Allstate Health Insurance Login

Allstate, a renowned name in the insurance industry, offers a comprehensive health insurance portfolio to cater to the diverse needs of its customers. The company's online platform provides an efficient and convenient way for policyholders to manage their health insurance plans. This article will delve into the process of logging into your Allstate health insurance account, exploring the features and benefits of the online portal, and providing valuable insights to enhance your overall experience.

Logging into Your Allstate Health Insurance Account

Accessing your Allstate health insurance account is a straightforward process that grants you various advantages. By logging in, you gain complete control over your policy, allowing for easy management and a more personalized experience. Here’s a step-by-step guide to help you navigate the login process seamlessly.

Step 1: Visit the Allstate Website

Begin by opening your preferred web browser and typing in the official Allstate website URL: www.allstate.com. This ensures you are directed to the authentic Allstate platform, providing a secure and reliable environment for managing your insurance.

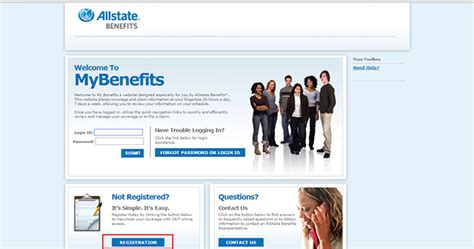

Step 2: Locate the Login Section

Once you’re on the Allstate homepage, scroll down to locate the login section. It is typically positioned in a prominent area, ensuring easy access. Look for a button or a link labeled “Login”, “Sign In”, or “Member Area”. Clicking on this will take you to the login page.

Step 3: Enter Your Credentials

On the login page, you will be prompted to enter your unique username and password. These credentials were provided to you when you initially signed up for your Allstate health insurance policy. Ensure that you enter them accurately, as case sensitivity may apply.

If you have forgotten your username or password, don't worry! Allstate provides a user-friendly password recovery process. Simply click on the "Forgot Username/Password" link, and you will be guided through the steps to retrieve or reset your credentials.

Step 4: Secure Login and Two-Factor Authentication

Allstate prioritizes the security of your personal information. As such, they may implement additional security measures, such as two-factor authentication (2FA). This adds an extra layer of protection, ensuring that only authorized individuals can access your account.

Two-factor authentication typically involves entering a unique code sent to your registered mobile device or email address. By combining something you know (your password) with something you have (your mobile device), Allstate enhances the security of your account.

Step 5: Successful Login

Upon successful login, you will be directed to your personalized Allstate health insurance dashboard. Here, you’ll find a comprehensive overview of your policy, including coverage details, claim status, and any upcoming payments or renewals.

The dashboard is designed to be user-friendly and intuitive, making it easy to navigate and understand. You can quickly access important information, make necessary updates, and stay informed about your health insurance coverage.

Features and Benefits of the Allstate Health Insurance Online Portal

The Allstate health insurance online portal offers a wide range of features and benefits, empowering policyholders to take control of their healthcare and insurance needs. Here are some key advantages:

1. Policy Management

The online portal allows you to manage your health insurance policy efficiently. You can view and update your personal information, add or remove dependents, and make changes to your coverage limits or deductibles. This flexibility ensures your policy remains aligned with your evolving healthcare needs.

2. Claim Submission and Tracking

Submitting claims online is a breeze with the Allstate portal. You can easily upload necessary documents, such as medical bills and receipts, and track the progress of your claim in real-time. The portal provides a transparent and efficient claims process, keeping you informed every step of the way.

| Feature | Description |

|---|---|

| Claim Status Updates | Receive instant notifications and updates on the status of your claims, ensuring transparency and peace of mind. |

| Online Document Upload | Conveniently upload supporting documents, such as medical reports and prescriptions, directly to your claim, streamlining the process. |

| Claim History | Access a comprehensive record of all your past claims, allowing for easy reference and analysis. |

3. Payment Options and Bill Management

The Allstate portal offers a variety of payment options, including online bill pay, direct debit, and credit card payments. You can choose the method that best suits your preferences and conveniently manage your insurance premiums.

Additionally, the portal provides a detailed breakdown of your bill, outlining the charges and coverage details. This transparency helps you understand your payments and ensures you stay informed about your financial obligations.

4. Healthcare Provider Search

Finding the right healthcare providers is crucial for effective healthcare management. The Allstate portal integrates a powerful search tool, enabling you to locate in-network doctors, specialists, and hospitals near your location. This feature saves time and ensures you receive the best possible care within your coverage network.

5. Educational Resources and Health Tools

Allstate understands the importance of staying informed about healthcare and insurance-related topics. The online portal provides a wealth of educational resources, including articles, videos, and infographics, covering a wide range of health and insurance-related subjects.

Additionally, the portal offers interactive health tools, such as symptom checkers and wellness trackers, empowering you to take a proactive approach to your health and make informed decisions.

Enhancing Your Allstate Health Insurance Experience

To maximize the benefits of your Allstate health insurance policy, here are some additional tips and insights to enhance your overall experience:

1. Stay Informed about Policy Changes

Allstate may introduce updates or changes to your policy from time to time. It is crucial to stay informed about these changes to ensure your coverage remains up-to-date and aligned with your needs. Regularly check your email and the Allstate portal for any notifications or updates regarding your policy.

2. Utilize Mobile Apps for Convenience

Allstate offers dedicated mobile apps for both iOS and Android devices. These apps provide a convenient way to access your policy information, submit claims, and manage your health insurance on the go. Download the Allstate app and enjoy the flexibility of managing your insurance wherever you are.

3. Explore Additional Coverage Options

Allstate offers a range of health insurance plans to cater to different lifestyles and needs. Consider exploring additional coverage options, such as dental, vision, or critical illness insurance. These supplemental plans can provide added protection and peace of mind, ensuring you have comprehensive coverage for various healthcare scenarios.

4. Take Advantage of Discounts and Rewards

Allstate often provides discounts and rewards to loyal customers. Keep an eye out for promotional offers, loyalty programs, or referral bonuses. By taking advantage of these opportunities, you can potentially reduce your insurance costs and enjoy additional benefits.

5. Engage with Customer Support

If you encounter any issues or have questions about your health insurance, Allstate’s customer support team is readily available to assist you. Reach out to their dedicated support channels, such as live chat, email, or phone, and receive prompt and personalized assistance. Their team of experts is trained to provide comprehensive support and ensure a positive customer experience.

FAQs

How often should I review my health insurance policy?

+

It is recommended to review your health insurance policy annually to ensure it aligns with your current healthcare needs. Life circumstances, such as marriage, the birth of a child, or changing employment, may impact your coverage requirements. Regular reviews allow you to make necessary adjustments and maintain optimal coverage.

Can I switch my health insurance provider while mid-contract?

+

Switching health insurance providers while mid-contract is possible but may come with certain restrictions and penalties. It is essential to carefully review your current contract and understand the terms and conditions before making a change. Consulting with an insurance expert can provide valuable guidance in such situations.

What documents do I need to submit for a claim?

+

The specific documents required for a claim may vary depending on the nature of the claim and your policy. Generally, you will need to provide medical records, prescriptions, receipts, and any other supporting documents that validate your claim. It is advisable to refer to your policy documents or reach out to Allstate’s customer support for a comprehensive list of required documents.

Logging into your Allstate health insurance account opens up a world of possibilities for managing your healthcare and insurance needs. With a user-friendly interface and a wealth of features, the Allstate online portal empowers policyholders to take control of their coverage. By following the steps outlined above and leveraging the portal’s capabilities, you can navigate your health insurance journey with ease and confidence.