Montana Marketplace Insurance

In the vast landscape of Montana, where the open skies meet the rugged mountains, healthcare is a crucial aspect of life. Montana Marketplace Insurance, also known as the Montana Health Insurance Marketplace, plays a vital role in ensuring that residents of this beautiful state have access to affordable and comprehensive healthcare coverage. This article will delve into the intricacies of Montana Marketplace Insurance, exploring its history, coverage options, benefits, and its impact on the healthcare landscape of Montana.

The Evolution of Montana Marketplace Insurance

Montana’s journey towards establishing a robust healthcare marketplace began with the implementation of the Affordable Care Act (ACA) in 2010. The ACA aimed to increase access to healthcare coverage and improve affordability, particularly for those who were previously uninsured or underinsured. Montana, recognizing the importance of healthcare for its residents, embraced the opportunity to create a state-based insurance marketplace.

The Montana Marketplace Insurance was officially launched in 2014, providing a centralized platform for individuals and small businesses to compare and purchase health insurance plans. This marketplace, governed by the state's Department of Health and Human Services, has since become a vital resource for Montanans seeking affordable healthcare options.

Coverage Options and Benefits

Montana Marketplace Insurance offers a wide range of coverage options to cater to the diverse needs of its residents. Here’s an overview of the key coverage types available:

Individual and Family Plans

Individual and family plans are designed for Montanans who are self-employed, uninsured, or seeking coverage outside of employer-sponsored plans. These plans offer flexibility and customization, allowing individuals to choose the level of coverage that best suits their needs and budget.

One of the standout features of Montana Marketplace Insurance is its emphasis on preventative care. Many plans cover essential health benefits, including annual check-ups, immunizations, and screenings, at no additional cost. This proactive approach to healthcare ensures that Montanans can stay on top of their health and catch potential issues early.

Small Business Plans

Montana Marketplace Insurance recognizes the unique challenges faced by small businesses when it comes to providing healthcare coverage for their employees. To address this, the marketplace offers Small Business Health Options Program (SHOP) plans. These plans allow small businesses to offer group health insurance to their employees, with the added benefit of tax credits for eligible businesses.

SHOP plans provide small businesses with a range of options, including different levels of coverage and cost-sharing. This flexibility ensures that businesses can find a plan that aligns with their budget and the needs of their workforce. Additionally, SHOP plans often come with resources and support to help businesses navigate the complexities of healthcare coverage.

Medicaid and CHIP

Montana Marketplace Insurance also serves as a gateway to Medicaid and the Children’s Health Insurance Program (CHIP), both of which provide essential healthcare coverage for low-income individuals and families. Through the marketplace, eligible residents can easily apply for and enroll in these programs, ensuring that no one is left without access to necessary medical services.

Medicaid and CHIP cover a comprehensive range of services, including doctor visits, hospital stays, prescription medications, and even dental and vision care for children. By connecting Montanans to these programs, the marketplace plays a crucial role in promoting health equity and ensuring that financial constraints do not prevent individuals from receiving the care they need.

Navigating the Marketplace: A Step-by-Step Guide

For those new to Montana Marketplace Insurance, the process of selecting a health insurance plan can seem daunting. However, with the right guidance and resources, it becomes a manageable task. Here’s a step-by-step guide to help you navigate the marketplace:

- Assess Your Needs: Before diving into the marketplace, take some time to evaluate your healthcare needs. Consider factors such as your age, existing medical conditions, and the frequency of doctor visits. Understanding your needs will help you choose a plan that provides adequate coverage without unnecessary expenses.

- Compare Plans: The Montana Marketplace Insurance website offers a user-friendly platform where you can compare different health insurance plans. Take advantage of the filters and search tools to narrow down your options based on your preferences, such as preferred healthcare providers or prescription drug coverage.

- Understand Cost-Sharing: Health insurance plans typically involve cost-sharing, which means you'll pay a portion of your healthcare expenses out of pocket. Familiarize yourself with terms like deductibles, copayments, and coinsurance. Understanding these terms will help you make informed decisions about the affordability and coverage of each plan.

- Check for Tax Credits: Montana Marketplace Insurance offers tax credits to eligible individuals and families to help make health insurance more affordable. These credits can significantly reduce your monthly premiums. Make sure to check your eligibility and apply for any available tax credits when enrolling in a plan.

- Enroll During Open Enrollment: Open Enrollment is the designated period each year when you can enroll in a new health insurance plan or make changes to your existing coverage. It's important to mark your calendar and stay informed about the Open Enrollment dates to ensure you don't miss out on the opportunity to secure coverage.

- Special Enrollment Periods: In certain situations, such as losing your job or experiencing a change in family status, you may be eligible for a Special Enrollment Period outside of the regular Open Enrollment timeframe. These periods allow you to enroll in a new plan or make changes to your coverage. Stay informed about the criteria for Special Enrollment to take advantage of these opportunities when needed.

The Impact of Montana Marketplace Insurance

Since its inception, Montana Marketplace Insurance has had a significant impact on the healthcare landscape of the state. Here are some key ways in which it has made a difference:

Increased Access to Healthcare

One of the primary goals of the marketplace is to increase access to healthcare for all Montanans. By providing a centralized platform for insurance comparison and enrollment, the marketplace has made it easier for individuals and families to find and obtain affordable coverage. This has led to a notable decrease in the number of uninsured residents, ensuring that more people can access the medical care they need.

Affordability and Financial Support

Montana Marketplace Insurance has played a crucial role in making healthcare more affordable for Montanans. Through the availability of tax credits and cost-sharing reductions, many individuals and families have been able to secure coverage that aligns with their financial means. This has not only improved access to healthcare but also reduced the financial burden associated with medical expenses.

Additionally, the marketplace has introduced innovative programs and partnerships to further enhance affordability. For example, the Montana Premium Assistance Program provides additional financial support to eligible individuals, helping them afford their insurance premiums. Such initiatives demonstrate the marketplace's commitment to ensuring that healthcare is accessible to all, regardless of income level.

Promoting Health Equity

Montana Marketplace Insurance has actively worked towards promoting health equity by addressing disparities in healthcare access. By offering coverage options tailored to the needs of diverse populations, the marketplace ensures that all Montanans, regardless of their background or socioeconomic status, have the opportunity to receive quality healthcare.

Furthermore, the marketplace's focus on preventative care and the inclusion of essential health benefits has had a positive impact on the overall health of the state's residents. By encouraging regular check-ups and early detection of health issues, Montana Marketplace Insurance contributes to the long-term well-being of the community.

Improving Quality of Care

Beyond providing access to healthcare, Montana Marketplace Insurance has also influenced the quality of care delivered to its residents. By partnering with reputable healthcare providers and emphasizing the importance of preventative care, the marketplace has helped raise the standard of medical services across the state.

Additionally, the marketplace's emphasis on transparency and consumer education has empowered Montanans to make informed decisions about their healthcare. With clear and accessible information about plan benefits and provider networks, individuals can choose plans that align with their preferences and ensure they receive the highest quality of care.

Future Outlook and Innovations

As Montana Marketplace Insurance continues to evolve, it remains committed to meeting the changing needs of its residents. Here’s a glimpse into the future and some potential innovations we can expect:

Digital Transformation

The marketplace is increasingly embracing digital technologies to enhance the user experience and improve efficiency. We can anticipate further developments in online enrollment processes, making it even more convenient for Montanans to compare and select health insurance plans. Additionally, the integration of digital tools for claim management and provider search is likely to streamline the overall healthcare experience.

Expanded Coverage Options

Montana Marketplace Insurance is likely to explore partnerships and collaborations to expand the range of coverage options available to its residents. This may include the introduction of new plan types, such as short-term health insurance or supplemental coverage options, to cater to the diverse needs of the population. By offering a wider array of choices, the marketplace can better meet the specific requirements of different demographics.

Enhanced Consumer Support

Recognizing the importance of consumer education and support, the marketplace is likely to invest in resources and initiatives to assist Montanans throughout their healthcare journey. This could involve the expansion of consumer assistance programs, the implementation of personalized healthcare navigation tools, and the establishment of community outreach programs to ensure that all residents have access to the information and resources they need.

Focus on Preventative Care

Building upon its existing emphasis on preventative care, Montana Marketplace Insurance is likely to continue promoting health and wellness initiatives. This may involve the development of incentives and rewards programs for individuals who actively engage in healthy behaviors. Additionally, the marketplace may explore partnerships with local wellness organizations and providers to offer discounted or free preventative services, further encouraging Montanans to take a proactive approach to their health.

Conclusion

Montana Marketplace Insurance stands as a testament to the state’s commitment to ensuring that its residents have access to affordable and comprehensive healthcare coverage. Through its evolution, the marketplace has not only increased access to healthcare but has also played a pivotal role in improving the overall health and well-being of Montanans. As it continues to innovate and adapt to the changing needs of its residents, Montana Marketplace Insurance will undoubtedly remain a vital resource for the healthcare landscape of the Big Sky Country.

How do I enroll in Montana Marketplace Insurance?

+To enroll in Montana Marketplace Insurance, you can visit the official website during the Open Enrollment period. You’ll need to create an account, provide personal and income information, and compare available plans. You can also receive assistance from navigators or customer support to guide you through the enrollment process.

What happens if I miss the Open Enrollment period?

+If you miss the Open Enrollment period, you may still be eligible for a Special Enrollment Period if you experience a qualifying life event, such as losing your job or getting married. Check the criteria for Special Enrollment and apply accordingly.

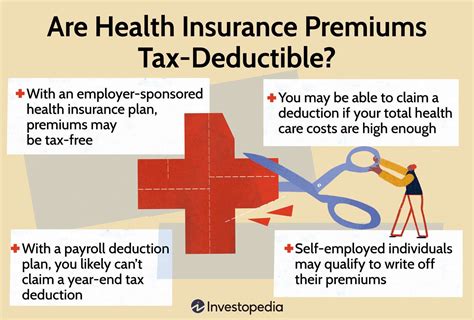

Are there any tax benefits associated with Montana Marketplace Insurance plans?

+Yes, Montana Marketplace Insurance offers tax credits to eligible individuals and families to help make health insurance more affordable. These credits can significantly reduce your monthly premiums, making healthcare coverage more accessible.