Telephone Number For Ambetter Insurance

Ambetter, a subsidiary of Centene Corporation, is a health insurance provider operating in the United States. With a focus on providing affordable healthcare coverage, Ambetter has established itself as a prominent player in the market. In this comprehensive guide, we will delve into the various aspects of Ambetter insurance, offering valuable insights and information to assist individuals in navigating their healthcare options effectively.

Understanding Ambetter Insurance

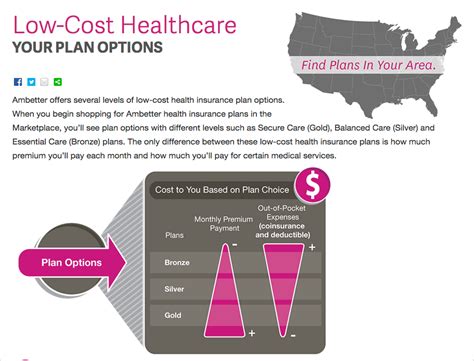

Ambetter insurance is designed to cater to individuals and families who are seeking comprehensive healthcare coverage at an affordable price. The company offers a range of health insurance plans, including Ambetter Balanced Care, Ambetter Essential Care, and Ambetter Secure Care, each tailored to meet different healthcare needs and preferences.

One of the key advantages of Ambetter insurance is its emphasis on preventive care. The plans often include no-cost preventive services, such as annual check-ups, immunizations, and screenings, ensuring that policyholders can maintain their health and well-being without incurring additional costs. This proactive approach to healthcare is a distinctive feature of Ambetter's insurance offerings.

Furthermore, Ambetter is committed to providing easy access to healthcare professionals. Policyholders can choose from a network of in-network providers, ensuring that they can receive quality care from trusted healthcare practitioners. The company's website and mobile app also offer convenient tools to search for providers and schedule appointments, enhancing the overall user experience.

Contacting Ambetter: The Importance of Telephone Support

When it comes to health insurance, having access to reliable customer support is essential. Ambetter understands this and offers multiple channels for customers to connect with their support team, including telephone support.

The Ambetter telephone number serves as a vital resource for policyholders and prospective customers alike. It provides a direct line of communication, allowing individuals to ask questions, clarify coverage details, and seek assistance with any insurance-related inquiries. Here's a closer look at how the telephone support system works and why it is an invaluable resource.

Ambetter’s Dedicated Customer Support Team

Ambetter has invested in building a knowledgeable and friendly customer support team. These professionals are trained to handle a wide range of inquiries, from basic plan information to more complex issues such as claims processing and billing.

By calling the Ambetter telephone number, individuals can connect with a real person who can address their concerns promptly and efficiently. This human touch is often preferred by customers who may find navigating insurance terminology and processes challenging.

The support team is well-versed in Ambetter's insurance offerings, ensuring that they can provide accurate and up-to-date information. They can guide callers through the enrollment process, explain the benefits and limitations of different plans, and assist with any changes or updates to existing policies.

| Ambetter Telephone Number | Toll-Free Number |

|---|---|

| 1-877-687-1366 | 1-877-687-1366 |

Benefits of Telephone Support

While Ambetter offers various support channels, including online chat and email, telephone support often provides a more personalized and efficient experience.

Calling the Ambetter telephone number allows individuals to have a real-time conversation, enabling them to ask follow-up questions and receive immediate clarifications. This can be especially beneficial when dealing with time-sensitive matters, such as understanding coverage for an upcoming medical procedure.

Furthermore, telephone support can be more accessible for individuals with limited digital literacy or those who prefer a more traditional method of communication. It ensures that everyone, regardless of their technical expertise, can receive the assistance they need.

In addition, the Ambetter support team can offer tailored advice based on an individual's specific circumstances. They can guide callers towards the most suitable plan for their needs, taking into account factors such as pre-existing conditions, preferred providers, and budget constraints.

Navigating the Ambetter Website for Contact Information

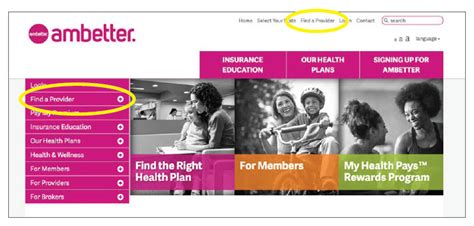

For those who prefer to explore support options online, the Ambetter website provides a wealth of resources. The website is designed to be user-friendly and intuitive, making it easy for visitors to find the information they need.

Locating the Contact Us Page

To access the contact information, simply navigate to the “Contact Us” page on the Ambetter website. This page serves as a central hub for all support-related inquiries, providing various methods of communication.

Here, you'll find the Ambetter telephone number prominently displayed, along with additional contact details such as mailing addresses, email addresses, and social media handles. The page also offers a convenient online form for general inquiries, allowing visitors to submit their questions and receive a response via email.

Using the Online Support Tools

In addition to the contact details, the “Contact Us” page provides links to several online support tools. These tools can be incredibly helpful for self-service inquiries, allowing individuals to find answers to common questions without having to wait for a phone call or email response.

One such tool is the online chat feature, which enables visitors to have real-time conversations with support agents directly from the website. This can be particularly useful for quick questions or for individuals who prefer a more interactive online experience.

The website also offers a comprehensive frequently asked questions (FAQ) section, which covers a wide range of topics related to Ambetter insurance. From understanding plan benefits to enrolling in a new plan, the FAQ section provides clear and concise answers to common queries. This resource can save time and effort for individuals who prefer to find answers independently.

Key Takeaways: Ambetter Insurance and Telephone Support

Ambetter insurance offers a range of affordable healthcare plans, with a strong focus on preventive care and easy access to healthcare professionals. The company’s commitment to customer support is evident through its dedicated telephone support line, providing a direct and personalized experience for policyholders and prospective customers.

By calling the Ambetter telephone number, individuals can receive timely assistance, tailored advice, and accurate information. This support system, combined with the user-friendly website and online tools, ensures that Ambetter customers have the resources they need to make informed decisions about their healthcare coverage.

Whether you're a current policyholder or exploring your insurance options, Ambetter's comprehensive approach to customer support makes it a reliable and accessible choice for your healthcare needs.

What are the eligibility criteria for Ambetter insurance plans?

+Eligibility for Ambetter insurance plans varies depending on the state and the specific plan. Generally, individuals and families can qualify if they meet certain income requirements and reside in a service area where Ambetter operates. It’s recommended to check the Ambetter website or contact their customer support for detailed eligibility criteria.

How can I enroll in an Ambetter insurance plan?

+Enrollment in an Ambetter insurance plan can be done online through their website or by calling their customer support. During the enrollment process, you’ll need to provide personal information, such as your name, date of birth, and income details. Ambetter representatives can guide you through the steps and help you choose the most suitable plan for your needs.

What are the benefits of Ambetter’s preventive care focus?

+Ambetter’s emphasis on preventive care offers several benefits. Firstly, it helps policyholders maintain their health and catch potential issues early on, potentially reducing the need for more extensive and costly treatments later. Additionally, many preventive services are covered at no additional cost, providing significant savings for policyholders.