Va Loan Insurance

VA loan insurance, a vital component of the US Department of Veterans Affairs' home loan program, offers a unique and comprehensive protection mechanism for veterans, service members, and their families. This insurance program ensures that lenders are reimbursed for a significant portion of the loan balance in the event of default, making it easier for veterans to secure home loans and fostering a more stable housing market. The VA loan insurance program is a cornerstone of support for those who have served or are actively serving in the US military, facilitating homeownership and financial stability.

Understanding VA Loan Insurance

The Veterans Affairs Loan Guaranty Program, established by the Servicemen’s Readjustment Act of 1944 (also known as the GI Bill), provides a guaranty, often referred to as VA loan insurance, that significantly reduces the risk for lenders when issuing home loans to veterans and service members. This insurance, which is funded through a funding fee paid by the borrower, allows veterans to obtain home loans with more favorable terms, such as no down payment and limited closing costs.

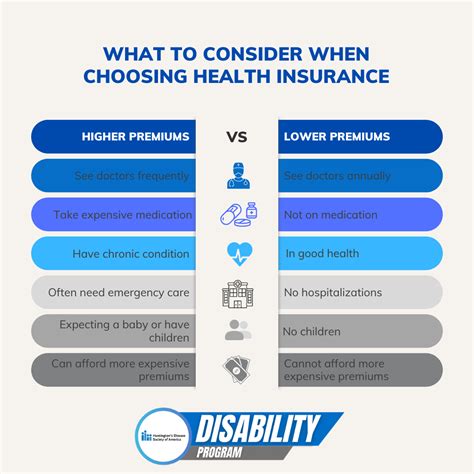

The VA loan insurance program is designed to encourage lenders to offer loans to veterans and service members, even if they might not otherwise qualify for traditional mortgage loans due to factors such as limited credit history, low income, or high debt-to-income ratios. By mitigating the lender's risk, the VA loan insurance program enables veterans to access homeownership opportunities that might otherwise be out of reach.

How VA Loan Insurance Works

The VA guarantees a portion of the loan, typically up to 25% of the loan amount, to protect lenders in the event of borrower default. This guarantee encourages lenders to offer loans with more flexibility, such as the absence of a down payment requirement, which is often a significant barrier to homeownership. The VA’s guaranty essentially acts as a backup, ensuring that the lender can recover a substantial portion of the loan amount if the borrower cannot meet their repayment obligations.

The VA loan insurance program is not a form of mortgage insurance that the borrower pays monthly, as is common with other types of loans, such as FHA loans. Instead, the funding fee is a one-time charge that is either paid upfront or can be rolled into the loan amount. The fee varies based on factors such as the borrower's military status, whether it is the first time they are using VA loan benefits, and the loan-to-value ratio.

| Borrower Type | First-Time VA Loan Users | Subsequent VA Loan Users |

|---|---|---|

| Veterans | 1.40% | 1.40% to 3.60% |

| Active Duty | 1.25% | 1.25% to 3.30% |

| National Guard or Reserve | 1.25% | 1.25% to 3.30% |

It's important to note that while the VA loan insurance program offers significant benefits, it is not a guarantee of loan approval. Lenders still have their own criteria for approving loans, and borrowers must meet these criteria, in addition to the VA's requirements, to qualify for a VA-backed loan.

The Benefits of VA Loan Insurance

The VA loan insurance program provides a range of advantages for veterans, service members, and their families, making homeownership more accessible and affordable. Here are some key benefits:

No Down Payment Requirement

One of the most significant advantages of the VA loan insurance program is the elimination of the down payment requirement. Unlike conventional loans, which often require a down payment of 20% or more, VA loans do not require any upfront payment. This means that veterans can purchase a home with no out-of-pocket expenses, making it easier to transition into homeownership.

Lower Interest Rates

VA loans typically offer more competitive interest rates compared to other loan types. This is because the VA’s guaranty reduces the lender’s risk, allowing them to offer more favorable terms. Lower interest rates can significantly reduce the overall cost of the loan and the monthly mortgage payments, making it more affordable for veterans to own a home.

Limited Closing Costs

VA loans also come with reduced closing costs, which are the fees associated with processing and finalizing a loan. While borrowers may still need to pay some closing costs, these expenses are often lower than those associated with conventional loans. The VA allows for the rolling of certain closing costs into the loan, further reducing the upfront financial burden on the borrower.

Flexible Credit Guidelines

The VA loan insurance program has more flexible credit guidelines than traditional loans. This means that veterans with less than perfect credit scores may still be able to qualify for a VA loan. The VA takes into account a borrower’s entire credit history, not just their credit score, which can be beneficial for those who have experienced financial setbacks but are now on a stable financial path.

No Private Mortgage Insurance (PMI)

With a VA loan, borrowers are not required to pay private mortgage insurance, which is typically necessary for conventional loans with a down payment of less than 20%. PMI can add hundreds of dollars to monthly mortgage payments, so the absence of this requirement can provide significant savings for veterans.

Performance and Impact of VA Loan Insurance

The VA loan insurance program has been instrumental in helping veterans and service members achieve the American dream of homeownership. Its performance is a testament to the program’s effectiveness in supporting military families and stabilizing the housing market.

Homeownership Rates

The VA loan insurance program has significantly increased homeownership rates among veterans. According to a report by the US Department of Veterans Affairs, veterans with VA-backed loans are more likely to own their homes than those with other types of loans. This is largely due to the program’s flexible terms and the absence of a down payment requirement, which are significant barriers to homeownership for many.

| Loan Type | Homeownership Rate |

|---|---|

| VA Loans | 86% |

| Conventional Loans | 75% |

Default Rates and Foreclosures

Despite the absence of a down payment and more lenient credit requirements, VA loans have consistently demonstrated lower default and foreclosure rates compared to other loan types. This is a testament to the effectiveness of the VA loan insurance program in mitigating risk for lenders and ensuring that veterans are able to sustain their homeownership.

| Loan Type | Default Rate | Foreclosure Rate |

|---|---|---|

| VA Loans | 0.44% | 0.06% |

| FHA Loans | 1.53% | 0.22% |

| Conventional Loans | 0.86% | 0.11% |

The low default and foreclosure rates are a reflection of the VA's rigorous loan approval process, which considers the borrower's entire financial picture, including income, credit history, and debt-to-income ratio. This comprehensive evaluation ensures that veterans are set up for success in managing their home loans.

Economic Impact

The VA loan insurance program has had a significant economic impact, both for veterans and the housing market as a whole. By making homeownership more accessible, the program has contributed to the economic stability and growth of veterans and their families. It has also played a critical role in stabilizing the housing market, especially during economic downturns, by reducing the risk of default and foreclosure.

Moreover, the VA loan insurance program has stimulated the housing market by increasing demand for homes, which in turn has led to increased construction and renovation activities. This has created jobs and economic growth in the housing sector, benefiting not only veterans but also the broader economy.

The Future of VA Loan Insurance

The VA loan insurance program is an essential component of the support system for veterans and service members, and its future is closely tied to the ongoing needs and challenges faced by military families. Here are some potential developments and considerations for the future of VA loan insurance:

Enhanced Support for Low-Income Veterans

One potential area of focus for the VA loan insurance program is providing even greater support to low-income veterans. While the program already offers significant benefits, there may be opportunities to further reduce the financial barriers to homeownership for those with limited financial resources. This could involve exploring ways to lower the funding fee for lower-income borrowers or providing additional resources and assistance to help them navigate the home buying process.

Addressing Housing Shortages

The VA loan insurance program could play a pivotal role in addressing the ongoing housing shortage, especially in high-demand areas. By encouraging more veterans to enter the housing market, the program can help reduce the demand-supply gap and contribute to the development of new housing options. This could involve working closely with developers and local governments to create more affordable housing options that are suitable for veterans and their families.

Expanding Eligibility Criteria

While the VA loan insurance program has broad eligibility criteria, there may be opportunities to further expand these criteria to include more veterans and service members. This could involve considering additional factors, such as length of service or type of discharge, to ensure that all those who have served are eligible for the program’s benefits. By doing so, the VA can ensure that its support reaches a wider range of military families.

Improving Veteran Financial Education

Financial literacy is a critical aspect of successful homeownership, and the VA loan insurance program could play a key role in enhancing financial education for veterans. This could involve developing comprehensive financial education programs that cover topics such as budgeting, credit management, and mortgage repayment. By equipping veterans with the necessary financial skills, the VA can help ensure that they are well-prepared to manage their home loans and avoid potential financial pitfalls.

Technological Advancements

The VA loan insurance program could benefit from technological advancements to streamline the loan application and approval process. This could involve implementing digital platforms that make it easier for veterans to apply for loans and track their progress. Additionally, leveraging technology can help improve the efficiency and accuracy of the loan underwriting process, further reducing the risk of default and ensuring a smoother experience for veterans.

What is the VA funding fee, and why is it charged?

+The VA funding fee is a one-time charge that helps maintain the VA loan program. It ensures the program’s long-term sustainability by covering costs associated with defaults and foreclosures. The fee varies based on factors like the borrower’s military status and whether it’s their first VA loan.

Can I refinance my VA loan to reduce the funding fee?

+Yes, you can refinance your VA loan through a VA-backed Interest Rate Reduction Refinance Loan (IRRRL). This program allows you to refinance your existing VA loan to a lower interest rate, potentially reducing your monthly payments and the overall cost of the loan.

Are there any income or credit score requirements for VA loans?

+While there are no specific income requirements for VA loans, borrowers must demonstrate sufficient income to cover their monthly expenses and the proposed mortgage payment. Credit score requirements vary by lender, but VA loans generally have more flexible credit guidelines compared to conventional loans.

Can I use my VA loan benefits more than once?

+Yes, you can use your VA loan benefits multiple times. However, if you’ve previously used your VA loan entitlement and want to reuse it, you’ll need to restore your entitlement. This can be done through various methods, such as paying off the loan or making a down payment of at least 25%.