Progressive Insurance Co

In the vast landscape of the insurance industry, few names resonate as strongly as Progressive Insurance Co. With a rich history spanning over eight decades, Progressive has established itself as a pioneering force, consistently pushing the boundaries of innovation and customer-centricity. From its humble beginnings to its current status as a leading insurer, Progressive's journey is a testament to the power of adaptability and forward-thinking strategies. This article delves into the core aspects of Progressive Insurance Co., exploring its remarkable evolution, the breadth of its offerings, and the factors that have solidified its position as a cornerstone in the insurance sector.

A Historical Perspective: The Evolution of Progressive Insurance Co.

Progressive Insurance Co. was founded in 1937 by Joseph Lewis and Jack Green in Ohio, USA. This dynamic duo envisioned a future where auto insurance was accessible, straightforward, and tailored to the needs of individual drivers. Their pioneering spirit laid the foundation for a company that would revolutionize the insurance industry.

In the early days, Progressive introduced the concept of "Pay-As-You-Drive" insurance, a groundbreaking innovation that allowed drivers to pay for their coverage based on their actual usage. This innovative model not only provided flexibility to customers but also marked a significant departure from the traditional flat-rate insurance plans of the time. By embracing this unique approach, Progressive quickly gained a reputation for its customer-centric philosophy, setting a new standard for the industry.

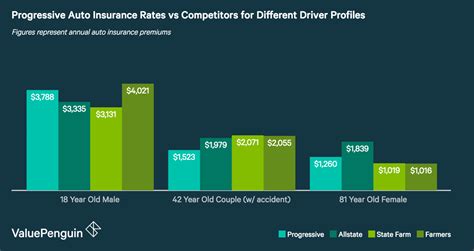

As the years progressed, Progressive continued to lead with innovation. In the 1980s, the company introduced its iconic Snapshot program, which utilized telematics technology to analyze driving behavior and offer personalized insurance rates. This program, a first of its kind, further solidified Progressive's commitment to fairness and individualization in insurance. By leveraging technology, Progressive empowered its customers to take control of their insurance costs, a move that resonated strongly with drivers across the United States.

The company's growth trajectory has been nothing short of impressive. From its early days as a regional player, Progressive has expanded its reach to become a national and, more recently, an international force. Today, Progressive Insurance Co. operates in all 50 states and offers a comprehensive suite of insurance products, catering to a diverse range of customer needs.

Product Portfolio: A Comprehensive Range of Insurance Solutions

Progressive Insurance Co. has evolved from its roots as an auto insurer to become a comprehensive insurance provider. The company’s product portfolio is vast and diverse, catering to the evolving needs of its customers.

Auto Insurance

Auto insurance remains at the core of Progressive’s offerings. The company provides a wide range of coverage options, including liability, collision, comprehensive, and medical payments insurance. Progressive’s innovative spirit shines through with its personalized coverage plans, such as the Snapshot program, which continue to attract and retain customers by offering fair and customized rates.

Home Insurance

In addition to auto insurance, Progressive has expanded its reach to offer home insurance solutions. The company understands that homeowners have unique needs, and its home insurance policies are designed to provide comprehensive protection against a wide range of risks, including fire, theft, and natural disasters. With its focus on customer service and innovation, Progressive has become a trusted partner for homeowners seeking peace of mind.

Commercial Insurance

Progressive’s reach extends beyond personal lines of insurance. The company offers a robust suite of commercial insurance products tailored to meet the diverse needs of businesses. From general liability insurance to property insurance and workers’ compensation, Progressive provides customized coverage solutions to help businesses protect their assets and operations.

Life Insurance and Annuities

Recognizing the importance of financial security and long-term planning, Progressive has expanded into the life insurance and annuities market. The company offers a range of life insurance policies, including term life, whole life, and universal life insurance, providing customers with the flexibility to choose coverage that aligns with their specific needs and budget.

| Insurance Type | Key Features |

|---|---|

| Auto Insurance | Customized coverage, Snapshot program, competitive rates |

| Home Insurance | Comprehensive protection, personalized policies, disaster response |

| Commercial Insurance | Tailored coverage for businesses, risk management solutions |

| Life Insurance | Term, whole, and universal life options, flexible payment plans |

Customer Experience and Service: The Progressive Advantage

At the heart of Progressive Insurance Co.’s success is its unwavering commitment to delivering an exceptional customer experience. The company understands that insurance is more than just a policy; it’s about providing peace of mind and supporting customers through life’s ups and downs.

Progressive's customer-centric approach is evident in its focus on education and transparency. The company provides a wealth of resources and tools to help customers make informed decisions about their insurance needs. From online calculators to comprehensive policy guides, Progressive empowers its customers with the knowledge to choose the right coverage.

Additionally, Progressive has invested heavily in technology to streamline the insurance experience. Its online platform and mobile app offer customers convenient access to their policies, allowing them to manage their insurance on the go. From making payments to filing claims, Progressive has made the insurance process more accessible and efficient.

In the event of a claim, Progressive's dedicated claims team is ready to assist. The company prides itself on its efficient and compassionate claims handling process, ensuring customers receive the support they need when they need it most. With a focus on timely resolutions and customer satisfaction, Progressive has set a new benchmark for the industry.

The Future of Progressive Insurance Co.: Embracing Innovation and Growth

As the insurance landscape continues to evolve, Progressive Insurance Co. remains at the forefront, embracing new technologies and trends. The company’s commitment to innovation is evident in its recent initiatives and partnerships.

Progressive has been at the forefront of embracing emerging technologies such as artificial intelligence and machine learning. These advancements are being utilized to enhance customer service, streamline claims processing, and improve risk assessment. By leveraging these technologies, Progressive is able to offer more accurate and personalized insurance solutions, further solidifying its position as an industry leader.

Additionally, Progressive has been proactive in exploring new business models and partnerships. The company has entered into strategic alliances with tech startups and established businesses, allowing it to expand its reach and offer innovative solutions to its customers. These collaborations have opened up new avenues for growth and have positioned Progressive as a forward-thinking insurer.

Looking ahead, Progressive Insurance Co. is poised for continued success. With its strong foundation, commitment to innovation, and focus on customer satisfaction, the company is well-positioned to navigate the evolving insurance landscape. As it continues to adapt and embrace new opportunities, Progressive will undoubtedly remain a key player in the industry for years to come.

Frequently Asked Questions

How does Progressive’s Snapshot program work?

+Progressive’s Snapshot program uses a small device installed in your vehicle to track your driving habits. This data is then used to calculate your insurance rates, offering discounts to safe drivers. The program rewards drivers for practicing safe habits like maintaining a steady speed, avoiding hard braking, and reducing excessive acceleration.

What sets Progressive’s commercial insurance apart from competitors?

+Progressive’s commercial insurance offers tailored coverage solutions designed to meet the unique needs of businesses. The company provides flexible policies, risk management support, and specialized coverage for a wide range of industries. Additionally, Progressive’s commitment to innovation and customer service sets it apart, ensuring businesses receive the support and protection they require.

How does Progressive handle claims and customer service inquiries?

+Progressive has a dedicated claims team that works to provide efficient and compassionate service to its customers. The company offers multiple channels for claim submissions, including online, by phone, or through its mobile app. Progressive’s focus on timely resolutions and customer satisfaction ensures that customers receive the support they need when it matters most.