Term Life Insurance Near Me

Term life insurance is a popular and affordable option for individuals and families seeking financial protection during a specific period of their lives. Unlike permanent life insurance policies, term life insurance provides coverage for a defined term or duration, typically ranging from 10 to 30 years. It offers a cost-effective way to secure your loved ones' future and ensures peace of mind during crucial life stages. As you explore term life insurance options near you, it's essential to understand the key factors that impact your coverage and how to find the right policy tailored to your needs.

Understanding Term Life Insurance

Term life insurance policies are designed to offer protection for a set period, often chosen to align with significant life events or financial milestones. For instance, you might opt for a 20-year term policy to cover your family’s financial needs until your youngest child reaches independence or to provide a buffer during your high-earning years when your income is critical to maintaining your family’s standard of living.

During the policy term, the insured individual receives a death benefit if they pass away. This benefit is a lump-sum payment that the insurance company provides to the policy's beneficiary, often a spouse, child, or other dependent. The beneficiary can use this money to cover various expenses, such as funeral costs, outstanding debts, daily living expenses, or even to maintain their standard of living.

Key Features of Term Life Insurance

- Fixed Premium and Coverage: Term life insurance policies offer a fixed premium for the duration of the policy term. This means you pay the same amount each month or year, regardless of any changes in your health or age. The coverage amount also remains the same, providing a guaranteed benefit to your beneficiaries.

- Affordability: One of the primary advantages of term life insurance is its affordability. Since the coverage is for a limited time, the premiums are often much lower than those for permanent life insurance policies. This makes term life insurance an accessible option for individuals and families on a budget.

- Renewable and Convertible Options: Many term life insurance policies offer the flexibility to renew the policy at the end of the term or convert it to a permanent life insurance policy without having to undergo a new medical exam. This ensures continued coverage and provides an option to transition to a permanent policy as your financial needs evolve.

Factors Influencing Term Life Insurance Near You

When searching for term life insurance options near you, several factors come into play. These factors influence the availability, cost, and suitability of policies, ensuring you find the right coverage tailored to your unique circumstances.

Insurance Companies and Availability

The availability of term life insurance policies can vary based on the insurance companies operating in your region. Different insurers may offer unique policy features, pricing structures, and additional benefits. It’s essential to explore multiple options to find the best fit for your needs.

For instance, some insurers may specialize in offering term life insurance to specific demographics, such as young professionals or individuals with pre-existing health conditions. Others might focus on providing comprehensive coverage with additional riders, such as accidental death benefit or critical illness coverage.

| Insurance Company | Specialty/Unique Features |

|---|---|

| Insurer A | Offers flexible term lengths and affordable rates for young adults. |

| Insurer B | Provides term life insurance with built-in waiver of premium for certain medical conditions. |

| Insurer C | Specializes in offering term life insurance to individuals with high-risk occupations. |

Pricing and Premium Structures

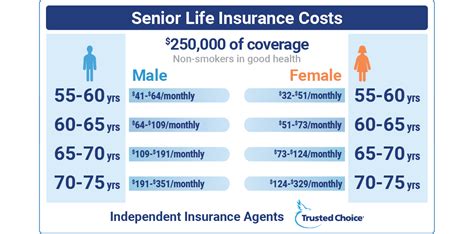

The cost of term life insurance policies can vary significantly between insurers and regions. Pricing is influenced by various factors, including the insured’s age, health status, and lifestyle. Generally, younger individuals with good health and low-risk lifestyles can expect more affordable premiums.

Insurance companies may also offer different premium structures, such as level term or decreasing term. In a level term policy, the premium remains the same throughout the policy term, providing stability in your budget. On the other hand, a decreasing term policy sees the premium and coverage amount decrease over time, reflecting the decreasing likelihood of death as the insured ages.

Coverage Amount and Policy Terms

The coverage amount and policy term are two critical factors to consider when choosing term life insurance. The coverage amount, also known as the death benefit, should be sufficient to cover your family’s financial needs during the policy term. This includes considering outstanding debts, future expenses, and any income replacement required.

The policy term should align with your specific financial goals and needs. For example, if you have young children and want to ensure their financial security until they become independent, a longer policy term, such as 25 or 30 years, might be appropriate. On the other hand, if you're nearing retirement and primarily need coverage for funeral expenses and final debts, a shorter term of 10 or 15 years might suffice.

Finding the Right Term Life Insurance Near You

With the vast array of term life insurance options available, finding the right policy near you can be a daunting task. However, by following these steps and considerations, you can streamline your search and make an informed decision.

Assess Your Needs and Goals

Before diving into policy comparisons, take the time to assess your unique needs and financial goals. Consider factors such as your current financial obligations, future milestones (e.g., children’s education, home ownership), and any specific concerns you have about your family’s financial security.

For instance, if you have significant outstanding debts, such as a mortgage or student loans, you might prioritize finding a term life insurance policy that offers a high coverage amount to ensure these debts can be paid off in the event of your untimely passing. Alternatively, if you're a young professional with no immediate financial obligations, you might focus on finding an affordable policy that provides adequate coverage for your current circumstances.

Compare Multiple Insurers and Policies

Once you have a clear understanding of your needs, compare term life insurance policies offered by multiple insurers in your region. Look beyond just the premium costs and consider the overall value and features of each policy. Some insurers might offer more comprehensive coverage or additional benefits that align with your specific needs.

For example, if you have a family history of critical illnesses, you might seek out insurers that offer term life insurance policies with built-in critical illness coverage or waiver of premium for specific medical conditions. This ensures that your policy provides the necessary protection and support if you or your loved ones face such challenges.

Consider Rider Options and Additional Benefits

Many term life insurance policies offer rider options or additional benefits that can enhance your coverage. Riders are essentially add-ons to your base policy, allowing you to customize your coverage to meet your specific needs. Some common rider options include:

- Accidental Death Benefit: Provides an additional death benefit if the insured passes away due to an accident.

- Waiver of Premium: Waives your premium payments if you become disabled and unable to work.

- Terminal Illness Acceleration: Allows you to receive a portion of your death benefit if you're diagnosed with a terminal illness.

- Child Rider: Provides life insurance coverage for your children, often at a low cost.

These riders can significantly enhance the value of your term life insurance policy, ensuring you have the coverage you need during various life stages and unexpected events.

Seek Professional Guidance

Navigating the world of term life insurance can be complex, especially with the multitude of options and factors to consider. Seeking guidance from a qualified insurance agent or financial advisor can provide invaluable insights and ensure you make the right choice.

A professional can assess your needs, compare policies on your behalf, and provide expert advice tailored to your circumstances. They can also help you understand the fine print of each policy, ensuring you're aware of any exclusions, limitations, or potential pitfalls.

Frequently Asked Questions

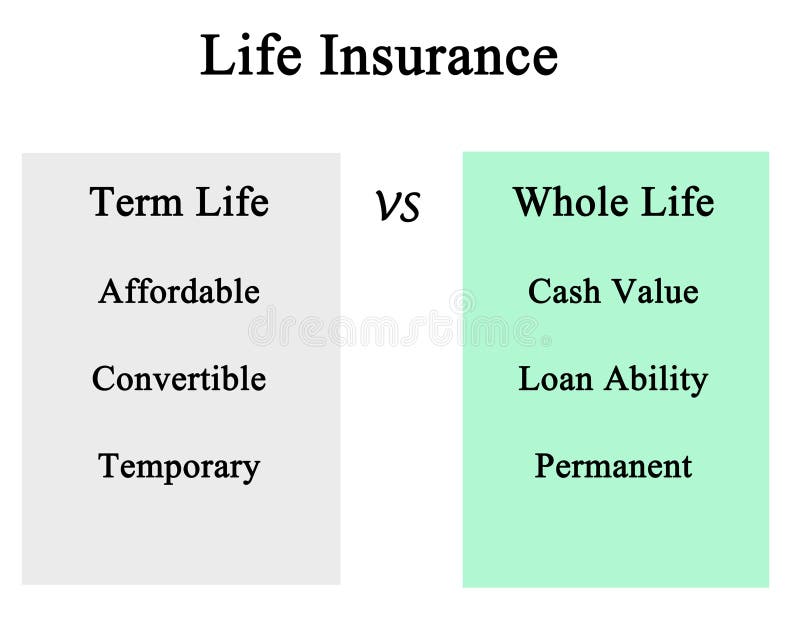

What is the difference between term life insurance and permanent life insurance?

+

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a fixed premium and coverage amount during the policy term. In contrast, permanent life insurance, such as whole life or universal life insurance, provides lifelong coverage with the potential for cash value accumulation. Permanent life insurance policies have higher premiums and are often more suitable for long-term financial planning and wealth accumulation.

How do I know if I need term life insurance near me?

+

Term life insurance is beneficial if you have financial dependents, such as a spouse, children, or aging parents, who rely on your income. It provides a safety net to ensure their financial stability if you pass away unexpectedly. Term life insurance is also ideal for covering specific financial obligations, such as a mortgage or outstanding debts, during a defined period.

Can I customize my term life insurance policy with additional riders or benefits?

+

Absolutely! Many term life insurance policies offer rider options to enhance your coverage. These riders can include accidental death benefit, waiver of premium for disability, terminal illness acceleration, and child riders. By adding these riders, you can tailor your policy to meet your specific needs and provide additional protection for your loved ones.

What happens if I outlive my term life insurance policy term?

+

If you outlive your term life insurance policy term, the coverage expires, and you’ll no longer have life insurance protection. However, many term life insurance policies offer the option to renew or convert the policy. Renewal allows you to extend the policy term for an additional period, often at a higher premium due to your increased age. Conversion lets you transform your term life insurance into a permanent life insurance policy without undergoing a new medical exam.

How much term life insurance coverage do I need near me?

+

The amount of term life insurance coverage you need depends on your specific financial obligations and goals. Generally, experts recommend a coverage amount that is 10 to 15 times your annual income. This ensures your loved ones can maintain their standard of living and cover any outstanding debts or expenses. However, your unique circumstances, such as the number of dependents, their ages, and your financial obligations, will influence the exact coverage amount required.