Best Car Insurance Agencies

Navigating the world of car insurance can be a daunting task, especially with the plethora of options available in the market. Choosing the right insurance agency is crucial to ensure you receive the coverage and benefits that align with your specific needs. In this comprehensive guide, we delve into the top car insurance agencies, analyzing their offerings, customer satisfaction, and industry reputation to help you make an informed decision.

Assessing the Top Car Insurance Agencies

The car insurance landscape is diverse, catering to a wide range of drivers with varying requirements. From comprehensive coverage to specialized policies, understanding the unique offerings of each agency is key to making the right choice. Here, we evaluate the top performers in the industry, considering factors such as financial stability, customer service, and policy options.

State Farm: A Trusted Companion

State Farm has cemented its position as one of the leading car insurance providers in the United States. With a rich history spanning over a century, the company has built a reputation for reliability and customer satisfaction. State Farm offers a comprehensive suite of insurance products, including auto, home, life, and health insurance, providing customers with a one-stop solution for their insurance needs.

One of the standout features of State Farm is its commitment to personalized service. The company assigns dedicated agents to each customer, ensuring a tailored approach to insurance coverage. This level of personalization extends to their claims process as well, with agents offering guidance and support throughout the claims journey.

| Coverage Options | Financial Strength |

|---|---|

| Comprehensive Auto, Home, Life, Health | A++ (Superior) - AM Best Rating |

State Farm's financial stability is exemplary, as evidenced by its top-tier rating from AM Best. This assurance provides peace of mind to policyholders, knowing their insurance needs are backed by a financially robust organization.

GEICO: Innovation and Affordability

GEICO, an acronym for Government Employees Insurance Company, has revolutionized the car insurance industry with its innovative digital approach. Known for its competitive rates and user-friendly online platform, GEICO has gained a strong following among tech-savvy drivers.

The company's focus on digital transformation has streamlined the insurance process, making it quick and convenient for customers to obtain quotes, manage policies, and file claims. GEICO's online platform is designed with ease of use in mind, ensuring a seamless experience for policyholders.

| Key Features | Customer Satisfaction |

|---|---|

| Digital Platform, Competitive Rates | 4.5/5 - J.D. Power Rating |

GEICO's dedication to customer satisfaction is evident in its J.D. Power rating, a testament to the company's commitment to providing excellent service. With a focus on affordability and convenience, GEICO is an attractive option for budget-conscious drivers without compromising on quality.

Progressive: Customized Coverage

Progressive Insurance has established itself as a leader in the car insurance industry with its commitment to providing customized coverage options. Understanding that every driver’s needs are unique, Progressive offers a range of policy options to cater to diverse requirements.

One of Progressive's standout features is its Name Your Price tool, which allows customers to set their desired premium amount and receive coverage options tailored to their budget. This level of customization empowers drivers to take control of their insurance costs while still receiving comprehensive coverage.

| Specialized Offerings | Claims Satisfaction |

|---|---|

| Name Your Price Tool, Customized Coverage | 4.2/5 - Consumer Reports Rating |

Progressive's claims process is designed with efficiency in mind, ensuring a quick and hassle-free experience for policyholders. The company's focus on customer satisfaction is reflected in its Consumer Reports rating, an indicator of its dedication to delivering a positive claims experience.

Allstate: Comprehensive Protection

Allstate Insurance is renowned for its comprehensive insurance offerings, providing policyholders with a wide range of coverage options to ensure their vehicles are adequately protected. The company’s commitment to delivering superior protection is evident in its extensive suite of insurance products.

Allstate's "Your Choice Auto" policy offers flexible coverage options, allowing drivers to choose the level of protection that suits their needs and budget. This approach ensures that policyholders receive the right balance of coverage and affordability.

| Coverage Options | Customer Service |

|---|---|

| Flexible Auto, Home, Life, Business | 4/5 - Consumer Satisfaction Survey |

Allstate's customer service is a key differentiator, with a dedicated team of agents providing personalized support to policyholders. This level of service extends to the claims process as well, with a focus on ensuring a smooth and efficient claims experience.

Evaluating Insurance Agencies: Factors to Consider

When selecting a car insurance agency, it’s essential to evaluate various factors to ensure you make an informed decision. Here are some key considerations to keep in mind:

- Coverage Options: Assess the range of coverage provided by the agency, ensuring it aligns with your specific needs.

- Financial Stability: Look for agencies with strong financial ratings to ensure the long-term viability of your insurance provider.

- Customer Service: Evaluate the quality of customer support, including the responsiveness and knowledge of agents.

- Claims Process: Understand the agency's claims procedure, including the speed and efficiency of the claims settlement process.

- Digital Convenience: Consider the availability of online tools and platforms for managing your policy and filing claims.

- Customized Options: Explore agencies that offer tailored coverage to suit your unique requirements and budget.

Future Trends in Car Insurance

The car insurance industry is continuously evolving, with emerging trends shaping the future of coverage. Here are some key developments to watch out for:

- Telematics and Usage-Based Insurance: The rise of telematics technology is revolutionizing insurance, offering policyholders the opportunity to save on premiums based on their driving behavior.

- Artificial Intelligence: AI is set to play a significant role in streamlining insurance processes, from claims assessment to personalized coverage recommendations.

- Digital Transformation: The shift towards digital insurance platforms will continue, providing customers with convenient and efficient ways to manage their policies.

- Connected Cars: As more vehicles become connected, insurance agencies are exploring ways to leverage this technology for enhanced safety and coverage.

- Sustainable Insurance: With a growing focus on environmental sustainability, insurance providers are developing green initiatives and eco-friendly coverage options.

FAQ

What factors should I consider when choosing a car insurance agency?

+

When selecting a car insurance agency, it’s important to evaluate coverage options, financial stability, customer service, claims process, digital convenience, and customized offerings. Consider your specific needs and budget to make an informed decision.

How do I compare car insurance quotes from different agencies?

+

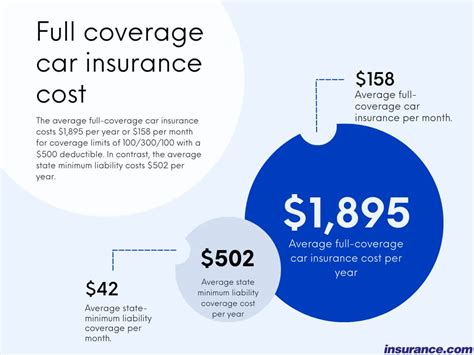

To compare car insurance quotes, obtain multiple quotes from different agencies and ensure you’re comparing similar coverage options. Consider factors such as deductibles, coverage limits, and any additional perks or discounts offered.

What are some common car insurance discounts I should look for?

+

Common car insurance discounts include multi-policy discounts (bundling auto and home insurance), safe driver discounts, good student discounts, and loyalty discounts for long-term policyholders. Check with agencies for specific discount offerings.