How To Stop Insurance Policy

Navigating the process of canceling an insurance policy can be a complex task, but with the right information and understanding of the potential implications, it can be done effectively. In this comprehensive guide, we will delve into the steps and considerations involved in stopping an insurance policy, providing valuable insights and expert advice to ensure a smooth and informed process.

Understanding the Process of Canceling an Insurance Policy

Canceling an insurance policy is a decision that requires careful consideration, as it involves understanding the terms and conditions, potential penalties, and the impact on future insurance needs. Here, we will explore the key aspects to ensure a well-informed approach.

Reviewing the Policy Terms and Conditions

Before initiating the cancellation process, it is crucial to thoroughly review the policy terms and conditions. This document outlines the rights and obligations of both the policyholder and the insurance company. Pay close attention to the cancellation provisions, which may include specific requirements or penalties.

For instance, some policies may have a minimum term or early cancellation fees that come into effect if the policy is canceled prematurely. Understanding these terms will help you make an informed decision and potentially negotiate better terms with the insurance provider.

Assessing the Impact on Future Insurance Needs

Canceling an insurance policy can have long-term implications on your future insurance needs and coverage options. It is essential to consider the following factors:

- Coverage Gaps: Ensure that canceling the policy does not leave you with gaps in coverage. Assess your current and future risks to determine if alternative insurance options are necessary.

- Pre-existing Conditions: Some insurance providers may consider a canceled policy as a gap in coverage, potentially impacting future applications. Understand how this could affect your eligibility and premiums.

- Claim History: Insurance companies may review your claim history when assessing future applications. Canceling a policy could make it challenging to find affordable coverage, especially if you have made multiple claims.

Exploring Alternatives and Options

Before taking the step to cancel, explore alternative options that could potentially address your concerns without terminating the policy. Consider the following possibilities:

- Policy Adjustments: Discuss with your insurance provider to explore options such as reducing coverage limits, adjusting deductibles, or making other changes to tailor the policy to your current needs.

- Rider Additions: If specific concerns have arisen, inquire about adding riders or endorsements to your existing policy to address those specific risks.

- Switching Providers: Shop around and compare insurance providers to find a better fit for your current situation. This could involve getting quotes from multiple companies and negotiating better terms.

Initiating the Cancellation Process

Once you have made the decision to cancel your insurance policy and explored all possible alternatives, it is time to initiate the cancellation process. This section will guide you through the steps and considerations to ensure a smooth and efficient transition.

Notifying the Insurance Company

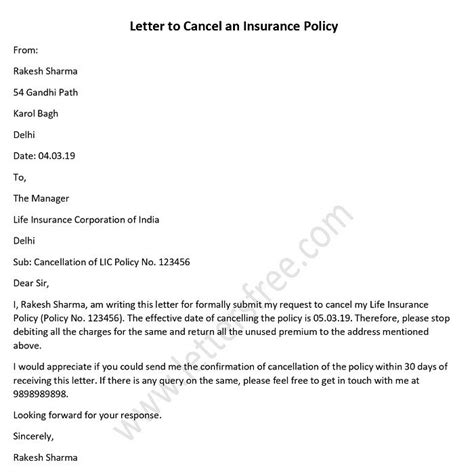

The first step in canceling your insurance policy is to officially notify the insurance company of your intent. Follow these steps to ensure a proper notification process:

- Written Notice: Send a written cancellation request to the insurance company. This can be done via email, letter, or through the company’s online portal, if available. Provide clear and concise details regarding your intention to cancel.

- Confirmation: Request a confirmation of receipt from the insurance company. This will ensure that they have received your cancellation request and will help avoid any potential disputes or misunderstandings.

- Effective Date: Specify the effective date of cancellation. This is typically the date when you want the policy to be terminated. Ensure that you understand any potential implications of the chosen date, such as coverage gaps or penalties.

Reviewing and Understanding Cancellation Fees

Cancellation fees are a common aspect of insurance policies, especially if the policy is canceled before the agreed-upon term. It is crucial to review and understand these fees to make an informed decision. Consider the following:

- Fee Structure: Review the policy documents to understand the fee structure and any potential waivers or discounts that may apply.

- Negotiation: In some cases, insurance companies may be open to negotiating cancellation fees, especially if you have a strong relationship or a long-term policy. Don’t hesitate to discuss this with your insurance provider.

- Payment Options: Understand the payment options for the cancellation fees. Some companies may offer flexible payment plans or the ability to deduct the fees from any remaining premium refunds.

Obtaining a Refund of Unused Premiums

When canceling an insurance policy, you are often entitled to a refund of the unused premiums. However, the refund process can vary depending on the insurance provider and the timing of the cancellation. Here’s what you need to know:

- Refund Calculation: The refund amount will depend on the policy’s terms and the date of cancellation. Typically, the closer you are to the policy’s renewal date, the higher the refund amount.

- Timing: Insurance companies have different timelines for processing refunds. Inquire about the expected timeframe for receiving your refund to manage your expectations.

- Method of Payment: Determine how the refund will be issued. It could be in the form of a check, direct deposit, or a credit to your account with the insurance company.

Potential Challenges and Considerations

Canceling an insurance policy may present certain challenges and considerations that require careful attention. Understanding these potential obstacles will help you navigate the process more effectively.

Dealing with Early Cancellation Penalties

Some insurance policies have early cancellation penalties, which are designed to discourage policyholders from canceling prematurely. These penalties can take various forms, such as:

- Fixed Fees: A flat fee that is charged regardless of when the policy is canceled.

- Percentage of Premium: A percentage of the total premium paid for the policy term.

- Pro-Rated Fees: A fee calculated based on the time remaining on the policy term.

When facing early cancellation penalties, consider the following strategies:

- Negotiation: Discuss your situation with the insurance provider and explore the possibility of waiving or reducing the penalty. They may be willing to accommodate your request, especially if you have a good relationship or a long-term policy.

- Understanding the Fine Print: Carefully review the policy documents to understand the exact terms and conditions of the penalty. This will help you make a more informed decision and potentially find ways to minimize the impact.

Addressing Claims and Refunds

If you have made claims on your insurance policy before canceling it, there are a few important considerations to keep in mind:

- Outstanding Claims: Ensure that all outstanding claims are resolved before canceling the policy. This includes providing all necessary documentation and following up with the insurance company to ensure timely processing.

- Refund Calculation: The refund amount may be affected by any claims made during the policy period. The insurance company will typically deduct the amount paid out for claims from the total premium, and then calculate the refund based on the remaining balance.

Impact on Credit Score

Canceling an insurance policy can have an impact on your credit score, especially if it is a significant policy such as home or auto insurance. Here’s what you need to know:

- Payment History: Insurance companies may report your payment history to credit bureaus. If you have a history of timely payments, canceling a policy may not have a significant impact on your credit score.

- Coverage Gaps: Canceling a policy and leaving yourself uninsured for a period of time could be viewed negatively by credit bureaus. It may indicate financial instability or increased risk, potentially impacting your credit score.

Seeking Professional Advice

Canceling an insurance policy is a significant decision, and seeking professional advice can provide valuable insights and guidance. Consider the following options:

- Insurance Brokers: Insurance brokers can offer impartial advice and help you navigate the cancellation process. They can provide alternative options, negotiate with insurance providers, and ensure a smooth transition.

- Financial Advisors: Financial advisors can assess your overall financial situation and provide advice on the potential impact of canceling an insurance policy. They can help you make informed decisions that align with your financial goals.

- Legal Counsel: In complex situations or if you have concerns about potential legal implications, consulting with a legal professional can provide peace of mind. They can review your policy, advise on your rights, and assist with any necessary legal steps.

Frequently Asked Questions

What happens if I cancel my insurance policy before the agreed-upon term?

+Canceling an insurance policy before the agreed-upon term may result in early cancellation penalties or fees. These fees can vary depending on the policy and the insurance provider. It is important to review the policy terms and conditions to understand the potential penalties.

Can I negotiate cancellation fees with my insurance company?

+Yes, it is possible to negotiate cancellation fees with your insurance company. They may be willing to waive or reduce the fees, especially if you have a good relationship or have been a long-term policyholder. It is worth discussing your situation with them to explore potential options.

How long does it take to receive a refund of unused premiums after canceling a policy?

+The timeframe for receiving a refund of unused premiums can vary depending on the insurance provider and their processing times. It is advisable to inquire about the expected timeframe when initiating the cancellation process. Typically, refunds are issued within a few weeks to a couple of months.

Can I cancel my insurance policy online?

+Yes, many insurance providers offer online cancellation options through their websites or portals. However, it is essential to ensure that you receive confirmation of the cancellation request to avoid any potential issues. It is always a good idea to follow up with the insurance company to confirm the effective date of cancellation.

What should I do if I have outstanding claims when canceling my insurance policy?

+If you have outstanding claims when canceling your insurance policy, it is crucial to ensure that all necessary documentation is provided and that the claims are resolved before the cancellation takes effect. This will help avoid any potential delays or complications with receiving your refund.