Ppo Insurances

Ppo insurances, or Preferred Provider Organization plans, have become increasingly popular in the healthcare industry, offering a unique blend of flexibility and cost control. This type of insurance plan stands out from traditional health insurance models by providing a network of preferred providers, giving policyholders the freedom to choose their healthcare services while also offering cost savings. In this comprehensive article, we will delve into the intricacies of PPO insurances, exploring their definition, how they work, their advantages, and the considerations one should make when choosing this type of insurance plan.

Understanding PPO Insurances

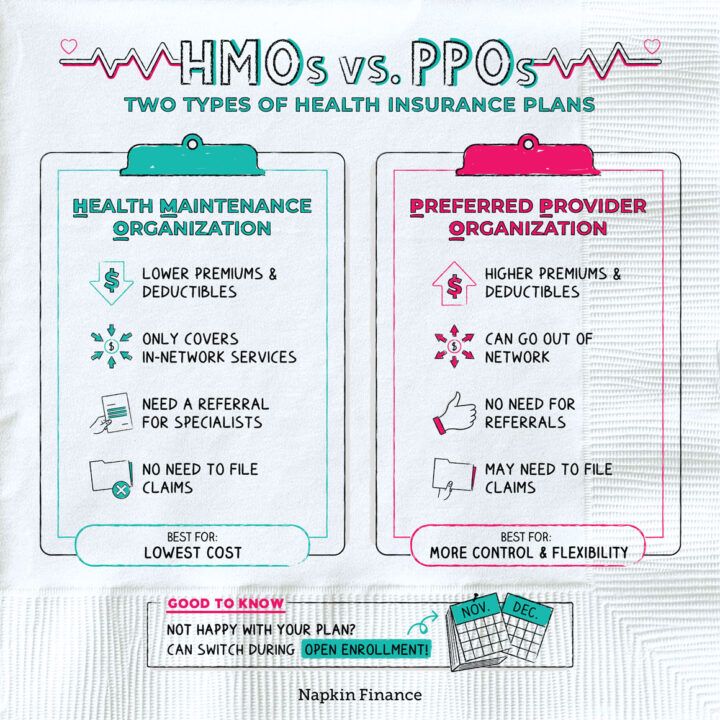

A Preferred Provider Organization (PPO) insurance plan is a type of health insurance that offers policyholders a network of medical providers, including doctors, hospitals, and other healthcare professionals. This network is carefully selected by the insurance company, ensuring that the providers offer high-quality care and services. The key characteristic of a PPO plan is the flexibility it provides to policyholders. Unlike Health Maintenance Organizations (HMOs) that typically require you to choose a primary care physician and obtain referrals for specialist care, PPOs allow direct access to any in-network provider without the need for prior authorization.

The concept behind PPOs is to encourage policyholders to use the in-network providers, as these providers have agreed to offer their services at discounted rates. This arrangement benefits both the insurance company and the policyholder, as it helps control healthcare costs while still providing a wide range of healthcare options.

How PPO Insurances Work

When you enroll in a PPO insurance plan, you will receive a comprehensive list of the in-network providers. This list typically includes various healthcare professionals, ensuring you have access to the care you need. One of the key advantages of PPOs is the ability to choose your primary care physician from this network without any restrictions. This means you can establish a long-term relationship with a doctor who understands your medical history and needs.

For any medical services you require, you can simply visit an in-network provider and present your insurance card. The provider will then bill the insurance company directly, and you will be responsible for any applicable copayments or deductibles. The insurance company will cover a portion of the cost, with the exact amount determined by your specific plan.

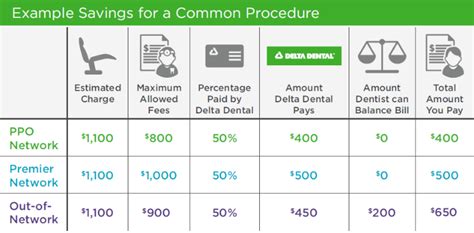

One unique aspect of PPOs is the out-of-network coverage. While using in-network providers is encouraged due to the cost savings, PPO plans also provide coverage for out-of-network services. However, the coverage for out-of-network care is typically more expensive, as you may be responsible for a higher deductible or a larger percentage of the total cost. This is where the flexibility of PPOs comes into play, allowing you to choose the best option for your specific healthcare needs.

Advantages of PPO Insurances

Flexibility and Choice

The primary advantage of PPO insurances is the flexibility they offer. Policyholders have the freedom to choose their healthcare providers without the restrictions often associated with other insurance plans. This flexibility extends to specialist care, as you can directly visit any in-network specialist without needing a referral.

Quality Care

PPO insurance plans carefully select their network of providers, ensuring that policyholders have access to high-quality healthcare services. This network typically includes renowned medical professionals and facilities, providing peace of mind when it comes to your healthcare needs.

Cost Control

PPOs are designed to control healthcare costs by encouraging the use of in-network providers. These providers offer their services at discounted rates, resulting in lower costs for both the insurance company and the policyholder. This cost-saving aspect is particularly beneficial for those who require regular medical care or have ongoing health conditions.

Out-of-Network Coverage

While PPOs primarily focus on in-network providers, they also provide coverage for out-of-network services. This is particularly useful for policyholders who may need to travel or who have specific healthcare needs that are not met by the in-network providers. Having out-of-network coverage ensures that you are protected even when accessing healthcare services outside the preferred network.

Considerations for Choosing a PPO Plan

Network Coverage

When considering a PPO plan, it’s crucial to carefully examine the network of providers. Ensure that the plan’s network includes healthcare professionals and facilities that are conveniently located and aligned with your specific healthcare needs. If you have a preferred doctor or specialist, verify that they are part of the network to avoid any surprises.

Cost and Deductibles

PPO plans can vary significantly in terms of cost and deductibles. It’s essential to review the plan’s details to understand the copayments, deductibles, and out-of-pocket maximums. Consider your expected healthcare needs and choose a plan that aligns with your budget and anticipated medical expenses.

Out-of-Network Coverage

While PPOs offer out-of-network coverage, it’s important to understand the limitations and potential costs associated with this coverage. Review the plan’s out-of-network benefits to ensure they meet your needs. If you frequently travel or have specific healthcare requirements, consider a PPO plan with more comprehensive out-of-network coverage.

Prescription Drug Coverage

Prescription drug coverage is an essential aspect of any health insurance plan. When evaluating PPO plans, pay close attention to the prescription drug benefits. Some plans may have preferred pharmacies or offer discounts on certain medications. Ensure that your plan covers the medications you require and that the costs are manageable.

Real-World Example: John’s Experience with PPO Insurance

Let’s consider the case of John, a 35-year-old professional who recently enrolled in a PPO insurance plan. John had previously experienced challenges with his HMO plan, finding it restrictive and inconvenient. With his new PPO plan, John was able to choose his primary care physician, Dr. Smith, who had a great reputation in the community.

When John needed to see a specialist for a specific medical condition, he was able to directly schedule an appointment with Dr. Johnson, a renowned specialist in his field. The PPO plan covered a significant portion of the specialist's fees, and John only had to pay a small copayment. John appreciated the flexibility and the fact that he didn't need to obtain a referral or wait for approval, which was a common issue with his previous HMO plan.

Additionally, John's PPO plan offered a wide range of prescription drug benefits. He was able to fill his prescriptions at a preferred pharmacy, receiving a substantial discount on his medications. This saved him a considerable amount of money and made managing his health condition more affordable.

John's experience highlights the advantages of PPO insurances, demonstrating how they can provide flexibility, access to quality care, and cost savings. By carefully selecting his PPO plan, John was able to tailor his healthcare experience to his specific needs, ensuring a more positive and efficient healthcare journey.

The Future of PPO Insurances

As the healthcare industry continues to evolve, PPO insurances are expected to play a significant role in providing accessible and affordable healthcare solutions. With their focus on quality care and cost control, PPOs are well-positioned to meet the diverse needs of policyholders. As technology advances, we can expect to see further innovations in PPO plans, such as improved digital tools for managing healthcare and more personalized insurance options.

Furthermore, the growing emphasis on preventative care and wellness programs is likely to shape the future of PPO insurances. Insurance companies may offer incentives and discounts to policyholders who actively participate in wellness initiatives, promoting healthier lifestyles and reducing healthcare costs in the long run. This shift towards preventative care aligns with the overall goal of providing comprehensive and sustainable healthcare solutions.

In conclusion, PPO insurances offer a unique and flexible approach to healthcare coverage. By providing a network of preferred providers and encouraging the use of in-network services, PPOs strike a balance between cost control and access to quality care. As policyholders, it's important to carefully evaluate PPO plans, considering factors such as network coverage, cost, and out-of-network benefits. With the right PPO plan, individuals can enjoy the flexibility and peace of mind that comes with having a comprehensive healthcare solution tailored to their needs.

What is the difference between a PPO and an HMO plan?

+A PPO plan offers more flexibility and direct access to specialists without referrals, while an HMO plan typically requires a primary care physician and referrals for specialist care.

Are PPO plans more expensive than other insurance plans?

+PPO plans can vary in cost, but they often provide cost savings by encouraging the use of in-network providers. It’s essential to compare plans and consider your specific healthcare needs.

Can I change my PPO plan if I’m not satisfied with the network providers?

+Yes, you can typically change your insurance plan during open enrollment or if you experience a qualifying life event. It’s important to review your options and choose a plan that aligns with your healthcare needs.