Which Medical Insurance Is Better

The world of medical insurance can be complex and daunting, with numerous options and plans available. When considering which medical insurance is better, it's essential to understand that the "best" option heavily depends on individual needs, circumstances, and preferences. Factors such as coverage, cost, provider networks, and additional benefits play a significant role in determining the most suitable medical insurance plan. In this comprehensive guide, we will delve into the key aspects to help you make an informed decision and find the medical insurance that aligns with your unique requirements.

Understanding Your Needs and Priorities

Before diving into the sea of medical insurance options, it’s crucial to identify your specific needs and priorities. Take into consideration your current and potential future health requirements, as well as your financial situation. Here are some key questions to ask yourself:

- What medical conditions or treatments do I currently have or anticipate needing in the future?

- Do I require specialized care, such as access to specific doctors or hospitals?

- Am I comfortable with a higher deductible and lower monthly premiums, or do I prefer a plan with a lower deductible and higher premiums?

- Are prescription medications an essential consideration for me and my family?

- Do I prioritize preventative care and wellness programs offered by insurance providers?

- Would I benefit from additional services like dental, vision, or mental health coverage in my plan?

By answering these questions, you can establish a clear understanding of your medical insurance needs and use this as a foundation for evaluating different plans.

Comparing Medical Insurance Plans

Once you have a grasp of your priorities, it’s time to compare medical insurance plans. Here are some crucial aspects to consider during your evaluation process:

Coverage and Benefits

Examine the scope of coverage provided by each plan. Look for plans that offer comprehensive coverage for your specific medical needs, including:

- Inpatient and outpatient services

- Prescription medications (considering both brand-name and generic drugs)

- Specialist consultations and treatments

- Emergency care

- Maternity and newborn care (if applicable)

- Mental health and substance abuse treatment

- Preventative care and screenings

Additionally, assess any limitations, exclusions, or pre-existing condition clauses to ensure the plan aligns with your health requirements.

Cost and Financial Considerations

Medical insurance plans can vary significantly in terms of cost. Evaluate the following financial aspects:

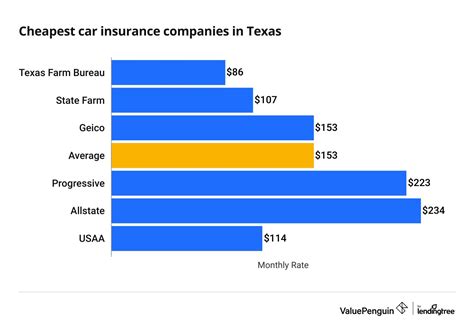

- Premiums: The amount you pay monthly or annually for your insurance coverage. Compare plans based on their premium costs, considering your budget and financial stability.

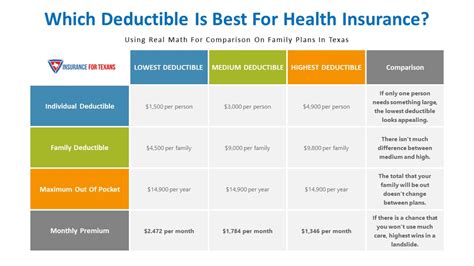

- Deductibles: The amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, so assess which option suits your financial situation and health needs.

- Copayments and Coinsurance: These are the costs you pay for covered services. Copayments are fixed amounts (e.g., $20 for a doctor's visit), while coinsurance is a percentage of the total cost (e.g., 20% of the cost of a hospital stay). Consider your expected medical expenses and choose a plan with manageable copays and coinsurance rates.

- Out-of-Pocket Maximum: This is the maximum amount you'll have to pay out of pocket for covered services in a year. Plans with lower out-of-pocket maximums can provide more financial security in case of major medical events.

Provider Networks

The provider network refers to the doctors, hospitals, and other healthcare professionals or facilities that are in-network with your insurance plan. Choosing a plan with a robust provider network can offer several advantages, including:

- Lower costs for in-network services

- Convenience in finding nearby healthcare providers

- Access to preferred specialists or hospitals

When comparing plans, verify the provider networks and ensure they include your preferred doctors and facilities. Consider whether you're willing to switch providers or if you require flexibility in choosing your healthcare team.

Additional Benefits and Services

Some medical insurance plans offer additional benefits and services beyond basic coverage. These can include:

- Dental and vision coverage

- Mental health and behavioral health services

- Alternative medicine options (e.g., acupuncture, chiropractic care)

- Wellness programs and incentives

- Travel insurance or international coverage

Evaluate which additional benefits align with your lifestyle and health goals, as these can enhance your overall insurance experience.

Reputation and Customer Satisfaction

Research the reputation and customer satisfaction ratings of the insurance providers you’re considering. Look for reviews and feedback from current and past customers to gain insights into the company’s reliability, customer service, and claim processing efficiency. A positive reputation and high customer satisfaction can indicate a more reliable and responsive insurance provider.

Seeking Professional Guidance

Navigating the complexities of medical insurance can be challenging, especially when comparing numerous plans. Consider seeking guidance from professionals who specialize in healthcare insurance. Insurance brokers or agents can provide valuable insights, answer your questions, and help you understand the intricacies of different plans. They can also assist in identifying the best options based on your specific needs and circumstances.

Stay Informed and Adaptable

The healthcare industry and insurance landscape are dynamic, with frequent changes and updates. Stay informed about any policy changes, new plan offerings, or modifications to existing plans. Regularly review and compare your options to ensure you’re still on the right track with your medical insurance choice. As your life and health needs evolve, be prepared to adapt and make adjustments to your insurance coverage accordingly.

Frequently Asked Questions

What are the differences between PPO, HMO, and EPO plans?

+

PPO (Preferred Provider Organization) plans offer flexibility by allowing you to choose any doctor or hospital, with in-network providers offering discounted rates. HMO (Health Maintenance Organization) plans typically require you to select a primary care physician and coordinate your care through them, often resulting in lower costs. EPO (Exclusive Provider Organization) plans are similar to PPOs but limit your coverage to in-network providers without out-of-network benefits.

How can I estimate my annual medical expenses to choose the right plan?

+

To estimate your annual medical expenses, consider your past medical bills, anticipated needs, and any potential changes in your health status. Analyze your prescription costs, anticipated specialist visits, and any planned procedures. This estimation will help you choose a plan with appropriate coverage and cost considerations.

Are there any government programs or subsidies available for medical insurance?

+

Yes, several government programs and subsidies are available to assist individuals and families with medical insurance costs. These include Medicaid, Medicare, and the Affordable Care Act’s Marketplace plans, which offer premium tax credits and cost-sharing reductions based on income.

What should I do if I have a pre-existing condition?

+

If you have a pre-existing condition, it’s crucial to carefully review the plan’s coverage and exclusions. The Affordable Care Act prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions. However, some plans may have waiting periods or limitations for certain conditions. Consider seeking plans with comprehensive coverage and minimal exclusions for pre-existing conditions.

Can I switch medical insurance plans during the year?

+

In most cases, you can only switch medical insurance plans during specific open enrollment periods or if you experience a qualifying life event, such as marriage, divorce, birth or adoption of a child, or loss of existing coverage. Check with your insurance provider or the healthcare marketplace to understand the rules and options for switching plans outside of the open enrollment period.