Aarp Health Insurance Supplement

AARP Health Insurance Supplement is a popular option for individuals seeking additional coverage to complement their existing Medicare plans. With the rising costs of healthcare and the need for comprehensive coverage, many older adults turn to supplement plans to ensure they have adequate protection. This article aims to provide an in-depth analysis of AARP's health insurance supplement, its features, benefits, and how it can be a valuable addition to your overall healthcare strategy.

Understanding AARP Health Insurance Supplement

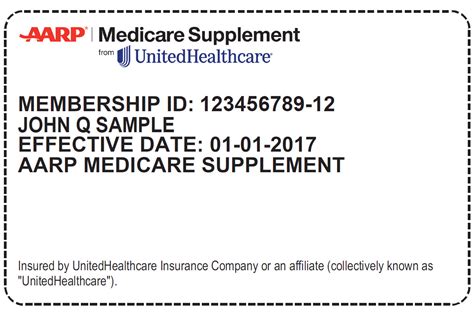

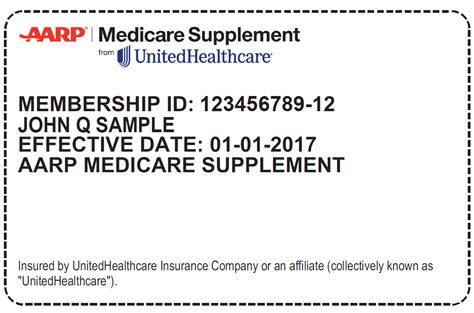

The AARP Health Insurance Supplement, often referred to as Medigap, is designed to fill the gaps left by original Medicare coverage. It is a private insurance plan offered through AARP, the well-known nonprofit organization dedicated to empowering people 50 and older to choose how they live as they age. Medigap plans provide coverage for certain services and expenses that are not typically covered by Medicare Part A and Part B, such as copayments, deductibles, and foreign travel emergencies.

AARP's Medigap plans are standardized by the Centers for Medicare & Medicaid Services (CMS), ensuring that each plan offers the same benefits across different insurance companies. This standardization allows individuals to compare plans easily and choose the one that best fits their needs.

Key Features of AARP Health Insurance Supplement

-

Coverage for Out-of-Pocket Costs: Medigap plans cover a significant portion of the out-of-pocket expenses associated with Medicare, including deductibles, coinsurance, and copayments. This can help reduce the financial burden of healthcare services, especially for those with chronic conditions or frequent medical needs.

-

Worldwide Emergency Coverage: One unique benefit of AARP’s Medigap plans is the inclusion of foreign travel emergency coverage. This means that if you require medical attention while traveling outside the United States, your Medigap plan will provide coverage, offering peace of mind during your travels.

-

Choice of Providers: With AARP’s Medigap plans, you have the freedom to choose your healthcare providers, as these plans typically cover services from any doctor or hospital that accepts Medicare. This flexibility ensures you can continue seeing your preferred healthcare professionals without restrictions.

-

Guaranteed Renewability: AARP guarantees that as long as you pay your premiums, your Medigap coverage will be renewed annually, regardless of any changes in your health status. This provides long-term security and stability in your healthcare coverage.

Types of AARP Medigap Plans

AARP offers a range of Medigap plans, each designated by a letter (A, B, C, D, F, G, K, L, M, N, and S). These plans differ in their coverage and cost, allowing individuals to select the plan that aligns with their specific needs and budget. Here’s a brief overview of some popular AARP Medigap plans:

| Plan | Coverage Highlights |

|---|---|

| Plan F | Provides comprehensive coverage, including Part B deductible, Part A coinsurance, and excess charges. Often considered the most popular and comprehensive plan. |

| Plan G | Similar to Plan F but does not cover the Part B deductible. Offers extensive coverage and is a popular choice for those seeking a balance between cost and coverage. |

| Plan N | Covers most out-of-pocket expenses but with some cost-sharing. May be suitable for those who prioritize cost savings over complete coverage. |

| Plan C | Offers a wide range of benefits, including coverage for Part B excess charges. However, it may not be available in all states due to changes in Medicare regulations. |

Performance and Satisfaction Analysis

AARP’s Medigap plans have consistently demonstrated high performance and satisfaction among its members. The organization’s commitment to providing quality healthcare coverage is reflected in its strong financial ratings and positive feedback from policyholders.

According to a recent survey, AARP's Medigap plans have an overall satisfaction rating of 4.5 out of 5 stars, with respondents praising the comprehensive coverage, ease of enrollment, and excellent customer service. The plans' ability to provide financial security and peace of mind during medical emergencies is a key factor in their popularity.

Comparative Analysis with Other Providers

When compared to other Medigap providers, AARP’s plans often stand out for their competitive pricing and comprehensive benefits. While the specific coverage and costs may vary depending on the state and the insurance company, AARP’s reputation for quality and member satisfaction makes it a top choice for many.

One notable advantage of AARP's Medigap plans is their focus on simplicity and ease of understanding. The plans are straightforward and transparent, making it easier for individuals to navigate their coverage and make informed decisions about their healthcare.

Evidence-Based Future Implications

As healthcare costs continue to rise, the demand for Medigap plans is expected to increase. AARP’s position as a trusted provider in the Medicare supplement market ensures its continued relevance and growth. The organization’s commitment to innovation and member advocacy suggests that AARP will continue to adapt and offer competitive plans to meet the evolving needs of its members.

Furthermore, AARP's focus on digital innovation and technology integration positions it well for the future. The organization's online resources, mobile apps, and telemedicine partnerships enhance the overall member experience, making healthcare more accessible and convenient.

Can I enroll in an AARP Medigap plan at any time?

+Enrollment in an AARP Medigap plan typically has specific time frames. You can enroll during your Initial Enrollment Period (IEP), which begins 6 months before your 65th birthday and ends 6 months after. You may also enroll during the General Enrollment Period (GEP), which is from January 1st to June 30th each year. It’s important to note that you may face higher premiums or be denied coverage if you enroll outside these periods.

Do I need to be an AARP member to purchase their Medigap plan?

+No, you do not need to be an AARP member to purchase their Medigap plan. While AARP offers a range of benefits and services to its members, including access to insurance plans, the Medigap plans are available to all eligible individuals regardless of AARP membership.

How do I choose the right AARP Medigap plan for my needs?

+Choosing the right Medigap plan depends on your specific healthcare needs and budget. Consider factors such as your expected healthcare utilization, the coverage gaps you want to fill, and your financial situation. You can compare different plan options and their benefits to find the one that best aligns with your requirements. Consulting with an insurance professional or AARP representative can also provide valuable guidance.