Top Rated Dog Insurance

In the ever-evolving landscape of pet healthcare, dog insurance has emerged as a vital tool for responsible pet owners, offering financial protection and peace of mind. With the rising costs of veterinary care, a good dog insurance plan can make all the difference in ensuring your furry friend receives the best medical attention when needed. This article aims to delve into the world of dog insurance, providing an in-depth analysis of the top-rated plans and the benefits they offer, helping you make an informed decision for your canine companion's well-being.

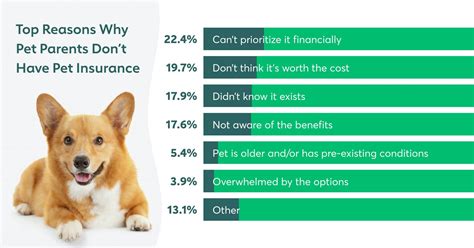

Understanding the Importance of Dog Insurance

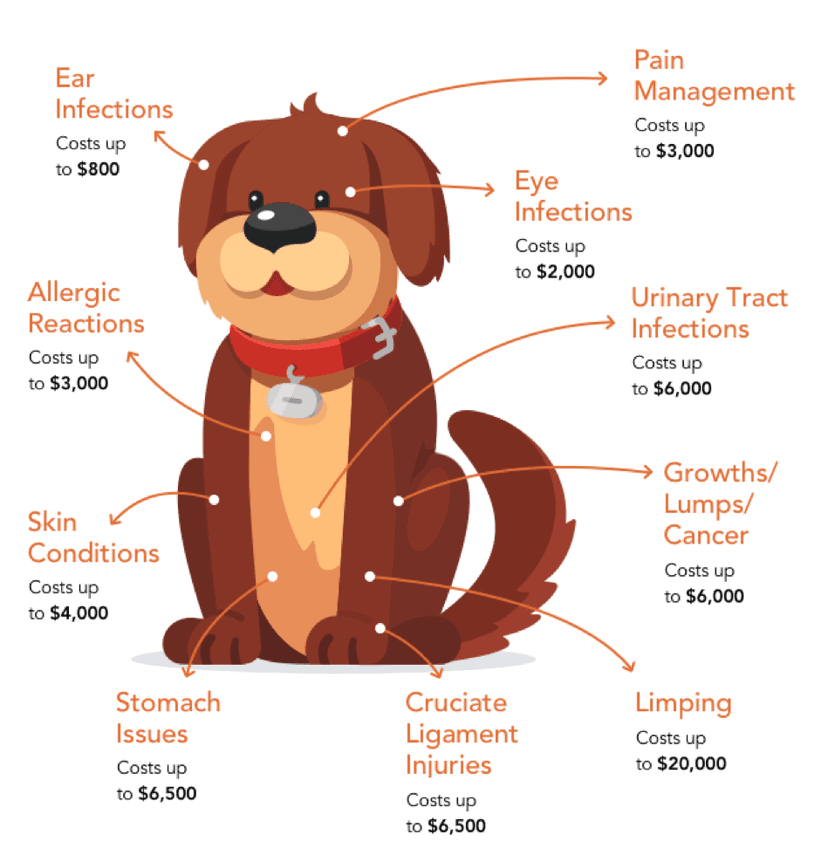

Dog insurance, much like any other health insurance, is a financial safeguard against unforeseen medical emergencies and routine healthcare needs. It provides coverage for a range of medical conditions, from accidental injuries to chronic illnesses, ensuring your dog receives the necessary treatment without putting a strain on your wallet. With the average cost of veterinary care rising annually, insurance has become an essential component of responsible pet ownership.

The benefits of dog insurance extend beyond financial protection. It encourages regular check-ups and preventative care, which can lead to early detection of potential health issues. Moreover, with insurance, pet owners are more likely to seek advanced treatments and procedures, knowing that the cost will be covered. This not only improves the quality of life for dogs but also extends their lifespans.

Top Rated Dog Insurance Plans: A Comprehensive Overview

When it comes to choosing the best dog insurance, several factors come into play, including the breadth of coverage, the reimbursement process, and the overall customer experience. Here, we present an analysis of the top-rated dog insurance plans in the market, highlighting their unique features and benefits.

Plan A: Comprehensive Coverage for Canine Companions

Key Features:

- Broad coverage for accidents, illnesses, and routine care.

- No upper age limit for new pets, ensuring lifelong coverage.

- Reimbursement of up to 90% of eligible veterinary expenses.

- Flexible deductibles and annual limits to suit various budgets.

Benefits:

Plan A offers a comprehensive approach to dog insurance, providing coverage for a wide range of medical conditions. The lack of an age limit makes it an ideal choice for long-term pet owners, as it ensures your dog is protected throughout their life. The high reimbursement rate and flexible payment options make it a financially viable option, ensuring pet owners can access the best care for their dogs without financial constraints.

Plan B: Tailored Coverage with Added Benefits

Key Features:

- Customizable coverage options to suit individual pet needs.

- Inclusive of alternative therapies like acupuncture and hydrotherapy.

- Unique wellness rewards program, offering discounts on preventive care.

- 24⁄7 access to a veterinary helpline for immediate advice.

Benefits:

Plan B stands out for its personalized approach to dog insurance. The ability to tailor the coverage ensures pet owners can select a plan that best suits their dog’s specific health needs. By including alternative therapies and a wellness program, it encourages a holistic approach to canine healthcare. Additionally, the veterinary helpline provides immediate support, offering peace of mind to pet owners facing urgent situations.

Plan C: Budget-Friendly Option with Comprehensive Benefits

Key Features:

- Affordable premiums with no compromise on coverage.

- Coverage for pre-existing conditions (after a waiting period).

- Lifetime coverage limit, ensuring financial protection over the pet’s lifetime.

- Easy online claim submission and fast reimbursement.

Benefits:

Plan C is designed with cost-conscious pet owners in mind, offering a budget-friendly option without sacrificing essential coverage. The inclusion of pre-existing conditions, albeit with a waiting period, makes it a viable choice for pet owners with older dogs or those who have recently adopted a pet with known health issues. The lifetime coverage limit provides long-term financial security, ensuring pet owners can plan for their dog’s future healthcare needs.

| Plan | Coverage | Reimbursement | Unique Features |

|---|---|---|---|

| Plan A | Comprehensive | Up to 90% | No age limit for new pets |

| Plan B | Customizable | Varies | Alternative therapies, wellness program |

| Plan C | Budget-friendly | Up to 80% | Pre-existing conditions (with waiting period) |

The Impact of Dog Insurance on Veterinary Care

The introduction of dog insurance has had a significant impact on the veterinary industry. With more pet owners opting for insurance, veterinarians can offer advanced treatments and procedures, knowing that the cost will be covered. This has led to an increase in the quality of veterinary care, with more specialized services and cutting-edge technologies becoming available. Additionally, insurance encourages pet owners to seek regular check-ups and preventative care, leading to early detection and management of health issues.

Future Prospects and Innovations in Dog Insurance

The dog insurance market is continually evolving, with insurers introducing innovative features to stay competitive. Some of the future prospects and potential innovations include:

- Genetic Testing Coverage: As genetic testing becomes more affordable and accessible, insurers may start offering coverage for these tests, allowing for early detection of genetic conditions and tailored treatment plans.

- Telemedicine Integration: With the rise of telemedicine, insurers could partner with veterinary telemedicine platforms, offering remote consultations and follow-ups, improving accessibility and convenience for pet owners.

- Data-Driven Personalization: By leveraging data analytics, insurers could offer more personalized plans, adjusting coverage and premiums based on the dog's breed, age, and health history.

- Wellness Incentives: To encourage preventative care, insurers might introduce incentives like discounts or reward points for regular check-ups, vaccinations, and healthy lifestyle choices.

Conclusion: Making an Informed Decision

Dog insurance is a vital component of responsible pet ownership, offering financial protection and peace of mind. With a range of top-rated plans available, pet owners can choose a plan that best suits their dog’s unique needs and their financial situation. By understanding the benefits and features of each plan, you can make an informed decision, ensuring your furry friend receives the best care possible.

What is the average cost of dog insurance plans?

+

The cost of dog insurance plans can vary significantly depending on factors such as the age and breed of the dog, the level of coverage chosen, and the location. On average, you can expect to pay anywhere from 30 to 100 per month for a comprehensive plan. However, it’s important to note that the cost can be higher or lower depending on your specific circumstances.

Are there any dog insurance plans that cover pre-existing conditions?

+

Yes, some dog insurance plans do offer coverage for pre-existing conditions. However, it’s important to note that these plans typically have a waiting period before the coverage kicks in. This waiting period can range from a few months to a year, and the conditions may need to be stable or under control before coverage begins. It’s always best to check the specific terms and conditions of the plan before purchasing.

How do I choose the right dog insurance plan for my pet?

+

Choosing the right dog insurance plan depends on various factors, including your pet’s age, breed, and health history, as well as your budget and the level of coverage you desire. It’s essential to compare multiple plans, considering factors such as the coverage limits, deductibles, reimbursement rates, and any additional perks like alternative therapy coverage or wellness rewards. Always read the policy documents carefully to understand the exclusions and waiting periods.