State Farm Insurance State Farm

Insurance is an integral part of modern life, providing financial protection and peace of mind to individuals and businesses alike. Among the myriad of insurance providers, State Farm stands out as one of the largest and most well-known companies in the United States. With a rich history spanning over a century, State Farm has established itself as a trusted name in the insurance industry, offering a comprehensive range of products and services to its customers.

A Legacy of Trust: State Farm’s Journey

State Farm Insurance was founded in 1922 by George J. Mecherle, a former farmer and insurance salesman. Mecherle’s vision was to create an insurance company that prioritized the needs of policyholders, offering fair and affordable coverage. This ethos has remained at the core of State Farm’s identity, shaping its growth and success over the decades.

The company's early years were marked by innovation and a customer-centric approach. State Farm introduced the concept of "multi-line" insurance, allowing customers to bundle their auto and home insurance policies, a practice that is now industry standard. This strategy not only provided convenience to customers but also helped State Farm expand its reach and establish a strong market presence.

As the years passed, State Farm continued to expand its offerings, branching out into various lines of insurance, including life, health, and business insurance. The company's commitment to customer satisfaction and its ability to adapt to changing market dynamics have been key factors in its longevity and success.

Comprehensive Coverage: State Farm’s Product Suite

Today, State Farm offers a diverse range of insurance products tailored to meet the needs of its diverse customer base. Here’s an overview of some of the key insurance lines:

Auto Insurance

State Farm’s auto insurance policies provide comprehensive coverage for vehicle owners. The company offers standard liability coverage, as well as optional add-ons such as collision, comprehensive, and uninsured/underinsured motorist protection. State Farm’s Drive Safe & Save program also rewards safe drivers with discounts, utilizing technology to track driving habits and provide personalized rates.

| Policy Type | Coverage Highlights |

|---|---|

| Liability Coverage | Covers bodily injury and property damage caused by the policyholder. |

| Collision Coverage | Pays for repairs or replacement of the insured vehicle after an accident, regardless of fault. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, vandalism, and natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Provides coverage in the event of an accident with a driver who lacks sufficient insurance. |

Home Insurance

State Farm’s home insurance policies are designed to protect homeowners and renters alike. The company offers various levels of coverage, from basic policies that cover the structure and its contents to more comprehensive plans that include additional living expenses and liability protection.

| Coverage Type | Key Benefits |

|---|---|

| Dwelling Coverage | Protects the physical structure of the home against damage or destruction. |

| Personal Property Coverage | Covers the contents of the home, including furniture, electronics, and personal belongings. |

| Liability Coverage | Provides protection against lawsuits arising from accidents on the insured property. |

| Additional Living Expenses | Covers the cost of temporary housing and other expenses if the home becomes uninhabitable due to a covered loss. |

Life Insurance

State Farm’s life insurance policies offer financial protection to individuals and their families. The company provides term life insurance, which offers coverage for a specific period, as well as permanent life insurance options, including whole life and universal life policies, which provide lifelong coverage and cash value accumulation.

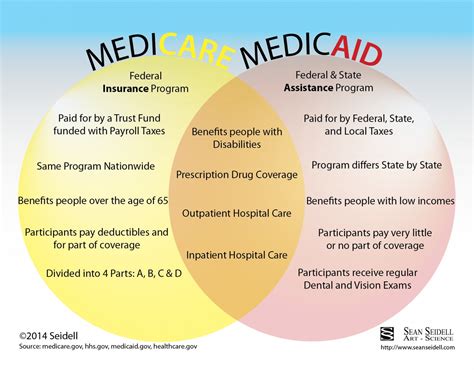

Health Insurance

State Farm’s health insurance plans aim to provide individuals and families with access to quality healthcare. The company offers a range of health insurance products, including major medical plans, short-term medical plans, and Medicare supplement insurance. State Farm’s health insurance policies focus on affordability and flexibility, catering to the diverse needs of its customers.

Business Insurance

State Farm’s business insurance division offers tailored coverage to protect small businesses and entrepreneurs. The company provides general liability insurance, which covers bodily injury and property damage claims, as well as business owners policies (BOPs) that combine property and liability coverage. State Farm also offers specialty insurance products for unique business needs, such as professional liability insurance for specific industries.

Technology and Innovation: Enhancing the Customer Experience

State Farm has embraced technology to enhance its services and improve the overall customer experience. The company’s online and mobile platforms allow customers to manage their policies, file claims, and access policy documents with ease. State Farm’s mobile app, for instance, provides real-time policy information, claim status updates, and even allows customers to take photos of damage for faster claim processing.

Additionally, State Farm has invested in innovative technologies to streamline the claims process. The company utilizes drone technology to assess damage to properties, particularly in the aftermath of natural disasters. This not only speeds up the claims process but also ensures a more accurate assessment of the damage, leading to faster and fairer settlements.

Community Engagement and Social Responsibility

Beyond its insurance offerings, State Farm is deeply committed to community engagement and social responsibility. The company actively supports various causes and initiatives aimed at making a positive impact in the communities it serves. State Farm’s corporate citizenship efforts focus on education, safety, and environmental sustainability.

State Farm's commitment to education is evident through its various scholarship programs, including the State Farm Good Neighbor Scholarship, which provides financial assistance to students pursuing higher education. The company also sponsors educational initiatives and partners with organizations that promote financial literacy and personal development.

In the realm of safety, State Farm is dedicated to promoting road safety and accident prevention. The company's Road Safety initiatives include educational programs for drivers, pedestrian safety campaigns, and partnerships with law enforcement agencies to promote safe driving practices. State Farm's commitment to safety extends beyond roads, as the company also supports initiatives focused on home and workplace safety.

Furthermore, State Farm demonstrates its dedication to environmental sustainability through various initiatives. The company has set ambitious goals to reduce its carbon footprint, increase energy efficiency, and promote renewable energy sources. State Farm's sustainability efforts are integrated into its operations, from reducing paper usage to promoting eco-friendly practices in its offices and facilities.

Customer Satisfaction and Industry Recognition

State Farm’s commitment to customer satisfaction and its focus on delivering high-quality service have been recognized by various industry organizations and consumer rating agencies. The company consistently ranks among the top insurance providers in customer satisfaction surveys, earning accolades for its claim handling processes, customer service, and overall value proposition.

J.D. Power, a leading consumer insights and analytics company, has repeatedly awarded State Farm for its outstanding customer service and claims handling processes. State Farm's focus on technology and its innovative approaches to customer engagement have been instrumental in earning these accolades.

Additionally, State Farm's financial strength and stability have been recognized by prominent rating agencies such as A.M. Best and Standard & Poor's. These agencies consistently rate State Farm highly for its financial strength, reflecting the company's ability to meet its policy obligations and its overall financial health.

Conclusion: A Trusted Partner for All Your Insurance Needs

State Farm Insurance has established itself as a trusted partner for individuals and businesses seeking comprehensive insurance coverage. With a rich history, a diverse product suite, and a commitment to customer satisfaction, State Farm continues to be a leading force in the insurance industry. From auto and home insurance to life, health, and business insurance, State Farm offers a range of tailored solutions to meet the unique needs of its customers.

As the company looks to the future, State Farm remains dedicated to innovation, embracing technology to enhance its services and improve the overall customer experience. With a strong focus on community engagement and social responsibility, State Farm strives to make a positive impact beyond its core business, earning the trust and loyalty of its customers for generations to come.

How does State Farm’s Drive Safe & Save program work?

+State Farm’s Drive Safe & Save program utilizes telematics technology to track and analyze your driving habits. By installing a small device in your vehicle or using a mobile app, the program monitors factors such as acceleration, braking, and time of day driven. Based on these metrics, State Farm assesses your driving behavior and provides personalized discounts on your auto insurance policy.

What sets State Farm’s health insurance plans apart from competitors?

+State Farm’s health insurance plans focus on affordability and flexibility. The company offers a range of plan options, including major medical plans and short-term medical plans, allowing customers to choose coverage that aligns with their specific needs and budget. State Farm’s commitment to customer service and its innovative approach to claims processing further set it apart.

How does State Farm ensure its financial stability and ability to meet policy obligations?

+State Farm’s financial stability is a top priority. The company maintains a strong capital position and is consistently rated highly by leading insurance rating agencies such as A.M. Best and Standard & Poor’s. These agencies assess State Farm’s financial strength, liquidity, and ability to meet its policyholder obligations, providing assurance to customers that their investments are secure.