1095 Health Insurance

The 1095 Health Insurance form is a critical document that plays a vital role in the United States healthcare system. It is a central component of the Affordable Care Act (ACA), also known as Obamacare, and is designed to provide transparency and accountability in healthcare coverage. This article will delve into the intricacies of the 1095 form, exploring its purpose, its different types, the information it contains, and its significance for individuals and businesses alike.

Understanding the 1095 Health Insurance Form

The 1095 form is an essential tool for tracking and reporting healthcare coverage under the ACA. It serves as a record of an individual’s or business’s healthcare plan and is used to verify compliance with the law’s requirements. The form comes in three distinct versions, each serving a specific purpose:

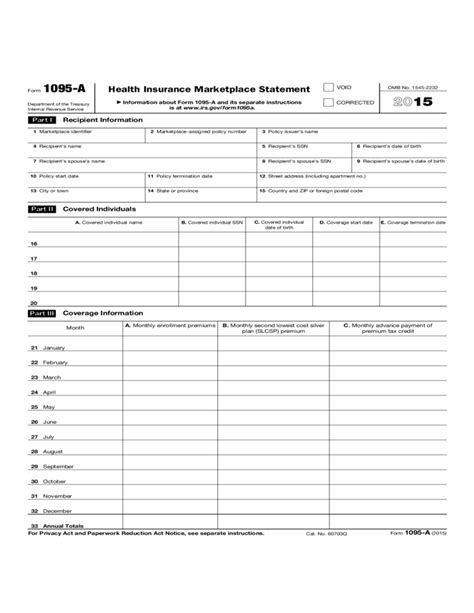

1095-A: Health Insurance Marketplace Statement

The 1095-A form is issued to individuals who enroll in a health insurance plan through the Health Insurance Marketplace. It provides a summary of their coverage, including the plan’s details, the premium amounts, and any applicable tax credits or cost-sharing reductions. This form is crucial for tax purposes, as it allows individuals to claim the Premium Tax Credit when filing their federal tax return.

1095-B: Health Coverage

The 1095-B form is issued by insurance providers or certain government agencies to individuals who obtain healthcare coverage outside of the Marketplace. It contains information about the individual’s coverage, such as the policy number, the dates of coverage, and the names of any dependents covered under the plan. This form is used to verify compliance with the individual mandate of the ACA, which requires most Americans to have minimum essential coverage.

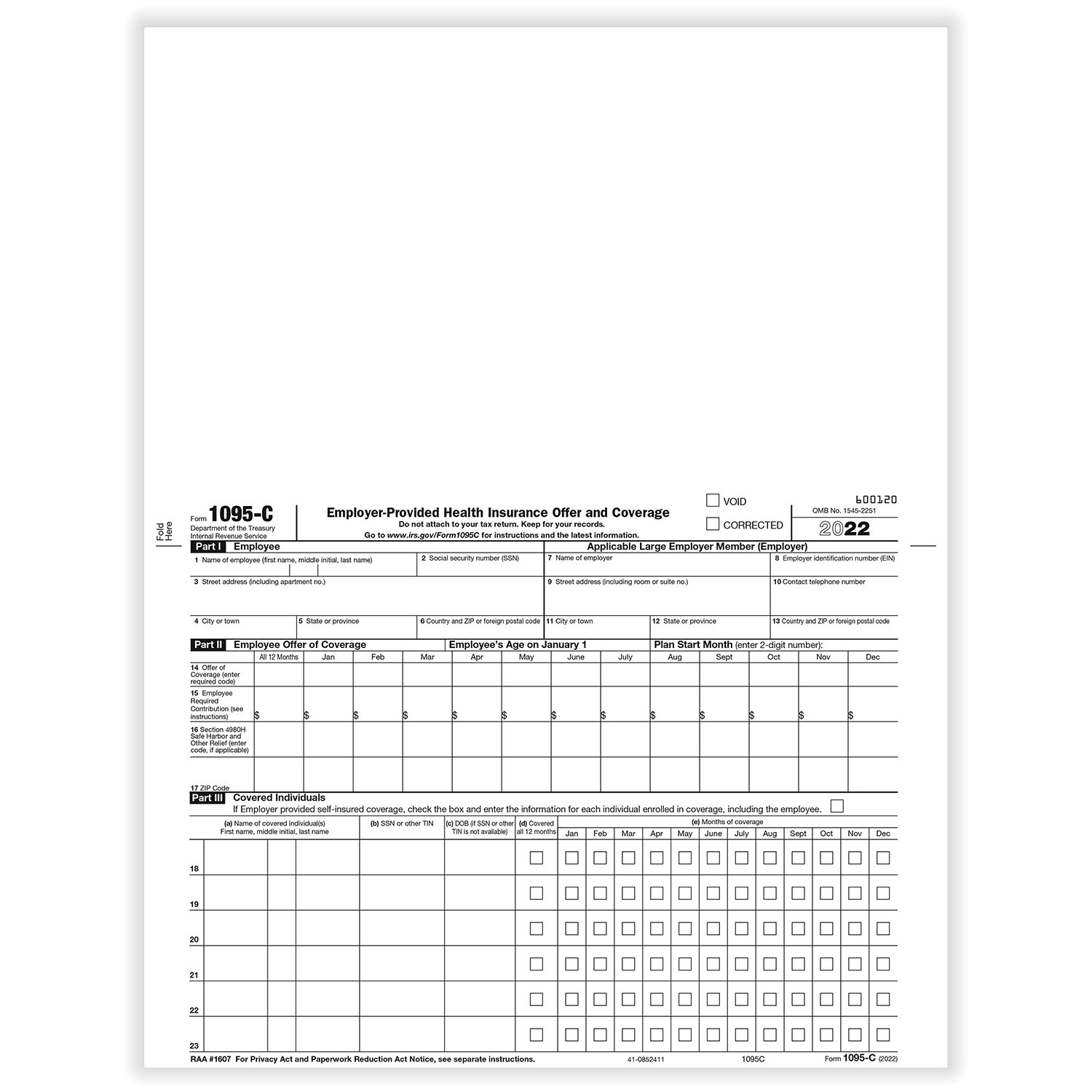

1095-C: Employer-Provided Health Insurance Offer and Coverage

The 1095-C form is provided by employers to their employees. It documents the healthcare coverage offered by the employer and the employee’s enrollment status. The form includes details such as the employee’s name, the employer’s name and EIN, the months of coverage, and the share of premium paid by the employer. The 1095-C form is crucial for employers to demonstrate compliance with the ACA’s employer mandate, which requires certain employers to offer affordable healthcare coverage to their full-time employees.

Key Information on the 1095 Forms

Each type of 1095 form contains specific information relevant to the individual’s or employer’s healthcare coverage. Here’s a breakdown of the key details found on these forms:

1095-A

- Coverage Start and End Dates: The dates when the healthcare coverage began and ended.

- Policy or Plan Number: A unique identifier for the healthcare plan.

- Taxpayer’s Name and Social Security Number: Personal identification details of the individual.

- Monthly Premiums: The amount paid each month for the healthcare coverage.

- Advance Payments of the Premium Tax Credit: Any tax credits received to help cover the cost of premiums.

1095-B

- Coverage Start and End Dates: Similar to the 1095-A, this form also includes coverage dates.

- Policy or Plan Number: Identifies the specific healthcare plan.

- Policyholder’s Name and Social Security Number: Personal information of the primary policyholder.

- Dependent Information: Names and personal details of any dependents covered under the plan.

- Relationship Codes: Codes indicating the relationship of each dependent to the policyholder.

1095-C

- Employee’s Name and Social Security Number: Personal details of the employee.

- Employer’s Name and EIN: Identification information of the employer.

- Months of Coverage: Indicates the months in which the employee had healthcare coverage.

- Offer of Coverage Codes: Codes representing the type of coverage offered (e.g., self-only, family coverage).

- Employee’s Share of Premium: The amount the employee paid towards the healthcare coverage.

Importance of the 1095 Forms

The 1095 forms are of utmost importance for several reasons:

- Compliance and Reporting: These forms ensure compliance with the ACA's requirements. They provide a clear record of an individual's or employer's healthcare coverage, helping to prevent potential penalties for non-compliance.

- Tax Benefits: The 1095-A form is crucial for claiming the Premium Tax Credit, which can significantly reduce an individual's tax liability. It allows eligible individuals to receive advance payments of the credit throughout the year, making healthcare more affordable.

- Data Analysis and Planning: The information on these forms can be analyzed to gain insights into healthcare coverage trends, plan popularity, and overall compliance with the ACA. This data can inform policy decisions and future planning.

- Transparency and Accountability: The 1095 forms promote transparency in the healthcare system. They provide individuals and employers with a clear understanding of their coverage and responsibilities, fostering accountability and trust.

The Future of 1095 Health Insurance Reporting

As the healthcare landscape continues to evolve, so too will the 1095 forms and their reporting requirements. The Internal Revenue Service (IRS) regularly updates its guidelines and forms to align with changes in healthcare laws and regulations. Here are some potential future developments and considerations:

- Simplification and Streamlining: Efforts may be made to simplify the 1095 forms and reporting processes to reduce administrative burdens on individuals and businesses. This could involve consolidating forms or introducing more user-friendly digital platforms for reporting and filing.

- Integration with Healthcare Technology: With the increasing adoption of healthcare technology, there may be opportunities to integrate 1095 form data with electronic health records (EHR) systems. This could streamline data collection and analysis, improving efficiency and accuracy.

- Enhanced Data Security: As healthcare data becomes more valuable, there will be a growing emphasis on protecting the sensitive information contained in 1095 forms. Stronger data encryption, access controls, and privacy measures will be essential to safeguard personal and financial details.

- Expansion of Tax Credits and Subsidies: The ACA and subsequent healthcare legislation may introduce new tax credits or expand existing ones. The 1095 forms will play a vital role in determining eligibility for these credits and ensuring accurate distribution of benefits.

Conclusion

The 1095 Health Insurance forms are a cornerstone of the Affordable Care Act, providing transparency, accountability, and compliance in the complex world of healthcare coverage. These forms empower individuals and businesses to understand their healthcare obligations and access the benefits they are entitled to. As the healthcare landscape continues to evolve, the 1095 forms will remain a critical tool for ensuring a fair and accessible healthcare system for all Americans.

What happens if I don’t receive a 1095 form?

+If you don’t receive a 1095 form, it’s important to take action. Contact your insurance provider or the appropriate government agency to request the form. You may need this form for tax purposes or to demonstrate compliance with the ACA’s requirements. It’s essential to address any missing forms promptly to avoid potential issues.

Are there any penalties for not providing or filing 1095 forms correctly?

+Yes, there can be penalties for not providing or filing 1095 forms accurately. Individuals who fail to file their taxes or provide incorrect information may face penalties from the IRS. Employers who do not provide 1095-C forms to their employees or file them incorrectly may also face penalties. It’s crucial to understand the requirements and ensure compliance to avoid these penalties.

How can I obtain a copy of my 1095 form if I lose it or it’s incorrect?

+If you lose your 1095 form or notice any errors, you should contact the entity that issued the form. This could be your insurance provider, the Health Insurance Marketplace, or your employer. They can provide you with a replacement form or make the necessary corrections. It’s important to keep track of these forms and ensure their accuracy.