Glic Insurance

Welcome to a comprehensive exploration of Glic Insurance, a leading name in the insurance industry. With a rich history spanning decades, Glic Insurance has established itself as a trusted provider, offering a diverse range of insurance solutions tailored to meet the unique needs of its clients. This article delves into the company's background, its product offerings, and the innovative approaches it employs to enhance customer experiences and satisfaction.

A Legacy of Trust: The Glic Insurance Story

Glic Insurance, headquartered in the heart of [city], boasts a legacy that extends back to [year]. Founded by [founder’s name], a visionary with a passion for financial security, the company’s initial focus was on providing comprehensive life insurance policies to individuals and families. Over the years, Glic Insurance has expanded its reach, branching out into various insurance sectors, including health, property, and commercial insurance.

The company's rapid growth can be attributed to its unwavering commitment to client satisfaction. Glic Insurance understands that insurance is not just a financial product but a means to provide peace of mind and security. With this philosophy at its core, the company has built a reputation for excellence, becoming a household name synonymous with reliability and integrity.

One of the key strengths of Glic Insurance lies in its ability to adapt to the ever-evolving insurance landscape. The company continuously invests in research and development, staying abreast of the latest industry trends and technological advancements. This proactive approach has enabled Glic Insurance to offer cutting-edge solutions, ensuring its products remain relevant and competitive in a dynamic market.

Product Portfolio: A Comprehensive Range of Insurance Solutions

Glic Insurance’s product portfolio is diverse and comprehensive, catering to a wide range of insurance needs. Let’s explore some of the key offerings that have solidified the company’s position as a leader in the industry.

Life Insurance: Securing Your Legacy

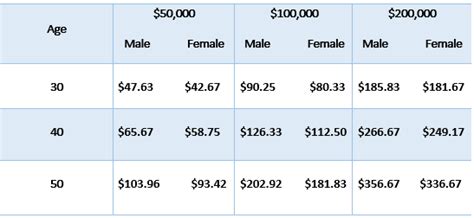

At the core of Glic Insurance’s offerings is its extensive range of life insurance policies. These policies are designed to provide financial protection to individuals and their families, ensuring that loved ones are taken care of in the event of unforeseen circumstances. Glic Insurance offers term life insurance, whole life insurance, and various other customized plans to suit different financial goals and needs.

One of the standout features of Glic Insurance's life insurance policies is their flexibility. Clients can choose from a variety of riders and additional benefits, tailoring their coverage to their specific requirements. Whether it's providing for a growing family, securing a child's future education, or planning for retirement, Glic Insurance's life insurance products offer the necessary financial security.

| Life Insurance Plans | Key Features |

|---|---|

| Term Life Insurance | Affordable coverage for a specified term, ideal for short-term financial protection. |

| Whole Life Insurance | Permanent coverage with cash value accumulation, offering lifelong protection. |

| Universal Life Insurance | Flexible coverage with adjustable premiums and death benefits, providing customization options. |

| Annuities | Long-term investment plans that provide regular income during retirement. |

Health Insurance: Prioritizing Your Well-being

Glic Insurance recognizes the importance of good health and the financial burdens that can accompany medical expenses. To address this, the company offers a comprehensive range of health insurance plans, designed to provide individuals and families with the necessary coverage to access quality healthcare.

From basic health maintenance plans to more comprehensive packages covering hospitalization, prescription drugs, and specialized treatments, Glic Insurance's health insurance offerings cater to a wide spectrum of healthcare needs. The company's plans often include preventive care benefits, encouraging policyholders to prioritize their health and well-being.

| Health Insurance Plans | Key Features |

|---|---|

| Individual Health Insurance | Personalized coverage for individuals, including preventive care, hospitalization, and prescription drug benefits. |

| Family Health Insurance | Comprehensive coverage for families, with additional benefits such as maternity care and pediatric services. |

| Senior Health Insurance | Specialized plans catering to the unique healthcare needs of seniors, including coverage for chronic conditions and long-term care. |

Property and Casualty Insurance: Protecting Your Assets

Glic Insurance understands that assets are an integral part of an individual’s financial security. To safeguard these assets, the company offers a comprehensive suite of property and casualty insurance solutions.

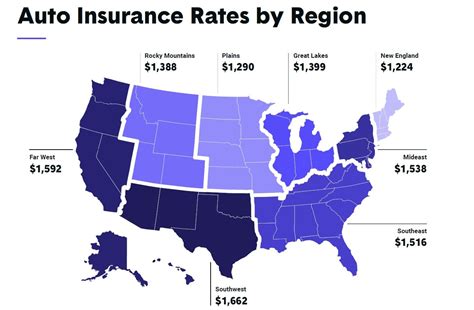

Whether it's homeowners insurance to protect against damage to your residence, auto insurance to cover your vehicles, or liability insurance to safeguard against legal risks, Glic Insurance's property and casualty insurance products provide the necessary peace of mind. The company's policies are designed to be flexible, allowing policyholders to customize their coverage based on their unique needs.

| Property and Casualty Insurance | Key Features |

|---|---|

| Homeowners Insurance | Coverage for damage to your home, including fire, theft, and natural disasters, with additional options for personal liability and guest medical protection. |

| Auto Insurance | Comprehensive coverage for vehicles, including liability, collision, and comprehensive protection, with optional add-ons such as rental car coverage and roadside assistance. |

| Business Insurance | Tailored coverage for small businesses, including general liability, property insurance, and professional liability, with options for cyber liability and business interruption coverage. |

Innovative Approaches: Enhancing the Customer Experience

Glic Insurance’s commitment to innovation is evident in its approach to customer service and digital solutions. The company recognizes that insurance can be complex, and it strives to simplify the process for its clients, making it more accessible and efficient.

Digital Platforms: Streamlining Insurance Processes

Glic Insurance has invested heavily in developing user-friendly digital platforms, allowing clients to manage their insurance policies conveniently and efficiently. Policyholders can access their accounts online, view policy details, make payments, and even file claims, all from the comfort of their homes.

The company's mobile app, available on both iOS and Android devices, offers an additional layer of convenience. Policyholders can receive real-time updates on their claims, access digital ID cards, and even use the app's GPS-enabled features to locate nearby repair shops or medical facilities.

Personalized Customer Service: A Human Touch

While digital solutions are essential, Glic Insurance understands the value of personal interaction. The company maintains a dedicated team of customer service representatives who are readily available to assist clients with their insurance needs. Whether it’s clarifying policy details, discussing coverage options, or providing support during the claims process, Glic Insurance’s customer service team ensures a personalized and supportive experience.

Furthermore, Glic Insurance offers educational resources and workshops to help clients better understand their insurance policies and the claims process. This proactive approach to customer education empowers policyholders to make informed decisions and navigate the insurance landscape with confidence.

Claim Management: A Seamless Process

Glic Insurance’s claim management process is designed to be efficient and stress-free for policyholders. The company utilizes advanced technology to streamline the claims process, ensuring that claims are processed promptly and accurately. Policyholders can track the progress of their claims online, receive regular updates, and even upload supporting documents digitally, eliminating the need for lengthy paperwork.

In the event of a complex claim, Glic Insurance's dedicated claims team provides personalized support, guiding policyholders through the process and ensuring a fair and timely resolution. The company's commitment to customer satisfaction extends to its claim management practices, ensuring that clients receive the support they need during challenging times.

The Future of Glic Insurance: Continuous Growth and Innovation

As the insurance landscape continues to evolve, Glic Insurance remains committed to staying at the forefront of industry advancements. The company’s strategic focus on innovation and customer-centric approaches positions it well for continued growth and success.

Glic Insurance's future plans include further expansion into emerging insurance sectors, such as cyber insurance and environmental liability coverage. The company is also exploring partnerships with fintech companies to leverage innovative technologies, such as blockchain and artificial intelligence, to enhance its operational efficiency and customer experiences.

Additionally, Glic Insurance is dedicated to fostering a culture of sustainability and corporate social responsibility. The company aims to reduce its environmental footprint and promote sustainable practices throughout its operations. This commitment extends to its investment strategies, with a focus on supporting environmentally and socially responsible initiatives.

As Glic Insurance continues to evolve, its commitment to providing comprehensive insurance solutions, coupled with its focus on customer satisfaction and innovation, positions it as a leading force in the insurance industry. With a rich history and a forward-thinking mindset, Glic Insurance is well-equipped to meet the diverse needs of its clients, both now and in the future.

FAQs

What makes Glic Insurance’s life insurance policies unique?

+

Glic Insurance’s life insurance policies stand out for their flexibility and customization options. Policyholders can choose from a range of riders and additional benefits, tailoring their coverage to their specific financial goals and needs. This level of personalization ensures that clients receive the right protection for their unique circumstances.

How does Glic Insurance’s digital platform enhance the customer experience?

+

Glic Insurance’s digital platform offers policyholders convenient access to their insurance policies. They can manage their accounts online, make payments, and even file claims digitally. The mobile app provides additional features, such as real-time claim updates and GPS-enabled location services, making the insurance process more efficient and user-friendly.

What sets Glic Insurance’s health insurance plans apart from competitors?

+

Glic Insurance’s health insurance plans are designed with a focus on comprehensive coverage and preventive care. The plans often include additional benefits such as maternity care, pediatric services, and specialized treatments, ensuring that policyholders have access to quality healthcare. The company’s dedication to customer education further enhances the value of its health insurance offerings.

How does Glic Insurance ensure a fair and timely claim resolution process?

+

Glic Insurance’s claim management process is streamlined and efficient. The company utilizes advanced technology to process claims promptly and accurately. In the event of a complex claim, the dedicated claims team provides personalized support, guiding policyholders through the process and ensuring a fair and timely resolution. The company’s focus on customer satisfaction is evident in its claims management practices.

What are Glic Insurance’s plans for the future?

+

Glic Insurance is committed to continuous growth and innovation. The company plans to expand into emerging insurance sectors, such as cyber insurance and environmental liability coverage. Additionally, Glic Insurance aims to leverage partnerships with fintech companies to integrate innovative technologies into its operations, enhancing efficiency and customer experiences. The company’s focus on sustainability and corporate social responsibility further solidifies its position as a leading insurance provider.