Supplement Insurance With Medicare

Navigating the complexities of health insurance, especially when it comes to older adults and those with specific healthcare needs, can be a daunting task. One of the crucial decisions involves understanding the role of supplement insurance in conjunction with Medicare. This article aims to provide an in-depth analysis of how supplement insurance works with Medicare, exploring its benefits, coverage options, and the considerations to make when deciding on the right plan.

Understanding Medicare and Its Gaps

Medicare, a federal health insurance program in the United States, is designed to provide healthcare coverage for individuals aged 65 and older, as well as those with certain disabilities. It offers a range of benefits, including hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D). However, despite its comprehensive nature, Medicare does have its limitations and coverage gaps.

One of the primary gaps in Medicare coverage is the lack of full coverage for certain services and procedures. For instance, Medicare Part A and B typically cover only a portion of hospital stays, doctor visits, and medical procedures. Additionally, Medicare's prescription drug coverage (Part D) has a coverage gap known as the "donut hole," where beneficiaries may have to pay a significant portion of their medication costs out of pocket.

These gaps can lead to substantial out-of-pocket expenses, especially for individuals with chronic conditions or those who require frequent medical attention. This is where supplement insurance, also known as Medigap, comes into play.

What is Supplement Insurance (Medigap)?

Supplement insurance, or Medigap, is a type of health insurance policy designed to fill the gaps in Original Medicare coverage. It is offered by private insurance companies and can be purchased by individuals who are enrolled in Medicare Part A and Part B. Medigap policies offer a range of benefits, depending on the plan chosen, and are standardized by the Centers for Medicare & Medicaid Services (CMS) to ensure consistency and clarity for consumers.

The primary goal of supplement insurance is to cover the costs that Medicare does not, including deductibles, copayments, and coinsurance. By doing so, Medigap plans can significantly reduce the financial burden on Medicare beneficiaries, providing them with more comprehensive and predictable healthcare coverage.

Standardized Medigap Plans

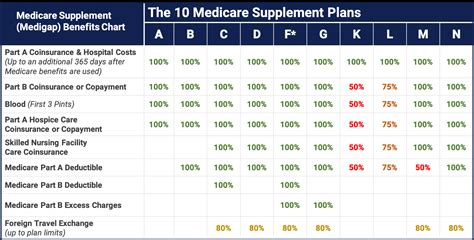

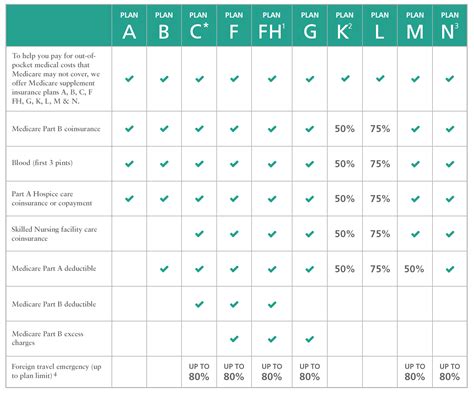

Medicare supplement insurance plans are categorized into standardized plans, labeled A through N, with each plan offering a unique set of benefits. These plans are designed to complement Original Medicare, ensuring that beneficiaries have access to a wide range of healthcare services without facing excessive financial strain.

| Medigap Plan | Coverage Highlights |

|---|---|

| Plan A | Basic coverage for deductibles, coinsurance, and copayments for Part A and B. |

| Plan F | Comprehensive coverage, including the Medicare Part B deductible and the Part B excess charges. |

| Plan G | Similar to Plan F but without the Part B deductible coverage. |

| Plan N | Offers lower premiums but comes with cost-sharing for some services, such as office visits. |

Each plan has its unique advantages, and the choice depends on an individual's specific healthcare needs and budget. For instance, Plan F provides the most comprehensive coverage, making it ideal for those with high medical expenses. On the other hand, Plan N might be more suitable for individuals who prioritize lower premiums and are willing to share some of the costs.

Benefits of Combining Supplement Insurance and Medicare

The combination of supplement insurance and Medicare offers a range of benefits that can significantly improve an individual’s healthcare experience and financial security.

Enhanced Coverage

Supplement insurance plans are designed to fill the gaps in Medicare coverage, ensuring that beneficiaries have access to a more comprehensive range of healthcare services. By covering deductibles, copayments, and coinsurance, Medigap plans reduce the financial burden associated with medical treatments, procedures, and prescription drugs.

Predictable Costs

One of the significant advantages of supplement insurance is the predictability it brings to healthcare costs. With a Medigap plan, individuals know exactly what their out-of-pocket expenses will be, as the plan covers a predetermined portion of the costs. This predictability can be especially beneficial for those on a fixed income or with limited financial flexibility.

Access to a Broader Network of Providers

Medicare Advantage plans, which are an alternative to Original Medicare, often have restricted provider networks. However, with a Medigap plan, individuals can typically access a broader network of healthcare providers, as these plans generally cover services provided by any Medicare-approved facility or practitioner.

Freedom of Choice

Supplement insurance plans allow beneficiaries to maintain their Original Medicare coverage while gaining additional financial protection. This means individuals can choose their healthcare providers and have the flexibility to seek care from specialists or facilities that best meet their needs.

Choosing the Right Supplement Insurance Plan

Selecting the appropriate supplement insurance plan is a critical decision that requires careful consideration of several factors.

Evaluating Healthcare Needs

The first step in choosing a Medigap plan is to evaluate one’s current and potential future healthcare needs. This includes assessing the frequency of doctor visits, the need for specialized treatments or procedures, and the prescription medications regularly used. By understanding these needs, individuals can choose a plan that provides adequate coverage without incurring unnecessary costs.

Comparing Plan Costs and Benefits

Medigap plans vary significantly in terms of costs and benefits. It is essential to compare different plans, considering factors such as monthly premiums, annual deductibles, and out-of-pocket limits. Some plans might offer lower premiums but come with higher out-of-pocket expenses, while others provide more comprehensive coverage with slightly higher premiums. Balancing these factors is crucial to finding the right plan.

Understanding Plan Availability and Eligibility

The availability and eligibility for Medigap plans can vary based on several factors, including location and the individual’s health status. Certain plans might not be available in all states, and some insurers may have medical underwriting, meaning they can deny coverage or charge higher premiums based on pre-existing conditions. Understanding these restrictions and requirements is vital before making a decision.

Considering Future Changes

Healthcare needs and circumstances can change over time. When selecting a Medigap plan, it is essential to consider future potential changes. For instance, if an individual’s health status improves or deteriorates, will the chosen plan still be suitable? Understanding the flexibility and adaptability of different plans can help ensure that the chosen supplement insurance remains a good fit in the long term.

Navigating the Application and Enrollment Process

The application and enrollment process for supplement insurance can vary depending on the state and the insurance provider. However, there are some general steps that individuals can expect to navigate.

Medicare Enrollment

Before applying for a Medigap plan, individuals must first enroll in Original Medicare. This typically involves signing up for Medicare Part A and Part B during the Initial Enrollment Period, which begins three months before the month the individual turns 65 and ends three months after.

Medigap Open Enrollment Period

The Medigap Open Enrollment Period is a critical time for individuals to enroll in a supplement insurance plan. This period begins on the first day of the month in which the individual is both 65 years old or older and enrolled in Medicare Part B. During this time, insurance companies cannot deny coverage or charge higher premiums based on health status. This is an ideal time to secure a Medigap plan, as it provides the most flexibility and protection.

Application and Underwriting Process

The application process for Medigap plans can vary, with some insurers offering simplified applications and others requiring more detailed medical underwriting. During the underwriting process, the insurance company may request medical records or conduct a health assessment to determine the individual’s eligibility and potential premium costs.

Selecting a Reputable Insurance Provider

Choosing a reputable insurance provider is crucial when selecting a Medigap plan. It is essential to research and compare different insurers, considering factors such as their financial stability, customer service reputation, and the range of plans they offer. Reading reviews and seeking recommendations from trusted sources can also provide valuable insights into the insurer’s reliability and service quality.

Conclusion: Empowering Healthcare Decisions

Understanding the interplay between supplement insurance and Medicare is a powerful tool for individuals seeking comprehensive and affordable healthcare coverage. By carefully evaluating their needs, comparing plans, and navigating the enrollment process, individuals can make informed decisions that align with their healthcare goals and financial realities.

Supplement insurance, when combined with Medicare, offers a robust and flexible approach to healthcare, ensuring that beneficiaries have access to the care they need without facing excessive financial strain. It is a vital component of a well-rounded healthcare strategy, providing peace of mind and empowering individuals to take control of their health and well-being.

Can I have both Medicare and supplement insurance simultaneously?

+Yes, supplement insurance, also known as Medigap, is specifically designed to be used alongside Original Medicare (Part A and Part B). It fills the gaps in Medicare coverage, providing additional financial protection for deductibles, copayments, and coinsurance.

Are there any age restrictions for enrolling in supplement insurance plans?

+Supplement insurance plans typically do not have age restrictions. However, it’s important to note that the Medigap Open Enrollment Period, which begins when you turn 65 and are enrolled in Medicare Part B, is the best time to enroll, as you can’t be denied coverage or charged more due to health status during this period.

What happens if I have both Medicare Advantage and Medigap?

+If you have both Medicare Advantage and Medigap, the two plans will likely conflict, and you will need to choose one or the other. Medicare Advantage plans (Part C) are an alternative to Original Medicare and often include prescription drug coverage (Part D). Medigap plans, on the other hand, are designed to supplement Original Medicare, so having both can lead to duplication of benefits and potential issues with billing and coverage.