Most Inexpensive Auto Insurance

Finding the most inexpensive auto insurance is a common goal for many vehicle owners. While the cost of insurance can vary significantly based on individual factors, understanding the market and exploring various options can help you secure the best deal without compromising on coverage. This comprehensive guide delves into the world of auto insurance, offering insights into how to navigate the market, compare policies, and make informed decisions to secure the most affordable coverage for your needs.

Understanding Auto Insurance Costs

Auto insurance premiums are influenced by a multitude of factors, including your age, gender, driving history, the make and model of your vehicle, and the location where you reside. These variables contribute to the calculation of your risk profile, which insurance companies use to determine the likelihood of you making a claim. The higher the perceived risk, the higher the insurance premium.

For instance, young drivers under the age of 25, particularly males, are often considered high-risk due to their propensity for aggressive driving and higher accident rates. This demographic typically faces higher insurance premiums. Similarly, certain vehicle makes and models, particularly high-performance sports cars, may attract higher premiums due to their association with increased accident risks and higher repair costs.

Geographic Factors

The geographical location where you reside plays a significant role in determining your insurance rates. Areas with higher populations, denser traffic, and higher crime rates often experience more accidents and car thefts, leading to elevated insurance costs. For example, metropolitan areas like New York City or Los Angeles generally have higher insurance rates compared to rural or suburban regions.

Moreover, the specific state or city you live in can impact your insurance costs due to variations in state laws and regulations governing auto insurance. Some states have no-fault insurance systems, which can affect premium rates and the claims process. Understanding these regional differences is crucial when comparing insurance quotes.

Coverage Types and Limits

The type and extent of coverage you choose also impact your insurance costs. Different states have varying minimum requirements for liability coverage, which pays for damages you cause to others. If you opt for higher liability limits or add additional coverage options like collision, comprehensive, or uninsured/underinsured motorist coverage, your premiums will likely increase.

Collision coverage, which pays for repairs to your vehicle after an accident, and comprehensive coverage, which covers damages from non-accident events like theft, vandalism, or natural disasters, can add significant value to your policy but also increase your costs. Balancing your coverage needs with your budget is essential to finding the most suitable and affordable insurance plan.

| Coverage Type | Description |

|---|---|

| Liability | Covers damages caused to others in an accident |

| Collision | Pays for repairs to your vehicle after an accident |

| Comprehensive | Covers damages from non-accident events (theft, vandalism, natural disasters) |

| Uninsured/Underinsured Motorist | Protects you if hit by a driver without sufficient insurance |

Shopping for the Most Inexpensive Auto Insurance

Now that we’ve established the key factors influencing insurance costs, let’s explore strategies to find the most inexpensive auto insurance that suits your needs.

Compare Quotes from Multiple Insurers

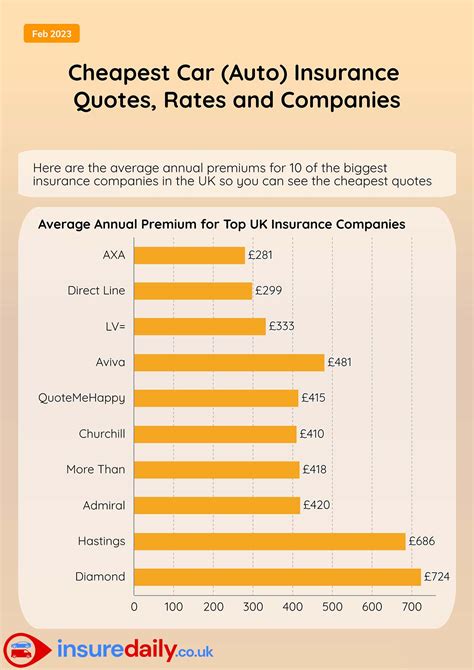

One of the most effective ways to find the best deal on auto insurance is to compare quotes from multiple insurers. Insurance companies use different algorithms and risk assessment models, so the rates they offer can vary significantly. By obtaining quotes from at least three to five insurers, you can identify the companies that offer the most competitive rates for your profile.

Online insurance comparison platforms can be a convenient way to quickly gather multiple quotes. These platforms allow you to input your information once and receive quotes from various insurers, saving you time and effort. However, it's important to note that these platforms may not include all insurers, so it's beneficial to also reach out to individual insurance companies directly.

Explore Discounts and Savings Opportunities

Insurance companies often provide a range of discounts to attract and retain customers. Some common discounts include:

- Multi-Policy Discounts: Insuring multiple vehicles or combining auto insurance with other policies like home or renters insurance can lead to significant savings.

- Safe Driver Discounts: Insurers often reward drivers with clean records or those who complete defensive driving courses with reduced premiums.

- Student Discounts: Many insurers offer discounts to students who maintain good grades or are enrolled in a full-time undergraduate or graduate degree program.

- Low-Mileage Discounts: If you drive fewer miles annually, you may be eligible for a low-mileage discount.

- Bundling Discounts: Bundling your auto insurance with other policies, such as life or health insurance, can result in savings.

It's important to inquire about these discounts when obtaining quotes and ensure that your insurer applies all eligible discounts to your policy.

Consider Usage-Based Insurance (UBI)

Usage-Based Insurance, also known as Pay-As-You-Drive or Pay-How-You-Drive insurance, is an innovative pricing model that tailors your insurance premium to your actual driving behavior. With UBI, insurers track your driving habits using telematics devices or smartphone apps, and your premium is adjusted based on factors like mileage driven, driving time, and your overall driving safety.

UBI can be particularly beneficial for safe drivers who drive infrequently or during off-peak hours. By adopting safer driving practices and reducing your mileage, you can potentially qualify for lower premiums. However, it's important to carefully review the terms and conditions of UBI policies to understand how your data is collected and used.

Maintain a Clean Driving Record

Your driving history is a significant factor in determining your insurance rates. A clean driving record, free from accidents and traffic violations, can lead to lower premiums. Conversely, a history of accidents or traffic citations can result in higher insurance costs.

If you have a less-than-perfect driving record, it's important to take steps to improve your record. This may involve completing a defensive driving course or, if you have a more serious violation, waiting for the violation to fall off your record (typically after three to five years, depending on the violation and state laws).

Evaluating Auto Insurance Policies

Once you’ve obtained multiple quotes and explored potential discounts, it’s essential to carefully evaluate the policies to ensure you’re getting the best value for your money.

Assess Coverage Limits and Deductibles

When comparing policies, pay close attention to the coverage limits and deductibles. Lower coverage limits and higher deductibles can lead to lower premiums, but they may not provide adequate protection in the event of an accident. It’s important to strike a balance between affordability and adequate coverage.

Consider your financial situation and potential risks when determining your coverage limits and deductibles. For example, if you have significant assets to protect, you may want to opt for higher liability limits. Similarly, if you frequently drive in high-risk areas or have a history of accidents, a lower deductible may be more suitable to minimize your out-of-pocket expenses in the event of a claim.

Examine the Fine Print

Beyond the headline coverage limits and deductibles, it’s crucial to delve into the policy’s fine print. This includes understanding the exclusions and limitations of your coverage, as well as any additional benefits or perks offered by the insurer.

For instance, some policies may include rental car coverage, roadside assistance, or accident forgiveness, which can add value to your policy. Conversely, certain exclusions or limitations may restrict your coverage in specific scenarios. By thoroughly reviewing the policy details, you can ensure that you're getting the coverage you need at a competitive price.

Consider Customer Service and Claims Handling

While price is a significant factor in choosing an insurance provider, it’s not the only consideration. The quality of customer service and claims handling can significantly impact your experience with the insurer.

Research the insurer's reputation for customer satisfaction and claims handling. Online reviews and ratings from independent sources can provide valuable insights. Additionally, consider factors like the insurer's financial stability, their availability of customer service representatives, and their claims process, including how quickly they respond to claims and their track record for fair and timely settlements.

Making the Switch to a New Insurer

If you’ve found a more affordable and suitable auto insurance policy, it’s time to make the switch. Here’s a step-by-step guide to help you through the process:

Obtain Your Policy Documents

Once you’ve decided on a new insurer, obtain all the necessary policy documents, including the declaration page and any endorsements or addendums. These documents will detail your coverage limits, deductibles, and any additional benefits or exclusions.

Notify Your Current Insurer

Inform your current insurer that you’re switching to a new provider. Most insurers require written notice of cancellation, which can be done via mail, email, or online forms. Be sure to provide the effective date of cancellation, which should align with the start date of your new policy to avoid gaps in coverage.

Transfer Your Policy

Work with your new insurer to transfer your policy. They will guide you through the process, which typically involves providing your vehicle and driver information, selecting your desired coverage limits and deductibles, and choosing any additional endorsements or options.

Your new insurer may also require proof of prior insurance, so be prepared to provide documentation from your previous insurer to avoid potential delays or complications.

Review and Understand Your New Policy

Take the time to thoroughly review your new policy documents. Ensure that all the coverage limits, deductibles, and additional benefits or exclusions align with your expectations. If you have any questions or concerns, reach out to your new insurer’s customer service team for clarification.

Monitor Your Coverage

Even after you’ve switched insurers, it’s important to periodically review your coverage to ensure it remains adequate and affordable. Life circumstances can change, and your insurance needs may evolve. Regularly assess your policy to ensure it aligns with your current situation and any changes in your driving habits or vehicle usage.

Conclusion

Finding the most inexpensive auto insurance requires a combination of thorough research, comparison shopping, and a deep understanding of your individual needs and circumstances. By leveraging the insights and strategies outlined in this guide, you can navigate the complex world of auto insurance with confidence, secure the most affordable coverage, and rest assured that you’re adequately protected on the road.

How can I lower my auto insurance premiums without compromising coverage?

+

To lower your auto insurance premiums without compromising coverage, you can explore various strategies such as comparing quotes from multiple insurers, considering usage-based insurance policies, maintaining a clean driving record, and evaluating coverage limits and deductibles. Additionally, researching and utilizing applicable discounts can help reduce costs while ensuring you maintain adequate protection.

What factors influence auto insurance rates, and how can I reduce my risk profile?

+

Auto insurance rates are influenced by factors such as age, gender, driving history, vehicle type, and geographical location. To reduce your risk profile, you can maintain a clean driving record, choose safer vehicles, and consider moving to areas with lower insurance rates. Additionally, understanding your coverage needs and opting for appropriate coverage limits can help strike a balance between affordability and protection.

Are there any potential drawbacks to usage-based insurance (UBI)?

+

While UBI can offer significant savings for safe and low-mileage drivers, it may not be suitable for everyone. Some potential drawbacks include concerns about privacy, as your driving behavior is tracked, and the possibility of higher premiums if you engage in riskier driving habits. It’s important to carefully review the terms and conditions of UBI policies before enrolling.