Term Life Insurance Definition

Understanding term life insurance is crucial for anyone looking to protect their loved ones and secure their financial future. Term life insurance is a fundamental component of financial planning, offering a cost-effective solution to ensure your family's well-being in the event of an untimely demise. This article will delve into the intricacies of term life insurance, exploring its definition, purpose, and key features, and providing valuable insights to help you make informed decisions.

Unraveling the Term Life Insurance Enigma

Term life insurance, often simply referred to as “term life,” is a specific type of life insurance policy designed to provide coverage for a defined period or “term.” Unlike whole life or permanent insurance policies, which offer lifetime coverage, term life insurance offers a fixed amount of coverage for a predetermined length of time, typically ranging from 10 to 30 years.

The primary purpose of term life insurance is to offer financial protection to your beneficiaries during a critical period, such as when you have young children or significant financial obligations. It ensures that your loved ones can maintain their standard of living and cover essential expenses if you were to pass away during the policy term.

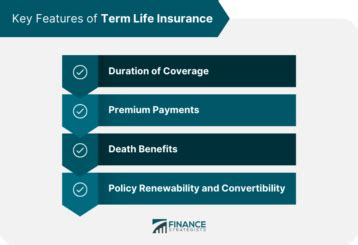

Key Characteristics of Term Life Insurance

- Fixed Coverage Period: Term life insurance policies have a set term, such as 10, 20, or 30 years. During this period, the insured is covered for a specified death benefit amount.

- Affordable Premiums: One of the most appealing aspects of term life insurance is its affordability. Premiums are generally lower compared to permanent life insurance policies, making it accessible to a wider range of individuals.

- Level Premiums: Most term life policies offer level premiums, meaning the cost remains the same throughout the policy term, providing stability and predictability in your financial planning.

- Renewable and Convertible Options: Many term life policies allow you to renew your coverage at the end of the term, often at a higher premium due to the increased age of the insured. Additionally, some policies offer the option to convert your term life insurance into a permanent policy without undergoing a new medical exam.

- Death Benefit Payout: In the event of the insured’s death during the policy term, the beneficiaries receive a tax-free lump sum payment, known as the death benefit. This can be used to cover various expenses, including funeral costs, outstanding debts, or daily living expenses.

| Term Life Insurance Features | Description |

|---|---|

| Coverage Period | Varies from 10 to 30 years, offering flexible options. |

| Premium Structure | Affordable and level premiums throughout the term. |

| Renewability | Option to renew coverage at the end of the term. |

| Conversion | Opportunity to convert term life into permanent insurance. |

| Death Benefit | Tax-free lump sum paid to beneficiaries upon insured's death. |

Understanding the Benefits and Considerations

Term life insurance offers numerous advantages, especially for those with a clear financial goal and a defined period of need. Here are some key benefits and considerations to keep in mind:

- Financial Security: Term life insurance provides a vital financial safety net for your family, ensuring they can maintain their lifestyle and cover expenses without your income.

- Flexibility: With various term lengths available, you can choose a policy that aligns with your specific needs and financial goals.

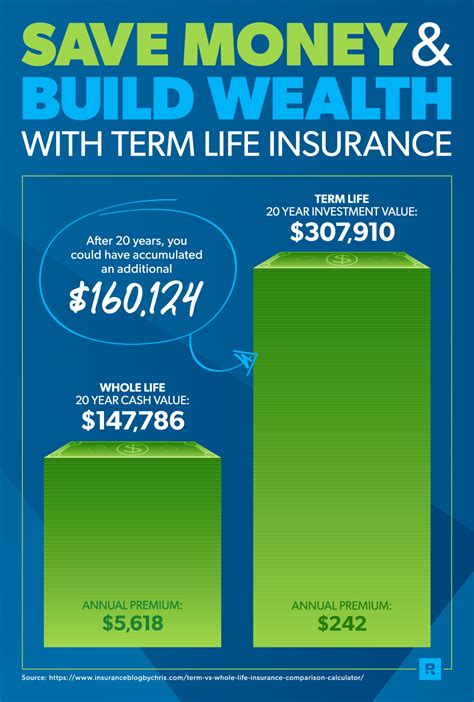

- Cost-Effectiveness: Lower premiums compared to permanent insurance make term life an attractive option for those on a budget.

- Renewal and Conversion: The renewal and conversion options offer flexibility to adapt your coverage as your needs change over time.

- Tax Benefits: The death benefit from a term life policy is typically tax-free, providing additional financial relief to your beneficiaries.

- No Cash Value: Unlike permanent insurance, term life does not build cash value over time, making it a purely protective measure.

Who Should Consider Term Life Insurance

Term life insurance is an excellent choice for individuals and families who fit the following profiles:

- Young adults starting their careers and wanting to protect their families.

- Parents with young children, ensuring financial stability during their formative years.

- Individuals with significant financial obligations, such as mortgages or loans.

- Those who prefer a simple, cost-effective insurance solution without unnecessary add-ons.

The Role of Term Life Insurance in Financial Planning

Incorporating term life insurance into your financial plan is a strategic move. It ensures that your loved ones are protected during a critical period, allowing them to focus on healing and adjusting to life without your financial contribution. Here’s how term life insurance can enhance your overall financial strategy:

- Peace of Mind: Knowing your family is financially secure in the event of your passing provides invaluable peace of mind, allowing you to focus on your goals and aspirations.

- Debt Repayment: Term life insurance can be used to pay off outstanding debts, such as mortgages or personal loans, preventing financial strain on your loved ones.

- Educational Expenses: For parents, term life insurance can provide funds to cover their children’s education, ensuring their future is not compromised.

- Estate Planning: It plays a crucial role in estate planning, ensuring your assets are distributed as per your wishes and providing liquidity to your estate.

- Business Continuity: Business owners can use term life insurance to protect their business, ensuring it can continue operations and provide for employees and stakeholders.

Making an Informed Decision

Choosing the right term life insurance policy involves careful consideration of your unique circumstances and financial goals. Here are some key factors to keep in mind:

- Coverage Amount: Determine the appropriate death benefit based on your financial obligations and the needs of your beneficiaries.

- Term Length: Select a term that aligns with your financial goals and the period you anticipate needing coverage.

- Renewal and Conversion Options: Understand the renewal and conversion provisions of the policy to ensure flexibility as your needs evolve.

- Rider Options: Explore additional rider benefits, such as waiver of premium or accelerated benefit riders, to enhance your coverage.

- Comparison Shopping: Compare policies from multiple insurers to find the best combination of coverage, premiums, and features.

How does term life insurance differ from permanent life insurance?

+

Term life insurance provides coverage for a defined period, typically offering lower premiums. In contrast, permanent life insurance, such as whole life or universal life, offers lifetime coverage and builds cash value over time, resulting in higher premiums.

Can I renew my term life insurance policy?

+

Yes, many term life policies offer the option to renew coverage at the end of the term. However, renewal premiums are often higher due to the increased age of the insured.

What happens if I pass away after the term life insurance policy expires?

+

If you pass away after the policy term, your beneficiaries will not receive the death benefit. It’s crucial to review and update your coverage as your needs change.