This can help protect homeowners from potential losses and ensure that the property is well-maintained.

However, it's important to carefully consider the terms and conditions of shared equity schemes. These arrangements often come with restrictions and requirements, such as limitations on the amount of equity you can own or restrictions on selling the property. It's crucial to understand the implications of these terms and ensure that they align with your long-term goals and financial plans.

Government-Backed Mortgage Programs: A Safe Option

Government-backed mortgage programs, such as those offered by the Federal Housing Administration (FHA) in the United States, provide an alternative to traditional insurance mortgage quotes. These programs are designed to make homeownership more accessible and affordable, particularly for first-time buyers or those with lower credit scores.

One of the primary benefits of government-backed mortgage programs is the reduced down payment requirement. These programs often allow borrowers to put down as little as 3.5% of the purchase price, making it easier to enter the housing market. Additionally, these programs often have more flexible credit requirements, allowing borrowers with lower credit scores to qualify for a mortgage.

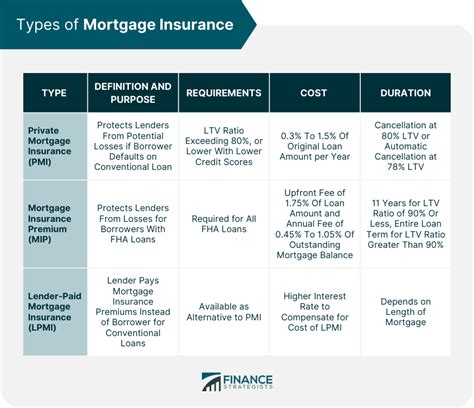

Furthermore, government-backed mortgage programs provide built-in insurance coverage. The FHA, for example, requires borrowers to pay for mortgage insurance, which protects the lender in case of default. This insurance coverage ensures that lenders are willing to offer mortgages to borrowers who may pose a higher risk, providing a safety net for both the lender and the borrower.

While government-backed mortgage programs offer advantages, it's important to consider the potential drawbacks. The mortgage insurance premiums associated with these programs can be higher than traditional insurance premiums, and they may be required for the life of the loan. Additionally, these programs often have specific eligibility criteria and may not be suitable for all borrowers.

Expert Insights: Navigating the Insurance Mortgage Quote Landscape

Obtaining an insurance mortgage quote can be a complex process, and seeking expert advice can provide valuable guidance and peace of mind. Insurance professionals, such as brokers and agents, possess extensive knowledge of the industry and can offer tailored recommendations based on your unique circumstances.

The Role of Insurance Brokers and Agents

Insurance brokers and agents play a crucial role in helping individuals and businesses navigate the insurance landscape. They act as intermediaries between insurance providers and their clients, offering unbiased advice and support throughout the insurance-buying process.

Brokers and agents have access to a wide range of insurance providers and can compare multiple policies to find the best fit for their clients. They can provide personalized recommendations based on factors such as property value, location, and coverage needs. By leveraging their industry expertise, brokers and agents can help clients secure the most comprehensive and cost-effective insurance coverage.

Additionally, insurance brokers and agents offer ongoing support and assistance. They can help clients understand their policy, file claims, and navigate any changes or updates to their insurance coverage. Their expertise ensures that clients receive the full benefits of their insurance policies and are protected against potential risks.

Tips for Choosing the Right Insurance Provider

When it comes to selecting an insurance provider, there are several key factors to consider. First and foremost, it’s essential to evaluate the provider’s financial stability and reputation. Look for insurance companies with a strong financial standing and a history of paying claims promptly and fairly. This ensures that you’ll have the necessary support in the event of a loss.

Additionally, consider the provider's customer service and claim handling processes. Look for companies with a positive track record of customer satisfaction and efficient claim handling. Prompt and responsive customer service can make a significant difference in times of need.

It's also beneficial to assess the provider's coverage options and customization capabilities. Choose an insurance company that offers a range of coverage levels and add-ons to suit your specific needs. Flexibility and the ability to tailor your policy can provide added peace of mind and ensure that you have the protection you require.

Lastly, don't underestimate the value of word-of-mouth recommendations and online reviews. Hearing about others' experiences with insurance providers can provide valuable insights and help you make an informed decision. Consider seeking recommendations from trusted sources and reading reviews to get a sense of the provider's overall performance and customer satisfaction.

Future Implications and Industry Trends

The insurance industry is constantly evolving, and staying informed about future implications and trends is crucial for homeowners and investors alike. As technology advances and consumer needs change, the insurance landscape is likely to undergo significant transformations.

The Rise of Insurtech and Digital Innovation

Insurtech, or insurance technology, is revolutionizing the industry with innovative digital solutions. Insurtech startups and established insurance companies are leveraging technology to enhance the customer experience, streamline processes, and offer more personalized coverage options.

One of the key trends in insurtech is the use of artificial intelligence (AI) and machine learning. These technologies enable insurance providers to analyze vast amounts of data, predict risks more accurately, and offer tailored insurance products. AI-powered chatbots and virtual assistants are also becoming increasingly common, providing customers with instant support and information.

Additionally, insurtech companies are leveraging mobile apps and online platforms to simplify the insurance-buying process. Customers can now easily compare policies, purchase coverage, and manage their policies from the convenience of their smartphones or computers. This digital transformation not only enhances customer convenience but also reduces administrative burdens for insurance providers.

Climate Change and its Impact on Insurance

Climate change is an increasingly pressing concern, and its impact on the insurance industry cannot be overlooked. As extreme weather events become more frequent and severe, insurance providers are faced with the challenge of assessing and managing these risks.

Insurance companies are adapting their strategies to address climate-related risks. This includes developing new products and coverage options specifically designed to protect against natural disasters, such as flood insurance or wildfire coverage. Additionally, insurance providers are utilizing advanced risk modeling and data analytics to better understand and mitigate climate-related risks.

However, the rising frequency and severity of climate-related events also pose challenges for insurance affordability. As insurance providers face increasing payouts for weather-related claims, premiums may rise, making insurance coverage less accessible for some individuals and businesses. This highlights the importance of sustainable practices and collective efforts to mitigate climate change impacts.

Emerging Risks and the Need for Adaptability

The insurance industry must continuously adapt to emerging risks and changing consumer needs. As technology advances and society evolves, new risks and challenges arise. For example, the rise of autonomous vehicles and the sharing economy has given rise to new liability concerns, prompting insurance providers to develop innovative coverage solutions.

Additionally, the COVID-19 pandemic has highlighted the importance of business interruption insurance and the need for comprehensive coverage against unforeseen events. Insurance providers are now reevaluating their policies and coverage options to ensure they can provide adequate protection against a wide range of risks, including pandemics and other unforeseen catastrophes.

As the insurance industry navigates these emerging risks, it's crucial for homeowners and investors to stay informed and proactive. Regularly reviewing and updating insurance policies to align with changing needs and risks is essential. By staying abreast of industry trends and developments, individuals can ensure they have the necessary coverage to protect their assets and mitigate potential losses.

How often should I review my insurance mortgage quote and coverage?

+It is recommended to review your insurance mortgage quote and coverage annually or whenever significant changes occur in your life or circumstances. These changes may include purchasing additional property, making renovations, or experiencing life events such as marriage or having children. Regular reviews ensure that your coverage remains adequate and aligned with your current needs.

What factors should I consider when comparing insurance mortgage quotes?

+When comparing insurance mortgage quotes, consider factors such as the coverage limits, deductibles, exclusions, and additional benefits offered by each policy. Look for policies that provide comprehensive coverage tailored to your specific needs. Additionally, assess the financial stability and reputation of the insurance providers to ensure they are reliable and capable of paying out claims.

Are there any tax benefits associated with insurance mortgage quotes?

+In some countries, there may be tax benefits associated with insurance mortgage quotes. For example, in the United States, certain insurance premiums, such as homeowners’ insurance, may be tax-deductible. It’s important to consult with a tax professional or refer to the specific tax laws in your jurisdiction to understand the potential tax advantages related to insurance mortgage quotes.