Life Insurance Term Insurance

Understanding Term Life Insurance: A Comprehensive Guide

In the intricate world of personal finance, few topics are as vital as ensuring the financial well-being of our loved ones. Term life insurance emerges as a cornerstone in this realm, offering a cost-effective and efficient means to protect our families and secure their future. This comprehensive guide delves into the intricacies of term life insurance, shedding light on its features, benefits, and how it can be a powerful tool in your financial planning arsenal.

Term life insurance is a contract between an individual and an insurance company. It provides financial coverage for a specified period, known as the term. This coverage ensures that, in the event of the policyholder's untimely demise during the term, their beneficiaries will receive a predetermined sum, known as the death benefit. This benefit can be a lifeline for families, helping them cover immediate expenses, pay off debts, and maintain their standard of living.

The Fundamentals of Term Life Insurance

The Term and Coverage Period

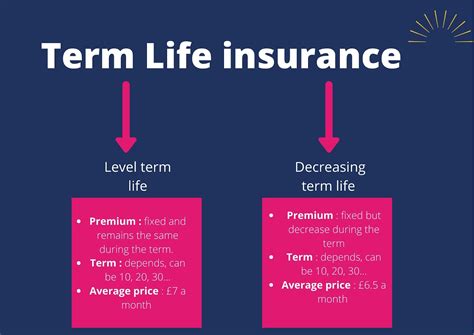

Term life insurance policies typically offer coverage for a fixed duration, ranging from 10 to 30 years. The term chosen should align with your specific needs and financial goals. For instance, if you’re looking to protect your family until your children become financially independent or until you’ve paid off your mortgage, a 20-year term might be suitable.

Death Benefit and Payouts

The death benefit is the heart of a term life insurance policy. It represents the amount the insurance company will pay to your beneficiaries in the event of your passing during the policy term. The benefit amount is determined at the policy’s inception and remains fixed throughout the term. It’s essential to choose a death benefit that adequately covers your financial obligations and provides for your loved ones’ future needs.

Renewability and Convertibility

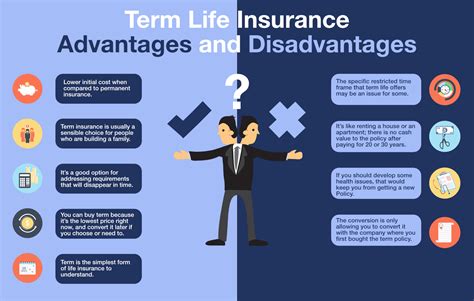

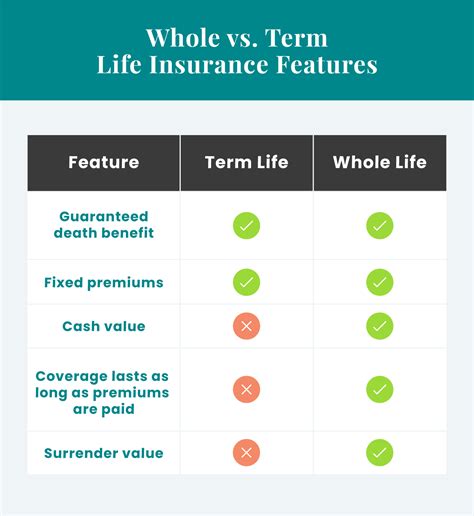

Many term life insurance policies offer renewability, allowing you to extend the coverage beyond the initial term. While the premiums may increase with age, renewability ensures continued protection. Some policies also offer convertibility, enabling you to switch to a permanent life insurance policy without undergoing a new medical exam. This can be beneficial if your financial needs or circumstances change over time.

Premium Structure and Payment Options

The premium is the cost you pay for your term life insurance policy. Premiums can be paid annually, semi-annually, quarterly, or monthly, depending on your preference and the insurance company’s terms. Term life insurance is known for its relatively low premiums compared to other types of life insurance, making it an attractive option for many.

| Payment Frequency | Premium Amount |

|---|---|

| Annual | $400 |

| Semi-Annual | $210 |

| Quarterly | $105 |

| Monthly | $35 |

Key Advantages of Term Life Insurance

Cost-Effectiveness

One of the primary advantages of term life insurance is its affordability. The premiums are generally lower compared to permanent life insurance policies like whole life or universal life. This makes term life insurance an accessible option for individuals and families on a budget, allowing them to secure substantial coverage without straining their finances.

Flexibility and Customization

Term life insurance offers a high degree of flexibility. You can choose the term length, death benefit amount, and payment frequency to suit your specific needs. This customization ensures that your policy aligns perfectly with your financial goals and obligations, providing peace of mind.

Focus on Protection

Term life insurance is designed purely for protection. Unlike permanent life insurance, which combines protection with an investment component, term life insurance focuses solely on providing financial security to your beneficiaries. This simplicity makes it an ideal choice for those who prioritize protection over investment returns.

Choosing the Right Term Life Insurance Policy

Assessing Your Needs

Before selecting a term life insurance policy, it’s crucial to assess your unique needs. Consider factors like your income, debts, family obligations, and future financial goals. Determine the coverage amount that would adequately cover these aspects and ensure your loved ones’ financial security.

Comparing Policy Options

Research and compare different term life insurance policies from reputable insurers. Look into factors like the financial stability of the insurance company, the policy’s terms and conditions, and the flexibility it offers in terms of renewability and convertibility. Seek out policies that align with your needs and provide the best value for your money.

Health and Lifestyle Considerations

Your health and lifestyle play a significant role in determining your term life insurance premiums. Insurers typically require a medical exam and assess your health history before issuing a policy. Leading a healthy lifestyle and maintaining good health can result in more favorable premium rates.

Maximizing the Benefits of Term Life Insurance

Regular Policy Reviews

It’s essential to review your term life insurance policy regularly, especially as your life circumstances change. Major life events like marriage, the birth of a child, purchasing a home, or changes in income can influence your insurance needs. Regular reviews ensure that your policy remains aligned with your evolving financial goals and obligations.

Combining Term Life with Other Policies

Term life insurance can be effectively combined with other financial tools and policies to create a comprehensive financial protection strategy. For instance, you might consider pairing it with disability insurance to ensure financial stability in the event of a disability that prevents you from working.

Utilizing Riders and Add-Ons

Many term life insurance policies offer riders or add-ons that can enhance your coverage. These can include provisions for accidental death, critical illness, or waiver of premium in case of disability. While these riders typically come at an additional cost, they can provide valuable added protection.

Common Misconceptions and FAQs

Is term life insurance suitable for everyone?

+Term life insurance is an excellent choice for those seeking cost-effective protection for a specific period. However, for individuals who require lifelong coverage or wish to accumulate cash value, permanent life insurance might be more suitable.

How do I know if my term life insurance policy is sufficient?

+Assessing the sufficiency of your term life insurance policy involves considering your financial obligations and future goals. Ensure that the death benefit is enough to cover debts, provide for your family's needs, and maintain their standard of living. Regular reviews can help ensure your policy remains adequate.

Can I switch from term life insurance to permanent life insurance later on?

+Many term life insurance policies offer the option to convert to a permanent life insurance policy without a new medical exam. This can be a beneficial strategy if your financial needs change, and you require lifelong coverage.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage ends, and you no longer have protection. However, depending on the policy's terms, you might have the option to renew the policy or convert it to a permanent life insurance policy.

Are term life insurance premiums tax-deductible?

+Generally, term life insurance premiums are not tax-deductible. However, if the policy is part of a business or self-employed individual's benefits package, the premiums might be deductible as a business expense. It's best to consult with a tax professional for specific advice.

Conclusion: Securing Your Family's Future

Term life insurance is a powerful tool in your financial planning arsenal, offering a cost-effective way to protect your loved ones' financial future. By understanding its fundamentals, advantages, and key considerations, you can make informed decisions and choose a policy that aligns perfectly with your unique needs. Remember, regular reviews and staying informed about your options are essential to ensuring your family's financial security.

As you embark on your journey towards financial security, term life insurance serves as a cornerstone, providing peace of mind and ensuring that your loved ones are taken care of, no matter what life brings.