How To Get Insurance For A Car

Ensuring your vehicle is adequately insured is an essential step for any car owner. Car insurance provides financial protection and peace of mind in the event of accidents, theft, or other unforeseen circumstances. This guide will take you through the process of understanding car insurance and how to obtain the right coverage for your vehicle.

Understanding Car Insurance Policies

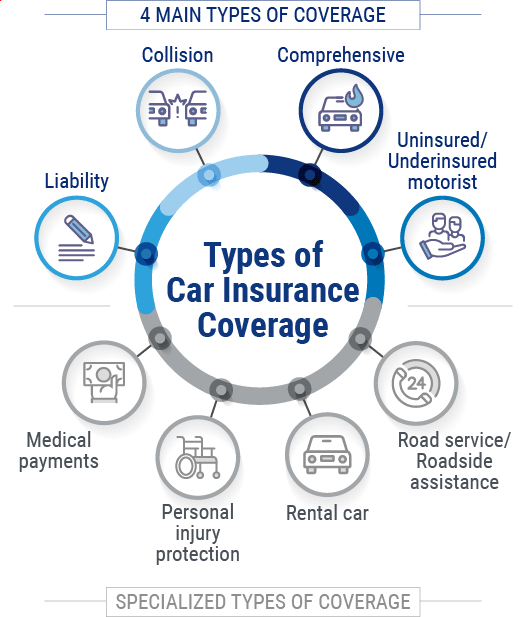

Car insurance policies are contracts between you and an insurance provider, offering financial coverage for specific situations involving your vehicle. These policies can vary widely, and it's crucial to understand the different types and what they cover.

Liability Insurance

Liability insurance is a fundamental component of car insurance. It covers the cost of damage or injury you cause to others in an accident. This type of insurance is legally required in most states and is typically the minimum coverage needed to drive a vehicle.

Liability insurance can be further divided into:

- Bodily Injury Liability: Covers medical expenses and lost wages for individuals injured in an accident caused by you.

- Property Damage Liability: Pays for the repair or replacement of property, such as another vehicle or fence, damaged in an accident caused by you.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional but highly recommended. Collision insurance covers damage to your vehicle in an accident, regardless of who is at fault. Comprehensive coverage, on the other hand, provides protection for your vehicle in situations other than accidents, such as theft, vandalism, natural disasters, or damage caused by animals.

Other Coverage Options

Depending on your state and personal needs, there are additional types of coverage you may want to consider:

- Personal Injury Protection (PIP): Covers medical expenses and lost income for you and your passengers, regardless of who is at fault in an accident.

- Medical Payments Coverage: Similar to PIP, this coverage helps pay for medical expenses for you and your passengers after an accident.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover the damages.

- Rental Car Reimbursement: Provides coverage for rental car expenses while your vehicle is being repaired after an insured accident.

Factors Affecting Car Insurance Premiums

The cost of your car insurance, known as the premium, can vary significantly based on several factors. Understanding these factors can help you make informed decisions about your coverage and potentially save money.

Vehicle Type and Usage

The type of vehicle you own and how you use it can impact your insurance rates. Sports cars and luxury vehicles, for instance, often have higher insurance premiums due to their higher repair costs and theft rates. Additionally, if you use your vehicle for business purposes, your insurance rates may be higher than if you use it solely for personal travel.

Driver's Profile

Your personal driving record and history play a significant role in determining your insurance premiums. Factors such as your age, gender, driving experience, and claims history are considered. Young drivers, for example, are often considered higher risk and may face higher premiums.

Your credit score can also impact your insurance rates. Insurance companies may use your credit score as an indicator of your financial responsibility, and a higher credit score can sometimes lead to lower insurance premiums.

Location and Mileage

The area where you live and the number of miles you drive annually can affect your insurance rates. Urban areas often have higher insurance rates due to increased traffic and higher accident and theft rates. Similarly, if you drive more miles each year, your insurance rates may be higher.

Discounts and Bundling

Insurance companies offer various discounts that can reduce your insurance premiums. Some common discounts include:

- Safe Driver Discount: Awarded to drivers with a clean driving record.

- Multi-Policy Discount: Offered when you bundle your car insurance with other types of insurance, such as home or renters insurance.

- Loyalty Discount: Given to long-term customers who have been with the insurance company for a certain period.

- Student Discount: Available to young drivers who maintain good grades or are enrolled in a defensive driving course.

Steps to Obtain Car Insurance

Obtaining car insurance involves several steps to ensure you get the right coverage at a competitive price. Here's a step-by-step guide:

1. Research Insurance Providers

Start by researching reputable insurance companies in your area. Look for providers with a good financial rating and positive customer reviews. You can use online tools and comparison websites to narrow down your options based on factors like coverage, price, and customer service.

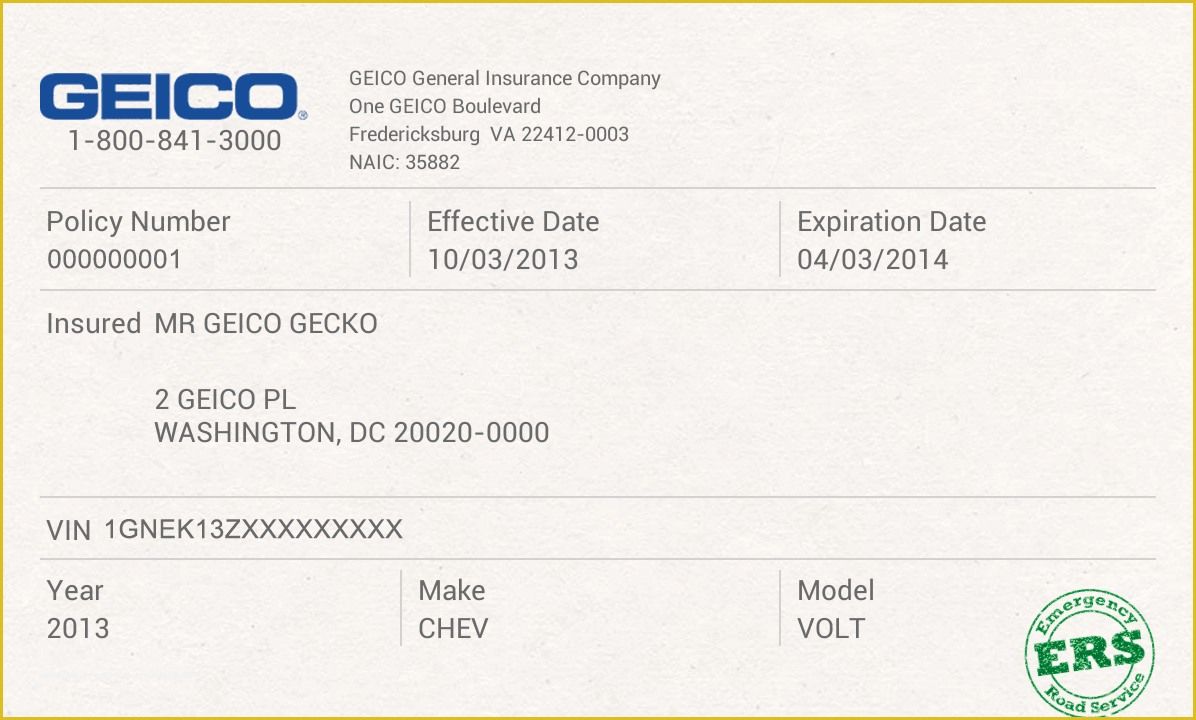

2. Gather Necessary Information

Before contacting insurance providers, gather the following information:

- Your driver's license number and state of issuance.

- The Vehicle Identification Number (VIN) for each vehicle you want to insure.

- Details about your driving history, including any accidents or violations.

- Information about any current insurance policies you have.

- An estimate of your annual mileage.

3. Obtain Quotes

Contact several insurance providers and request quotes. Provide them with the information you've gathered, and ask about any discounts you may be eligible for. Compare the quotes based on price, coverage, and customer service ratings.

4. Review Policy Details

Once you've received quotes, carefully review the policy details. Make sure you understand the coverage limits, deductibles, and any exclusions. Consider adding optional coverage if you feel it's necessary.

5. Choose Your Policy

Select the insurance policy that best fits your needs and budget. Keep in mind that the cheapest policy may not always provide the best coverage.

6. Finalize the Application

Complete the application process with your chosen insurance provider. This may involve paying your initial premium and providing additional documentation, such as proof of vehicle ownership.

Maintaining Your Car Insurance

Once you've obtained your car insurance policy, it's important to maintain it and periodically review your coverage to ensure it continues to meet your needs.

Regularly Review Your Policy

Life circumstances can change, and it's essential to update your insurance policy accordingly. For example, if you get married, have a child, or purchase a new vehicle, you may need to adjust your coverage.

Keep Your Driving Record Clean

A clean driving record can lead to lower insurance premiums. Avoid traffic violations and accidents to maintain a good driving history.

Explore Discount Opportunities

Periodically review your insurance policy to see if you qualify for any new discounts. For example, if you've completed a defensive driving course or installed safety features in your vehicle, you may be eligible for additional discounts.

Consider Higher Deductibles

Increasing your deductible can lower your insurance premiums. However, keep in mind that a higher deductible means you'll pay more out of pocket if you need to file a claim.

Shop Around for Renewals

When it's time to renew your insurance policy, don't automatically stick with your current provider. Shop around for the best rates and coverage. Insurance providers often offer discounts to new customers, so it can be beneficial to switch providers periodically.

Frequently Asked Questions

What happens if I don't have car insurance?

+Driving without car insurance is illegal in most states. If you're caught, you may face fines, have your license and registration suspended, and even face jail time. Additionally, if you're involved in an accident without insurance, you'll be responsible for all the costs associated with the damage and injuries, which can be financially devastating.

Can I switch insurance providers after an accident?

+Yes, you can switch insurance providers after an accident. However, keep in mind that your new insurance company may ask about your accident history, and the accident may impact your premiums with the new provider.

How often should I review my car insurance policy?

+It's a good idea to review your car insurance policy annually or whenever your life circumstances change significantly. This ensures your coverage remains adequate and that you're not overpaying for unnecessary coverage.

What should I do if I'm unsure about the coverage I need?

+If you're unsure about the coverage you need, consider consulting with an insurance agent or broker. They can provide expert advice based on your specific situation and help you choose the right coverage for your needs.

Are there any online tools to help me compare car insurance rates?

+Yes, there are several online comparison tools available that can help you compare car insurance rates from different providers. These tools often provide quotes based on your specific needs and allow you to easily compare coverage and prices.