The General For Car Insurance

In the realm of car insurance, the General is a prominent player, offering coverage options to drivers across the United States. With a focus on providing affordable and accessible insurance solutions, The General has become a go-to choice for many vehicle owners. This comprehensive guide delves into the intricacies of The General car insurance, exploring its coverage, benefits, and unique features, all while uncovering why it has gained such popularity among American drivers.

Unveiling The General Car Insurance: A Comprehensive Overview

The General, officially known as The General Insurance Company, is a subsidiary of PGC Holdings Corp., which also owns Permanent General Assurance Corporation and Permanent General Liability Insurance Company. Founded in 1963, The General has a rich history of serving drivers with a range of insurance needs. What sets The General apart is its commitment to making car insurance accessible and affordable without compromising on quality coverage.

The General’s Coverage Options: A Detailed Breakdown

The General offers a diverse range of car insurance coverage options to cater to the varied needs of its customers. Here’s a detailed look at the key coverage types:

- Liability Coverage: This fundamental coverage option provides protection in the event of bodily injury or property damage to others caused by the policyholder. The General offers both bodily injury liability and property damage liability coverage, ensuring drivers are protected in the event of an at-fault accident.

- Collision Coverage: Designed to cover the cost of repairing or replacing a vehicle after an accident, regardless of fault. The General's collision coverage is an essential component of a comprehensive insurance plan, ensuring drivers can get back on the road quickly after an incident.

- Comprehensive Coverage: Going beyond collision, comprehensive coverage protects against damages caused by events other than accidents, such as theft, vandalism, natural disasters, or collisions with animals. This coverage is particularly valuable for drivers who want added peace of mind and protection for their vehicles.

- Uninsured/Underinsured Motorist Coverage: This coverage steps in when the at-fault driver in an accident either doesn't have insurance or doesn't have sufficient coverage to pay for the damages they've caused. It ensures policyholders are protected even when dealing with uninsured or underinsured drivers.

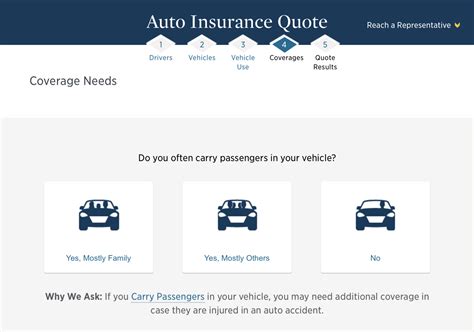

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses and lost wages resulting from an accident, regardless of fault. It provides a vital safety net for drivers and their passengers, ensuring medical bills are covered after an accident.

- Rental Car Reimbursement: In the event that a policyholder's vehicle is inoperable due to an insured incident, this coverage provides reimbursement for the cost of renting a substitute vehicle.

- Roadside Assistance: Offering 24/7 emergency roadside assistance, this coverage includes services like towing, battery jumps, flat tire changes, and fuel delivery. It provides essential support for drivers facing unexpected vehicle breakdowns.

Additionally, The General offers specialized coverage options such as SR-22 insurance, which is required for drivers with certain violations or convictions, and non-owner car insurance, which provides liability coverage for individuals who drive a vehicle they don't own.

Benefits and Features of The General Car Insurance

Beyond its comprehensive coverage options, The General boasts several benefits and unique features that enhance the overall insurance experience for its policyholders. Here’s a closer look:

- Affordable Premiums: One of the standout features of The General is its commitment to offering affordable car insurance premiums. The company caters to budget-conscious drivers by providing competitive rates without sacrificing coverage quality.

- Customizable Policies: The General understands that every driver's needs are unique. As such, it offers customizable policies that allow policyholders to tailor their coverage to their specific requirements, ensuring they only pay for the protection they need.

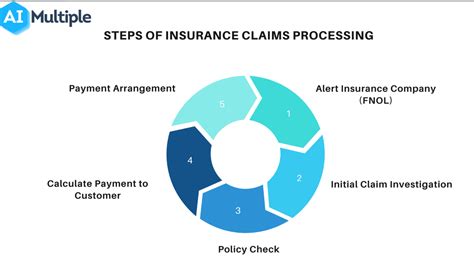

- Quick Claims Process: In the event of an accident or incident, The General prides itself on its efficient and streamlined claims process. Policyholders can file claims online or over the phone, and the company's dedicated claims team works swiftly to resolve claims, ensuring policyholders receive the compensation they're entitled to promptly.

- 24/7 Customer Support: The General provides around-the-clock customer support, ensuring policyholders can access assistance whenever they need it. Whether it's a simple policy inquiry or a complex claims issue, the company's customer service team is always available to provide guidance and support.

- Online Account Management: Policyholders can manage their insurance policies conveniently through The General's online platform. From making policy changes to viewing billing information and filing claims, the online account management system offers a seamless and user-friendly experience.

- Discounts and Rewards: The General rewards its policyholders with a range of discounts and incentives. These include multi-policy discounts for customers who bundle their insurance policies, safe driver discounts for those with a clean driving record, and loyalty rewards for long-term customers.

- Flexible Payment Options: Recognizing that paying insurance premiums can be a financial burden, The General offers flexible payment options. Policyholders can choose from monthly, quarterly, or annual payment plans, and there are no additional fees for choosing a payment plan that suits their budget.

The General’s Performance and Customer Satisfaction

The General has consistently demonstrated its commitment to providing high-quality insurance services, as evidenced by its strong performance and positive customer feedback. Here’s a glimpse into The General’s performance metrics and customer satisfaction ratings:

| Metric | Rating/Performance |

|---|---|

| AM Best Rating | A- (Excellent) |

| J.D. Power Claims Satisfaction | 3 out of 5 stars |

| J.D. Power Shopping Study | 3 out of 5 stars |

| NAIC Complaint Index | 0.02 (2021) |

| Customer Satisfaction Rating | 4.5/5 stars (based on online reviews) |

These metrics showcase The General's commitment to customer satisfaction and its ability to deliver on its promises. The low complaint index and positive customer reviews indicate that policyholders are generally satisfied with their experiences with The General.

The General’s Impact and Future Outlook

The General’s impact on the car insurance industry is significant, particularly in terms of making insurance more accessible and affordable for a broader range of drivers. Its focus on providing comprehensive coverage options at competitive rates has attracted a loyal customer base.

Looking ahead, The General is well-positioned to continue its growth and success. With a strong financial rating from AM Best and a commitment to innovation, the company is likely to enhance its offerings and services, further solidifying its position as a leading provider of car insurance.

As The General continues to adapt to the evolving needs of its customers and the insurance industry, its future prospects remain bright. The company's dedication to customer satisfaction and its ability to offer tailored insurance solutions position it well to thrive in the dynamic world of car insurance.

Frequently Asked Questions

How does The General determine insurance premiums?

+

The General uses a combination of factors to determine insurance premiums, including the policyholder’s driving record, the type of vehicle insured, the coverage options selected, and the policyholder’s location. The company strives to offer competitive rates while ensuring the policy provides adequate coverage.

What discounts does The General offer?

+

The General offers a range of discounts, including multi-policy discounts for bundling insurance policies, safe driver discounts for those with a clean driving record, and loyalty rewards for long-term customers. These discounts can significantly reduce the cost of insurance premiums.

How can I file a claim with The General?

+

Policyholders can file claims with The General online or over the phone. The company’s dedicated claims team works efficiently to process claims and provide policyholders with the compensation they’re entitled to.

Does The General offer SR-22 insurance?

+

Yes, The General provides SR-22 insurance, which is often required for drivers with certain violations or convictions. SR-22 insurance certifies that a driver has the minimum level of liability insurance required by law.

What is The General’s financial stability rating?

+

The General has an A- (Excellent) financial stability rating from AM Best, indicating its ability to meet its insurance obligations and providing assurance to policyholders.