Car Insurance Coverages Explained

In the realm of personal finance and asset protection, few topics are as important as car insurance. It is a legal requirement in most countries and a financial safeguard for countless drivers. Yet, understanding the intricacies of car insurance coverage can be a complex and confusing endeavor. From the diverse types of coverage to the specific exclusions and limitations, there's a lot to unpack. This comprehensive guide aims to demystify car insurance coverages, empowering you to make informed decisions about your policy and ensuring you're adequately protected on the road.

The Fundamentals of Car Insurance Coverages

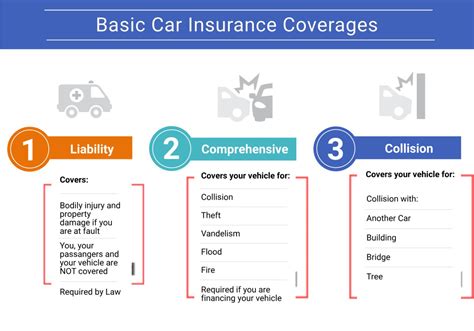

Car insurance is designed to provide financial protection in the event of an accident, theft, or other vehicle-related incidents. It does this by offering a range of coverage types, each addressing specific risks and potential liabilities. These coverages can be broadly categorized into three main types: liability, collision, and comprehensive.

Liability Coverage

Liability coverage is a cornerstone of car insurance policies. It protects you financially if you’re found at fault in an accident that results in property damage, bodily injury, or both. This coverage is typically divided into two parts: property damage liability and bodily injury liability. Property damage liability covers the cost of repairing or replacing someone else’s vehicle or property, while bodily injury liability covers medical expenses, lost wages, and pain and suffering for individuals injured in the accident.

| Liability Coverage Types | Description |

|---|---|

| Property Damage Liability | Covers damage to others' property, including vehicles. |

| Bodily Injury Liability | Provides financial protection for injuries caused to others. |

Collision Coverage

Collision coverage comes into play when your vehicle is damaged in an accident, regardless of fault. This coverage pays for repairs or the replacement of your vehicle, up to its actual cash value, less any applicable deductibles. It’s especially beneficial for newer or leased vehicles, as it can help cover the full cost of repairs or replacement, even if the vehicle’s market value has depreciated.

Comprehensive Coverage

Comprehensive coverage provides protection for a wide range of non-collision incidents, including theft, vandalism, natural disasters, and animal collisions. It’s an essential coverage for anyone who wants protection beyond the scope of collision coverage. For instance, if your vehicle is damaged by a fallen tree during a storm or if it’s stolen from your driveway, comprehensive coverage would apply.

| Comprehensive Coverage Scenarios | Description |

|---|---|

| Theft | Covers the cost of a stolen vehicle. |

| Vandalism | Repairs damage caused by intentional acts. |

| Natural Disasters | Provides assistance for weather-related incidents. |

| Animal Collisions | Offers coverage if you hit an animal. |

Additional Car Insurance Coverages

Beyond the fundamental coverages, car insurance policies can offer a variety of additional protections tailored to specific needs. These coverages often come at an extra cost but can provide significant peace of mind for certain drivers.

Uninsured/Underinsured Motorist Coverage

Uninsured motorist coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages. This coverage can pay for your medical expenses, lost wages, and other related costs. Similarly, underinsured motorist coverage steps in when the at-fault driver’s liability coverage limits are insufficient to cover the full extent of your damages.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a no-fault coverage that provides financial assistance for medical expenses, lost wages, and other related costs, regardless of who’s at fault in an accident. PIP coverage is mandatory in some states and can be a valuable addition to your policy, ensuring you have immediate access to medical care and financial support after an accident.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, provides additional coverage for medical expenses resulting from an auto accident. It can cover you, your passengers, and even members of your household who are injured while occupying another vehicle. MedPay can be a useful supplement to health insurance, offering quick and easy access to medical care after an accident.

Rental Car Coverage

Rental car coverage, sometimes called Loss of Use coverage, reimburses you for the cost of renting a vehicle while your own car is being repaired or replaced after an insured loss. This coverage can be a lifesaver for those who rely heavily on their vehicles for daily transportation or business purposes.

Gap Insurance

Gap insurance, or Guaranteed Auto Protection, is particularly beneficial for drivers who lease their vehicles or have a significant loan balance. It covers the difference between the actual cash value of your vehicle and the remaining balance on your loan or lease, protecting you from financial loss in the event your vehicle is totaled or stolen.

Understanding Policy Exclusions and Limitations

While car insurance policies offer a wide range of coverages, they also come with certain exclusions and limitations. These are specific situations or events that aren’t covered by your policy. It’s crucial to understand these exclusions to avoid any surprises if you need to make a claim.

Common Exclusions

- Normal Wear and Tear: Your policy typically won’t cover damage resulting from regular use and aging of your vehicle, such as worn brakes or bald tires.

- Mechanical Breakdowns: Most policies exclude coverage for mechanical issues that aren’t the result of an accident, such as engine failure or transmission problems.

- Intentional Acts: Damages caused intentionally by you or another insured party are generally not covered.

- Racing or Stunts: Participating in organized racing events or performing stunts with your vehicle is often excluded from coverage.

- Business Use: If you use your vehicle for business purposes, you may need a commercial auto insurance policy, as standard policies often exclude business-related incidents.

Policy Limitations

In addition to exclusions, car insurance policies also have specific limitations. These are conditions or circumstances that can affect the amount of coverage you receive.

- Deductibles: A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles can result in lower premiums, but they also mean you'll pay more out of pocket if you need to make a claim.

- Coverage Limits: Each type of coverage has a maximum amount it will pay out in the event of a claim. It's important to review these limits and ensure they align with your needs and the value of your vehicle.

- Depreciation: Insurance companies often use depreciation tables to determine the value of your vehicle. This means that if your car is damaged or totaled, you may only receive the depreciated value, not the original purchase price.

The Importance of Tailoring Your Coverage

Every driver’s needs and circumstances are unique, which is why it’s essential to tailor your car insurance coverage to your specific situation. Factors such as the age and value of your vehicle, your driving record, and your daily commute can all influence the types and levels of coverage you require.

Newer vs. Older Vehicles

If you drive a newer vehicle, collision and comprehensive coverage are generally recommended to protect your investment. These coverages can help cover the full cost of repairs or replacement, even if the vehicle’s value has depreciated. For older vehicles, the decision to carry collision and comprehensive coverage often comes down to the vehicle’s current market value and your budget.

Your Driving Record

A clean driving record can earn you discounts on your insurance premiums and may influence the types of coverage you choose. If you’ve been accident-free for several years, you might consider increasing your deductibles to lower your premiums. However, if you’ve had recent accidents or traffic violations, you may want to maintain lower deductibles and higher coverage limits to minimize your financial risk.

Your Daily Commute and Usage

The nature of your daily commute and how you use your vehicle can also impact your insurance needs. If you have a long daily commute or frequently drive in high-risk areas, you may want to consider higher liability limits and additional coverages like uninsured/underinsured motorist protection. On the other hand, if you primarily use your vehicle for pleasure and have a short daily commute, you might be able to save money by choosing lower coverage limits and higher deductibles.

Tips for Choosing the Right Car Insurance Coverage

Selecting the right car insurance coverage can be a complex decision, but with the right information and guidance, you can make an informed choice. Here are some tips to help you navigate the process:

- Review Your Policy Regularly: Insurance needs can change over time. Regularly review your policy to ensure it still meets your needs and reflects your current circumstances.

- Understand Your State's Requirements: Every state has its own minimum insurance requirements. Ensure your policy meets or exceeds these requirements to avoid legal issues.

- Consider Your Assets: If you have significant assets, you may want to carry higher liability limits to protect yourself from lawsuits in the event of an accident.

- Shop Around: Don't settle for the first policy you find. Compare quotes from multiple insurers to find the best coverage at the most competitive price.

- Ask About Discounts: Many insurers offer discounts for safe driving, good grades, multiple policies, and more. Inquire about these discounts to potentially lower your premiums.

The Future of Car Insurance Coverages

As technology advances and driving behaviors evolve, the landscape of car insurance coverages is likely to change as well. The rise of autonomous vehicles, for example, could lead to a shift in liability coverage, as manufacturers and technology companies may share responsibility for accidents alongside drivers. Additionally, the increasing prevalence of ride-sharing and car-sharing services may lead to the development of new insurance products tailored to these unique usage models.

The introduction of usage-based insurance (UBI) programs, which use telematics devices to monitor driving behavior and offer personalized premiums, is another trend that's shaping the future of car insurance. These programs reward safe driving habits and can provide significant savings for drivers who maintain good driving records.

Conclusion

Understanding car insurance coverages is an essential part of being a responsible driver and a wise financial decision-maker. By familiarizing yourself with the different types of coverage, exclusions, and limitations, you can make informed choices about your policy and ensure you have the protection you need. Remember, car insurance is not a one-size-fits-all product, and tailoring your coverage to your unique needs is key to finding the right balance of protection and affordability.

What is the average cost of car insurance per month in the United States?

+

The average cost of car insurance in the U.S. varies greatly depending on factors like location, age, and driving history. As of 2023, the average monthly cost for minimum liability coverage is around 150, while a more comprehensive policy can cost upwards of 250 per month.

How do I know if I have sufficient liability coverage?

+

Sufficient liability coverage depends on your assets and financial situation. As a general rule, you should carry enough liability insurance to cover your net worth. This ensures that if you’re sued, your assets are protected.

Is it worth getting collision and comprehensive coverage for an older car?

+

For older vehicles, collision and comprehensive coverage may not be worth the cost. Consider the vehicle’s market value and your budget when deciding whether to keep these coverages. If the cost of the coverage exceeds the value of the vehicle, it may not be financially prudent to maintain it.

What is a usage-based insurance (UBI) program, and how does it work?

+

A usage-based insurance program uses telematics devices to monitor your driving behavior. Based on factors like miles driven, time of day, and driving habits, your insurance company can offer personalized premiums. These programs can reward safe drivers with lower premiums.