Residential Insurance Quotes

In the complex landscape of homeownership, safeguarding your residence is a top priority. Among the many considerations, residential insurance stands out as a critical aspect that demands careful attention. Obtaining accurate insurance quotes is a pivotal step in ensuring you have the right coverage for your home and its contents.

The process of securing residential insurance is multifaceted, influenced by various factors such as the location of your home, its construction type, the value of your possessions, and the specific perils you wish to protect against. This article delves into the intricacies of residential insurance quotes, offering an expert's guide to help you navigate this crucial aspect of homeownership.

Understanding the Basics of Residential Insurance

Residential insurance, often referred to as home insurance or homeowners insurance, is a contractual agreement between a policyholder and an insurance company. This contract outlines the terms and conditions under which the insurance provider agrees to compensate the policyholder for losses or damages covered by the policy.

The primary objective of residential insurance is to provide financial protection against a variety of risks, including natural disasters, theft, vandalism, and liability claims. By understanding the basics of residential insurance, you can make informed decisions about the type and extent of coverage you need to safeguard your home and its contents.

Key Components of a Residential Insurance Policy

A typical residential insurance policy consists of several key components, each designed to address specific risks and provide comprehensive coverage.

- Dwelling Coverage: This covers the physical structure of your home, including its exterior and interior components. It typically includes protection against damage caused by fire, storms, vandalism, and other perils.

- Personal Property Coverage: This covers the contents of your home, such as furniture, electronics, clothing, and other personal belongings. It ensures that you can replace or repair these items in the event of a covered loss.

- Liability Coverage: This protects you against claims and lawsuits arising from accidents or injuries that occur on your property. It covers medical expenses, legal fees, and other costs associated with such incidents.

- Additional Living Expenses (ALE): In the event your home becomes uninhabitable due to a covered loss, ALE coverage provides financial assistance for temporary housing and other necessary expenses until your home is repaired or rebuilt.

- Loss of Use Coverage: Similar to ALE, this coverage provides reimbursement for additional living expenses incurred when your home is being repaired or rebuilt after a covered loss.

- Personal Liability Coverage: This extends beyond your property, covering you against claims arising from accidents or injuries that occur away from your home, such as while you're on vacation or visiting a public place.

Factors Influencing Residential Insurance Quotes

When seeking residential insurance quotes, it’s essential to understand the various factors that can influence the cost and coverage of your policy. These factors are considered by insurance providers to assess the level of risk associated with your home and determine the appropriate premium.

Location and Climate

The geographical location of your home plays a significant role in determining your insurance quote. Areas prone to natural disasters like hurricanes, earthquakes, or wildfires tend to have higher insurance premiums due to the increased risk of property damage.

Additionally, the climate in your region can impact your insurance rates. For instance, homes in areas with high humidity or extreme temperatures may face higher risks of mold or pest infestations, leading to increased insurance costs.

| Location Factor | Impact on Insurance Quote |

|---|---|

| Proximity to Coastlines | Higher rates due to potential hurricane damage. |

| Seismic Activity Zones | Increased premiums for earthquake coverage. |

| Fire-Prone Regions | Higher rates to cover wildfire risks. |

| Extreme Weather Zones | Premiums adjusted for potential damage from storms. |

Home Construction and Age

The construction type and age of your home are important considerations for insurance providers. Older homes may require more extensive repairs or use outdated materials, increasing the risk of damage and subsequent claims. Similarly, certain construction types, such as those using flammable materials, may also result in higher insurance costs.

Insurance companies often offer discounts for homes that meet certain construction standards or have been upgraded to modern safety codes. These upgrades can include features like reinforced roofs, fire-resistant materials, or improved electrical systems.

Claim History

Your insurance claim history is a significant factor in determining your insurance quote. A history of frequent or costly claims can lead to higher premiums, as it indicates a higher risk to the insurance provider. Conversely, a clean claim history may result in lower rates and more favorable insurance terms.

Home Security and Safety Features

Installing security systems, fire alarms, and other safety features can significantly impact your insurance quote. These measures reduce the risk of theft, vandalism, and fire-related incidents, leading to potential discounts on your insurance policy. Some insurance companies even offer specific discounts for homes with certain safety features.

Comparing Residential Insurance Quotes

Obtaining multiple residential insurance quotes is crucial to ensure you get the best coverage at the most competitive price. Comparing quotes allows you to assess the coverage and premiums offered by different insurance providers, helping you make an informed decision about your home insurance.

Key Considerations When Comparing Quotes

- Coverage Limits: Ensure that the quotes you receive provide adequate coverage for your home and its contents. Consider the replacement cost of your home and the value of your personal belongings when assessing coverage limits.

- Deductibles: Compare the deductibles (the amount you pay out-of-pocket before the insurance coverage kicks in) across different quotes. Higher deductibles can result in lower premiums, but it’s essential to choose a deductible that aligns with your financial capacity.

- Additional Coverages: Evaluate the quotes for any optional coverages that may be beneficial for your specific situation. This could include coverage for high-value items, flood insurance, or earthquake insurance, depending on your location and needs.

- Policy Terms and Conditions: Carefully read the terms and conditions of each quote. Pay attention to exclusions, limitations, and any fine print that could impact your coverage in the event of a claim.

- Provider Reputation and Financial Stability: Research the reputation and financial stability of the insurance providers offering the quotes. Choose a provider with a strong financial standing and a history of prompt claim settlements.

Online Quote Comparison Tools

In today’s digital age, online quote comparison tools have become a valuable resource for homeowners seeking residential insurance. These tools allow you to input your home details and receive multiple quotes from various insurance providers, making it easier to compare coverage and prices.

When using online quote comparison tools, be sure to provide accurate and detailed information about your home and its features. Inaccurate information can lead to quotes that don't accurately reflect your insurance needs, potentially resulting in inadequate coverage or higher premiums.

Obtaining an Accurate Residential Insurance Quote

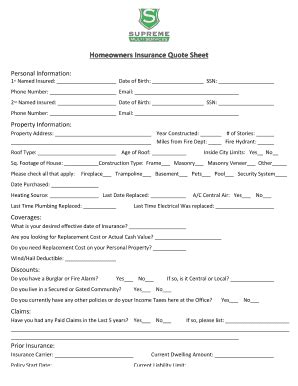

To ensure you receive an accurate residential insurance quote, it’s essential to provide comprehensive and honest information about your home and its contents. Here are some tips to help you obtain an accurate quote:

- Know Your Home's Value: Understand the replacement cost of your home, which is the cost to rebuild your home from the ground up using similar materials and construction techniques. This value is different from the market value of your home and is a critical factor in determining your insurance coverage.

- Inventory Your Personal Belongings: Create a detailed inventory of your personal possessions, including their value and any receipts or appraisals you may have. This ensures that you receive adequate coverage for your belongings in the event of a loss.

- Understand Your Risks: Be aware of the specific risks your home faces, such as natural disasters, theft, or liability claims. Discuss these risks with your insurance agent to ensure they are adequately covered in your policy.

- Review Your Policy Regularly: Insurance needs can change over time, so it's important to review your policy annually or whenever significant changes occur in your home or personal circumstances. This ensures that your coverage remains up-to-date and adequate.

The Importance of Regular Policy Reviews

Regularly reviewing your residential insurance policy is a critical aspect of homeownership. Life changes, such as home renovations, the addition of valuable possessions, or changes in your family structure, can impact your insurance needs. By reviewing your policy annually, you can ensure that your coverage remains aligned with your current circumstances.

During your policy review, consider the following:

- Home Improvements: Have you made any significant renovations or upgrades to your home? Inform your insurance provider about these changes, as they may impact your coverage and premiums.

- Increased Value of Belongings: Have you acquired any high-value items, such as jewelry, artwork, or electronics? Ensure that these items are adequately covered by your personal property insurance.

- Liability Risks: Have your liability risks changed? For instance, if you now have a swimming pool or trampoline on your property, your liability coverage may need to be adjusted to protect against potential accidents.

- Discounts and Credits: Check if you're eligible for any new discounts or credits, such as those for multi-policy bundles or safety features. Insurance providers often offer these incentives to encourage policyholders to maintain their coverage.

FAQs

What is the difference between actual cash value and replacement cost coverage for my home?

+Actual cash value coverage reimburses you for the cost of your home and its contents minus depreciation. On the other hand, replacement cost coverage pays the full cost to rebuild or replace your home and its contents, without deducting for depreciation.

How often should I review my residential insurance policy?

+It’s recommended to review your policy annually or whenever there are significant changes to your home or personal circumstances. Regular reviews ensure your coverage remains adequate and up-to-date.

Can I bundle my residential insurance with other policies to save money?

+Yes, many insurance providers offer multi-policy discounts when you bundle your residential insurance with other policies, such as auto insurance or umbrella liability coverage. Bundling can result in significant savings on your insurance premiums.