What Is A Health Insurance Exchange

In the realm of healthcare and insurance, the concept of a Health Insurance Exchange, often simply referred to as an Exchange, plays a pivotal role in shaping the landscape of healthcare accessibility and affordability. This article delves into the intricacies of Health Insurance Exchanges, exploring their purpose, functionality, and impact on individuals and the healthcare system as a whole.

Understanding Health Insurance Exchanges

A Health Insurance Exchange is a regulated marketplace or platform where individuals and small businesses can shop for and purchase health insurance plans. It serves as a centralized hub, offering a transparent and standardized environment for consumers to compare and choose from a range of qualified health plans. This concept emerged as a key component of the Affordable Care Act (ACA) in the United States, with the goal of increasing competition, improving transparency, and expanding access to affordable healthcare coverage.

The Role of Exchanges in Healthcare

Health Insurance Exchanges are designed to empower individuals and families by providing them with a user-friendly platform to understand and navigate their healthcare coverage options. These exchanges aim to simplify the often complex process of selecting health insurance, ensuring that consumers have access to clear and comparable information about various plans, including their benefits, costs, and provider networks.

Additionally, Exchanges play a crucial role in promoting competition among insurance providers. By bringing multiple insurers together on a single platform, Exchanges create a competitive environment that can drive down prices and improve the quality of healthcare plans offered. This dynamic has the potential to significantly impact the affordability and accessibility of healthcare for millions of Americans.

Key Features and Benefits of Health Insurance Exchanges

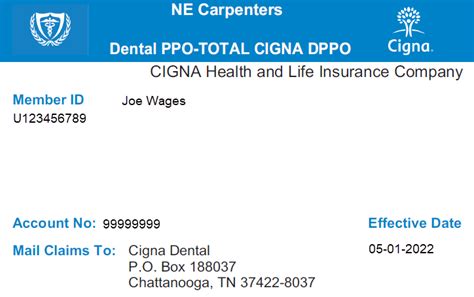

Standardized Information

One of the most significant advantages of Health Insurance Exchanges is the standardization of information. Exchanges present health plans in a uniform manner, making it easier for consumers to compare and contrast different options. This includes details such as monthly premiums, deductibles, co-pays, and the scope of coverage, including essential health benefits like hospitalization, emergency care, and prescription drugs.

Transparency and Consumer Protection

Exchanges are governed by regulations that promote transparency and consumer protection. This means that insurance providers must disclose clear and accurate information about their plans, ensuring that consumers are not misled. Additionally, Exchanges often include tools and resources to help consumers understand their healthcare options, making informed decisions easier.

Premium Subsidies and Cost Assistance

For many individuals and families, the cost of health insurance is a significant barrier to accessing adequate healthcare. Health Insurance Exchanges address this challenge by offering premium subsidies and cost assistance to eligible enrollees. These subsidies, in the form of tax credits, can reduce the monthly premium costs, making healthcare coverage more affordable for low- and middle-income households.

Competition and Innovation

The competitive nature of Health Insurance Exchanges encourages insurers to innovate and offer more attractive plans. This competition can lead to improved coverage options, enhanced customer service, and potentially lower costs over time. As insurers strive to attract consumers, the overall quality of healthcare plans available on Exchanges may increase, benefiting all enrollees.

Easy Enrollment and Year-Round Access

Health Insurance Exchanges typically offer a streamlined enrollment process, often with online platforms that simplify the application and selection process. Additionally, Exchanges provide year-round access to health insurance plans, allowing individuals to enroll or switch plans outside of the traditional open enrollment period. This flexibility is particularly beneficial for those experiencing life changes or seeking coverage outside of the standard enrollment window.

Performance and Impact of Health Insurance Exchanges

The implementation of Health Insurance Exchanges has had a notable impact on the healthcare landscape. Since their establishment, Exchanges have enrolled millions of Americans in health insurance plans, significantly increasing the percentage of insured individuals. This has led to improved access to healthcare services, particularly for those who were previously uninsured or underinsured.

Moreover, Exchanges have contributed to a more competitive and dynamic healthcare insurance market. Insurers have responded to the increased competition by introducing new plans, expanding provider networks, and offering more comprehensive benefits. This has resulted in a wider range of options for consumers, fostering a more consumer-centric healthcare insurance market.

| Key Performance Metrics | Value |

|---|---|

| Number of Enrollees (2023) | 14.5 million |

| Percentage of Uninsured Reduced | 20% (since 2013) |

| Average Premium Subsidy | $570 per month (2023) |

| Number of Participating Insurers | Over 200 (2023) |

Future Implications and Considerations

As Health Insurance Exchanges continue to evolve, several key considerations and potential developments may shape their future trajectory.

Expanding Access and Affordability

Efforts to expand access to Exchanges and enhance affordability are likely to remain a priority. This may involve extending premium subsidies to a broader range of income levels, simplifying enrollment processes, and improving outreach and education initiatives to ensure that eligible individuals are aware of their coverage options.

Innovations in Technology and Consumer Experience

The digital transformation of healthcare is likely to continue, with Exchanges investing in technology to enhance the consumer experience. This could include the development of user-friendly mobile applications, improved data analytics for personalized plan recommendations, and the integration of artificial intelligence to streamline processes and improve efficiency.

Addressing Regional Disparities

Regional variations in healthcare costs and coverage options are a challenge that Exchanges may aim to address. Strategies to mitigate these disparities could include regional collaborations among insurers, the development of standardized plans that can be offered across multiple states, and initiatives to attract a more diverse range of insurers to less competitive markets.

Policy and Regulatory Changes

The regulatory environment surrounding Health Insurance Exchanges is subject to change. Policy shifts at the federal and state levels can impact the structure and functioning of Exchanges, including eligibility criteria for subsidies, the scope of essential health benefits, and the overall design of the healthcare insurance marketplace. Staying abreast of these changes is crucial for understanding the future direction of Exchanges.

Conclusion

Health Insurance Exchanges have emerged as a pivotal mechanism for increasing access to affordable healthcare coverage. Their standardized and transparent approach to presenting healthcare options has empowered millions of Americans to make informed choices about their health insurance. As these Exchanges continue to evolve, their impact on the healthcare landscape is expected to be far-reaching, shaping the future of healthcare accessibility and affordability for years to come.

What is the purpose of a Health Insurance Exchange?

+A Health Insurance Exchange, or simply Exchange, is a regulated marketplace where individuals and small businesses can shop for and purchase health insurance plans. Its primary purpose is to increase competition, improve transparency, and expand access to affordable healthcare coverage.

How do Health Insurance Exchanges impact consumers?

+Exchanges empower consumers by providing a user-friendly platform to compare and choose from a range of qualified health plans. They offer standardized information, transparency, and often provide premium subsidies, making healthcare coverage more accessible and affordable.

What are the key benefits of Health Insurance Exchanges?

+Key benefits include standardized information for easy comparison, transparency and consumer protection, premium subsidies and cost assistance, a more competitive and innovative insurance market, and year-round access to health insurance plans.