Car Insurance A

In the complex landscape of financial protection, car insurance stands out as a crucial pillar, safeguarding vehicle owners and drivers from the uncertainties and costs associated with road incidents. This comprehensive guide delves into the intricacies of car insurance, exploring its fundamental aspects, the benefits it offers, and the considerations that underpin its selection and customization. With a focus on the A-Z of car insurance, we aim to demystify this essential coverage, empowering readers to make informed choices tailored to their unique needs.

Understanding Car Insurance Fundamentals

Car insurance is a contract between an individual (the policyholder) and an insurance company. This contract outlines the terms and conditions of coverage, specifying the types of risks insured against and the limits of the insurance company’s financial responsibility. The primary goal is to provide financial protection against physical damage, bodily injury, and liability arising from road accidents or other covered events.

The coverage provided by car insurance policies can be divided into several key components, each addressing specific risks and responsibilities. These include:

- Liability Coverage: This covers the costs of bodily injury or property damage to others for which the policyholder is legally responsible. It typically includes both bodily injury liability and property damage liability.

- Collision Coverage: This pays for the repair or replacement of the insured vehicle after a collision, regardless of fault.

- Comprehensive Coverage: Comprehensive insurance provides protection against damage to the insured vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for the medical expenses of the policyholder and their passengers after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder against financial loss caused by an accident involving a driver who either does not have insurance or does not have enough insurance to cover the costs of the accident.

The Importance of Personalized Car Insurance

Car insurance is not a one-size-fits-all solution. Every driver and vehicle owner has unique needs and circumstances that influence the type and level of coverage required. Factors such as the make and model of the vehicle, the driver’s age and driving record, the geographic location, and the intended use of the vehicle all play a role in determining the appropriate car insurance coverage.

For instance, a young driver with a history of accidents may require higher liability limits and comprehensive coverage to mitigate the financial risks associated with their driving record. In contrast, an older driver with a clean record and a less valuable vehicle might opt for basic liability coverage to meet state requirements and keep insurance costs down.

Tailoring Coverage to Individual Needs

Customizing car insurance involves selecting the right combination of coverage types and limits to address specific risks. Here’s a breakdown of how policyholders can tailor their coverage:

| Coverage Type | Considerations |

|---|---|

| Liability Coverage | Ensure you have sufficient limits to cover potential damages in an accident. State minimums may be too low to adequately protect your assets. |

| Collision Coverage | Consider the age and value of your vehicle. If it's older and has a low resale value, you might choose to waive collision coverage to save on premiums. |

| Comprehensive Coverage | Comprehensive insurance is particularly important for newer vehicles. It covers a wide range of non-collision incidents that could lead to costly repairs. |

| Medical Payments Coverage | This coverage is essential for ensuring you and your passengers have access to medical care after an accident, regardless of fault. |

| Uninsured/Underinsured Motorist Coverage | In states with high rates of uninsured drivers, this coverage is crucial. It protects you from financial loss if an uninsured driver causes an accident. |

Maximizing Benefits and Cost-Effectiveness

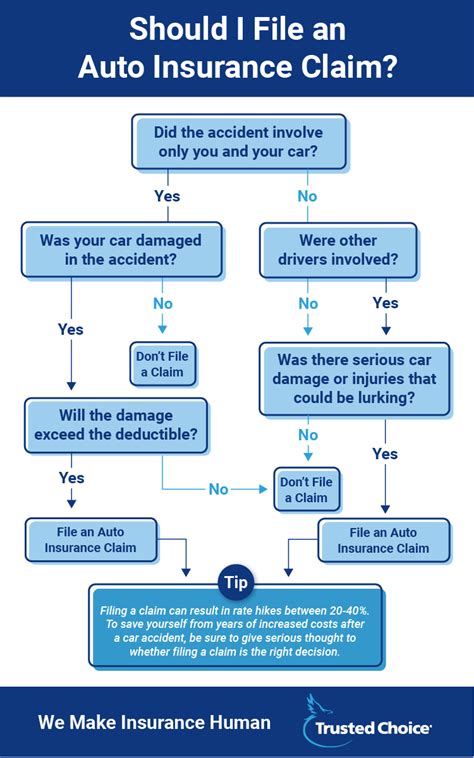

Navigating the complex world of car insurance requires a delicate balance between securing adequate coverage and managing costs. Here are some strategies to help policyholders maximize the benefits of their car insurance while keeping premiums under control:

Choosing the Right Deductibles

A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By selecting a higher deductible, you can lower your insurance premiums. However, it’s essential to choose a deductible amount that you can comfortably afford to pay if the need arises.

Bundle and Save

Many insurance companies offer discounts when you bundle multiple insurance policies with them. For instance, you might bundle your car insurance with your homeowners or renters insurance to qualify for a multi-policy discount.

Explore Discount Opportunities

Insurance companies often provide discounts for a range of factors, such as safe driving records, loyalty, educational achievements, vehicle safety features, and more. Be sure to ask your insurance provider about all the potential discounts you might qualify for.

Regularly Review and Update Your Policy

Life circumstances and financial situations can change, which may impact your car insurance needs. Regularly review your policy to ensure it still aligns with your current needs. For instance, if you’ve paid off your car loan, you might consider dropping collision coverage to reduce your premiums.

The Future of Car Insurance

The car insurance landscape is evolving, driven by technological advancements and changing consumer needs. The rise of connected cars and autonomous driving technologies is expected to bring significant changes to the way car insurance is priced and structured. Here’s a glimpse into the potential future of car insurance:

Usage-Based Insurance (UBI)

UBI policies, also known as pay-as-you-drive or pay-how-you-drive, use telematics devices or smartphone apps to monitor driving behavior and habits. Insurance premiums are then calculated based on the actual driving data collected. This approach rewards safe driving behaviors and can lead to significant savings for policyholders.

Predictive Analytics and AI

Insurance companies are increasingly using advanced analytics and artificial intelligence to predict and manage risks more accurately. By analyzing vast amounts of data, these technologies can identify patterns and trends, enabling insurers to offer more personalized and competitive policies.

Autonomous Vehicles and Liability Shifts

As autonomous vehicles become more prevalent, the traditional concept of liability in car accidents may shift. If a self-driving car is involved in an accident, the liability may rest with the manufacturer or the software developer rather than the driver. This could lead to a fundamental restructuring of car insurance policies.

Conclusion

Car insurance is a vital financial tool that provides peace of mind and protection against the unforeseen. By understanding the fundamentals of car insurance, tailoring coverage to individual needs, and staying informed about the latest developments, policyholders can make the most of their insurance coverage while managing costs effectively. As the car insurance landscape continues to evolve, staying ahead of the curve will be key to making the right choices for your unique circumstances.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy at least once a year, or whenever your life circumstances change significantly. This ensures your coverage remains adequate and up-to-date.

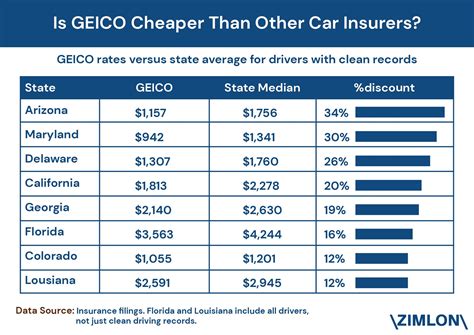

What factors influence car insurance rates?

+Car insurance rates are influenced by a variety of factors, including the make and model of your vehicle, your driving record, the geographic location, the coverage limits you choose, and any discounts you qualify for.

Can I switch car insurance providers mid-policy term?

+Yes, you can switch car insurance providers at any time, but you may incur a fee if you cancel your policy before the end of the term. It’s a good idea to compare rates and coverage from different providers to find the best fit for your needs.