Mortgage Calculator With Pmi Taxes And Insurance

In the world of homeownership, understanding the true cost of your mortgage is essential. Beyond the principal and interest, there are additional expenses that can significantly impact your monthly budget. This article delves into the comprehensive mortgage calculator, exploring the factors that contribute to your overall mortgage payment, including Private Mortgage Insurance (PMI), property taxes, and homeowners insurance.

Unraveling the Mortgage Equation: Beyond Principal and Interest

When you embark on the journey of homeownership, it’s crucial to have a clear understanding of the financial commitments involved. While the principal and interest form the backbone of your mortgage payment, there are other critical components that need to be considered. These include Private Mortgage Insurance (PMI), property taxes, and homeowners insurance.

Let's delve into each of these elements and explore how they influence your monthly mortgage expenses.

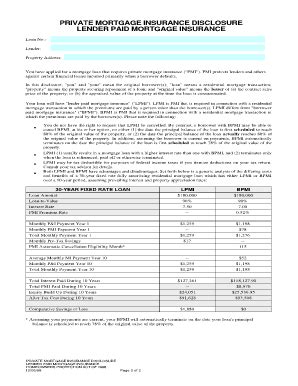

1. Private Mortgage Insurance (PMI): A Safety Net for Lenders

Private Mortgage Insurance, often referred to as PMI, is a common requirement for homebuyers who make a down payment of less than 20% of the home’s purchase price. PMI protects the lender in case of default, providing an added layer of security.

The cost of PMI is typically expressed as a percentage of the loan amount and is added to your monthly mortgage payment. It's important to note that PMI can be removed once you've reached a certain level of equity in your home, usually when the loan-to-value ratio (LTV) drops below 80%. This can be achieved through a combination of principal payments and home value appreciation.

For instance, let's consider a hypothetical scenario where you purchase a home valued at $300,000 with a 10% down payment. Your initial loan amount would be $270,000, and the monthly PMI cost could range from $50 to $100, depending on the lender and the specific mortgage product.

| Loan Amount | Monthly PMI Cost |

|---|---|

| $270,000 | $50 - $100 |

While PMI can add a significant burden to your monthly payments, it's a necessary step for many homebuyers to secure their dream homes. Fortunately, there are strategies to mitigate the impact of PMI, which we will explore further in this article.

2. Property Taxes: A Civic Duty with Financial Implications

Property taxes are a vital source of revenue for local governments and are used to fund essential services such as schools, emergency services, and infrastructure development. As a homeowner, you have a responsibility to contribute to these taxes, which can significantly impact your monthly mortgage payments.

The amount of property tax you owe is determined by the assessed value of your home and the tax rate set by your local government. It's important to note that property taxes can vary widely depending on your location and the specific services provided by your local authorities.

To illustrate, let's consider a homeowner in a suburban area with a home valued at $400,000. The annual property tax rate in this region is 1.5%. By multiplying the home's value by the tax rate, we can estimate the annual property tax bill as follows:

| Home Value | Tax Rate | Annual Property Tax |

|---|---|---|

| $400,000 | 1.5% | $6,000 |

This homeowner would expect to pay approximately $500 per month towards property taxes as part of their mortgage payment. It's worth noting that property tax assessments can change annually, so it's crucial to stay informed about any adjustments to your tax liability.

3. Homeowners Insurance: Protecting Your Investment

Homeowners insurance is a crucial aspect of homeownership, providing financial protection in the event of unforeseen circumstances such as natural disasters, theft, or accidents. This insurance coverage is essential to safeguard your investment and ensures that you can rebuild or repair your home in the face of adversity.

The cost of homeowners insurance can vary significantly depending on factors such as the location, size, and construction of your home, as well as the level of coverage you choose. On average, homeowners insurance can range from a few hundred to a few thousand dollars annually.

Let's consider an example where a homeowner has a standard policy with $300,000 in dwelling coverage and $100,000 in personal property coverage. The annual premium for this policy could be around $1,000. By dividing this amount by 12 months, we can estimate the monthly cost of homeowners insurance to be approximately $83.

| Dwelling Coverage | Personal Property Coverage | Annual Premium | Monthly Cost |

|---|---|---|---|

| $300,000 | $100,000 | $1,000 | $83 |

It's important to note that homeowners insurance is not a one-size-fits-all policy. You can customize your coverage to suit your specific needs and budget. By working with an insurance agent, you can explore different policy options and ensure that you have adequate protection without overspending.

Empowering Homebuyers: Strategies to Optimize Your Mortgage

As a prospective homeowner, understanding the intricacies of your mortgage payment is essential. By breaking down the components of your mortgage, you can make informed decisions that align with your financial goals and budget. Let’s explore some strategies to optimize your mortgage and make the most of your homeownership experience.

1. Maximizing Your Down Payment

One of the most effective ways to reduce your monthly mortgage payment and minimize the impact of PMI is by making a larger down payment. By putting down 20% or more of the home’s purchase price, you can avoid PMI altogether. This not only saves you money in the long run but also demonstrates your financial stability and commitment to homeownership.

For example, let's consider a homebuyer who is purchasing a home valued at $500,000. By making a 20% down payment, they can avoid PMI and potentially save hundreds of dollars each month. This strategy not only reduces their monthly expenses but also accelerates their equity buildup, allowing them to reach the point where they can cancel PMI sooner.

2. Exploring Alternative Mortgage Products

Not all mortgage products are created equal, and exploring alternative options can be beneficial. Some lenders offer specialized mortgage programs that may have lower down payment requirements or unique features to suit specific borrower profiles. For instance, government-backed loans such as FHA loans or VA loans often have more flexible down payment options and may be ideal for first-time homebuyers or those with unique financial circumstances.

Additionally, adjustable-rate mortgages (ARMs) can provide initial interest rate savings, which can be advantageous if you plan to sell your home within a few years. However, it's important to carefully consider the potential risks and understand the terms and conditions of such loans before making a decision.

3. Refinancing Your Mortgage

Refinancing your mortgage can be a strategic move to optimize your financial situation. By taking advantage of favorable market conditions or improving your credit score, you may be able to secure a lower interest rate and reduce your monthly payments. Refinancing can also provide an opportunity to remove PMI if your home’s value has increased, allowing you to cancel PMI earlier than anticipated.

Let's consider a homeowner who purchased their home a few years ago with a 30-year fixed-rate mortgage. Since then, they have consistently made on-time payments and have improved their credit score. By refinancing their mortgage, they may be able to lower their interest rate from 4.5% to 3.75%, resulting in a significant reduction in their monthly payments.

| Original Interest Rate | Refinanced Interest Rate | Monthly Payment Savings |

|---|---|---|

| 4.5% | 3.75% | $150 |

In this scenario, the homeowner could save $150 per month by refinancing their mortgage, providing additional financial flexibility and potentially accelerating their home equity buildup.

4. Strategically Managing Property Taxes

Property taxes are an unavoidable expense for homeowners, but there are strategies to minimize their impact. By staying informed about tax assessments and appealing them if necessary, you can ensure that your property taxes are fair and accurate. Additionally, some local governments offer tax relief programs or exemptions for eligible homeowners, which can provide significant savings.

Furthermore, it's crucial to maintain open communication with your local tax assessor's office. If you have made improvements to your home or believe your property value has been overestimated, you can request a reassessment. This can lead to a reduction in your property taxes, providing much-needed relief to your monthly budget.

5. Customizing Your Homeowners Insurance

Homeowners insurance is a vital aspect of homeownership, but it’s important to customize your policy to meet your specific needs. By reviewing your coverage annually and making adjustments as necessary, you can ensure that you have adequate protection without overspending. Consider factors such as your home’s replacement cost, personal property value, and any unique risks associated with your location.

For instance, if you live in an area prone to natural disasters such as hurricanes or earthquakes, you may need to purchase additional coverage to protect your home and belongings. By working closely with your insurance agent, you can create a customized policy that provides the right level of protection at a reasonable cost.

Conclusion: Empowering Homeownership with Financial Insight

Understanding the true cost of your mortgage is a critical step in the homeownership journey. By delving into the details of your mortgage payment, including PMI, property taxes, and homeowners insurance, you gain valuable insights into your financial commitments. This knowledge empowers you to make informed decisions, optimize your mortgage, and navigate the complexities of homeownership with confidence.

Throughout this article, we've explored the various components that contribute to your monthly mortgage payment and provided strategies to minimize their impact. By maximizing your down payment, exploring alternative mortgage products, and strategically managing your expenses, you can take control of your financial future and make your homeownership dreams a reality.

Remember, homeownership is a long-term commitment, and by staying informed and proactive, you can ensure that your mortgage works for you, not against you. With the right tools, knowledge, and strategies, you can achieve your financial goals and enjoy the many benefits of owning a home.

Frequently Asked Questions

What is the purpose of Private Mortgage Insurance (PMI)?

+

PMI is a type of insurance that protects lenders in case of borrower default. It provides an added layer of security, especially for homebuyers with a down payment of less than 20% of the home’s purchase price.

How can I reduce my monthly mortgage payment?

+

To reduce your monthly mortgage payment, you can consider making a larger down payment, exploring alternative mortgage products with lower interest rates or down payment requirements, or refinancing your mortgage when market conditions are favorable.

Are there any ways to minimize property tax expenses?

+

Yes, you can minimize property tax expenses by staying informed about tax assessments, appealing unfair assessments, and taking advantage of tax relief programs or exemptions offered by your local government.