Why Life Insurance

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their loved ones. In an uncertain world, it acts as a safety net, ensuring that families are protected and their financial future is safeguarded. This article delves into the significance of life insurance, exploring its benefits, how it works, and why it is a crucial component of any comprehensive financial plan.

Understanding the Importance of Life Insurance

Life insurance is a contract between an individual and an insurance company. The insured person pays a premium, and in return, the insurer promises to pay a sum of money, known as the death benefit, to the designated beneficiaries upon the insured’s death. This benefit can provide a crucial financial cushion, helping beneficiaries cover various expenses and maintain their standard of living.

The importance of life insurance lies in its ability to offer financial protection and stability during a time of emotional turmoil. It ensures that families can continue to pay off mortgages, cover daily expenses, fund their children's education, and maintain their lifestyle without the financial strain that often accompanies the loss of a loved one. Life insurance is particularly crucial for those with dependents, as it can provide a source of income to replace the earnings of the deceased.

Benefits of Life Insurance

Financial Security for Beneficiaries

The primary benefit of life insurance is the financial security it provides to beneficiaries. In the event of the insured’s death, the death benefit can be used to pay off debts, such as credit card balances, car loans, and even student loans. It can also cover funeral and burial expenses, which can be a significant financial burden for families.

Furthermore, the death benefit can be used to maintain the family's current lifestyle. It can provide income to cover day-to-day living expenses, ensuring that the surviving family members can continue to pay for groceries, utilities, and other necessary household costs. This financial support can be a crucial factor in helping families cope with their grief and adjust to life without their loved one.

Peace of Mind and Long-Term Planning

Life insurance offers peace of mind to the insured, knowing that their loved ones will be taken care of financially. It provides a sense of security, especially for those with young children or aging parents who depend on their income. With life insurance in place, individuals can focus on their careers, relationships, and other aspects of life without constant worry about their family’s financial future.

Moreover, life insurance is a long-term financial planning tool. It can be used to fund retirement, pay for a child's college education, or even start a business. By including life insurance as part of their overall financial strategy, individuals can ensure that their financial goals are met, even in the unfortunate event of their premature death.

How Life Insurance Works

Types of Life Insurance Policies

There are several types of life insurance policies available, each designed to meet different needs and financial goals. The two main categories are term life insurance and permanent life insurance, with further variations within each category.

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit only, with no cash value accumulation. Term life is often more affordable than permanent life insurance, making it a popular choice for those seeking coverage for a set period, such as while their children are young or during their working years.

On the other hand, permanent life insurance, including whole life, universal life, and variable life insurance, provides lifelong coverage. These policies have a cash value component that grows over time and can be accessed by the insured during their lifetime. Permanent life insurance is generally more expensive than term life but offers the benefit of both death protection and cash value accumulation.

The Application and Underwriting Process

To obtain a life insurance policy, individuals must go through an application and underwriting process. The application typically involves providing personal and health-related information, such as age, gender, smoking status, and any pre-existing medical conditions. The insurance company uses this information to assess the risk of insuring the individual and determine the premium amount.

Underwriting is the process by which the insurance company evaluates the risk associated with the applicant. This involves a thorough review of the application and medical records, as well as potentially conducting a medical exam. The underwriter considers various factors, including the applicant's health, lifestyle, and occupation, to determine the level of risk and set the premium accordingly.

Choosing the Right Life Insurance Policy

Assessing Your Needs and Goals

Selecting the appropriate life insurance policy involves a careful assessment of your specific needs and financial goals. Consider factors such as your age, health, income, and the financial responsibilities you wish to cover. For example, if you have young children, you may want a policy that can provide sufficient funds to cover their education and support your spouse until they are financially independent.

It's also essential to think about the long-term. Do you have plans to start a business or retire early? Life insurance can be a valuable tool to help fund these aspirations. By evaluating your short-term and long-term financial needs, you can choose a policy that provides the right level of coverage and fits within your budget.

Term vs. Permanent Life Insurance

When choosing between term and permanent life insurance, consider the duration of coverage you require and your financial goals. Term life insurance is ideal for those seeking coverage for a specific period, such as until their children reach adulthood or their mortgage is paid off. It is generally more affordable, making it a suitable option for those on a budget.

Permanent life insurance, on the other hand, offers lifelong coverage and the potential for cash value accumulation. This makes it a more comprehensive option, suitable for those who want long-term financial protection and the ability to build wealth within their policy. However, it is important to note that permanent life insurance is typically more expensive and may not be necessary for everyone.

Real-Life Examples and Testimonials

To illustrate the impact of life insurance, let’s look at some real-life scenarios and testimonials from individuals who have benefited from having life insurance.

Case Study 1: John's Story

"When my wife passed away suddenly, I was devastated. But thanks to the life insurance policy she had, I was able to focus on grieving and caring for our young daughter without the added stress of financial worries. The death benefit covered our mortgage, and I used the remaining funds to pay for our daughter's education and set up a trust fund for her future."

Case Study 2: Sarah's Experience

"As a single mother, life insurance was a priority for me. I wanted to ensure that my son would be taken care of financially if something happened to me. My policy provided the peace of mind I needed, knowing that he would have the financial support to continue his education and maintain our comfortable lifestyle."

The Future of Life Insurance

The life insurance industry is continuously evolving to meet the changing needs of policyholders. With advancements in technology, insurers are exploring digital solutions to enhance the customer experience and streamline the application and claims processes.

Additionally, there is a growing focus on personalized insurance products. Insurers are developing policies that cater to specific needs, such as providing coverage for critical illnesses or offering enhanced benefits for certain occupations. This shift towards customization ensures that policyholders can access insurance products that align with their unique circumstances and financial goals.

Conclusion

Life insurance is an invaluable tool that provides financial security and peace of mind to individuals and their families. By understanding the benefits, types of policies, and the application process, individuals can make informed decisions about their financial future. With life insurance, families can face the future with confidence, knowing they are protected and prepared for whatever life may bring.

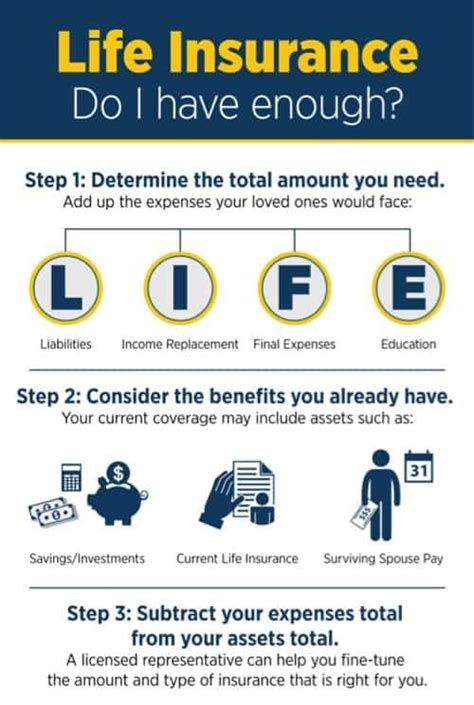

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on your specific financial situation and goals. Generally, experts recommend having coverage that is 10 to 15 times your annual income. However, it’s essential to consider your debts, future expenses, and the financial needs of your dependents. Consult with a financial advisor or use online calculators to estimate your coverage needs accurately.

Can I get life insurance if I have a pre-existing medical condition?

+Yes, individuals with pre-existing medical conditions can still obtain life insurance. While it may be more challenging and potentially more expensive, there are specialized policies available for those with health issues. It’s important to be transparent about your medical history during the application process to ensure you receive the appropriate coverage.

What happens if I miss a premium payment?

+Missing a premium payment can have serious consequences. Most life insurance policies have a grace period, typically 30 days, during which you can still make the payment without affecting your coverage. However, if you miss the grace period, your policy may lapse, and you will need to reapply for coverage, which could result in higher premiums or a denial of coverage.