Tufts Health Insurance

Tufts Health Insurance is a renowned and trusted provider of health insurance plans in the United States, particularly in the states of Massachusetts and New Hampshire. With a long-standing history of over 70 years, Tufts has established itself as a reliable partner for individuals, families, and businesses seeking comprehensive and affordable healthcare coverage. In this comprehensive guide, we will delve into the world of Tufts Health Insurance, exploring its offerings, benefits, and the impact it has on the lives of its policyholders.

A Legacy of Caring: The Tufts Health Story

Founded in 1950, Tufts Health Insurance has a rich heritage deeply rooted in the principles of accessibility and quality healthcare. Over the decades, the organization has evolved and expanded its reach, becoming a prominent player in the healthcare industry. Tufts’ commitment to its mission is evident in its broad network of healthcare providers, innovative plan designs, and a customer-centric approach.

The Evolution of Tufts Health Plans

Tufts Health Insurance offers a diverse range of plans to cater to the unique needs of its diverse customer base. These plans include:

- Tufts Health Freedom Plan: This plan provides flexibility and choice, allowing members to select their own doctors and hospitals within an extensive network. It offers cost-effective coverage and is ideal for those who prefer having control over their healthcare decisions.

- Tufts Health Together Plan: Designed with a focus on coordinated care, this plan connects members with a team of healthcare professionals who work together to manage their health. It promotes preventive care and offers personalized support, making it a great choice for those who value comprehensive wellness.

- Tufts Health Direct Plan: Aimed at providing direct access to high-quality care, this plan offers a streamlined experience with minimal bureaucracy. Members enjoy quick appointments and reduced wait times, ensuring efficient and effective healthcare.

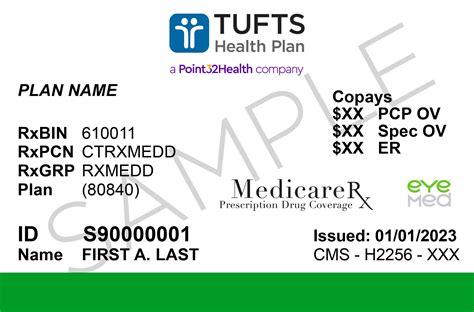

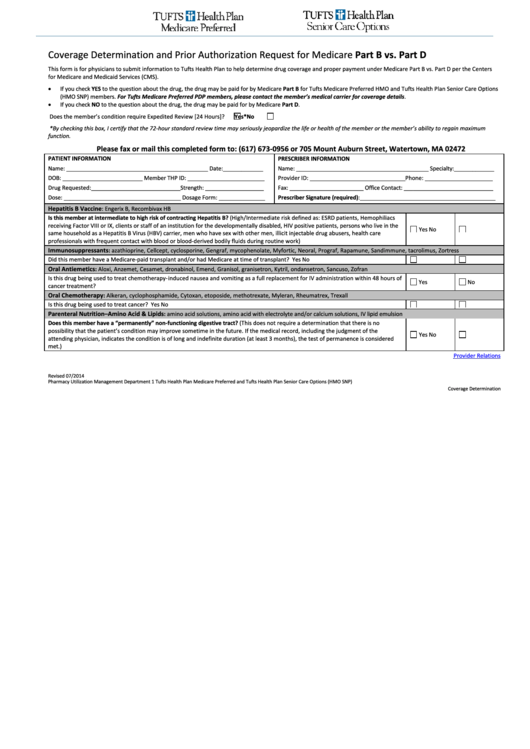

- Tufts Health Medicare Advantage Plans: Tailored for individuals eligible for Medicare, these plans offer additional benefits and coverage options beyond what traditional Medicare provides. Tufts Health ensures that its Medicare Advantage plans are designed to meet the unique healthcare needs of older adults.

Each plan offered by Tufts Health Insurance is meticulously crafted to provide a balance between affordability and comprehensive coverage. Tufts understands that healthcare needs vary, and thus, their plans are designed to be adaptable and customizable, ensuring that policyholders receive the care they need without compromising their financial well-being.

The Benefits of Choosing Tufts Health Insurance

Selecting Tufts Health Insurance as your healthcare partner comes with a multitude of advantages. Here are some key benefits that make Tufts a preferred choice for many:

1. Extensive Network of Providers

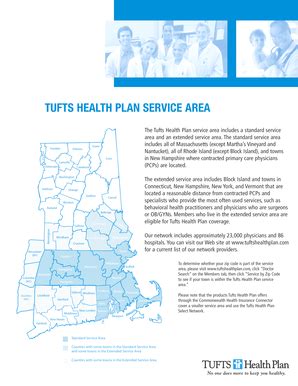

Tufts Health Insurance boasts an expansive network of healthcare providers, including top-rated hospitals, specialist physicians, and primary care doctors. This network ensures that policyholders have easy access to high-quality care, no matter their location. With a strong presence in both Massachusetts and New Hampshire, Tufts makes healthcare convenient and accessible.

| Network Type | Provider Count |

|---|---|

| In-Network Hospitals | 500+ |

| In-Network Physicians | 15,000 |

| Specialist Centers | 200 |

2. Comprehensive Coverage Options

Tufts Health Insurance offers a comprehensive suite of coverage options, ensuring that policyholders receive the care they need without financial strain. From preventive care to specialized treatments, Tufts plans are designed to cover a wide range of healthcare services. This includes:

- Doctor visits and check-ups

- Hospitalization and emergency care

- Prescription drug coverage

- Maternity and newborn care

- Mental health and substance abuse treatment

- Dental and vision benefits (optional add-ons)

3. Affordable Premiums and Cost-Saving Measures

Tufts Health Insurance understands the importance of keeping healthcare costs manageable. Their plans are competitively priced, offering excellent value for the coverage provided. Additionally, Tufts implements various cost-saving measures to further reduce out-of-pocket expenses for policyholders.

Tufts offers a range of cost-sharing options, such as deductibles, copayments, and coinsurance, allowing policyholders to choose a plan that aligns with their budget and healthcare needs. Furthermore, Tufts actively negotiates with healthcare providers to secure preferred rates, ensuring that members receive high-quality care at competitive prices.

4. Focus on Wellness and Prevention

Tufts Health Insurance believes in the power of preventive care. Their plans encourage policyholders to prioritize their health and well-being through various initiatives and programs. This includes:

- Wellness programs: Tufts offers incentives and rewards for policyholders who actively participate in wellness activities, such as fitness challenges and healthy lifestyle workshops.

- Preventive care coverage: Tufts plans cover a wide range of preventive services, including annual check-ups, cancer screenings, and immunizations, ensuring that policyholders can access these essential services without additional costs.

- Chronic condition management: For policyholders with chronic conditions, Tufts provides dedicated support and resources to help manage their health effectively, reducing the risk of complications and improving overall quality of life.

Real-Life Impact: Tufts Health Insurance Success Stories

Tufts Health Insurance takes pride in the positive impact its plans have on the lives of its policyholders. Here are a few real-life stories that showcase how Tufts has made a difference:

Story 1: Empowering Families

The Smith family, residents of Massachusetts, had been struggling with high healthcare costs and limited access to specialized care for their young daughter, who required ongoing treatment for a chronic condition. After switching to Tufts Health Insurance, they were able to access a broader network of pediatric specialists and benefit from the plan’s comprehensive coverage. The Smiths now have peace of mind, knowing that their daughter’s health is in capable hands, and they no longer face financial strain due to medical expenses.

Story 2: Supporting Small Businesses

As a small business owner in New Hampshire, Mr. Johnson wanted to provide his employees with affordable and comprehensive health insurance. Tufts Health Insurance offered a group plan tailored to the unique needs of his business, ensuring that his employees had access to high-quality healthcare. Mr. Johnson’s business has thrived, and he credits Tufts’ support and cost-effective solutions for contributing to the overall success and well-being of his team.

Story 3: Prioritizing Wellness

Ms. Davis, a Tufts Health Insurance policyholder, has embraced the wellness initiatives offered by Tufts. Through the plan’s fitness incentives and wellness challenges, she has made significant improvements to her overall health and fitness. Ms. Davis credits Tufts for providing her with the motivation and resources to adopt a healthier lifestyle, leading to increased energy levels and a sense of well-being.

The Future of Tufts Health Insurance

As the healthcare landscape continues to evolve, Tufts Health Insurance remains committed to staying at the forefront of innovation and excellence. With a focus on digital transformation, Tufts is investing in technology to enhance the overall member experience. This includes:

- Online portals for easy access to policy information and claim management.

- Telehealth services for convenient and remote consultations.

- Mobile apps to provide policyholders with real-time updates and health tracking tools.

- Artificial intelligence-powered assistance for personalized healthcare guidance.

Tufts Health Insurance is dedicated to adapting to the changing needs of its policyholders, ensuring that they remain a trusted partner in the pursuit of good health and well-being. By continuously improving their offerings and staying connected with the latest advancements in healthcare, Tufts is poised to deliver exceptional value and support for years to come.

Conclusion

Tufts Health Insurance has established itself as a leading provider of comprehensive and affordable healthcare coverage, making a positive impact on the lives of its policyholders. With an extensive network of providers, a wide range of plan options, and a focus on wellness and prevention, Tufts ensures that its members receive the care they need, when they need it. As the organization continues to innovate and adapt, Tufts Health Insurance remains a trusted choice for individuals, families, and businesses seeking reliable and accessible healthcare solutions.

How can I find out if Tufts Health Insurance is available in my area?

+Tufts Health Insurance primarily operates in the states of Massachusetts and New Hampshire. To determine if Tufts plans are available in your area, you can visit their official website and use their online zip code checker or contact their customer support team. They will be able to provide you with specific information regarding plan availability and coverage options in your region.

What makes Tufts Health Insurance different from other providers?

+Tufts Health Insurance stands out for its commitment to providing comprehensive coverage, an extensive network of providers, and a focus on preventive care and wellness. They offer a range of plan options to cater to different needs and budgets, ensuring that policyholders receive the care they need without financial strain. Additionally, Tufts’ customer-centric approach and innovative initiatives make them a trusted partner in the healthcare industry.

How can I enroll in a Tufts Health Insurance plan?

+Enrolling in a Tufts Health Insurance plan is a straightforward process. You can visit their official website, where you’ll find detailed information about their plans and the enrollment process. You can also contact their customer support team, who will guide you through the steps and assist you in selecting the plan that best suits your needs. Remember to gather any necessary documentation, such as proof of identity and income, to complete the enrollment process smoothly.

Does Tufts Health Insurance offer Medicare Advantage plans?

+Yes, Tufts Health Insurance understands the unique healthcare needs of individuals eligible for Medicare. They offer a range of Medicare Advantage plans tailored to provide additional benefits and coverage beyond what traditional Medicare offers. These plans are designed to cater to the specific requirements of older adults, ensuring they receive the care they need while managing their healthcare costs effectively.