Rental Apartments Insurance

Renting an apartment comes with its own set of responsibilities and considerations, and one crucial aspect that often gets overlooked is insurance. Understanding the nuances of rental apartments insurance is essential for every tenant, as it can provide financial protection and peace of mind. In this comprehensive guide, we will delve into the world of rental apartments insurance, exploring its benefits, coverage options, and how it can safeguard your belongings and liabilities. Whether you're a seasoned renter or a first-time tenant, this article will equip you with the knowledge to make informed decisions about protecting your rental space.

Unveiling the Importance of Rental Apartments Insurance

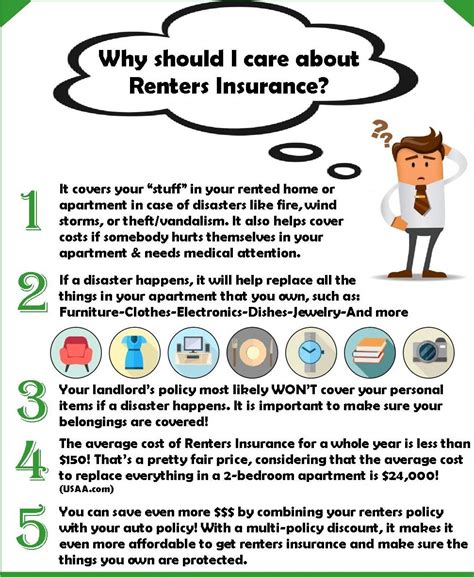

Renting an apartment is a common choice for many individuals and families seeking flexibility and convenience. However, the responsibilities that come with tenancy extend beyond regular rent payments. One critical aspect that often flies under the radar is insurance coverage. Rental apartments insurance, also known as renters insurance, is a vital component of any rental agreement, offering a safety net for tenants in the face of unexpected events and liabilities.

The significance of rental apartments insurance cannot be overstated, as it provides a comprehensive layer of protection for both the tenant and their belongings. In an ideal world, accidents and unforeseen circumstances would not occur, but reality dictates otherwise. From natural disasters to accidental damages, the potential risks are numerous, and without adequate insurance, tenants could find themselves facing significant financial burdens.

The Peace of Mind that Comes with Insurance

Rental apartments insurance is designed to offer tenants a sense of security and assurance. By investing in a suitable insurance policy, tenants can rest easy knowing that their personal belongings, liability risks, and even additional living expenses are covered in the event of an insured loss. This peace of mind is invaluable, allowing tenants to focus on their daily lives without the constant worry of unforeseen financial strains.

Furthermore, rental apartments insurance plays a crucial role in maintaining a healthy landlord-tenant relationship. Landlords often require tenants to have adequate insurance coverage as a condition of the lease agreement. This requirement is not merely a formality but a necessary measure to protect the landlord's investment and ensure that any potential damages or liabilities are appropriately addressed. By obtaining insurance, tenants demonstrate their responsibility and commitment to maintaining a harmonious rental environment.

Exploring Coverage Options: Understanding the Essentials

Rental apartments insurance offers a range of coverage options tailored to meet the unique needs of tenants. Understanding these options is essential to ensure that your insurance policy provides the necessary protection. Here's a closer look at some of the key coverage components:

Personal Property Coverage

One of the primary benefits of rental apartments insurance is the protection it offers for your personal belongings. This coverage ensures that in the event of a covered loss, such as a fire, theft, or natural disaster, your valuable possessions are financially safeguarded. From furniture and electronics to clothing and jewelry, personal property coverage provides a sense of security, knowing that your assets are protected.

| Coverage Category | Description |

|---|---|

| Furniture | Covers losses or damages to furniture, including sofas, beds, tables, and chairs. |

| Electronics | Provides protection for electronic devices like laptops, smartphones, and televisions. |

| Clothing & Accessories | Covers clothing, shoes, handbags, and other personal items. |

| Jewelry & Valuables | Offers specialized coverage for valuable items such as jewelry, watches, and fine art. |

Liability Protection

Liability coverage is a critical aspect of rental apartments insurance, providing financial protection in the event of accidental injuries or property damage caused by the tenant or their guests. This coverage shields tenants from potential lawsuits and legal fees, ensuring that they are not held personally responsible for such incidents.

For instance, if a guest slips and falls in your apartment, resulting in injuries, liability coverage would step in to cover the medical expenses and any potential legal costs. This protection extends beyond your rental space, covering accidents that occur on your property, such as a neighbor's injury from a faulty gate.

Additional Living Expenses

In the unfortunate event that your rental apartment becomes uninhabitable due to a covered loss, additional living expenses coverage kicks in. This coverage reimburses you for the temporary costs incurred while you find alternative accommodations. It covers expenses such as hotel stays, meals, and other necessary living costs until your apartment is suitable for habitation again.

Loss of Use Coverage

Loss of use coverage is closely related to additional living expenses and provides compensation for the inconvenience and disruption caused by a covered loss. It covers expenses beyond the standard living costs, such as the cost of storing your belongings during the repair or reconstruction of your rental apartment.

Tailoring Your Insurance Policy: Finding the Right Fit

Every rental situation is unique, and finding the right insurance policy involves considering your specific needs and circumstances. Here are some key factors to keep in mind when tailoring your rental apartments insurance coverage:

Valuables and Collectibles

If you possess valuable items such as fine art, collectibles, or high-end electronics, it's crucial to ensure that your insurance policy provides adequate coverage for these assets. Standard policies often have limitations on coverage for high-value items, so you may need to obtain additional endorsements or riders to fully protect your valuables.

Location and Risk Factors

The location of your rental apartment plays a significant role in determining the coverage you require. Consider factors such as crime rates, natural disaster risks (e.g., hurricanes, earthquakes), and proximity to potential hazards. For instance, if you live in an area prone to floods, ensuring that your policy includes flood insurance is essential.

Personal Preferences and Budget

Your personal preferences and budget constraints should also guide your insurance choices. Evaluate the coverage limits and deductibles offered by different policies to find a balance between comprehensive protection and affordability. Remember that while a higher deductible may result in lower premiums, it also means you'll have to pay more out of pocket in the event of a claim.

Frequently Asked Questions (FAQ)

What happens if I don't have rental apartments insurance and there's a fire in my unit?

+In the absence of rental apartments insurance, you would be financially responsible for replacing your personal belongings and covering any additional living expenses incurred due to the fire. This can be a significant financial burden, especially if you have valuable possessions or require extended alternative accommodations.

Can I bundle my rental apartments insurance with other insurance policies to save money?

+Yes, bundling your rental apartments insurance with other policies, such as auto insurance or homeowners insurance, can often lead to significant savings. Many insurance providers offer multi-policy discounts, making it more affordable to protect your assets and liabilities.

How much does rental apartments insurance typically cost?

+The cost of rental apartments insurance varies based on several factors, including the coverage limits, deductibles, location, and the insurer. On average, renters insurance policies range from $15 to $30 per month, making it an affordable way to protect your belongings and liabilities.

Is rental apartments insurance mandatory for tenants?

+While rental apartments insurance is not legally mandatory for tenants in most cases, landlords often require tenants to have adequate insurance coverage as a condition of the lease agreement. This requirement ensures that both the landlord's and tenant's interests are protected in the event of an insured loss.

Can I add my roommates to my rental apartments insurance policy?

+Yes, many rental apartments insurance policies allow you to add roommates as additional insureds. This ensures that their personal belongings and liabilities are also covered under your policy. However, it's important to note that each roommate's belongings would be subject to the policy's coverage limits.

Understanding the intricacies of rental apartments insurance is crucial for every tenant. By investing in a suitable policy, you can protect your belongings, mitigate liabilities, and maintain a harmonious rental experience. Remember to carefully review your policy’s coverage options, consider your unique needs, and consult with insurance professionals to ensure you have the right protection in place.