Insurance Quotes Car Insurance

In today's fast-paced world, having reliable car insurance is an essential aspect of responsible vehicle ownership. With countless insurance providers offering a wide range of policies, obtaining accurate and affordable insurance quotes can be a daunting task. This comprehensive guide aims to provide an expert analysis of the car insurance landscape, offering insights and strategies to help you navigate the process and secure the best coverage for your needs.

Understanding Car Insurance Quotes

A car insurance quote is an estimate of the cost of your insurance policy, tailored to your specific circumstances and the coverage options you select. It serves as a preliminary step in the insurance purchasing process, allowing you to compare different providers and policy options before making a final decision. The quote provides a snapshot of the potential costs and coverage details, enabling you to make informed choices.

Factors Influencing Car Insurance Quotes

Several key factors play a role in determining the price of your car insurance quote. These include your age, gender, driving record, location, the make and model of your vehicle, and the coverage options you choose. Insurance providers assess these factors to evaluate the level of risk associated with insuring you, which directly impacts the quote they offer.

For instance, younger drivers, particularly those under the age of 25, often face higher insurance premiums due to their perceived higher risk of accidents. Similarly, individuals with a history of traffic violations or accidents may also see increased insurance costs. The type of vehicle you drive and its safety features can also influence the quote, with certain makes and models considered higher risk or more expensive to insure.

| Factor | Impact on Quote |

|---|---|

| Age | Younger drivers may face higher premiums. |

| Driving Record | A clean record can lead to lower costs. |

| Location | Urban areas often have higher insurance rates. |

| Vehicle Type | Luxury or sports cars may be more expensive to insure. |

Types of Car Insurance Coverage

Car insurance policies offer a range of coverage options to suit different needs and budgets. The most common types of coverage include:

- Liability Coverage: This is the most basic form of car insurance, covering damages or injuries you cause to others in an accident. It is mandatory in most states and typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs to your vehicle if you're involved in an accident, regardless of fault. It is particularly beneficial for newer or more expensive vehicles.

- Comprehensive Coverage: Comprehensive coverage protects against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or collisions with animals. It is often paired with collision coverage.

- Personal Injury Protection (PIP): PIP coverage provides medical and rehabilitation benefits to you and your passengers, regardless of fault, after an accident. It is mandatory in some states.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Strategies for Securing the Best Car Insurance Quotes

Obtaining the best car insurance quotes requires a strategic approach. Here are some expert tips to help you navigate the process effectively:

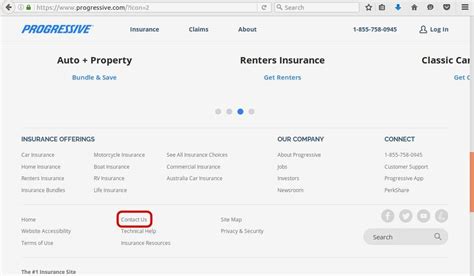

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare quotes from multiple providers. This allows you to identify the best combination of coverage and price for your specific needs. Online quote comparison tools can be particularly useful for this purpose, offering a convenient way to gather multiple quotes in one place.

Understand Your Coverage Needs

Before requesting quotes, take the time to assess your specific coverage needs. Consider factors such as your vehicle’s value, your daily driving habits, and any additional risks you may face. For instance, if you frequently drive in urban areas or have a history of accidents, you may want to prioritize comprehensive coverage. Understanding your needs will help you make more informed choices when comparing quotes.

Consider Bundle Discounts

Many insurance providers offer discounts when you bundle multiple policies, such as car insurance with home or renters insurance. Bundling can lead to significant savings, so it’s worth exploring this option. Additionally, some providers offer discounts for loyal customers, so consider the long-term benefits of staying with one provider.

Explore Discounts and Savings Opportunities

Insurance providers offer a range of discounts to attract and retain customers. These may include discounts for safe driving records, low mileage, anti-theft devices, or membership in certain organizations. Some providers also offer usage-based insurance programs, where your premium is based on your actual driving behavior. By understanding the discounts available, you can potentially reduce your insurance costs significantly.

Maintain a Good Driving Record

Your driving record is a key factor in determining your insurance quote. A clean driving record, free of accidents and traffic violations, can lead to lower insurance premiums. If you have a less-than-perfect record, consider taking defensive driving courses or other programs that may help improve your driving skills and potentially reduce your insurance costs.

Choose the Right Coverage Limits

When selecting coverage limits, it’s important to find a balance between adequate protection and affordable premiums. While higher coverage limits provide more protection, they can also lead to increased costs. Assess your financial situation and potential risks to determine the right coverage limits for your needs. Consider seeking advice from an insurance professional to ensure you have the appropriate level of coverage.

The Future of Car Insurance Quotes

The car insurance landscape is evolving, driven by advancements in technology and changing consumer expectations. Here’s a glimpse into the future of car insurance quotes:

Telematics and Usage-Based Insurance

Telematics devices, which monitor driving behavior and provide real-time data, are gaining popularity in the insurance industry. Usage-based insurance programs use this data to offer personalized insurance quotes based on actual driving habits. These programs reward safe driving with lower premiums, providing an incentive for drivers to adopt safer behaviors.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are transforming the insurance industry, enabling providers to make more accurate risk assessments and offer tailored insurance quotes. By analyzing vast amounts of data, insurance companies can identify patterns and trends, leading to more efficient pricing and coverage recommendations.

Enhanced Customer Experience

Insurance providers are investing in digital transformation to enhance the customer experience. This includes streamlined quote processes, personalized recommendations, and self-service options. With the rise of digital platforms and mobile apps, obtaining car insurance quotes and managing policies is becoming increasingly convenient and efficient.

Industry Collaboration and Partnerships

Insurance providers are collaborating with technology companies and automotive manufacturers to develop innovative solutions. For instance, partnerships with ride-sharing platforms or autonomous vehicle developers may lead to new insurance models and coverage options. These collaborations aim to stay ahead of the curve and meet the evolving needs of consumers.

Conclusion

Obtaining the best car insurance quotes requires a strategic approach and a deep understanding of the factors that influence insurance costs. By shopping around, comparing quotes, and leveraging discounts and savings opportunities, you can secure affordable and comprehensive coverage. As the car insurance landscape continues to evolve, staying informed and adapting to new technologies and trends will be key to making the most of your insurance experience.

How often should I review my car insurance policy and quotes?

+It’s recommended to review your car insurance policy and quotes at least once a year, or whenever your circumstances change significantly. This ensures that your coverage remains adequate and you’re not overpaying for unnecessary coverage.

What is the difference between liability coverage and collision coverage?

+Liability coverage protects you against claims for bodily injury or property damage that you cause to others in an accident. Collision coverage, on the other hand, covers damage to your own vehicle, regardless of fault, in the event of an accident.

How can I reduce my car insurance costs if I have a poor driving record?

+If you have a poor driving record, you may still be able to reduce your insurance costs by taking defensive driving courses, which can improve your driving skills and potentially lead to lower premiums. Additionally, exploring usage-based insurance programs may provide an opportunity to demonstrate your improved driving behavior and reduce your insurance costs over time.