How Much Will Flood Insurance Cost

Flood insurance is an essential protection for homeowners, especially those residing in high-risk flood zones. The cost of this insurance can vary significantly based on several factors, making it a complex topic to navigate. This article aims to provide an in-depth analysis of the factors influencing flood insurance premiums and offer insights to help individuals make informed decisions.

Understanding the Basics of Flood Insurance

Flood insurance is a specialized form of property insurance that covers damages caused by flooding. It is distinct from standard home insurance policies, which typically do not cover flood-related losses. The primary provider of flood insurance in the United States is the National Flood Insurance Program (NFIP), a federal program managed by the Federal Emergency Management Agency (FEMA). NFIP offers coverage to homeowners, renters, and business owners in participating communities.

The cost of flood insurance is determined by a combination of factors, including the risk level of the property's location, the amount of coverage needed, and the type of structure being insured. Understanding these factors is crucial for homeowners to make informed choices and manage their flood insurance costs effectively.

Factors Influencing Flood Insurance Premiums

Several key factors contribute to the cost of flood insurance, and each plays a significant role in determining the final premium. Let’s explore these factors in detail.

Risk Level and Flood Zones

The primary determinant of flood insurance premiums is the risk level associated with the property’s location. FEMA assesses and classifies different areas into flood zones based on their historical flood risk. These zones are designated using letters and numbers, with each zone representing a different level of flood risk.

- V Zones: Properties located in V zones are considered to be in the highest-risk areas, often subject to wave action and storm surge. These zones are typically along the coast and are vulnerable to significant flooding and erosion during storms.

- A Zones: A zones are also high-risk areas, but they do not experience wave action and storm surge. These zones are typically inland from the coast and are at risk of flooding from rivers, streams, and other water sources.

- X Zones: Properties in X zones are considered to be in lower-risk areas. While they are not completely immune to flooding, the risk is significantly lower compared to V and A zones. X zones are often further inland and have a reduced probability of flooding.

The higher the risk level, the more expensive the flood insurance will be. Properties in V and A zones will typically have higher premiums than those in X zones.

Coverage Amount and Deductibles

The amount of coverage an individual chooses will directly impact their flood insurance premiums. Coverage limits refer to the maximum amount the insurance policy will pay out in the event of a flood. The higher the coverage limit, the more expensive the insurance will be. It is important to note that flood insurance typically has separate coverage limits for the building and its contents.

Additionally, deductibles play a role in determining premiums. A deductible is the amount an insured individual must pay out of pocket before the insurance coverage kicks in. Higher deductibles can result in lower premiums, as the policyholder assumes more financial responsibility in the event of a flood. However, it's important to carefully consider the potential financial burden of a higher deductible.

Type of Structure and Construction

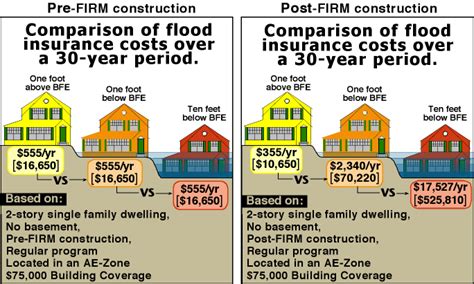

The type of structure being insured can also influence flood insurance premiums. Homes built on elevated foundations or with flood-resistant materials may qualify for lower premiums. Conversely, older homes or those with basements may face higher premiums due to increased flood risk.

The construction date of the home can also be a factor. Homes built before certain floodplain management regulations were implemented may be considered higher risk and therefore subject to higher premiums. Additionally, homes built after these regulations may benefit from more flood-resistant design features, leading to potentially lower premiums.

Other Factors

Several other factors can influence flood insurance premiums, including:

- Previous Flood Claims: A history of flood claims can impact future premiums, as it indicates a higher risk of future flooding.

- Distance from Water Sources: Properties closer to rivers, streams, or other bodies of water may face higher premiums due to increased flood risk.

- Community Participation: Communities that actively participate in flood mitigation programs or have effective floodplain management plans may qualify for lower premiums.

Real-World Examples and Case Studies

To illustrate the variability in flood insurance costs, let’s consider a few real-world examples. These case studies will provide concrete data and scenarios to help readers better understand the range of premiums they might encounter.

Case Study 1: Coastal Property in a High-Risk Zone

Imagine a homeowner residing in a coastal area classified as a V zone. This property is a single-family home built on a slab foundation with a coverage limit of 250,000 for the building and 100,000 for its contents. The homeowner chooses a 2,000 deductible. In this scenario, the annual flood insurance premium might range from 2,500 to $5,000, depending on various factors such as the construction date and previous flood claims.

Case Study 2: Inland Property in a Moderate-Risk Zone

Consider a homeowner living further inland in an X zone. Their property is a two-story home with a coverage limit of 300,000 for the building and 150,000 for its contents. They opt for a 1,000 deductible. In this case, the annual flood insurance premium could range from 500 to $1,500, again depending on factors like the home’s construction and flood mitigation features.

Case Study 3: Historic Property with Flood-Resistant Upgrades

Now, let’s look at a unique scenario involving a historic home. This property, built in the early 1900s, has undergone extensive renovations to improve its flood resistance. It is located in an A zone but has features like a raised foundation and waterproof materials. With a coverage limit of 400,000 for the building and 200,000 for its contents, and a 3,000 deductible, the annual flood insurance premium might fall between 1,500 and $3,000.

| Case Study | Flood Zone | Coverage Limit (Building) | Coverage Limit (Contents) | Deductible | Estimated Annual Premium |

|---|---|---|---|---|---|

| Coastal Property | V Zone | $250,000 | $100,000 | $2,000 | $2,500 - $5,000 |

| Inland Property | X Zone | $300,000 | $150,000 | $1,000 | $500 - $1,500 |

| Historic Property | A Zone | $400,000 | $200,000 | $3,000 | $1,500 - $3,000 |

Strategies to Reduce Flood Insurance Costs

While flood insurance is a necessary expense for many homeowners, there are strategies that can help mitigate the cost. Here are some tips to consider:

- Review Your Policy Regularly: Flood insurance policies and premiums can change over time. It's important to review your policy annually to ensure it still meets your needs and to take advantage of any potential savings.

- Consider a Higher Deductible: As mentioned earlier, opting for a higher deductible can lower your premiums. However, ensure you can afford the deductible in the event of a flood.

- Explore Private Insurance Options: In some cases, private flood insurance providers may offer more competitive rates than the NFIP. It's worth shopping around and comparing quotes to find the best deal.

- Implement Flood Mitigation Measures: Investing in flood-resistant upgrades or implementing flood mitigation strategies can potentially reduce your risk level and, consequently, your premiums. These measures might include elevating the structure, installing flood barriers, or waterproofing the basement.

- Community Flood Programs: Engage with your community to explore local flood mitigation programs or initiatives. Participating in these programs could lead to reduced premiums for the entire community.

Conclusion

Flood insurance is a complex but necessary aspect of homeownership, especially for those living in flood-prone areas. Understanding the factors that influence premiums and taking proactive steps to manage these costs can help homeowners make informed decisions and protect their investments effectively. By staying informed and taking advantage of available resources, individuals can navigate the world of flood insurance with confidence.

FAQ

How often should I review my flood insurance policy?

+It’s recommended to review your flood insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and up-to-date.

Are there any government programs to assist with flood insurance costs?

+Yes, the National Flood Insurance Program (NFIP) offers subsidies for certain properties, particularly those in high-risk zones. These subsidies can help reduce the cost of flood insurance premiums.

Can I get flood insurance if my property is not in a designated flood zone?

+While properties outside designated flood zones may not be required to have flood insurance, it’s still recommended. Flooding can occur in areas not considered high-risk, and having insurance provides peace of mind and financial protection.

What are some common flood mitigation measures that can reduce insurance costs?

+Common flood mitigation measures include elevating the structure, installing flood barriers, waterproofing basements, and using flood-resistant materials during construction or renovations. These measures can lower your flood risk and potentially reduce insurance premiums.