Hartford Fire Insurance

The Hartford Fire Insurance Company, a subsidiary of The Hartford Financial Services Group, Inc., is a renowned name in the insurance industry. With a rich history spanning over a century and a half, it has established itself as a trusted provider of insurance solutions. In this article, we will delve into the fascinating world of Hartford Fire Insurance, exploring its history, key offerings, notable achievements, and its impact on the insurance landscape.

A Historical Journey: The Birth of Hartford Fire Insurance

The roots of Hartford Fire Insurance can be traced back to 1810, a time when the insurance industry was in its infancy. It was founded by a group of visionary individuals who recognized the need for a reliable insurance provider to protect businesses and individuals against the devastating effects of fire. This group, led by prominent figures like Eliphalet Terry and Samuel Watkins, laid the foundation for what would become one of the oldest and most respected insurance companies in the United States.

In its early years, Hartford Fire Insurance focused primarily on providing fire insurance policies to businesses. The company's expertise and innovative approaches quickly gained recognition, leading to its expansion into other insurance sectors. Over time, it diversified its offerings to include property, casualty, and life insurance, catering to the evolving needs of its customers.

Key Milestones and Achievements:

- In 1851, Hartford Fire Insurance became the first insurance company to offer fire insurance policies to individuals, a groundbreaking move that democratized insurance coverage.

- The company played a pivotal role in the recovery efforts following the Great Chicago Fire of 1871, demonstrating its commitment to supporting communities in times of need.

- During the late 19th century, Hartford Fire Insurance expanded its reach internationally, establishing a presence in Europe and becoming one of the first American insurance companies to do so.

- The 20th century saw the company’s continued growth and innovation. It introduced new insurance products, such as automobile insurance and workers’ compensation, keeping pace with the changing times.

- In the 1960s, Hartford Fire Insurance made significant strides in the realm of diversity and inclusion, becoming one of the first insurance companies to appoint a female executive.

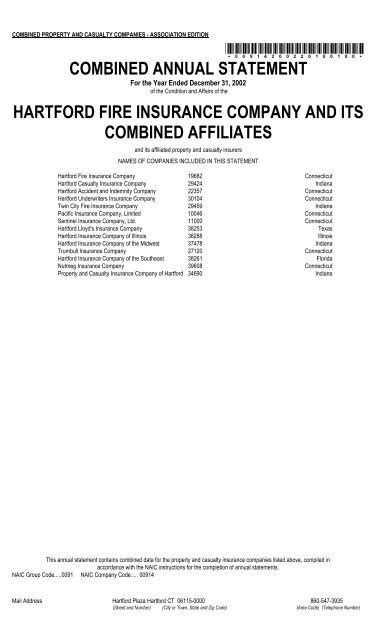

Today, Hartford Fire Insurance stands as a testament to its founders' vision and the company's ability to adapt and thrive. It has maintained its reputation for financial strength and stability, consistently earning high ratings from leading credit rating agencies.

Insurance Offerings: Protecting What Matters

Hartford Fire Insurance offers a comprehensive suite of insurance products tailored to meet the diverse needs of its customers. Here’s an overview of its key offerings:

Property Insurance

Hartford Fire Insurance provides a range of property insurance solutions, including:

- Homeowners Insurance: Protecting homeowners against fire, theft, and other perils, with customizable coverage options.

- Renters Insurance: Covering personal belongings and providing liability protection for renters.

- Condo Insurance: Tailored coverage for condominium owners, addressing unique risks associated with condo living.

- Landlord Insurance: Offering protection for rental properties, including coverage for damage and liability.

Casualty Insurance

The company’s casualty insurance offerings include:

- Auto Insurance: Providing comprehensive coverage for vehicles, with options for collision, liability, and comprehensive protection.

- Motorcycle Insurance: Tailored policies for motorcycle enthusiasts, covering various bike types and riding styles.

- Boat Insurance: Protecting boat owners against damage, theft, and liability claims.

- Umbrella Insurance: Offering additional liability coverage beyond standard policies, providing an extra layer of protection.

Life and Health Insurance

Hartford Fire Insurance’s life and health insurance products include:

- Life Insurance: Term life, whole life, and universal life insurance options to suit different financial goals and needs.

- Disability Insurance: Providing income protection in the event of disability, ensuring financial stability.

- Long-Term Care Insurance: Covering the costs associated with long-term care, including nursing home and assisted living expenses.

- Critical Illness Insurance: Offering a lump-sum payment upon the diagnosis of a covered critical illness, providing financial support during challenging times.

Innovative Solutions and Customer Experience

Hartford Fire Insurance has embraced technology and innovation to enhance its customer experience. The company offers convenient online platforms for policyholders to manage their accounts, file claims, and access resources. Additionally, its mobile apps provide on-the-go access to insurance information and emergency assistance.

Hartford Fire Insurance also prioritizes customer education and financial literacy. It provides resources and tools to help individuals and businesses make informed insurance decisions. The company's commitment to transparency and customer satisfaction has earned it numerous accolades and customer loyalty.

Community Engagement and Social Responsibility

Beyond its insurance offerings, Hartford Fire Insurance is dedicated to giving back to the communities it serves. The company actively engages in philanthropic initiatives, supporting causes such as education, disaster relief, and environmental sustainability. Its corporate social responsibility programs have made a positive impact on society, reinforcing its commitment to making a difference.

Future Prospects and Industry Leadership

As the insurance industry continues to evolve, Hartford Fire Insurance remains at the forefront, adapting to new trends and technologies. The company is investing in digital transformation, data analytics, and artificial intelligence to enhance its underwriting and claims processes. By leveraging these advancements, it aims to provide even more efficient and personalized insurance solutions.

Looking ahead, Hartford Fire Insurance is well-positioned to maintain its industry leadership. Its strong financial foundation, coupled with its commitment to innovation and customer satisfaction, ensures its continued success and relevance in the dynamic insurance landscape.

| Insurance Type | Coverage Highlights |

|---|---|

| Property Insurance | Customizable coverage for homeowners, renters, and landlords; tailored solutions for unique property types. |

| Casualty Insurance | Comprehensive auto, motorcycle, boat, and umbrella insurance; specialized coverage for diverse lifestyles. |

| Life and Health Insurance | Flexible life insurance options; disability and long-term care coverage; critical illness protection. |

How does Hartford Fire Insurance ensure financial stability for its policyholders?

+Hartford Fire Insurance maintains a strong financial foundation by adhering to rigorous financial management practices. It consistently receives high ratings from credit rating agencies, reflecting its stability and ability to meet its financial obligations. The company’s commitment to fiscal responsibility ensures that policyholders can trust their insurance coverage.

What sets Hartford Fire Insurance apart from its competitors in the insurance industry?

+Hartford Fire Insurance’s long-standing reputation, financial strength, and commitment to innovation set it apart. The company’s ability to adapt to changing market dynamics and its focus on customer satisfaction have earned it a loyal customer base. Additionally, its diverse range of insurance products and services cater to a wide spectrum of needs.

How does Hartford Fire Insurance handle claims and customer support?

+Hartford Fire Insurance is dedicated to providing exceptional customer support throughout the claims process. Its online platforms and mobile apps offer convenient access to resources and claims management. The company’s customer service team is known for its responsiveness and expertise, ensuring a seamless experience for policyholders.