Vehicle Gap Insurance

Vehicle gap insurance, a specialized type of coverage, has become an essential consideration for vehicle owners seeking comprehensive protection. This policy fills the "gap" between an insured vehicle's actual cash value and any outstanding loan or lease balance, ensuring financial security in the event of a total loss or theft. As the automotive industry continues to evolve, with advancements in technology and changes in ownership models, understanding the nuances of gap insurance becomes increasingly vital. This article delves into the intricacies of vehicle gap insurance, exploring its benefits, coverage scenarios, and how it can provide peace of mind to vehicle owners.

Understanding Vehicle Gap Insurance

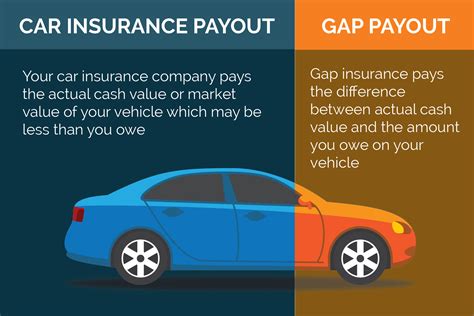

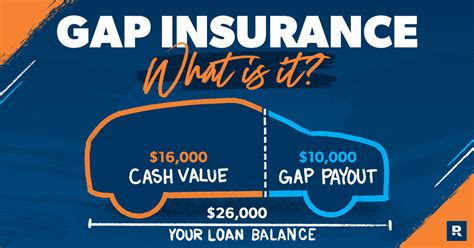

Vehicle gap insurance, often referred to as guaranteed asset protection (GAP) insurance, is a form of coverage designed to bridge the financial gap that can occur when a vehicle is declared a total loss by an insurance company but still has an outstanding loan or lease balance. This situation commonly arises due to depreciation, where the vehicle’s value decreases over time, often more rapidly than the reduction in the loan or lease balance.

Consider a scenario where you purchase a new car for $30,000 and take out a loan for the full amount. After a year, the car's value drops to $25,000 due to depreciation, but you still owe $28,000 on the loan. If the vehicle is involved in an accident and deemed a total loss, the insurance company will pay out the actual cash value of the car, which is $25,000. However, this leaves a gap of $3,000 between the insurance payout and the remaining loan balance. This is where gap insurance steps in, covering the difference and ensuring you are not left with a substantial financial burden.

| Key Aspect | Description |

|---|---|

| Coverage Type | Specialized insurance covering the difference between a vehicle's actual cash value and loan/lease balance. |

| Primary Purpose | To protect vehicle owners from financial loss in cases of total vehicle loss or theft. |

| Common Scenarios | Accidents, theft, or other incidents resulting in a total loss declaration by the insurance company. |

Benefits of Vehicle Gap Insurance

Financial Protection

The primary benefit of gap insurance is its ability to provide financial protection in situations where a vehicle’s value has depreciated significantly. By covering the gap between the insurance payout and the remaining loan or lease balance, gap insurance ensures that vehicle owners do not face unexpected financial obligations.

Peace of Mind

Knowing that you are covered in the event of a total loss can provide significant peace of mind. Vehicle owners can drive with the assurance that, should the worst happen, they will not be left with a substantial debt. This is particularly important for those who have taken out loans or leases for their vehicles, as the financial burden of a total loss can be significant.

Cost-Effectiveness

Gap insurance is often more affordable than one might expect, especially when considering the potential financial risks it mitigates. The cost of gap insurance can vary depending on factors such as the vehicle’s make and model, the loan or lease terms, and the coverage provider. However, it is generally a one-time fee or can be included in the overall loan or lease package, making it a cost-effective way to ensure comprehensive protection.

Coverage Scenarios and Considerations

Total Loss Declaration

Gap insurance primarily comes into play when a vehicle is declared a total loss by an insurance company. This typically occurs in situations where the cost of repairing the vehicle exceeds a certain percentage of its pre-accident value, often around 75%. In such cases, the insurance company will pay out the actual cash value of the vehicle, which may not cover the outstanding loan or lease balance.

Lease vs. Purchase

Gap insurance is particularly beneficial for those who lease their vehicles. In a lease scenario, the vehicle is returned to the leasing company at the end of the term, and the outstanding balance typically covers the remaining depreciation. However, if the vehicle is declared a total loss, the leasing company may still expect the lessee to pay the remaining balance. Gap insurance can cover this difference, ensuring the lessee is not responsible for additional costs.

Loan Repayment

For vehicle owners who have taken out loans, gap insurance can provide crucial protection. In the event of a total loss, the insurance payout may not cover the remaining loan balance, leaving the owner responsible for paying off the difference. Gap insurance steps in to cover this gap, ensuring the loan is fully repaid and the owner is not left with a financial burden.

Additional Coverage Options

While gap insurance focuses on covering the gap between a vehicle’s value and its loan or lease balance, there are other coverage options available to vehicle owners. These include comprehensive and collision insurance, which cover damage to the vehicle from various causes, and personal injury protection (PIP) or medical payments coverage, which cover medical expenses for injuries sustained in an accident.

| Coverage Type | Description |

|---|---|

| Comprehensive | Covers damage to the vehicle from non-collision incidents, such as theft, vandalism, or natural disasters. |

| Collision | Covers damage to the vehicle resulting from a collision with another object or vehicle. |

| Personal Injury Protection (PIP) / Medical Payments | Covers medical expenses for injuries sustained in an accident, regardless of fault. |

Performance Analysis and Real-World Examples

Claim Settlement

The performance of gap insurance is best evaluated through real-world claim settlement scenarios. For instance, consider a vehicle owner who purchased gap insurance along with their comprehensive coverage. In an unfortunate accident, the vehicle is deemed a total loss, and the insurance company offers a settlement of 20,000, which is the actual cash value of the vehicle at the time of the accident. However, the owner still owes 25,000 on their loan. With gap insurance in place, the insurance company covers the additional $5,000, ensuring the owner is not left with a financial deficit.

Lease Termination

Gap insurance is especially beneficial for individuals who lease their vehicles. In a lease termination scenario, if the vehicle is involved in an accident and declared a total loss, the leasing company may still expect the lessee to pay off the remaining lease balance. Gap insurance steps in to cover this difference, ensuring the lessee is not held responsible for an additional financial burden.

Depreciation Factors

The effectiveness of gap insurance is closely tied to the rate of depreciation of the insured vehicle. Vehicles that depreciate rapidly, such as certain luxury or sports car models, may benefit significantly from gap insurance. On the other hand, vehicles that retain their value over time may not see as much value in gap insurance, as the gap between the vehicle’s value and the loan or lease balance may not be substantial.

Evidence-Based Future Implications

Automotive Industry Trends

As the automotive industry continues to evolve, with advancements in electric vehicles (EVs) and autonomous driving technologies, the landscape of vehicle ownership and leasing is likely to change. Gap insurance will need to adapt to these changing dynamics, particularly as EV values and depreciation rates may differ significantly from traditional vehicles.

Technological Advancements

The integration of advanced technologies in vehicles, such as telematics and connected car systems, can provide valuable data for insurance companies. This data can be used to more accurately assess the value of vehicles, potentially impacting the need and pricing of gap insurance. Additionally, as autonomous vehicles become more prevalent, the nature of accidents and claims may change, further influencing the role of gap insurance.

Regulatory Changes

Regulatory bodies and insurance providers may introduce new policies or guidelines related to gap insurance. For instance, there may be increased scrutiny on the accuracy of vehicle valuations, or new standards for determining total loss declarations. Vehicle owners and insurers will need to stay abreast of these changes to ensure compliance and optimal coverage.

Consumer Awareness

As consumer awareness of financial protection products increases, there is likely to be a greater understanding of the value of gap insurance. Education and outreach efforts can play a significant role in ensuring vehicle owners are aware of the potential risks associated with vehicle ownership and the benefits of gap insurance in mitigating these risks.

Is gap insurance necessary for all vehicle owners?

+

Gap insurance is particularly beneficial for individuals who have financed or leased their vehicles, as it protects them from potential financial losses in the event of a total loss or theft. However, the need for gap insurance depends on individual circumstances, including the type of vehicle, the loan or lease terms, and the owner’s financial situation. It is recommended to carefully assess one’s specific needs and consult with insurance professionals to determine if gap insurance is a suitable option.

How does gap insurance differ from other types of vehicle insurance?

+

Gap insurance is a specialized form of coverage that specifically addresses the financial gap between a vehicle’s actual cash value and its outstanding loan or lease balance in cases of total loss or theft. It complements, but does not replace, other types of vehicle insurance such as comprehensive and collision coverage, which protect against physical damage to the vehicle, and personal injury protection (PIP) or medical payments coverage, which cover medical expenses for injuries sustained in an accident.

Can gap insurance be purchased at any time during vehicle ownership?

+

Gap insurance is typically most effective when purchased at the time of acquiring the vehicle, either as an add-on to the initial insurance policy or as part of the loan or lease agreement. However, some insurance providers may offer gap insurance as an optional coverage even after the vehicle has been purchased. It is important to note that the availability and terms of gap insurance may vary depending on the insurance provider and the specific circumstances of the vehicle ownership.

What factors influence the cost of gap insurance?

+

The cost of gap insurance can vary based on several factors, including the make and model of the vehicle, the terms of the loan or lease, the coverage provider, and the duration of the coverage. Vehicles that depreciate rapidly, such as certain luxury or sports car models, may have higher gap insurance premiums. Additionally, the length of the loan or lease term and the amount of the loan or lease balance can also impact the cost of gap insurance.

How can vehicle owners ensure they are adequately protected by gap insurance?

+

To ensure adequate protection, vehicle owners should carefully review their gap insurance policy, including the terms and conditions, the coverage limits, and any exclusions or limitations. It is crucial to understand how the policy defines “total loss” and how the gap between the vehicle’s value and the loan or lease balance is calculated. Additionally, regular communication with the insurance provider and staying informed about any changes to the policy can help vehicle owners maintain optimal protection.