Car Insurance And Quote

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind for drivers. Obtaining a car insurance quote is the first step towards securing coverage tailored to your specific needs. In this comprehensive guide, we will delve into the world of car insurance, exploring the factors that influence quotes, the types of coverage available, and the steps to secure the best possible insurance plan. By understanding the intricacies of car insurance and quotes, you can make informed decisions to protect your vehicle and yourself on the road.

Understanding Car Insurance Quotes

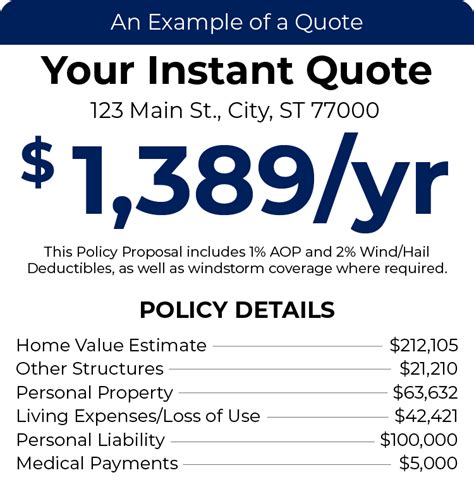

A car insurance quote is an estimate of the cost of your insurance policy, based on various factors that assess the level of risk associated with insuring your vehicle. Insurance companies use these quotes to determine the premium you will pay for coverage. Quotes are not set in stone; they can vary depending on the information provided and the insurer's assessment of your driving profile.

Factors Influencing Car Insurance Quotes

- Vehicle Type and Usage: The make, model, and year of your car play a significant role in determining your insurance quote. Additionally, the primary use of your vehicle (e.g., commuting, business, pleasure) can impact the cost.

- Driver Profile: Your age, gender, driving record, and years of experience are crucial factors. Young and inexperienced drivers, for instance, often face higher premiums due to the perceived risk.

- Location and Address: The area where you live and park your car can affect your quote. Urban areas with higher accident rates and theft risks may result in increased insurance costs.

- Coverage Requirements: The level of coverage you choose, such as liability, comprehensive, and collision, directly influences your quote. More extensive coverage typically leads to higher premiums.

- Discounts and Bundles: Many insurance providers offer discounts for various reasons, including safe driving records, multiple policies (e.g., home and auto), and safety features on your vehicle.

Types of Car Insurance Coverage

Car insurance policies typically offer a range of coverage options to cater to different needs. Understanding these coverages is essential when seeking a quote and selecting the right policy.

- Liability Coverage: This is the most basic form of car insurance, covering damages and injuries you cause to others in an accident. It includes both bodily injury and property damage liability.

- Collision Coverage: This coverage pays for repairs to your vehicle after an accident, regardless of who is at fault. It protects you from high repair costs, especially for newer or valuable cars.

- Comprehensive Coverage: Comprehensive insurance covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or animal collisions. It provides broad protection for your vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards you financially if you're involved in an accident with a driver who has little or no insurance. It ensures you're not left with substantial out-of-pocket expenses.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers after an accident, regardless of fault. It provides quick access to medical care and covers a range of treatment options.

Securing the Best Car Insurance Quote

Obtaining the most favorable car insurance quote requires a combination of research, comparison, and an understanding of your specific needs. Here are some steps to help you secure the best possible deal:

- Research Insurance Providers: Explore different insurance companies and their reputations. Look for reviews, customer satisfaction ratings, and financial stability to ensure you're dealing with a reliable insurer.

- Compare Quotes: Obtain quotes from multiple insurers to compare costs and coverage options. Online comparison tools can simplify this process, allowing you to quickly assess different policies side by side.

- Assess Your Coverage Needs: Evaluate your specific requirements based on your vehicle, driving habits, and personal preferences. Consider the level of coverage you desire and the potential costs associated with different scenarios.

- Utilize Discounts: Insurance providers often offer discounts for various reasons. Common discounts include safe driving records, multi-policy bundles, safety features on your vehicle, and even educational achievements or occupational affiliations. Ask about available discounts and ensure you're taking advantage of all applicable options.

- Consider Payment Options: Some insurers provide flexibility in payment plans, allowing you to choose between monthly, quarterly, or annual payments. Evaluate the impact of different payment schedules on your budget and select the option that best suits your financial situation.

- Read the Fine Print: Carefully review the policy documents and understand the terms and conditions of the insurance contract. Pay attention to exclusions, deductibles, and any limitations to ensure you're fully aware of what is and isn't covered.

- Bundle Policies: If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same insurer. Bundling can often result in significant savings and streamlined management of your insurance portfolio.

- Seek Expert Advice: Consult with insurance agents or brokers who can provide personalized guidance based on your circumstances. They can offer insights into the best coverage options and help you navigate the complexities of car insurance.

Performance Analysis and Future Implications

Car insurance quotes and policies have evolved over time to adapt to changing driving trends and technological advancements. Here's an analysis of recent developments and their potential impact on the future of car insurance:

- Telematics and Usage-Based Insurance (UBI): With the rise of telematics technology, insurers can now track driving behavior in real-time. UBI policies offer customized premiums based on how, when, and where you drive. This data-driven approach could revolutionize car insurance, rewarding safe driving habits and providing more accurate risk assessments.

- Electric and Autonomous Vehicles: The increasing popularity of electric vehicles (EVs) and the impending arrival of autonomous cars present new challenges and opportunities for insurers. EVs may require specialized coverage for battery replacement, while autonomous vehicles could significantly reduce accident rates, impacting liability and collision insurance needs.

- Data Analytics and AI: Advanced data analytics and artificial intelligence (AI) are transforming the insurance industry. Insurers can now use vast amounts of data to predict risks and personalize policies. AI-driven claims processing and fraud detection systems are enhancing efficiency and accuracy.

- Online and Digital Platforms: The shift towards digital interactions and online insurance platforms has streamlined the quote and policy acquisition process. Insurers are investing in user-friendly interfaces and chatbots to provide instant quotes and policy management. This trend is expected to continue, offering greater convenience and accessibility to consumers.

- Collaborative and Shared Mobility: The sharing economy and collaborative mobility models, such as ride-sharing and car-sharing services, are impacting car insurance. Insurers are developing policies that cater to these new business models, ensuring adequate coverage for both drivers and passengers in shared mobility arrangements.

Frequently Asked Questions

How often should I review my car insurance policy and quotes?

+It's advisable to review your car insurance policy and quotes annually, or whenever significant changes occur in your life or driving circumstances. This ensures you have adequate coverage and are not overpaying for unnecessary features.

<div class="faq-item">

<div class="faq-question">

<h3>Can I negotiate car insurance quotes with insurers?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While car insurance quotes are based on standardized algorithms, you can still negotiate with insurers to some extent. Discussing your specific needs, driving record, and any unique circumstances may lead to a more favorable quote.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I need to make a claim on my car insurance policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you need to make a claim, contact your insurance provider as soon as possible. They will guide you through the claims process, which typically involves filing a report, providing necessary documentation, and potentially arranging repairs or settlements.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any alternative insurance options for high-risk drivers with poor driving records?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, some insurance providers specialize in high-risk drivers with poor driving records. These insurers offer non-standard policies with higher premiums to cater to drivers who may have had accidents, traffic violations, or license suspensions. It's worth exploring these options if you fall into this category.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I know if I have the right amount of car insurance coverage?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Assessing your coverage needs involves considering your financial situation, the value of your vehicle, and your risk tolerance. Speak with an insurance agent or broker to determine the appropriate levels of liability, collision, and comprehensive coverage for your circumstances.</p>

</div>

</div>

</div>