Cheap Life Insurance Policy

In today's world, life insurance is an essential aspect of financial planning, offering a safety net for your loved ones and a sense of security for your future. However, finding an affordable life insurance policy that suits your needs can be a daunting task, especially with the plethora of options available in the market. This article aims to guide you through the process, providing expert insights and practical tips to secure a cheap life insurance policy without compromising on quality.

Understanding the Basics of Life Insurance

Life insurance is a contract between an individual (the policyholder) and an insurance company, where the insurer agrees to pay a sum of money (known as the death benefit) to the designated beneficiaries upon the insured person’s death. This financial protection can help cover various expenses, such as funeral costs, outstanding debts, and everyday living expenses, ensuring your loved ones’ financial well-being.

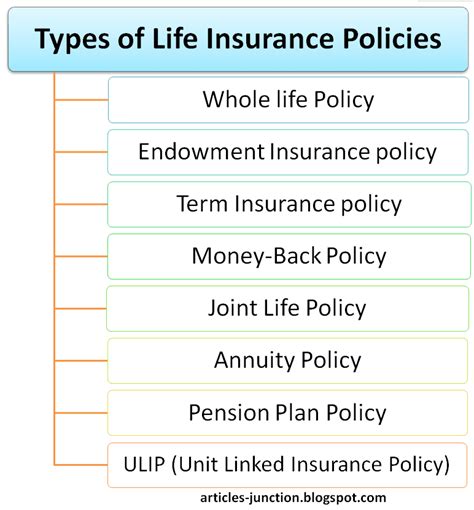

The two main types of life insurance are term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically 10 to 30 years, and is often more affordable. On the other hand, permanent life insurance, such as whole life or universal life insurance, offers lifelong coverage and also accumulates cash value over time.

Key Factors Influencing Life Insurance Premiums

When it comes to life insurance, several factors determine the cost of your premiums. Understanding these factors can help you make informed decisions and potentially reduce your insurance costs. Here are some of the most influential factors:

- Age: Generally, younger individuals pay lower premiums as they are considered less risky to insure. As you age, the cost of life insurance tends to increase.

- Health Status: Your overall health plays a significant role in determining your life insurance premiums. Those with pre-existing health conditions or high-risk lifestyles may face higher costs or even be declined coverage.

- Lifestyle Factors: Habits such as smoking, excessive alcohol consumption, or engaging in dangerous hobbies can increase your insurance premiums. Leading a healthy lifestyle can often result in lower costs.

- Occupation and Hobbies: Certain occupations or hobbies that carry a higher risk of injury or death can impact your life insurance rates. For instance, individuals working in high-risk jobs or engaging in extreme sports may face higher premiums.

- Coverage Amount: The amount of coverage you require will directly affect your premiums. Higher coverage amounts typically result in higher costs.

- Term Length: In term life insurance, the length of the policy term can influence premiums. Longer terms often come with higher costs.

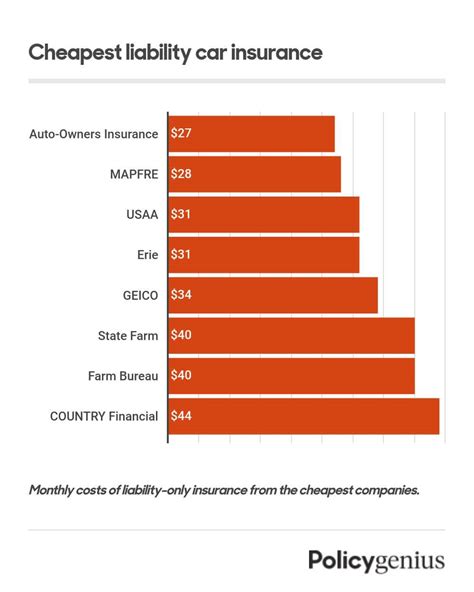

- Company and Policy Type: Different insurance companies offer various policy types with unique features and costs. Comparing multiple providers can help you find the most affordable option for your needs.

By considering these factors and making informed choices, you can take control of your life insurance costs and find a policy that aligns with your budget and requirements.

Tips for Securing a Cheap Life Insurance Policy

Obtaining a cheap life insurance policy requires a combination of knowledge, research, and strategic decision-making. Here are some expert tips to help you navigate the process:

Shop Around and Compare

Don’t settle for the first insurance quote you receive. Shopping around and comparing multiple providers is crucial to finding the best deal. Utilize online comparison tools and seek recommendations from trusted sources to narrow down your options. Consider factors such as coverage, customer reviews, and financial stability when evaluating different insurance companies.

Assess Your Coverage Needs

Determining the appropriate coverage amount is essential to securing an affordable policy. Consider your financial obligations, such as outstanding debts, mortgage payments, and future expenses like your children’s education. A life insurance calculator can be a valuable tool to help you estimate the coverage you need.

Improve Your Health Status

Your health is a significant factor in determining life insurance premiums. Taking steps to improve your overall health can lead to lower costs. Adopt a healthy lifestyle by exercising regularly, maintaining a balanced diet, and quitting harmful habits like smoking. Regular check-ups and managing any pre-existing conditions can also positively impact your insurance costs.

Consider Term Life Insurance

Term life insurance is often the most cost-effective option for individuals seeking temporary coverage. It provides financial protection for a specific period, typically 10 to 30 years, and is ideal for covering short-term needs like mortgage payments or supporting your family during your working years. By opting for term life insurance, you can save on costs compared to permanent life insurance policies.

Bundle Policies for Discounts

If you already have other insurance policies, such as auto or home insurance, consider bundling your life insurance with the same provider. Many insurance companies offer discounts for customers who purchase multiple policies, helping you save on your life insurance premiums.

Explore Group Life Insurance

If you are employed, check if your employer offers group life insurance as a benefit. Group life insurance policies are often more affordable than individual policies, as the risk is spread across a larger group of individuals. Additionally, these policies may not require a medical exam, making the process quicker and more accessible.

Consider No-Exam Policies

Some insurance companies offer life insurance policies without requiring a medical exam. While these policies may have higher premiums, they can be a convenient option for individuals who want immediate coverage or have difficulty obtaining a traditional policy due to health reasons.

Pay Annually or Bi-Annually

Paying your life insurance premiums annually or bi-annually can sometimes result in discounts. By spreading out the cost over a longer period, you may save on administrative fees and other expenses associated with more frequent payments.

Understand Policy Riders and Add-Ons

Policy riders and add-ons are additional benefits or features that can be attached to your life insurance policy. While these may enhance your coverage, they can also increase your premiums. Carefully review and understand these options before adding them to your policy to ensure they align with your needs and budget.

| Policy Type | Average Premium (Monthly) |

|---|---|

| Term Life Insurance (10-Year Term) | $20 - $40 |

| Term Life Insurance (20-Year Term) | $30 - $60 |

| Whole Life Insurance | $100 - $300 |

| Universal Life Insurance | $80 - $200 |

Common Misconceptions about Life Insurance

Despite its importance, life insurance is often shrouded in misconceptions and myths. Here are some common misconceptions clarified:

- Life Insurance is Only for the Wealthy: Life insurance is accessible to individuals from all income levels. It is a valuable tool to protect your loved ones, regardless of your financial status.

- Life Insurance is Too Expensive: While life insurance can be a significant expense, it doesn't have to break the bank. By shopping around, comparing policies, and adopting healthy habits, you can find affordable coverage.

- Life Insurance is Only for the Elderly: Life insurance is relevant at various stages of life. Young adults, parents, and even retirees can benefit from having life insurance to protect their financial interests and provide for their loved ones.

- Life Insurance is Unnecessary if You Have Savings: While savings can provide some financial security, life insurance offers a more comprehensive solution. It ensures your loved ones have immediate access to funds, covering various expenses and providing long-term financial stability.

The Future of Life Insurance

The life insurance industry is evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of life insurance:

Digital Transformation

The digital age has revolutionized the way life insurance is purchased and managed. Insurtech companies are leveraging technology to streamline the insurance process, making it more efficient and accessible. Online applications, instant quotes, and digital policy management are becoming the norm, enhancing the customer experience and reducing administrative costs.

Personalized Coverage

With the advancement of data analytics and artificial intelligence, life insurance companies are better equipped to offer personalized coverage options. By analyzing individual health data, lifestyle choices, and financial needs, insurers can provide tailored policies that meet the unique requirements of each policyholder.

Focus on Prevention and Wellness

The future of life insurance is moving beyond traditional indemnity coverage. Many insurers are now offering wellness programs and incentives to encourage policyholders to adopt healthier lifestyles. By promoting prevention and wellness, insurers aim to reduce the incidence of costly health conditions, benefiting both the insured and the insurer.

Enhanced Customer Service

Customer service is a key differentiator in the competitive life insurance market. Insurers are investing in innovative technologies, such as chatbots and virtual assistants, to provide efficient and personalized support to policyholders. Additionally, the rise of digital platforms allows for better communication and more convenient claim processes.

Simplified Claims Process

The claims process is a critical aspect of life insurance, and insurers are working to simplify and streamline this process. Digital documentation, real-time claim tracking, and faster payment processing are some of the improvements being implemented to ensure policyholders receive their benefits promptly and without hassle.

Conclusion

Securing a cheap life insurance policy is within your reach with the right knowledge and strategies. By understanding the factors that influence premiums, shopping around for the best deals, and making informed choices, you can find affordable coverage that provides peace of mind for you and your loved ones. Remember, life insurance is an essential component of your financial plan, and with the right policy, you can ensure a secure future for those who matter most.

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on your individual circumstances, including your financial obligations, outstanding debts, and future expenses. A general rule of thumb is to aim for 10 to 15 times your annual income. However, it’s best to use a life insurance calculator or consult a financial advisor to determine your specific needs.

Can I get life insurance if I have pre-existing health conditions?

+Yes, many life insurance companies offer policies for individuals with pre-existing health conditions. However, these policies may come with higher premiums or certain exclusions. It’s essential to disclose all relevant health information during the application process to ensure you receive accurate coverage.

What happens if I miss a life insurance premium payment?

+Missing a premium payment can have serious consequences. Depending on your policy’s terms, you may enter a grace period, allowing you to make the payment without any penalties. However, if you miss multiple payments, your policy may lapse, and you may need to reapply, potentially facing higher premiums or being declined coverage.