What Is A Liability Insurance

Liability insurance is a vital component of any comprehensive insurance portfolio, offering protection and peace of mind to individuals, businesses, and professionals alike. This specialized form of insurance safeguards policyholders against claims arising from negligence, accidents, or errors that result in bodily injury or property damage to third parties. It plays a critical role in mitigating financial risks and ensuring that individuals and entities can manage potential liabilities effectively.

Understanding Liability Insurance: A Comprehensive Overview

Liability insurance is a complex yet indispensable form of coverage that acts as a safety net for policyholders, providing financial protection against a wide range of potential claims and lawsuits. It is designed to cover the costs associated with legal defense, settlements, and damages awarded by courts, thereby ensuring that policyholders are not left financially devastated by unexpected legal liabilities.

This type of insurance is particularly relevant in today's litigious society, where the potential for lawsuits and claims is ever-present. Whether it's a slip and fall accident on a business premise, a product defect that causes injury, or professional advice that goes awry, liability insurance steps in to protect the insured's financial interests.

Key Features of Liability Insurance

- Broad Coverage: Liability insurance policies typically offer extensive coverage, protecting policyholders against a wide array of potential liabilities. This can include bodily injury, property damage, personal and advertising injury, and even coverage for legal defense costs.

- Financial Protection: One of the primary benefits of liability insurance is the financial protection it affords. Policyholders can rest assured that, should they face a liability claim, their insurance policy will provide the necessary funds to cover settlements, judgments, and legal expenses.

- Risk Mitigation: Beyond financial protection, liability insurance plays a crucial role in risk mitigation. By understanding the potential liabilities they face and securing appropriate insurance coverage, policyholders can proactively manage their risks and minimize the impact of unforeseen events.

For instance, a small business owner might purchase general liability insurance to protect against claims of bodily injury or property damage that occur on their business premises. A professional, such as a consultant or accountant, might opt for professional liability insurance (also known as errors and omissions insurance) to protect against claims of negligence or mistakes in their work.

The Importance of Policy Limits and Deductibles

When selecting a liability insurance policy, policyholders must carefully consider the policy limits and deductibles. The policy limits represent the maximum amount the insurance company will pay for a covered claim, while the deductible is the amount the policyholder must pay out of pocket before the insurance coverage kicks in.

| Policy Type | Typical Policy Limits | Average Deductible |

|---|---|---|

| General Liability | $1 million to $2 million per occurrence | $500 to $2,500 |

| Professional Liability | $1 million to $5 million per claim | $1,000 to $5,000 |

| Product Liability | $1 million to $5 million per occurrence | $1,000 to $5,000 |

Types of Liability Insurance

Liability insurance comes in various forms, each tailored to address specific liability risks. Here’s an overview of some common types of liability insurance:

General Liability Insurance

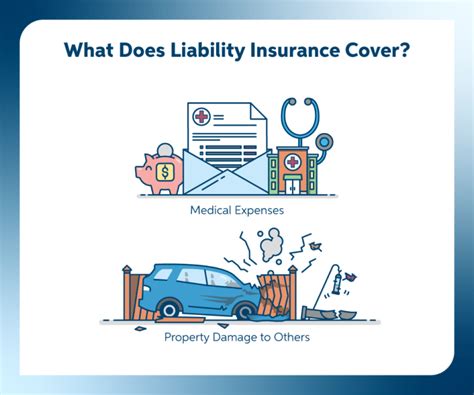

General liability insurance is a broad form of coverage that protects businesses and individuals against a wide range of liability claims. It covers bodily injury, property damage, personal injury (such as libel, slander, or invasion of privacy), and advertising injury.

For example, if a customer slips and falls on a wet floor in your store, general liability insurance would cover the medical expenses and potential lawsuit costs arising from the incident. This type of insurance is crucial for businesses of all sizes, as it provides a financial safety net against unexpected accidents and claims.

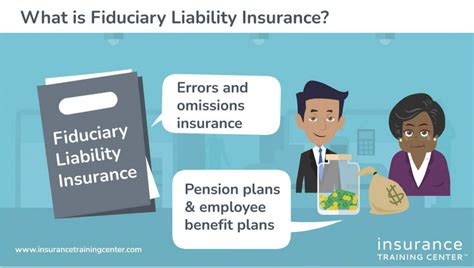

Professional Liability Insurance

Also known as errors and omissions (E&O) insurance, professional liability insurance is designed for professionals such as consultants, accountants, lawyers, and healthcare providers. It protects against claims of negligence, errors, or omissions in the professional services provided.

Consider a software consultant who provides advice to a client, and due to an oversight, the client's system crashes. Professional liability insurance would cover the consultant for the resulting losses and any legal fees associated with the claim.

Product Liability Insurance

Product liability insurance is essential for businesses that manufacture, distribute, or sell products. It protects against claims of bodily injury or property damage caused by a defect in the product.

For instance, if a manufacturing company produces a faulty batch of kitchen appliances that cause fires, product liability insurance would cover the costs of the resulting lawsuits and compensation for victims.

Commercial Auto Liability Insurance

Commercial auto liability insurance is crucial for businesses that operate vehicles, such as delivery companies or transportation services. It covers bodily injury and property damage caused by the business-owned vehicles in accidents.

A pizza delivery driver gets into an accident while on the job, resulting in injuries to the other driver and damage to their vehicle. Commercial auto liability insurance would step in to cover the medical expenses and property damage costs associated with the accident.

Other Types of Liability Insurance

Beyond the above-mentioned types, there are several other specialized forms of liability insurance, including:

- Cyber Liability Insurance: Protects against cyber-related risks such as data breaches, hacking, and cyber extortion.

- Directors and Officers (D&O) Liability Insurance: Shields company directors and officers from claims arising from their management decisions.

- Umbrella Liability Insurance: Provides additional liability coverage beyond the limits of other policies, offering an extra layer of protection.

The Process of Filing a Liability Insurance Claim

When a liability incident occurs, it’s crucial to understand the steps involved in filing an insurance claim. Here’s a general overview of the claim process:

Step 1: Notification

As soon as a liability incident occurs, or a claim is made against you or your business, it’s essential to notify your insurance company promptly. Most insurance policies require immediate notification to ensure coverage.

Step 2: Claim Investigation

Once you’ve notified your insurer, they will initiate a claim investigation. This process involves gathering all relevant information about the incident, including details of the claim, evidence, and any supporting documentation.

Step 3: Coverage Determination

After the investigation, the insurance company will determine whether the claim is covered under your policy. They will review the policy terms, conditions, and exclusions to make this decision.

Step 4: Payment or Denial

If the claim is covered, the insurance company will pay out the benefits as outlined in your policy. This may include covering legal defense costs, settlements, or judgments. If the claim is not covered, the insurer will issue a denial letter explaining the reasons for the denial.

Liability Insurance: A Critical Component of Risk Management

Liability insurance is an indispensable tool for managing financial risks and protecting your assets. By understanding the different types of liability insurance and their specific coverages, you can make informed decisions to safeguard your personal or business interests.

Whether you're a small business owner, a professional providing services, or an individual with potential liability risks, liability insurance provides a vital layer of protection against unforeseen events. It ensures that you can focus on your core activities and pursuits, knowing that you're prepared for the unexpected.

FAQ

How much does liability insurance cost?

+

The cost of liability insurance varies widely depending on several factors, including the type of coverage, policy limits, industry, and location. For instance, general liability insurance for a small business might cost 500 to 1,000 per year, while professional liability insurance for a high-risk profession could exceed $5,000 annually. It’s best to obtain quotes from multiple insurers to find the most competitive rates.

What are some common exclusions in liability insurance policies?

+

Liability insurance policies often exclude certain types of risks or claims. Common exclusions may include intentional acts, contractual liabilities, pollution, and claims arising from the use of alcohol or drugs. It’s crucial to carefully review the policy exclusions to understand what’s not covered.

Can liability insurance be tailored to my specific needs?

+

Yes, liability insurance policies can often be customized to meet your specific needs and risk profile. This may involve selecting higher policy limits, adding endorsements for specific coverages, or opting for additional insurance policies to complement your primary liability coverage. Working with an insurance professional can help you tailor your coverage to your unique circumstances.