Car Rental Car Insurance

Car rental insurance is a vital aspect to consider when planning your travel or even for short-term vehicle needs. With the convenience of renting a car comes the responsibility of ensuring it's protected, and understanding the intricacies of car rental insurance is key to making informed decisions.

Unraveling Car Rental Insurance: The Basics

Car rental insurance provides coverage for the rental vehicle, offering protection against potential damages, theft, or accidents during the rental period. It’s a crucial aspect that every renter should be aware of, as it can significantly impact their overall travel experience and financial liability.

When you rent a car, the rental company typically offers various insurance options, each designed to cover different scenarios. These insurance types can often be confusing, with terms like Collision Damage Waiver (CDW), Loss Damage Waiver (LDW), or Liability Insurance being thrown around. Let's break these down and understand their implications.

Collision Damage Waiver (CDW) and Loss Damage Waiver (LDW)

CDW and LDW are two of the most common types of car rental insurance. They provide coverage for damage to the rental vehicle itself, including collisions, accidents, and even vandalism. While CDW is more commonly used in Europe, LDW is often the term used by rental companies in the United States.

Both CDW and LDW waive the renter's responsibility for any damage to the rental car, up to a certain amount. This means that if you're involved in an accident and the car is damaged, you won't have to pay out of pocket for repairs, as long as you have this coverage. However, it's important to note that there may be a deductible, which is the amount you'd have to pay before the insurance kicks in.

| Insurance Type | Coverage | Deductible |

|---|---|---|

| CDW | Covers damage to the rental car due to collision or theft | Varies, typically $500 - $1,500 |

| LDW | Similar to CDW, but may have slightly different terms | Usually around $1,000 |

Liability Insurance

Liability insurance is another crucial aspect of car rental insurance. This type of coverage protects you against claims made by other parties involved in an accident, such as the other driver or pedestrians. It covers damages to their vehicles or property and any medical expenses they incur as a result of the accident.

Most rental companies include basic liability insurance in their rental rates, but it's often not enough to cover all potential damages. Therefore, it's advisable to consider purchasing additional liability coverage, especially if you're renting an expensive vehicle or driving in an area with high accident rates.

Personal Effects Coverage

Personal effects coverage is an optional insurance add-on that protects your personal belongings in the rental car. If your luggage or other items are stolen or damaged while in the rental vehicle, this coverage can reimburse you for the loss. It’s especially useful for long-term rentals or if you’re carrying valuable items.

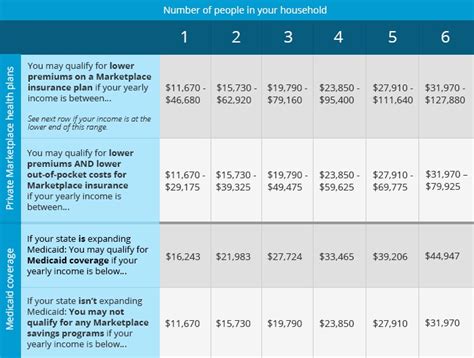

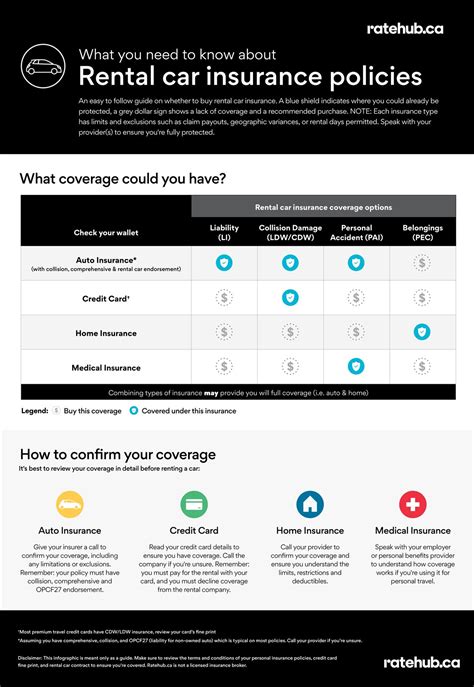

Understanding Your Existing Insurance Coverage

Before purchasing any additional car rental insurance, it’s crucial to understand your existing insurance coverage. Your personal auto insurance policy may already provide some level of protection for rental cars. For instance, your comprehensive and collision coverage might extend to rental vehicles, though there might be limitations on the rental period or the value of the car.

Additionally, as mentioned earlier, your credit card company might offer rental car insurance benefits. These benefits can vary widely depending on the card issuer and the specific card you hold. Some cards may provide primary coverage, which means they'll cover any claims before your personal insurance, while others offer secondary coverage, kicking in only after your insurance has paid out.

It's essential to carefully review your personal insurance policy and credit card benefits to understand the extent of your coverage. This will help you make an informed decision about whether you need to purchase additional insurance from the rental company.

Tips for Choosing the Right Car Rental Insurance

When deciding on car rental insurance, it’s crucial to consider your specific needs and the terms of the rental agreement. Here are some tips to help you make the right choice:

- Review the rental agreement carefully. Understand the terms and conditions, including any exclusions or limitations on coverage.

- Consider the value of the rental car. If you're renting an expensive vehicle, you might want to opt for more comprehensive insurance to protect yourself financially.

- Assess your personal insurance coverage and credit card benefits. This will help you determine any gaps in coverage that need to be addressed.

- Evaluate the rental period. For short-term rentals, your personal insurance or credit card coverage might be sufficient. However, for longer rentals, additional coverage might be beneficial.

- Compare prices and coverage options from different rental companies. Some companies offer better rates or more inclusive packages.

The Impact of Car Rental Insurance on Your Travel Budget

Car rental insurance can significantly impact your travel budget. While it provides essential protection, it can also add a substantial cost to your rental. It’s important to carefully consider your budget and the potential risks you might face during your rental period.

Some rental companies offer pre-paid insurance packages, which can sometimes be more cost-effective than paying daily rates. These packages often include CDW, LDW, and liability coverage, providing comprehensive protection. However, it's crucial to read the fine print and understand any exclusions or limitations.

Future Implications and Industry Trends

The car rental insurance industry is constantly evolving, with new technologies and trends shaping the way insurance is offered and utilized. One notable trend is the rise of digital insurance platforms, which provide renters with more control and flexibility over their insurance choices.

These platforms often offer a range of insurance options, allowing renters to customize their coverage based on their specific needs. Additionally, they provide real-time updates and claims management, making the entire process more efficient and transparent. As technology advances, we can expect to see further innovations in this space, making car rental insurance more accessible and tailored to individual preferences.

Can I decline car rental insurance if I have my own personal auto insurance?

+Yes, if your personal auto insurance policy provides coverage for rental cars, you can typically decline the insurance offered by the rental company. However, it’s essential to carefully review your policy to understand any limitations or exclusions.

What happens if I’m involved in an accident while renting a car?

+If you’re involved in an accident, it’s crucial to follow the rental company’s procedures. This usually involves reporting the accident to the rental company immediately and providing all the necessary details. The specific steps may vary depending on the company and the insurance coverage you have.

Are there any situations where my personal auto insurance might not cover a rental car?

+Yes, there are situations where your personal auto insurance might not cover a rental car. These can include renting an exotic or luxury vehicle, renting for an extended period (typically over 30 days), or using the rental car for commercial purposes. It’s important to review your policy or consult with your insurance provider to understand any limitations.