Term Policies In Life Insurance

Term life insurance is a widely utilized form of coverage that offers financial protection for a specified period, typically ranging from 10 to 30 years. Unlike permanent life insurance policies, term plans focus solely on providing coverage during the chosen term and do not accumulate cash value over time. This article delves into the intricacies of term policies in life insurance, exploring their features, benefits, and considerations for policyholders.

Understanding Term Life Insurance Policies

Term life insurance policies are designed to offer temporary coverage for a defined period. During this term, the policyholder pays regular premiums, and in the event of their death, the beneficiary receives a payout known as the death benefit. These policies are particularly appealing to individuals seeking affordable coverage for a specific timeframe, such as during their working years when financial responsibilities are high.

Key Features of Term Life Insurance

Term life insurance policies boast several distinctive features:

- Level Premiums: Policyholders enjoy stable premium payments throughout the term, ensuring predictable expenses.

- Flexible Terms: Insurers offer various term lengths, allowing individuals to choose coverage durations that align with their financial goals and life stages.

- Death Benefit: In the event of the policyholder’s death during the term, beneficiaries receive a tax-free lump sum payment, providing financial security.

- Conversion Options: Many term policies offer the option to convert to permanent life insurance without undergoing a medical exam, ensuring continuous coverage.

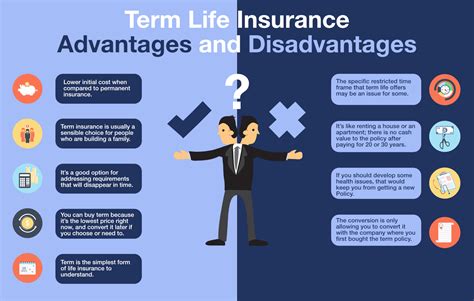

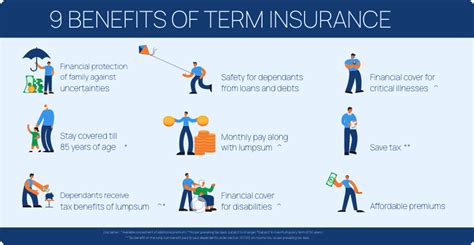

Benefits of Term Life Insurance

Term life insurance policies present numerous advantages:

- Affordability: Term policies are often more cost-effective than permanent life insurance, making them accessible to a broader range of individuals.

- Flexibility: Policyholders can select term lengths that suit their needs, providing coverage for specific life stages such as raising a family or paying off a mortgage.

- Death Benefit: The death benefit offers financial security to beneficiaries, helping cover expenses like funeral costs, outstanding debts, or daily living expenses.

- Conversion Opportunities: The ability to convert term policies to permanent life insurance ensures long-term coverage without the need for additional medical underwriting.

Choosing the Right Term Policy

Selecting the appropriate term life insurance policy involves careful consideration of several factors:

Term Length

The term length of a policy should align with an individual’s financial goals and responsibilities. Common term lengths include 10, 15, 20, and 30 years, with the choice often depending on factors such as when financial obligations are expected to decrease or when dependents will become financially independent.

Death Benefit Amount

Determining the appropriate death benefit amount requires an assessment of financial needs. This includes considering outstanding debts, funeral expenses, daily living costs for dependents, and potential future expenses like college tuition. It’s essential to strike a balance between adequate coverage and affordability.

Conversion Options

Policyholders should review the conversion options available with their term policy. Converting to a permanent life insurance policy without a medical exam can provide long-term coverage, ensuring financial protection even as health conditions change.

Performance and Real-World Examples

Term life insurance policies have proven effective in providing financial security to families and individuals. For instance, consider the case of John, a 35-year-old with a wife and two young children. John opted for a 20-year term life insurance policy with a death benefit of $500,000. This policy ensured that in the event of his untimely death, his family would receive sufficient financial support to cover their immediate needs and maintain their standard of living.

| Policy Feature | Real-World Data |

|---|---|

| Average Premium | $20–$30 per month for a healthy 30-year-old male with a $500,000 death benefit. |

| Conversion Rates | Approximately 15% of term policyholders convert to permanent life insurance. |

| Death Benefit Payouts | Over 99% of death benefit claims are paid out by insurers. |

FAQ

Can I renew my term life insurance policy when it expires?

+Yes, many insurers offer renewal options for term life insurance policies. However, it’s important to note that premiums may increase upon renewal, and a new medical exam may be required.

What happens if I miss a premium payment for my term policy?

+Missing a premium payment can have consequences. Some policies offer a grace period of 30 days, while others may lapse immediately. It’s crucial to stay up-to-date with premium payments to maintain coverage.

Can I increase the death benefit on my term policy?

+In certain cases, policyholders can increase the death benefit during the term. This option is often subject to a new medical exam and may result in higher premiums.