Motorbike Insurance Price

Understanding the price of motorbike insurance is essential for any bike enthusiast looking to protect their valuable investment. In the world of motorcycling, insurance rates can vary significantly due to a multitude of factors. This comprehensive guide aims to delve into the intricacies of motorbike insurance pricing, providing an expert analysis to help riders make informed decisions.

The Impact of Rider Profile

One of the primary determinants of motorbike insurance costs is the rider’s profile. Insurance providers assess various aspects of a rider’s background to gauge the level of risk associated with insuring them. Here’s a breakdown of the key components:

Age and Experience

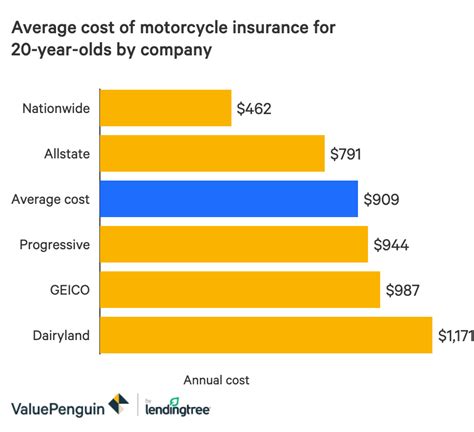

The age of the rider plays a significant role in insurance pricing. Generally, younger riders, particularly those under the age of 25, are considered higher-risk due to their lack of experience. Insurance companies often charge higher premiums for this demographic, reflecting the increased likelihood of accidents and claims.

On the other hand, older riders with extensive riding experience are often viewed as lower-risk. Their maturity and years of safe riding can lead to more favorable insurance rates. However, it's important to note that age-related discounts may vary depending on the insurer and other factors.

Riding History

A rider’s claims history is a crucial factor in determining insurance costs. Insurers closely examine past claims, accidents, and traffic violations to assess the potential risk associated with insuring an individual. Riders with a clean record, free of accidents and traffic citations, are often rewarded with lower premiums.

Conversely, those with a history of accidents, particularly those at fault, may face higher insurance rates. Insurance companies consider such incidents as indicators of higher risk and adjust premiums accordingly. It's worth noting that the impact of a claims history can vary based on the severity and frequency of incidents.

Riding Style and Behavior

Insurance providers also consider a rider’s riding style and behavior when calculating insurance costs. Riders who engage in high-risk activities, such as aggressive riding or off-road racing, may face increased premiums. These activities are often associated with a higher likelihood of accidents and damage, leading to higher insurance costs.

Additionally, insurance companies may use data from telematics devices or smartphone apps to monitor riding behavior. This technology can track factors like speed, acceleration, and braking, providing insurers with valuable insights into a rider's habits. Riders who demonstrate safe and responsible behavior may be eligible for discounts or lower premiums.

The Role of Bike Specifications

The specifications and characteristics of the motorbike itself play a significant role in determining insurance costs. Here’s an overview of the key factors:

Make, Model, and Age

The make and model of the motorbike are crucial considerations for insurance providers. Certain brands and models are known for their higher performance, which can attract higher insurance rates due to the increased risk of accidents and theft. Additionally, newer models, particularly those with advanced features and technology, may also command higher premiums.

The age of the bike is another important factor. Older motorcycles, especially vintage or classic models, may have lower insurance costs due to their lower market value and reduced risk of theft. However, it's essential to note that older bikes may have higher maintenance costs, which can impact insurance pricing.

Engine Size and Performance

The engine size and overall performance of a motorbike are key considerations for insurance companies. High-performance motorcycles with larger engines are often associated with higher insurance rates. These bikes are typically more expensive to repair or replace, and their higher speeds and acceleration capabilities can increase the risk of accidents.

Conversely, motorcycles with smaller engine sizes and lower performance specifications may be eligible for more affordable insurance rates. These bikes are generally considered less risky and may be suitable for riders who prioritize fuel efficiency and practicality over performance.

Safety Features and Accessories

The presence of safety features and accessories on a motorbike can impact insurance pricing. Insurance companies often offer discounts or reduced premiums for bikes equipped with advanced safety technologies such as anti-lock brakes (ABS), traction control, or stability control systems.

Additionally, motorcycles with security features like GPS tracking, alarm systems, or hardened locks may also be eligible for insurance discounts. These features reduce the risk of theft and vandalism, leading to lower insurance costs. It's worth noting that the specific safety features and their impact on insurance rates can vary between insurers.

Insurance Coverage and Deductibles

The type of insurance coverage chosen and the associated deductibles are crucial factors in determining the overall insurance price. Riders have the option to customize their coverage based on their needs and budget. Here’s an exploration of these aspects:

Comprehensive and Collision Coverage

Choosing comprehensive and collision coverage is a critical decision for motorcyclists. These coverages provide protection for the motorbike in various scenarios, including accidents, theft, and vandalism. While comprehensive coverage is optional, collision coverage is often mandatory for newer or high-value motorcycles.

The level of coverage and the associated premiums can vary significantly. Riders can opt for higher coverage limits, which offer more financial protection but come at a higher cost. Conversely, selecting lower coverage limits or opting for higher deductibles can reduce insurance costs but may result in higher out-of-pocket expenses in the event of a claim.

Liability Coverage

Liability coverage is a crucial aspect of motorbike insurance, as it protects riders from financial losses arising from accidents they cause. This coverage is typically divided into bodily injury liability and property damage liability.

The amount of liability coverage chosen can have a significant impact on insurance rates. Higher liability limits provide greater protection but come at a higher cost. Conversely, selecting lower liability limits or opting for a higher deductible can reduce insurance premiums but may leave riders vulnerable to higher out-of-pocket expenses in the event of a liability claim.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is an essential consideration for motorcyclists. This coverage protects riders in the event of an accident caused by a driver who either lacks insurance or has insufficient coverage to fully compensate for the damages. It provides financial protection for medical expenses, lost wages, and other related costs.

The decision to include uninsured/underinsured motorist coverage and the associated limits can affect insurance rates. Riders can choose higher coverage limits for greater protection, but this comes at a higher cost. Alternatively, selecting lower limits or opting for a higher deductible can reduce insurance costs but may result in higher out-of-pocket expenses in the event of an uninsured/underinsured motorist claim.

Geographic Location and Usage Patterns

The geographic location where the motorbike is primarily used and the usage patterns of the rider can significantly influence insurance pricing. Here’s an exploration of these factors:

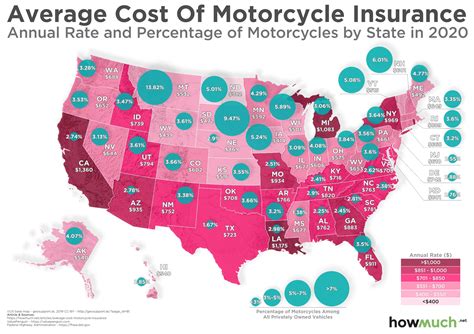

Regional Variations

Insurance rates can vary widely depending on the region or state in which the motorbike is registered and primarily used. Factors such as population density, traffic congestion, crime rates, and weather conditions can all impact insurance costs.

High-population areas with dense traffic and higher rates of accidents or theft may command higher insurance premiums. Conversely, rural or less congested regions may offer more affordable insurance rates due to lower risk factors. It's essential for riders to be aware of regional variations and consider how their location may impact insurance costs.

Usage Patterns and Mileage

The usage patterns and mileage of a motorbike can also affect insurance pricing. Insurance companies often offer discounts or lower premiums for riders who use their motorcycles primarily for leisure or occasional commuting. These usage patterns are generally considered lower-risk, as they involve fewer miles traveled and reduced exposure to potential hazards.

Conversely, riders who use their motorcycles for daily commuting or business purposes may face higher insurance rates. These usage patterns involve higher mileage and increased exposure to traffic, accidents, and theft risks. Insurance companies may view such riders as higher-risk and adjust premiums accordingly.

Discounts and Savings Opportunities

While motorbike insurance costs can vary significantly, there are various discounts and savings opportunities that riders can explore to reduce their insurance expenses. Here’s an overview of some common avenues for potential savings:

Bundling Policies

One effective way to save on motorbike insurance is by bundling policies with other types of insurance, such as auto, home, or renters’ insurance. Many insurance companies offer discounts when customers purchase multiple policies from them. By bundling policies, riders can often secure significant savings on their overall insurance costs.

Memberships and Affiliations

Riders can explore potential savings opportunities through memberships and affiliations with various organizations. Many insurance companies offer discounts to members of motorcycle clubs, veteran organizations, or professional associations. These discounts are often a way for insurers to recognize the safe riding practices and responsible behavior associated with these groups.

Safe Riding Courses and Certifications

Completing safe riding courses or obtaining riding certifications can be an excellent way for riders to demonstrate their commitment to safety and reduce insurance costs. Many insurance companies offer discounts to riders who have completed approved safety courses or obtained advanced riding certifications. These programs often cover topics like defensive riding, emergency maneuvers, and hazard recognition.

Multi-Bike Discounts

Riders who own multiple motorcycles may be eligible for multi-bike discounts on their insurance policies. Insurance companies often offer reduced rates when customers insure multiple bikes with them. This discount recognizes the efficiency and convenience of managing multiple policies through a single insurer.

Understanding Insurance Claims

When it comes to motorbike insurance, understanding the claims process and the potential impact on insurance costs is crucial. Here’s an overview of key considerations:

Filing a Claim

In the event of an accident or incident, riders should promptly file a claim with their insurance company. It’s important to provide accurate and detailed information about the circumstances of the incident, including any relevant photos or documentation. Cooperating with the insurer’s investigation process is essential to ensure a smooth claims experience.

Impact on Premiums

Filing a claim can have an impact on insurance premiums. Insurance companies consider claims history when calculating future premiums. While a single claim may not significantly affect rates, multiple claims or claims involving high-cost repairs or liability may lead to increased premiums. It’s essential for riders to carefully consider the necessity of filing a claim and explore all available options before proceeding.

Alternatives to Claims

In some cases, riders may have the option to avoid filing a claim and instead cover the costs of repairs or damages out of pocket. This approach can help maintain a clean claims history and potentially avoid premium increases. However, it’s crucial to carefully assess the financial feasibility and potential long-term implications of this decision.

Understanding Deductibles

When filing a claim, riders should be aware of the deductible associated with their policy. The deductible is the amount the rider must pay out of pocket before the insurance coverage kicks in. Choosing a higher deductible can reduce insurance premiums but may result in higher out-of-pocket expenses in the event of a claim. It’s important for riders to carefully consider their financial situation and select a deductible that aligns with their risk tolerance and budget.

Conclusion: Empowering Riders with Knowledge

Understanding the factors that influence motorbike insurance pricing is a powerful tool for riders. By considering their rider profile, bike specifications, coverage choices, geographic location, and potential discounts, motorcyclists can make informed decisions to secure the best insurance coverage at the most competitive rates. Additionally, staying informed about the claims process and its potential impact on premiums can further empower riders to navigate the insurance landscape with confidence.

As the world of motorcycling continues to evolve, staying up-to-date with industry trends and best practices is essential. Riders can explore resources like motorcycle forums, insurance company websites, and independent reviews to gather valuable insights and make educated choices. With knowledge and careful consideration, riders can ensure they have the right insurance coverage to protect their investments and enjoy the thrill of the open road.

What is the average cost of motorbike insurance?

+The average cost of motorbike insurance can vary widely based on numerous factors, including the rider’s profile, bike specifications, coverage choices, and geographic location. While exact averages are difficult to determine due to these variables, riders can expect insurance premiums to range from a few hundred dollars to several thousand dollars annually.

Are there any ways to reduce motorbike insurance costs?

+Yes, there are several strategies riders can employ to potentially reduce their motorbike insurance costs. These include exploring discounts for safe riding courses, memberships, and multi-bike policies, as well as carefully considering coverage choices and deductibles. Additionally, riders can review their policies periodically to ensure they are getting the best rates and coverage for their needs.

How does my riding history impact insurance rates?

+Your riding history is a critical factor in determining insurance rates. Insurance companies closely examine claims history, accidents, and traffic violations to assess risk. Riders with a clean record are often rewarded with lower premiums, while those with a history of accidents or violations may face higher insurance costs. It’s important to maintain a safe riding record to keep insurance rates as low as possible.

What safety features can lower insurance costs for motorbikes?

+Motorcycles equipped with advanced safety features, such as anti-lock brakes (ABS), traction control, and stability control systems, are often eligible for insurance discounts. These features enhance the bike’s safety and reduce the risk of accidents, leading to lower insurance premiums. Additionally, security features like GPS tracking, alarm systems, and hardened locks can also contribute to insurance savings.