Whole Life Insurance Versus Term

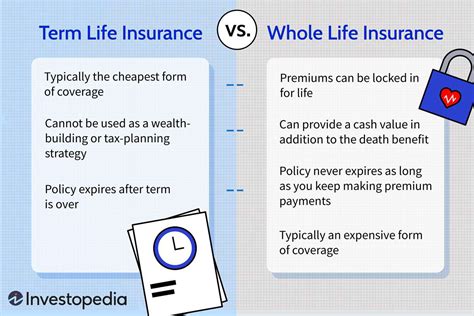

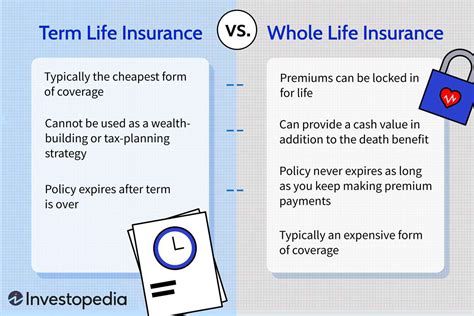

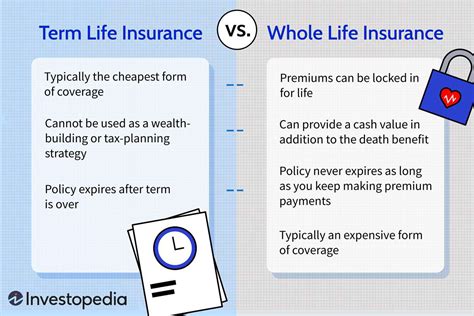

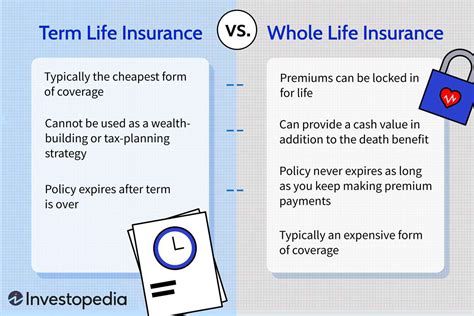

Navigating the world of insurance can be a complex task, especially when it comes to choosing the right type of life insurance policy. Two of the most common options available are whole life insurance and term life insurance. Understanding the differences between these two policies and their respective advantages and disadvantages is crucial for making an informed decision that aligns with your financial goals and long-term planning.

Whole Life Insurance: A Comprehensive Overview

Whole life insurance, also known as permanent life insurance, is a type of policy that provides coverage for the insured’s entire life, assuming the premiums are paid as required. This long-term investment not only offers a death benefit to beneficiaries but also accumulates cash value over time, which can be accessed through loans or withdrawals.

The premiums for whole life insurance remain level throughout the policy's duration, providing a sense of stability and predictability for policyholders. The policy's cash value grows at a guaranteed rate, determined by the insurance company, and can be used for various purposes such as emergency funds, supplemental retirement income, or even paying for future premiums.

Key Features of Whole Life Insurance

- Guaranteed Death Benefit: Whole life insurance provides a fixed amount of coverage that remains in force as long as premiums are paid.

- Cash Value Accumulation: Policyholders can access the cash value of their policy, which can be used for various financial needs.

- Flexible Premium Payment Options: Some whole life policies allow for varying premium amounts, providing flexibility in financial planning.

- Policy Loans: Borrow against the cash value of the policy without impacting the death benefit, offering a source of emergency funds.

| Pros of Whole Life Insurance | Cons of Whole Life Insurance |

|---|---|

| Lifetime Coverage | Higher Premiums |

| Cash Value Accumulation | Limited Investment Options |

| Policy Loans and Withdrawals | Potential Surrender Charges |

| Potential Tax Benefits | Complex and Less Transparent |

Term Life Insurance: A Focused Approach

Term life insurance, as the name suggests, offers coverage for a specific period of time, typically ranging from 10 to 30 years. Unlike whole life insurance, term policies do not accumulate cash value, and the premiums are generally much lower during the policy term.

This type of insurance is designed to provide financial protection during specific life stages, such as starting a family, purchasing a home, or during high-income earning years. Term life insurance is often seen as a more affordable option for individuals who require coverage for a defined period, without the need for a long-term investment or savings component.

Key Features of Term Life Insurance

- Level Premiums: Premiums remain constant throughout the term of the policy, providing predictable costs.

- Flexible Term Lengths: Policyholders can choose the duration of coverage based on their specific needs and financial goals.

- Renewable Options: Many term policies offer the opportunity to renew the policy at the end of the term, often at a higher premium.

- Convertibility: Some term policies can be converted to permanent life insurance, providing flexibility in the future.

| Pros of Term Life Insurance | Cons of Term Life Insurance |

|---|---|

| Lower Premiums | No Cash Value Accumulation |

| Flexible Term Lengths | Coverage Ends After the Term |

| Renewable Options | Premiums May Increase with Age |

| Convertibility to Permanent Life Insurance | May Not Cover Long-Term Financial Needs |

Comparative Analysis: Whole Life vs. Term Life Insurance

When comparing whole life and term life insurance, several key factors come into play. The choice between the two depends on individual financial goals, risk tolerance, and the desired level of coverage.

Cost and Premiums

Whole life insurance typically has higher premiums compared to term life insurance. The premiums for whole life insurance remain level throughout the policy’s duration, offering stability. In contrast, term life insurance premiums are generally lower but can increase as the policyholder ages.

Coverage Duration

Whole life insurance provides coverage for the insured’s entire life, as long as premiums are paid. This makes it an attractive option for those seeking long-term financial protection. Term life insurance, on the other hand, offers coverage for a specific term, after which the policy expires. Policyholders can choose the term length based on their needs, such as covering children’s education or mortgage payments.

Cash Value Accumulation

One of the unique features of whole life insurance is its ability to accumulate cash value over time. This cash value can be used for various purposes, such as emergency funds, supplemental retirement income, or even paying for future premiums. Term life insurance, however, does not offer any cash value accumulation.

Flexibility and Customization

Whole life insurance policies often come with more flexibility in terms of premium payments and coverage customization. Policyholders can choose to pay varying premiums, and some policies even allow for adjustments to the death benefit over time. Term life insurance, while offering flexible term lengths, may have more limited options for customization.

Potential Tax Benefits

Whole life insurance can offer certain tax benefits, as the cash value growth within the policy may be tax-deferred. Term life insurance, on the other hand, does not provide any significant tax advantages.

Making the Right Choice

Choosing between whole life and term life insurance depends on your personal financial situation, goals, and risk tolerance. Whole life insurance is ideal for those seeking long-term financial security and peace of mind, as it provides a guaranteed death benefit and the potential for cash value accumulation. However, the higher premiums and limited investment options may be a drawback for some.

Term life insurance, with its lower premiums and flexible term lengths, is an excellent choice for those seeking temporary coverage during specific life stages. It offers a cost-effective solution for financial protection during critical periods, such as starting a family or purchasing a home. However, it's important to consider the potential need for coverage beyond the term length and the possibility of increasing premiums with age.

Ultimately, the decision between whole life and term life insurance should be made after careful consideration of your unique circumstances and financial goals. Consulting with a financial advisor or insurance professional can provide valuable insights and guidance to help you make an informed choice.

What is the difference between whole life and term life insurance in terms of coverage duration?

+Whole life insurance provides coverage for the insured’s entire life, assuming premiums are paid. Term life insurance, on the other hand, offers coverage for a specific period, typically ranging from 10 to 30 years.

Can I convert my term life insurance policy to a whole life insurance policy later on?

+Yes, many term life insurance policies offer the option to convert to a permanent life insurance policy, such as whole life insurance, during a specific period of time. This provides flexibility for policyholders who may wish to transition to a long-term coverage option.

Are there any tax benefits associated with whole life insurance?

+Whole life insurance can offer certain tax advantages. The cash value growth within the policy may be tax-deferred, and the death benefit is typically received tax-free. However, it’s important to consult with a tax professional to understand the specific tax implications in your jurisdiction.