Which Is Always A Cost When Buying Insurance

Insurance is an essential aspect of financial planning and risk management, providing individuals and businesses with a safety net against unforeseen events. However, when it comes to purchasing insurance, one crucial factor that often comes into play is the cost. Understanding the various costs associated with insurance is vital for making informed decisions and ensuring you get the best value for your money.

In this comprehensive guide, we will delve into the world of insurance costs, exploring the different types of expenses you may encounter when buying insurance policies. By the end of this article, you will have a clear understanding of the financial implications of insurance and the factors that influence its pricing.

The Essential Costs of Insurance

When it comes to insurance, there are several fundamental costs that you need to be aware of. These costs are integral to the insurance industry and are essential for the proper functioning of insurance providers and policyholders alike.

Premium Payments

The most obvious cost associated with insurance is the premium. A premium is the amount you pay to an insurance company to maintain your insurance coverage. Premiums are typically paid on a monthly, quarterly, or annual basis and vary depending on the type of insurance, the level of coverage, and individual risk factors.

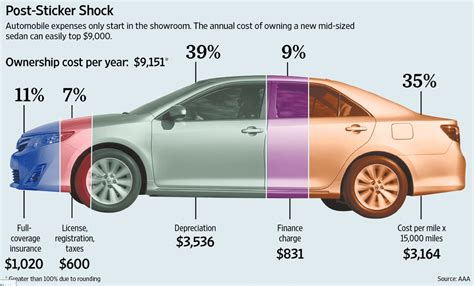

For instance, let's consider car insurance. The premium for a young driver with a clean record might be significantly lower than that of an older driver with a history of accidents. This is because the insurance company assesses the risk associated with each driver and adjusts the premium accordingly.

Premiums can be further customized with various deductibles and limits. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can often reduce your premium, as you are taking on a larger portion of the risk.

| Policy Type | Premium | Deductible |

|---|---|---|

| Car Insurance | $1,200/year | $500 |

| Health Insurance | $800/month | $2,000 |

| Home Insurance | $1,500/year | $1,000 |

In the above table, we can see how different insurance policies have varying premiums and deductibles. It's important to choose a deductible that aligns with your financial capabilities and risk appetite.

Administrative Costs

Insurance companies incur various administrative expenses to maintain their operations. These costs are often passed on to policyholders and can include:

- Underwriting Costs: The process of evaluating and assessing risk is known as underwriting. This involves analyzing your application, medical records (in the case of health insurance), and other relevant factors to determine your premium and coverage.

- Policy Management Fees: Insurance companies charge fees for the ongoing management of your policy, which includes processing claims, maintaining records, and providing customer support.

- Marketing and Sales Expenses: Like any business, insurance providers invest in marketing and sales strategies to attract new customers and retain existing ones. These expenses are often reflected in the premiums you pay.

While administrative costs are necessary for the smooth functioning of insurance companies, it's essential to choose a provider that offers transparent pricing and a competitive cost structure.

Additional Costs to Consider

Beyond the fundamental costs, there are other expenses associated with insurance that you should be aware of. These costs can vary depending on the type of insurance and your specific circumstances.

Policy Add-Ons and Riders

Insurance policies often offer additional coverage options, known as add-ons or riders. These are optional enhancements to your basic policy that can provide more comprehensive protection. However, they come at an extra cost.

For example, in health insurance, you might opt for a rider that covers alternative therapies or a specific medical condition. Similarly, car insurance policies may offer add-ons for rental car coverage or roadside assistance.

While these add-ons can provide valuable peace of mind, it's crucial to carefully evaluate your needs and budget before adding them to your policy. Ensure that the additional coverage is worth the extra cost.

Claim Fees and Surprises

When you make a claim, there may be additional fees or expenses involved. These can include claim processing fees, inspection fees, or even surprise charges that were not initially disclosed.

For instance, some insurance companies may charge a fee for processing each claim, regardless of whether the claim is approved or denied. Additionally, if an insurance adjuster needs to inspect your property or vehicle, there may be associated costs.

It's essential to review your insurance policy and understand any potential claim-related fees to avoid unexpected expenses during a time of need.

Taxes and Regulatory Fees

Insurance premiums may be subject to various taxes and regulatory fees imposed by local, state, or federal governments. These charges can add a significant amount to your insurance costs.

For example, in some states, there may be a premium tax or a surcharge for certain types of insurance. It's important to factor in these additional costs when comparing insurance quotes and making your purchasing decision.

Strategies for Managing Insurance Costs

While insurance costs are an inherent part of the process, there are strategies you can employ to manage and minimize these expenses. Here are some tips to consider:

- Shop around and compare quotes from multiple insurance providers. Prices can vary significantly, so it's worth investing time in finding the best deal.

- Consider bundling your insurance policies. Many providers offer discounts when you purchase multiple policies, such as combining your car and home insurance.

- Review your coverage annually and make adjustments as needed. Your circumstances may change over time, and you might be able to reduce your premiums by adjusting your coverage or deductibles.

- Practice good risk management. By taking steps to reduce the likelihood of claims, such as installing security systems or practicing safe driving, you may be eligible for discounts or lower premiums.

Conclusion

Understanding the costs associated with insurance is crucial for making informed decisions about your coverage. From premium payments to administrative expenses and additional fees, there are various factors that influence the overall cost of insurance.

By being aware of these costs and employing strategic approaches to manage them, you can ensure that you are getting the best value for your insurance dollar. Remember, insurance is a long-term investment in your financial security, and making informed choices is essential for a secure future.

What is the average cost of insurance premiums?

+

The average cost of insurance premiums varies significantly depending on the type of insurance, your location, and personal factors. For example, the average annual cost of car insurance in the United States is around 1,674, while the average cost of health insurance can range from a few hundred dollars to over 1,000 per month. It’s important to obtain quotes tailored to your specific circumstances to get an accurate estimate.

Are there ways to reduce insurance costs without sacrificing coverage?

+

Absolutely! There are several strategies to reduce insurance costs without compromising your coverage. These include increasing your deductibles, bundling multiple policies with the same provider, maintaining a good credit score (which can impact insurance rates), and shopping around for the best deals. Additionally, practicing good risk management and maintaining a clean record can often lead to lower premiums.

What are some common hidden costs associated with insurance policies?

+

Hidden costs can include claim processing fees, inspection fees, and additional charges for add-ons or riders. It’s important to carefully review your policy and understand any potential fees that may apply. Some insurance providers may also charge cancellation fees if you decide to terminate your policy early.