Assurity Life Insurance

Assurity Life Insurance: A Comprehensive Guide

Assurity Life Insurance Company is a prominent player in the insurance industry, offering a wide range of products and services to meet the diverse needs of individuals and businesses. With a rich history and a strong commitment to customer satisfaction, Assurity has established itself as a trusted provider in the realm of financial protection. In this comprehensive guide, we will delve into the world of Assurity Life Insurance, exploring its history, product offerings, customer experience, and its impact on the industry.

A Legacy of Financial Protection

Assurity Life Insurance Company has a long-standing legacy that dates back to its establishment in 1909. Over more than a century of operation, the company has evolved and adapted to the changing landscape of the insurance industry, consistently delivering innovative solutions and exceptional service. Headquartered in Lincoln, Nebraska, Assurity has grown into a nationally recognized brand, known for its stability, integrity, and dedication to its policyholders.

The company’s journey began with a focus on providing life insurance policies to individuals and families. Over time, Assurity expanded its portfolio to include a diverse range of insurance products, catering to the evolving needs of its customers. Today, Assurity Life Insurance offers a comprehensive suite of insurance solutions, including life insurance, annuity products, disability income insurance, and various specialty products.

Product Offerings: Tailored Solutions for Every Need

Assurity Life Insurance prides itself on offering a wide array of products that cater to different life stages, financial goals, and risk profiles. Let’s explore some of the key offerings:

Life Insurance

- Term Life Insurance: Assurity provides term life insurance policies that offer affordable coverage for a specified period, typically ranging from 10 to 30 years. These policies are ideal for individuals seeking temporary protection to cover financial obligations, such as mortgage payments or children’s education expenses.

- Permanent Life Insurance: For long-term financial protection, Assurity offers permanent life insurance options, including whole life, universal life, and variable universal life policies. These policies build cash value over time, providing both death benefit coverage and a savings component.

Annuity Products

- Fixed Annuities: Assurity’s fixed annuity products guarantee a fixed rate of return and provide a steady income stream during retirement. These annuities offer stability and peace of mind, ensuring a predictable income for retirees.

- Variable Annuities: Variable annuities, on the other hand, offer the potential for higher returns by investing in a range of subaccounts. Assurity’s variable annuity products provide flexibility and the opportunity for growth, catering to investors seeking a balance between risk and reward.

Disability Income Insurance

Assurity recognizes the importance of protecting one’s income in the event of a disability. Their disability income insurance policies provide a monthly benefit to replace a portion of an individual’s income, ensuring financial stability during times of illness or injury.

Specialty Products

In addition to the above, Assurity Life Insurance offers a range of specialty products to address unique needs:

- Long-Term Care Insurance: This policy provides coverage for the costs associated with long-term care, including nursing home stays and home healthcare services.

- Critical Illness Insurance: Assurity’s critical illness insurance policies provide a lump-sum payment upon the diagnosis of a specified critical illness, such as cancer or heart disease, helping individuals cover medical expenses and maintain their quality of life.

- Accidental Death and Dismemberment (AD&D) Insurance: AD&D insurance offers financial protection in the event of an accidental death or dismemberment, providing beneficiaries with a death benefit or a specified sum for specific injuries.

Customer Experience: A Commitment to Excellence

Assurity Life Insurance understands that the customer experience is a cornerstone of its success. The company has invested in creating a seamless and personalized journey for its policyholders, ensuring a positive and efficient interaction at every touchpoint.

Ease of Application

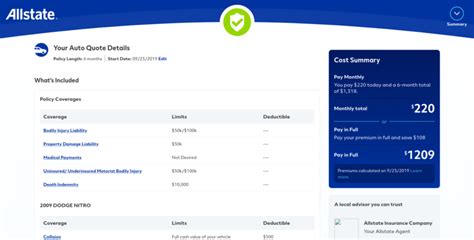

Assurity simplifies the application process by offering online applications and providing clear guidance throughout. Customers can easily compare different policies, obtain quotes, and apply for coverage, all from the comfort of their homes. The company’s user-friendly interface ensures a hassle-free experience, saving time and effort for prospective policyholders.

Excellent Customer Service

Assurity prides itself on its dedicated customer service team, known for its expertise and friendly approach. The company offers multiple channels of communication, including a toll-free number, live chat support, and email, ensuring prompt assistance and quick resolution of inquiries and concerns. Policyholders can expect timely responses and personalized attention, fostering a sense of trust and satisfaction.

Claim Process Efficiency

In the event of a claim, Assurity Life Insurance aims to streamline the process, making it as stress-free as possible for its policyholders. The company’s claims department is known for its efficiency and empathy, ensuring a swift and fair assessment of claims. Assurity understands the importance of timely payouts, providing financial support when it matters most.

Online Resources and Tools

Assurity recognizes the value of providing accessible resources to its customers. The company’s website offers a wealth of information, including educational articles, policy summaries, and interactive tools. Policyholders can access their accounts online, manage their policies, and stay informed about their coverage and benefits. Additionally, Assurity provides regular updates and newsletters, keeping customers informed about industry trends and relevant news.

Industry Impact and Recognition

Assurity Life Insurance’s commitment to innovation and customer satisfaction has not gone unnoticed. The company has received numerous accolades and industry recognition, solidifying its position as a leader in the insurance sector.

Financial Strength and Stability

Assurity’s financial strength is a testament to its stability and reliability. The company consistently maintains a strong financial position, as evidenced by its high ratings from reputable rating agencies such as A.M. Best and Standard & Poor’s. This financial stability assures policyholders that their investments and coverage are secure.

Awards and Acclaim

Assurity Life Insurance has been recognized for its excellence in various categories. The company has received awards for its customer service, innovation, and product offerings. Additionally, Assurity has been praised for its commitment to social responsibility and its involvement in community initiatives. These accolades further reinforce the company’s reputation as a trusted and responsible insurer.

Industry Partnerships and Collaborations

Assurity actively engages in partnerships and collaborations with industry leaders and organizations. These strategic alliances allow the company to leverage expertise, share best practices, and stay at the forefront of industry developments. Assurity’s collaborative approach ensures that its products and services remain relevant and aligned with the evolving needs of its customers.

Conclusion: A Trusted Companion on Your Financial Journey

Assurity Life Insurance Company stands as a beacon of financial protection and stability in the insurance industry. With its extensive product offerings, commitment to customer satisfaction, and recognition as a trusted partner, Assurity has solidified its position as a go-to provider for individuals and businesses seeking comprehensive insurance solutions.

As you navigate the complex world of insurance, Assurity Life Insurance offers a personalized and supportive experience, ensuring that your financial needs are met with precision and care. Whether you’re seeking life insurance, annuity products, disability coverage, or specialty policies, Assurity is dedicated to providing tailored solutions that empower you to achieve your financial goals and protect what matters most.

What is the history of Assurity Life Insurance Company?

+Assurity Life Insurance Company was founded in 1909 and has since grown into a nationally recognized insurer. The company’s headquarters are located in Lincoln, Nebraska, and it has established a strong reputation for its financial stability and commitment to customer satisfaction.

What types of insurance products does Assurity offer?

+Assurity offers a wide range of insurance products, including life insurance (term and permanent), annuity products (fixed and variable), disability income insurance, long-term care insurance, critical illness insurance, and accidental death and dismemberment (AD&D) insurance.

How does Assurity ensure a positive customer experience?

+Assurity prioritizes customer satisfaction by offering easy-to-use online applications, providing efficient customer service through multiple channels, and streamlining the claims process. The company’s focus on education and accessibility ensures that policyholders have the resources they need to make informed decisions.

What sets Assurity Life Insurance apart from its competitors?

+Assurity Life Insurance stands out for its comprehensive product offerings, financial stability, and commitment to customer service. The company’s focus on innovation and its involvement in industry partnerships contribute to its reputation as a trusted and reliable insurer.