Premiums Insurance

In the world of financial protection and risk management, insurance plays a pivotal role, especially when it comes to Premiums Insurance, a term that may sound familiar to many but often raises questions. This comprehensive guide aims to unravel the complexities surrounding Premiums Insurance, shedding light on its nature, benefits, and the crucial role it plays in safeguarding individuals and businesses alike.

Understanding Premiums Insurance: A Fundamental Overview

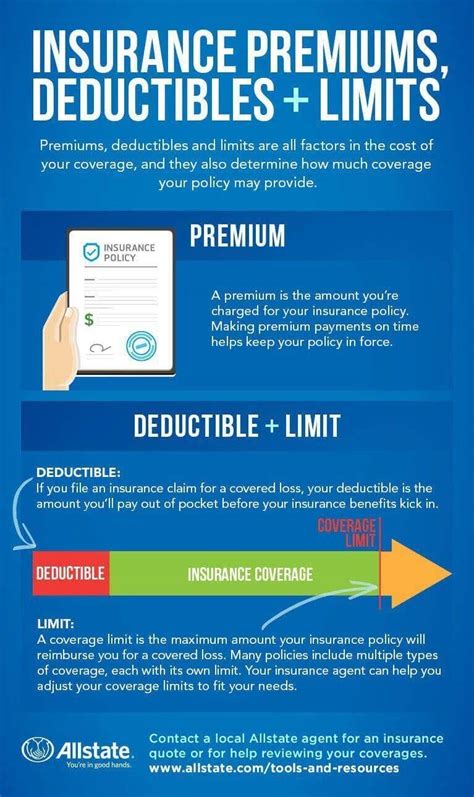

Premiums Insurance, at its core, represents the monetary amount paid to an insurance company to secure coverage for a specified period. This payment, often referred to as a premium, acts as a form of financial protection, offering peace of mind and a safety net against unforeseen circumstances. The concept is deeply rooted in the insurance industry, serving as the primary mechanism through which policyholders contribute to the shared risk pool.

The premium amount is determined by a host of factors, including the type of insurance, the coverage level, and the individual or entity's specific risk profile. For instance, health insurance premiums might be influenced by age, pre-existing medical conditions, and lifestyle factors, while auto insurance premiums can vary based on driving history, vehicle type, and geographical location.

Premiums Insurance operates on the principle of risk sharing, where the collective contributions of policyholders are utilized to provide financial support to those who experience covered losses or damages. This shared responsibility model ensures that individuals or businesses can access necessary funds during challenging times, mitigating the potential financial devastation caused by unexpected events.

The Importance of Premiums in Insurance Policies

Premiums are the lifeblood of the insurance industry, serving as the primary revenue stream for insurance companies. These payments not only enable insurers to offer coverage but also allow them to invest in research, development, and the creation of innovative products to meet the evolving needs of their customers.

From a policyholder's perspective, understanding and managing premiums is crucial. It empowers individuals to make informed decisions about their insurance coverage, balancing the need for adequate protection with their financial capabilities. By actively managing their premiums, policyholders can ensure they receive the most suitable coverage at a reasonable cost, thereby optimizing their financial well-being.

| Insurance Type | Average Annual Premium (USD) |

|---|---|

| Health Insurance | $5,000 - $15,000 |

| Auto Insurance | $1,000 - $2,500 |

| Homeowners Insurance | $1,200 - $2,000 |

| Life Insurance | $500 - $2,000 |

As evident from the table, the cost of premiums can vary significantly depending on the type of insurance and the individual's circumstances. This highlights the importance of personalized insurance plans, tailored to meet the unique needs and budgets of each policyholder.

The Role of Premiums in Insurance: A Deeper Dive

The significance of premiums extends beyond the mere payment of insurance fees. It is a fundamental aspect that shapes the entire insurance ecosystem, influencing coverage, claims processes, and the overall financial health of insurance providers.

Premiums and Coverage: A Direct Correlation

Premiums are the gateway to insurance coverage. The amount paid directly impacts the scope and extent of the protection provided. Higher premiums often signify broader coverage, offering policyholders greater financial security in the event of a claim. For instance, a higher health insurance premium might translate to more comprehensive medical coverage, including additional benefits such as vision and dental care.

Conversely, lower premiums might restrict coverage, limiting the policyholder's financial protection. This trade-off between premium cost and coverage depth is a critical consideration when selecting an insurance plan. It underscores the importance of careful evaluation and personalized decision-making to ensure the chosen plan aligns with the policyholder's specific needs and risk profile.

The Impact of Premiums on Claims Management

Premiums also play a pivotal role in the claims management process. When a policyholder files a claim, the insurance company leverages the collected premiums to provide financial compensation for the covered loss. This process is a testament to the efficacy of the risk-sharing model, where the contributions of all policyholders are utilized to support those in need.

Efficient claims management is a critical component of an insurance company's reputation and success. A well-managed claims process, supported by adequate premium reserves, can lead to faster payouts, improved customer satisfaction, and a positive brand image. Conversely, inadequate premium management can result in delayed or denied claims, negatively impacting the insurer's reputation and customer trust.

Premiums and Financial Stability of Insurance Providers

The financial health of insurance companies is intrinsically linked to the premiums they collect. These payments are a primary source of revenue, enabling insurers to cover claims, manage operational costs, and invest in business growth. Adequate premium income is essential for the long-term viability and sustainability of insurance providers.

Furthermore, premiums contribute to the establishment of reserve funds, which serve as a safety net for insurance companies. These reserves are crucial in mitigating the financial impact of large-scale claims or unexpected events, ensuring the insurer's ability to honor its commitments to policyholders. The effective management of premiums and reserves is thus a critical aspect of risk management for insurance providers.

Optimizing Premiums: Strategies for Policyholders

Understanding the intricate relationship between premiums and insurance coverage empowers policyholders to make strategic decisions. Here are some key strategies to optimize premiums and maximize the value of insurance coverage:

Comparative Shopping

Before committing to an insurance plan, it’s essential to compare multiple options. Different insurers offer varying premium rates for similar coverage. By obtaining quotes from multiple providers, policyholders can identify the most cost-effective plan that aligns with their needs.

Understanding Coverage Limits

Policyholders should carefully review the coverage limits of their chosen plan. Higher coverage limits often result in higher premiums. It’s crucial to strike a balance between adequate protection and financial feasibility. Understanding the potential costs associated with exceeding coverage limits can help policyholders make informed decisions.

Exploring Discounts and Bundling

Many insurance companies offer discounts for policyholders who meet certain criteria, such as a clean driving record or a home security system. Additionally, bundling multiple insurance policies, such as auto and home insurance, can often lead to significant savings. Policyholders should explore these options to maximize their insurance value.

Maintaining a Good Risk Profile

The risk profile of a policyholder is a critical factor in determining premiums. Maintaining a positive risk profile, such as a good driving record or a healthy lifestyle, can lead to lower premiums. Policyholders should be mindful of their actions and behaviors that might impact their risk profile and, consequently, their premiums.

Regularly Reviewing and Updating Coverage

Insurance needs can evolve over time. Policyholders should regularly review their coverage to ensure it remains adequate and aligned with their current circumstances. This might involve increasing coverage limits, adding new policies, or making adjustments to reflect changes in their lifestyle or financial situation.

Future Trends in Premiums Insurance

The insurance industry is evolving, driven by technological advancements, changing consumer expectations, and emerging risks. This evolution is set to have a significant impact on Premiums Insurance, shaping the way premiums are calculated, managed, and optimized.

The Rise of Telematics and Usage-Based Insurance

Telematics, the technology used to track and analyze vehicle data, is gaining traction in the insurance industry. This technology allows insurers to gather real-time driving data, such as speed, acceleration, and braking patterns. By leveraging this data, insurers can offer Usage-Based Insurance (UBI) policies, where premiums are tailored to an individual’s actual driving behavior.

UBI policies have the potential to revolutionize Premiums Insurance, offering policyholders a more personalized and fair pricing model. Those who drive safely and responsibly can expect lower premiums, while those with riskier driving habits may pay more. This data-driven approach to pricing not only incentivizes safer driving but also empowers policyholders with greater control over their insurance costs.

The Impact of Digitalization and Insurtech

The digital transformation of the insurance industry, driven by Insurtech innovations, is set to streamline and enhance the premiums management process. Digital platforms and applications are making it easier for policyholders to compare plans, purchase insurance, and manage their premiums. This increased accessibility and convenience are expected to drive competition, leading to more affordable premiums and improved customer service.

Additionally, Insurtech solutions are enabling insurers to more accurately assess and manage risk. Advanced analytics and machine learning algorithms can process vast amounts of data, including historical claims data and external factors, to more precisely calculate premiums. This enhanced risk assessment capability can lead to fairer pricing and more efficient insurance coverage.

Addressing Emerging Risks

The insurance industry is continuously evolving to address emerging risks, such as cyber threats, climate change, and new technologies. As these risks become more prominent, insurers are developing innovative coverage options and adapting their pricing models. This includes the introduction of new insurance products and the adjustment of premiums to reflect the changing risk landscape.

For instance, with the increasing frequency and severity of natural disasters due to climate change, insurers are reevaluating premiums for homeowners' insurance policies. Similarly, the rise of cyberattacks has led to the development of specialized cyber insurance coverage, with premiums tailored to the specific risks associated with digital operations.

Conclusion: Navigating the Premiums Insurance Landscape

Premiums Insurance is a fundamental aspect of the insurance ecosystem, serving as the bridge between policyholders and the financial protection they need. Understanding the role and impact of premiums is crucial for both insurers and policyholders, as it shapes the coverage, claims processes, and overall financial health of the insurance industry.

For policyholders, managing premiums is a strategic endeavor, involving careful consideration of coverage needs, comparative shopping, and an understanding of the factors influencing premium rates. By actively engaging in the premiums management process, policyholders can optimize their insurance coverage, ensuring they receive the best value for their investment.

As the insurance industry continues to evolve, driven by technological advancements and changing risk landscapes, Premiums Insurance will play a pivotal role in shaping the future of financial protection. Policyholders can expect more innovative coverage options, personalized pricing models, and enhanced accessibility, empowering them to make informed decisions and navigate the complex world of insurance with confidence and peace of mind.

How are insurance premiums calculated?

+Insurance premiums are calculated based on a variety of factors, including the type of insurance, coverage level, and the individual’s or entity’s risk profile. For instance, health insurance premiums might consider age, medical history, and lifestyle, while auto insurance premiums might consider driving history, vehicle type, and location.

What is the role of premiums in the insurance industry?

+Premiums serve as the primary revenue stream for insurance companies, enabling them to offer coverage, manage claims, and invest in business growth. They also facilitate the risk-sharing model, where the collective contributions of policyholders are used to support those who experience covered losses.

How can policyholders optimize their insurance premiums?

+Policyholders can optimize their premiums by comparing multiple insurance plans, understanding coverage limits, exploring discounts and bundling options, maintaining a good risk profile, and regularly reviewing and updating their coverage to align with their changing needs and circumstances.